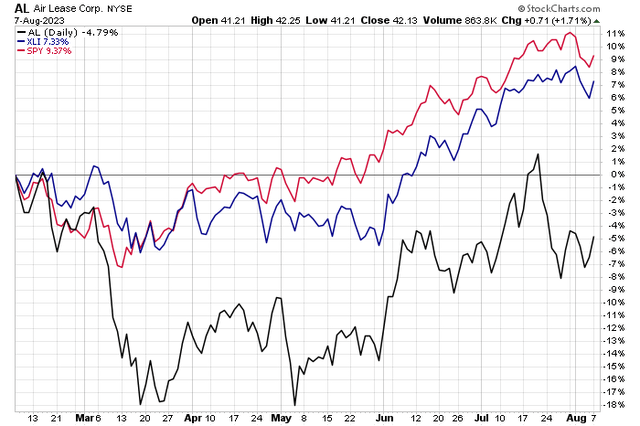

The Industrials sector has been a quiet leader in 2023. While mega-cap tech-related stocks have been in the limelight and as the “Magnificent Seven” moniker went viral, boring transportation, aerospace, and other niches in the broad Industrials space have taken off over the last several months. One stock, Air Lease Corp (NYSE:AL), is up solidly on the year but has also produced negative alpha over the past six months.

After a mixed quarterly profit report, I reiterate my hold rating on the stock.

Last 6 Months: Industrials Keeping Pace with SPX, Air Lease Lags

StockCharts.com

According to Bank of America Global Research, AL is one of the fastest-growing aircraft lessors. As of December 31, 2022, it owned a fleet of 417 aircraft, including 306 narrowbody aircraft and 111 widebody aircraft. AL is an investment grade lessor based in Los Angeles, but with offices worldwide.

The California-based $4.7 billion market cap Trading Companies and Distributors industry company within the Industrials sector trades at a low 9.9 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.9% dividend yield, according to Seeking Alpha. Following its Q2 earnings report last week, implied volatility is now low at just 26% while the stock’s short interest is modest at 1.2%.

Earlier this month, AL reported Q2 earnings per share of $1.58 which was above BofA’s outlook but below the street consensus. Top-line results were better on a year-on-year basis, with a +21% print. $673 million in net sales were solid, and that came in part from the company taking delivery of 19 aircraft from its order book and sales of eight aircraft. The firm’s commercial demand still looks robust, but higher costs dinged margins and the bottom line.

With a growing fleet, there is upside potential to earnings going forward. Its order book is booked through next year, with 58% already placed, according to the quarterly report. Key risks include higher interest expenses and funding costs along with expenses related to aviation insurance. Its young fleet, solid order book, modest leverage, and experienced management team are favorable features while a tighter capital market and FX change are risks.

Investors should watch out for what happens with Airbus. AL anticipates increased demand for its aircraft due to Airbus’s delays in new plane deliveries caused by a jet-engine recall by Pratt & Whitney, a unit of RTX, according to a report last week.

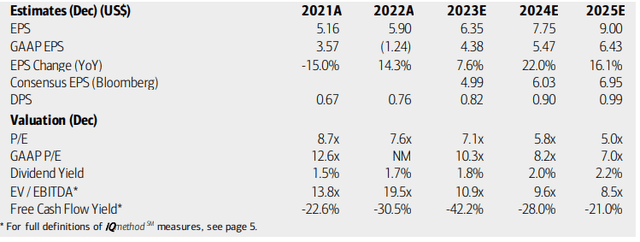

On valuation, analysts at BofA see earnings rising at a slower pace compared with what was seen a year ago, but a re-acceleration is expected in the out year through 2025. The Bloomberg consensus estimate is significantly less sanguine than what BofA projects, and with a soft Q2 report last week, I am not expecting a slew of upward EPS revisions. Still, dividends are expected to rise over the coming quarters while shares continue to trade at very depressed P/E multiples. Moreover, AL’s EV/EBITDA ratio is significantly below that of the broad market, but extremely negative free cash flow, care of high capex, is concerning, profitability trends are generally positive, however.

Air Lease: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

If we assume $5 of the next 12-month normalized earnings per share and apply a 10 forward operating P/E, then shares should be near $50. That is a reasonable discount compared to the latest price, but not quite enough for me to upgrade it to a buy.

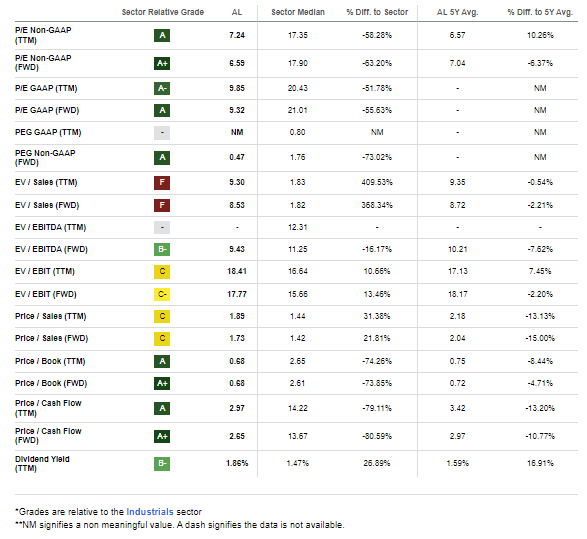

Consider that the company’s 5-year average earnings ratio is just 7 while some of its key peers have high single-digit to mid-double-digit non-GAAP P/Es, so we can’t get too aggressive on what to pay for AL. What’s more, the company does not trade all that cheap on a forward price-to-sales look either, though trading under 1 on a price-to-book basis is compelling on an absolute basis.

