Background

Akero Therapeutics (NASDAQ:AKRO) continues to march forward with big and small successes in its quest to develop a treatment for the serious metabolic diseases of non-alcoholic steatohepatitis, or NASH.

The disease is an area of high unmet medical need with no approved treatment yet. NASH is a severe form of nonalcoholic fatty liver disease, or NAFLD, characterized by inflammation and fibrosis in the liver that can progress to cirrhosis, liver failure, cancer, and death. The growing prevalence of NASH is being driven by the obesity epidemic, with a poor diet and lack of exercise leading to caloric overburdening of the liver and accumulation of excessive liver fat. NASH patients have a high rate of cardiovascular-related (CV) events, such as stroke and heart attack, which is the leading cause of death in patients with NASH. In the US, the NASH patient population is expected to surge from 17 million in 2016 to close to over 27 million by 2030, as per the Journal of Hepatology.

After limited progress for decades, there has been a spurt of highly promising results since the second half of 2022 from a few companies developing treatments for NASH, including Akero Therapeutics and Madrigal Pharmaceuticals (MDGL).

Lead NASH Product Efruxifermin – EFX

Akero Therapeutics’ lead product candidate is Efruxifermin, or EFX, which is an analog of fibroblast growth factor 21. The Company believes EFX is engineered optimally for NASH efficacy with weekly dosing. The treatment has received Fast Track and Breakthrough Therapy designations from the FDA.

EFX is being developed for two distinct patient populations:

- patients with compensated cirrhosis (F4), and

- patients with pre-cirrhotic NASH (F2/F3).

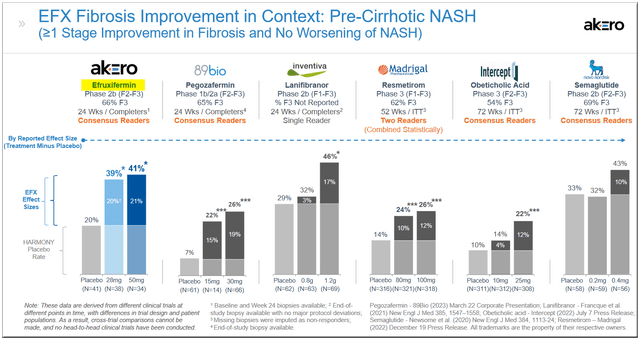

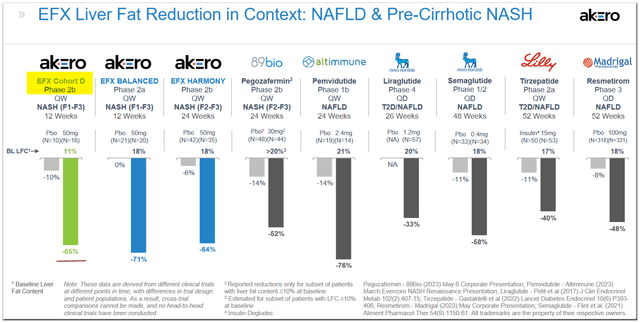

In a HARMONY Phase 2b trial for F2-F3 NASH, highly statistically significant effects were noted after 24 weeks, and these compared quite well with trials measuring similar endpoints, including fibrosis improvement, from other potential treatments. The results from the HARMONY trial were reported in September 2022.

Akero Therapeutics, PrudentBiotech.com

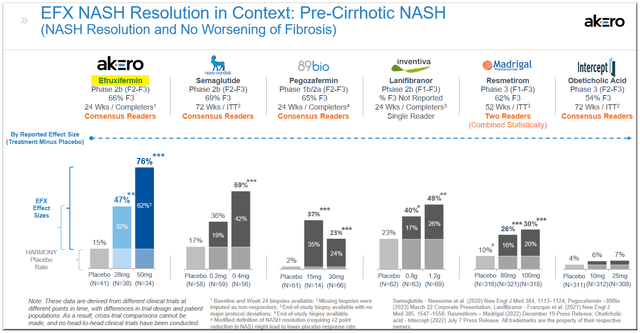

Both dosages also contributed significantly to the secondary endpoint of NASH resolution and again compared favorably with other treatments in development.

