Akoustis Technologies (NASDAQ:AKTS) continues to disrupt the global RF-filter market with proprietary XBAW designs that deliver superior size, power, frequency selectivity, and bandwidth advantages as compared to legacy polycrystalline BAW filter technology. Indeed, just last week AKTS announced two new design wins in the Wi-Fi 6E market – a rapidly growing market that is driving Akoustis’ revenue and unit volume growth. Today, I’ll review AKTS’s Q3 earnings report (which was released on May 8th) as well as recent new orders and the potential impact of CHIPS & Science Act of 2022. I’ll also make a rather convincing argument for why Akoustis is shaping up to be a very attractive takeover target.

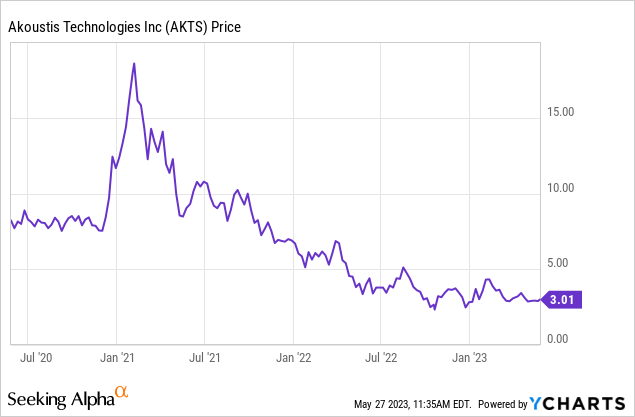

Meantime, and unfortunately for existing shareholders, Akoustis’ stock continues to trade well off its highs despite what I consider to be its continued strong strategic, operational, and financial performance:

But the weak stock is exactly what makes AKTS such an interesting speculative growth opportunity for investors with a longer-term perspective. In my opinion, it also makes AKTS a very attractive takeover target.

Investment Thesis

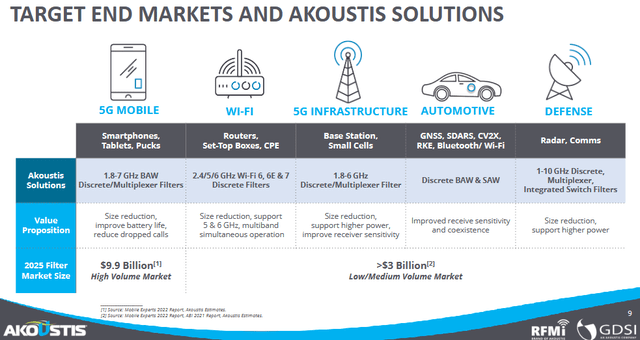

The slide below was taken from Akoustis’ May Investor Presentation and shows the multiple global market opportunities the company aims to exploit with its technically superior XBAW RF-filter designs:

Akoustis

As you can see, there are multiple key and fast-growing RF-filter markets that, in aggregate, add up to a ~$13 billion TAM for Akoustis. Today, these markets are dominated by big companies like Broadcom (AVGO), Qorvo (QRVO), and Murata (OTCPK:MRAAF). However, these companies primarily offer the older polycrystalline BAW RF-filter technology. Akoustis, on the other hand, is disrupting these entrenched companies by developing proprietary high-purity piezoelectric RF-filter technology that delivers superior technical performance. Akoustis’ XBAW RF-filters are optimized for the most stringent frequency selectivity requirements with superior resonator characteristics. In addition, AKTS’s XBAW filters are smaller and offer superior power performance as well. The end result: AKTS’ RF-filters are the ideal solution for today’s leading–edge Wi-Fi and 5G mobile/infrastructure designs.

Earnings

Akoustis released its Q3 FY23 EPS report on May 8th and it demonstrated continued progress on the company’s strategic, operational, and financial plans. Highlights of the report included:

- Record revenue of $7.3 million. That compares to revenue of $5.9 million in the previous quarter (+23.7% sequentially) and to revenue of $4.6 million in Q3 of FY22 (+58.7% yoy).

- A GAAP net-loss of $0.23/share as compared to a loss of $0.27/share in Q3 of FY22.

- Cash and cash equivalents at the end of the quarter was $52.75 million, up from $46.57 million from the prior quarter.

The increase in cash sequentially was due primarily to net proceeds of $32 million from a secondary offering in January. That was offset by cash used to fund the recent Grinding & Dicing Services (“GDSI”) acquisition as well as cap-ex and operating expenses.

CapEx spending for Q3 was $2.2 million. That was down $1 million from the prior quarter as the company placed into service the last its ordered equipment and nears completion of the company’s New York fab expansion.

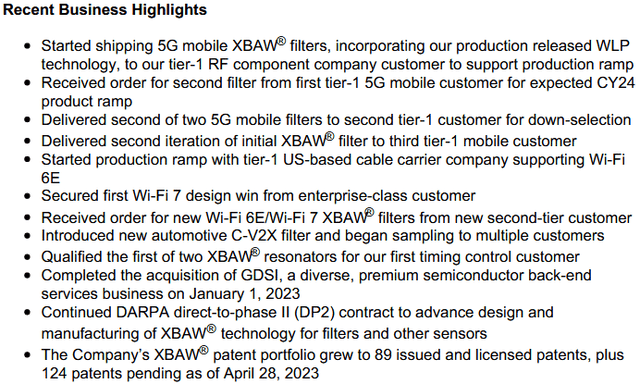

It was another quarter of robust business development and continued patent activity:

Akoustis

Going Forward

On the Q3 conference call, Akoustis CFO Ken Boller commented on expectations for Q4:

In the current June quarter, we expect multiple new WiFi 6 and network infrastructure customers to ramp production, and therefore, we expect to see record revenue and continued operating cash flow improvement with revenue up between 10% and 20% sequentially from the March quarter, — and based upon our growing backlog of design wins, we anticipate that robust top line growth will continue into our next fiscal year and beyond.