AL: Mixed Valuation Situation

StockCharts.com

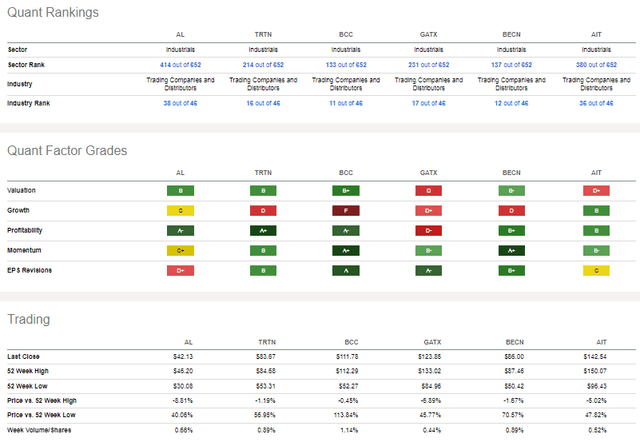

Compared to its competitors, AL features a decent valuation, but low P/Es are generally seen in the space. Also, overall growth prospects are not all that strong and can be volatile based on swings in the global macroeconomy. What is particularly concerning are bearish EPS revisions on AL versus its counterparts.

Peer Comparison

Seeking Alpha

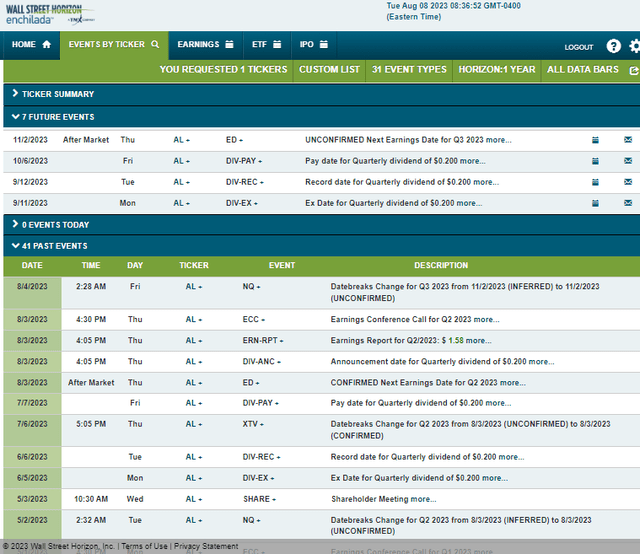

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Thursday, November 2 AMC. Before that, shares trade ex-dividend on Monday, September 11. No other volatility catalysts are expected over the coming months.

Corporate Event Risk Calendar

Wall Street Horizon

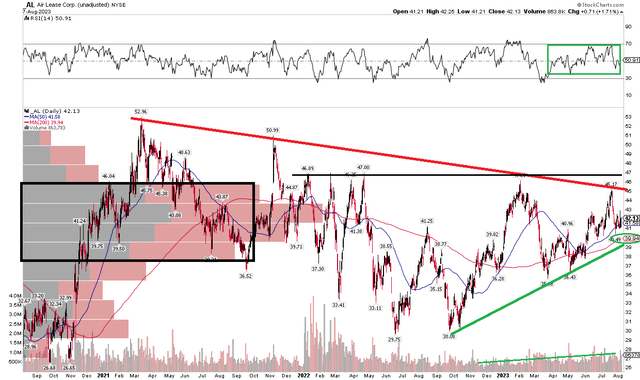

The Technical Take

With shares somewhat undervalued, the chart has taken on a slightly different look over the past two quarters compared with when I initiated coverage on the Industrials stock earlier this year. Notice in the chart below that after notching a double bottom which I noted in January, shares indeed struggled to climb above resistance in the mid-$40s. Jump ahead to today, and a symmetrical triangle pattern off the early 2021 high and from the low last September has come about.

I continue to wait and watch for a bullish upside breakout above the $45 to $47 range. What is positive, though, is that AL’s long-term 200-day moving average is now trending higher – which it was not at the start of the year. Moreover, the RSI momentum gauge at the top of the graph leans in the bullish 40 to 90 zone, and not in the bearish 20 to 60 range. What I also find interesting is that volume has been generally rising – but we do not yet know if that is a bearish or bullish feature (we have to wait for a breakout or breakdown). My presumption is that it is bullish since the stock has been rising over the last 11 months.

Overall, I am hopeful for the AL bulls, but we still need price action to rise above $47 in my view.

AL: Triangle Pattern Emerges, Mid-$40s Resistance, Rising 200dma

StockCharts.com

The Bottom Line

I reiterate my hold rating on AL. The valuation is decent, but the chart is simply in consolidation mode right now. Shares have underperformed the strong Industrials sector this year, too.

Read the full article here