Akero Therapeutics, PrudentBiotech.com

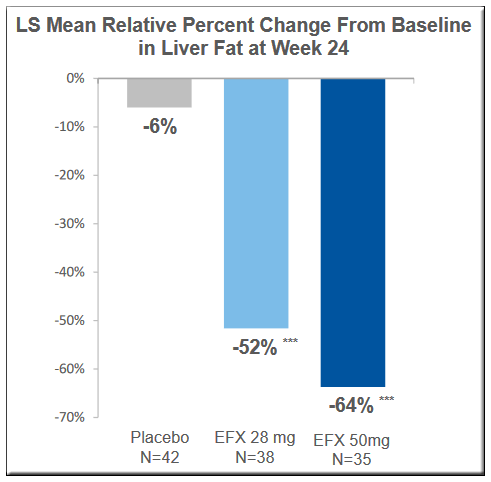

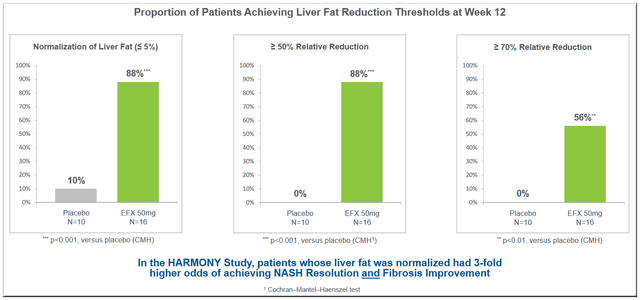

The magnitude of reduction and normalization of liver fat was notable and comparable to the earlier Phase 2a study.

Akero Therapeutics, PrudentBiotech.com

Based on the results, the company believes EFX has the potential to be a highly differentiated, potentially best-in-class FGF21 analog and foundational NASH monotherapy for each of the F2/F3 and F4 NASH populations.

Recent Results

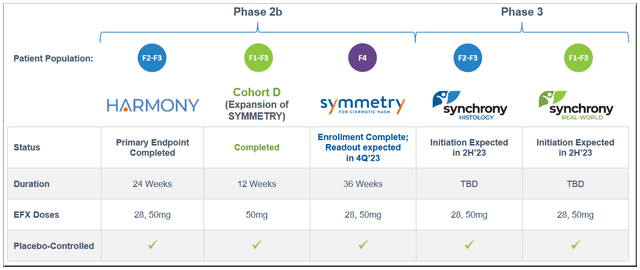

Earlier this month, Akero Therapeutics released topline data from an expansion cohort of the Phase 2b SYMMETRY study known as Cohort D. The primary endpoint of the 12-week study was to assess the safety and tolerability of EFX, compared to placebo when added to an existing GLP-1 receptor agonist in patients with Type 2 diabetes (T2D) and F1-F3 liver fibrosis due to NASH. The GLP-1, or Glucagon-like peptide-1, agonists are a class of medications utilized in the treatment of Type 2 diabetes and obesity. Thus, one could say, this trial was to test the efficacy of a combo comprising a liver therapy drug and a weight loss treatment.

EFX was reported to be generally well tolerated in Cohort D with comparable results for the EFX and placebo (N=10) groups and the overall tolerability profile was similar to that observed in prior studies. The Cohort D study also met all key secondary endpoints, including relative reduction of liver fat and the proportion of patients whose absolute liver fat level normalized to 5% or less. The substantial benefit of the combination suggests that EFX could be an important treatment for patients with NASH who are being treated with GLP-1 for underlying comorbidities of T2D or obesity. The data compares favorably with other NASH treatments being investigated.

Akero Therapeutics, PrudentBiotech.com

The results of the trial showed that more patients treated with the EFX and GLP-1 combo met higher thresholds of liver fat reduction and normalization and greater reductions in markers of fibrosis, than GLP-1 alone.

Akero Therapeutics, PrudentBiotech.com

Trial Timeline

The next major data release will be for the Symmetry Phase 2B extended trial for Cirrhotic NASH. It will build on the positive 16-week data in patients with F4 fibrosis. The data is expected in the final quarter of 2023.

The Phase 3 trials, Synchrony, for F1-F2-F3, are expected to begin in the second half of 2023 and will test both the 28 mg and 50 mg doses of EFX.

Akero Therapeutics, PrudentBiotech.com

Conclusion

There is a growing body of evidence, built over the multiple trials, suggesting EFX is a highly promising and unique treatment for NASH. The stock has been part of the Prudent Biotech model portfolio since last year and we intend to continue holding the position at this time.

There will be trial-related news during the second half, which can provide reasons for further increases in the share price. After the recent results, we believe Akero Therapeutics has positioned itself to become an attractive acquisition candidate, perhaps as early as in the second half. Pfizer had made a $25 million investment in the company last year after the Phase 2 results were announced.

The company has ~$650 million in liquid resources, after a recent capital raise in May 2023, and believes its cash runway extends into 2026. There are multiple companies in the field including Intercept Pharmaceuticals (ICPT), Madrigal Pharmaceuticals (MDGL), Viking Therapeutics (VKTX), 89bio (ETNB), and Novo Nordisk (NVO).

Please do your own research to determine the suitability of biotech investments. We always recommend a portfolio approach for biotechs and have up to eight stocks in our Prudent Biotech model portfolio.

___________________________

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here