Indeed, this past week AKTS announced two new Wi-Fi 6E design wins – both of which utilize MU-MIMO (multiple-in, multiple-out) architectures which result in multiple filters per end product:

- A design win with a Wi-Fi 6E Access Point Customer for the European Communications Carrier Market. This customer is currently ramping-up production.

- A separate design win with a Tier-1 Enterprise-Class customer for a Wi-Fi 6E “User Experience Sensor Solution”. This customer is expected to ramp-up production in the 2H of this year.

Dave Aichele, EVP of Business Development at Akoustis, commented on the announcement:

Our design win activity in Wi-Fi 6E remains one of the most significant drivers of revenue and unit growth for Akoustis. We have multiple consumer, enterprise-class, and now service-provider class Wi-Fi 6E customers. Additionally, we expect increased interest in our Wi-Fi 7 filter solutions as we iterate higher-performing versions of our existing standard products, introduce new products, including the recent sampling of our 5.6 GHz and 6.6 GHz Wi-Fi 6E/7 XBAW® solutions, offer customized solutions, and grow our foundry business across Wi-Fi and 5G mobile.

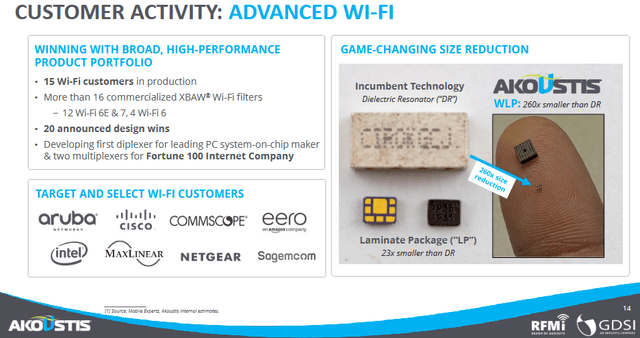

To date, Akoustis has announced over 20 Wi-Fi design wins and has at least 16 customers currently in production:

Akoustis

But, of course, Wi-Fi 6E/7 is only one of the fast-growing opportunities Akoustis has identified. The others are 5G Mobile, 5G Infrastructure, Automotive, and Defense.

The CHIPS & Science Act

Another and potentially very positive catalyst are on-going developments with respect to the CHIPS & Science Act of 2022. According to Akoustis CEO Jeff Shealy on the Q3 conference call:

As of today, we have a DoD proposal, which was submitted during the March quarter with Akoustis as the lead contractor focused on electronic warfare or EW, for defense applications. The proposed 5-year contract, if awarded, has an initial program budget of over $150 million, our proposal incorporates multiple partners, including over 10 industrial and government labs as well as numerous university partners focused on the goal of developing and manufacturing semiconductors into advanced RF modules at our 57-acre campus located in upstate New York.

This DoD proposal would build on AKTS’s existing relationship and development contract with DARPA for high-frequency XBAR R&D.

Akoustis is also active in expanding its domestic manufacturing footprint under the DOC chips for America program. Akoustis submitted a statement of interest (“SOI”) in late March and expects a full application submission by the end of the current quarter. In parallel, AKTS is working closely with New York’s local, regional and state governments for financial support to include in the application. AKTS plans to propose a project contemplating spending up to roughly twice its current market cap to establish 200-millimeter silicon wafer manufacturing capability as well as a U.S. advanced packaging center.

A Potential Wildcard

If Akoustis’ RF-filter technology is as superior as I believe it to be, the company will likely continue to ramp-up RFFE (RF front-end) design wins across multiple technology sub-sectors (Wi-Fi, 5G mobile/infrastructure, Auto, Defense). As a result, AKTS is certainly being closely watched by much bigger competitors like Broadcom, Qorvo, Murata. All of these relatively entrenched companies need not only to protect their current market share, but to provide compelling technology for its customers going forward. Considering AKTS’s currently has: a market-cap is only $215.6 million, $44 million of long-term debt, and cash of $52.7 million (i.e. an EV = $206.9 million), it would be a small-fish to swallow for any of these bigger companies. Considering the size of TAM at stake and AKTS’s demonstrated and technically superior RF-Filter solutions, it is conceivable that AKTS could easily be taken over at 3-4x its current stock price. That multiple would likely go up considerably if AKTS was awarded contract wins on either of the proposals discussed above.

Risks

Akoustis is still, obviously, losing money. However, note that CFO Boller said this on the previously referenced Q3 conference call:

… then breakeven I still expect to occur in the next 12 months at approximately $15 million to $18 million of revenue per quarter depending on our mix.

AKTS is still a small-fry, and there are no guarantees that its proposals for CHIP & Science Act awards will be chosen in what is expected to be a very competitive selection process.

Upside risks include an acceleration of new design win announcements. Seeking Alpha currently reports a large 8.44% short position in the stock. That being the case, any upside momentum in the stock could be turbocharged if the shorts are forced to cover.

Summary & Conclusions

Akoustis continues to execute on its strategic business plan: continued development of superior and proprietary RF-Filter design technology, expand its manufacturing capacity, and to take advantage of the CHIPS & Science Act of 2022 to scale-up to 8″ wafer manufacturing, re-shore advanced packaging to New York, and to expand its RF-Filter manufacturing capacity from 500 million to 5 billion units on an annual basis. The company continues to announce strong design wins and customer engagement – especially in Wi-Fi 6E. Ramp-up of these design wins in the 2H of this year should lead to continued strong revenue and unit-volume growth going into 2024. As a result, I rate AKTS stock a STRONG BUY in the speculative growth stock category.

Read the full article here