Airlines are facing an interesting peak travel season ahead. After the chaos many airlines witnessed the past year, this summer season we will see whether airlines and airports have actually learned lessons from last year. One airline or better said airline group which already faces some challenges as it heads into the peak travel days in July and August is Air France-KLM (OTCPK:AFRAF) due to a combination of circumstances.

I covered Air France-KLM earlier in May, back then the airline already had some problems, but since then the problems have become somewhat bigger and that is why I am providing an update.

Air France-KLM Faces Some Long-Term Challenges

Air France-KLM faces some long-term challenges that focus on short haul flights as they are in a relative sense pressuring the environment significantly. While banning short haul flights seems significant, the scope is significantly limited by the framework requiring high-speed rail as an alternative and reference stations used. So, while some routes might be canceled, they might still be operated from a different airport doing little to nothing to reduce emissions, and in some cases, an even more polluting route towards the network exists. So, the French ban is not a big negative to the business I would say due to limited scope, but one can wonder how the regulatory framework will be amended in the future to broaden the scope.

KLM Royal Dutch Airlines

The bigger challenge without doubt is in KLM’s hub in Amsterdam. While the airport has modern security lanes, it’s been a pain for travelers to use the airport as the security lanes got overwhelmed. Therefore, passenger flows were capped last year and even this year there has been a cap. Separately, the government has been looking to reduce the number of flights to and from Schiphol due to noise pollution. A group of airlines has sued the authorities over the noise pollution issue and won, as a reduction of the number of flights is one of many ways to reduce noise pollution but not the only one.

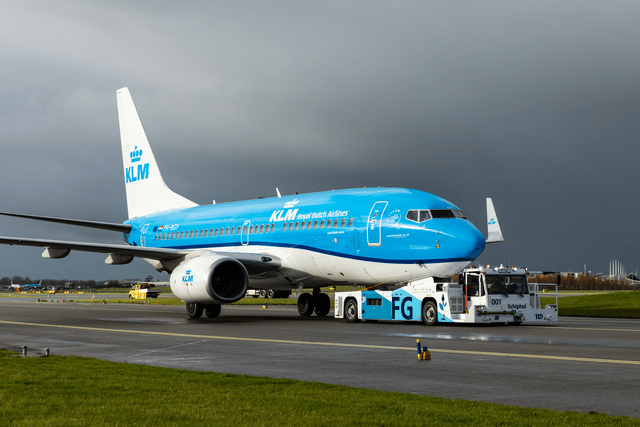

The Dutch government, however, is facing a bigger issue and that is related to nitrogen crisis. The fear is that reductions in flights from Schiphol will be used for a permanent reduction in ammonia and NOx emissions. The Netherlands, measured by surface area, emits too much nitrogen compound. Because the country has some Natura 2000 areas that have to be protected according to EU regulations, a judge concluded that The Netherlands is not doing enough to comply with regulations. The result has been very impactful to society. Until August 2022, I lived in The Netherlands and saw the consequences of the judge ruling first-hand as policies to reduce emissions took effect. The maximum speed for cars was reduced, which has cost businesses, including mine, a lot of money and removes a lot of efficiency from the system. The Netherlands already has a housing problem and that problem has gotten even worse as construction permits are suspended and many projects that were planned cannot be executed. Further reductions are demanded from agriculture and the transport sector. All of this, in my view, is happening without considering the fact that The Netherlands has high emissions measured per surface area and that is because the country is so small and has a relatively high output in terms of efficiency but also emissions. The current measures have a broad impact and could affect Schiphol and subsequently Air France-KLM as well while there are other ways to reduce emissions as well. Fleet renewal and taxibots, as shown in the picture above, are just one of many ways to reduced emissions.

Problems At KLM and Transavia

So, the problems specific to nitrogen and the environment could eventually harm Air France-KLM. The company, however, is facing two imminent issues directly related to problems with airplanes it intended to operate.

Dhierin-Perkash Bechai

Previously, I discussed a big Airbus (OTCPK:EADSF) customer going bankrupt citing issues with the geared turbofans developed by Pratt & Whitney and is part of Raytheon Technologies (RTX). The engines, which are used on the Airbus A320neo as an engine option and exclusively power the Embraer E2 (ERJ) and Airbus A220 are suffering from and that has caused problems for operators. KLM Cityhopper which operates a fleet of 62 airplanes including 15 Embraer E2 jets on a normal day had to ground five jets. The company is extending some leases that were expiring this year and some additional wet lease contracts have also been signed.

Transavia, the low-cost part of Air France-KLM, is suffering from an airplane shortage that is messing up the flight schedule. Since April, Transavia has been canceling tens of flights per week. It is just bad luck for Transavia. Out of nearly 45 airplanes, 8 airplanes had been parked. One airplane suffered delays in maintenance due to supply chain challenges in the aerospace industry, three airplanes were hit ground vehicles and one was hit by lighting. Separately, the paperwork for five Boeing 737-800s of which three already should have entered service is being delayed. Transavia leases these airplanes from Air Lease Corporation (AL) which placed the airplanes with the carrier after the insolvency of Romanian Blue Air. In August and July, less than 2% of the flights will be cancelled but what is clear is that the cancelled flights are causing lost revenues for Transavia.

Air France-KLM has not made clear how big or small the financial damages will be. I would assume that relative to its operations the problems are small but it is needless to say that while operational issues are significantly smaller than a year ago, there still are some left which also means that the airline is not fully benefiting from the high demand for air travel.

Conclusion: Impact Expected To Be Small

While the issues for KLM and Transavia are inconvenient and even more so for passengers, over the entire line of business I do expect the impact to be relatively small. Transavia only scratches around 2% of its flights which is an even smaller share of the airline group capacity and the same holds for KLM Cityhopper. What, however, is noteworthy is that the Dutch businesses for years were a leading example in business operations and that is no longer the case. While the issues are beyond the control of KLM or Transavia, it does make one wonder how strong the Dutch businesses will be going forward and whether not continuing with the former CEO has been the right decision.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here