Dear readers/followers,

I wrote my first article on Alexandria Real Estate (NYSE:ARE) not too long ago (March 8), but a lot has happened since so I believe an update is warranted. This is one of my core holdings, not only in my REIT portfolio, but in the whole portfolio so I try to keep a close eye on what the company is doing. Since my last article the stock price has dropped by 15% while the S&P 500 moved sideways. The drop was to a large extend caused by the collapse of SVB (Silicon Valley Bank).

Why did the price fall?

Indeed many of the early-stage life science companies (including some of ARE’s tenants) were banking with SVB, however, this was a relatively small percentage of tenants (remember ARE has 50% of investment grade or publicly traded tenants and most of the other companies are also well established). In case, management confirmed on their earnings call that they were very actively involved with about 100 tenants to resolve any issues, they didn’t identify any major problems as most tenants were banking with multiple institutions and can access various sources of venture capital beyond SVB. Management also reassured investors that there will be no long-term effect on the life science industry. And I tend to agree that beyond the short term fear of a banking crisis, the collapse of SVB was largely a non-event for ARE.

Of course, general concerns regarding commercial real estate and especially office didn’t help the stock performance either. ARE is technically classified as an office REIT and it seems that it has suffered from a general sell-off of office REITs. But I think that the market got it wrong on this point as well, because as mentioned in my original article, Alexandria is nothing like a normal office REIT, because they focus exclusively on life-science tenants (big pharma, bio-tech, academic institutions etc.). That means no real threat from the work from home (WFH) trend as you cannot take a lab home the same way you can take your laptop. As you can tell I feel that the fall in price wasn’t justified which makes me quite bullish, especially after reviewing their stellar Q1 results.

What makes ARE special?

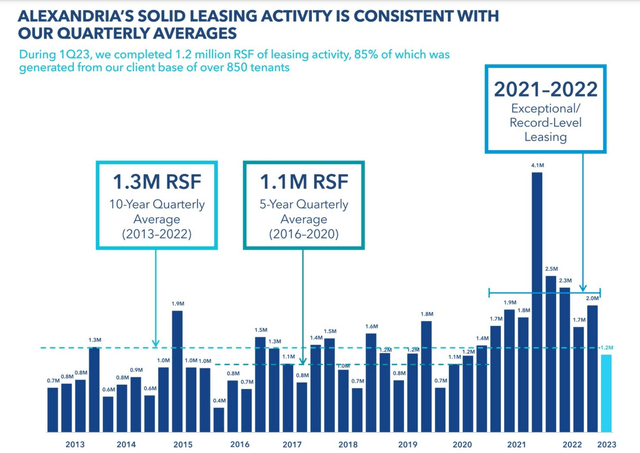

First off let’s look at their leasing. During the first quarter, the company completed 1.2 Million sft of leasing activity, 85% of which came existing clients. What this tells me is that tenants like ARE which has over 80% retention rate over the past five years. Moreover, it’s not that ARE is giving their tenants discounts and begging them to renew their leases. It’s quite the opposite, ARE is able to get some great terms on their renewals as illustrated by highest ever rental rate increases in Q1 of 48.3% (24.2% on a cash basis).

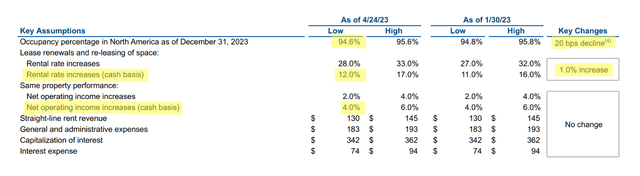

Going back to leasing, the first quarter activity was somewhat lower than the exceptional 2021-2022 period, but was consistent with a 10-year average for the company. Moreover, with 1.7 Million of lease expirations this year and about 3.5 Million per year in the following years, it’s easy to see that even at this level of leasing, the company should be able to maintain a stable occupancy thanks to a long WAULT (weighted average unexpired lease term) of 7.2 years. This is consistent with the fact that managements guides towards an increase in occupancy from 93.6% to 94.6-96.5% by the end of the year. Though it’s worth noting that they have revised their occupancy target down by 20bps compared to Q4 2022.

ARE Presentation

As far as the rest of guidance, management expects increases in rent on renewals of 12-17% on a cash basis, which is fairly conservative and would represent the lowest increase since 2019. On a same-store basis, the forecast calls for a 4-6% growth in NOI which again is quite conservative considering that they achieved 9% growth in Q1. Part of this growth is highly visible thanks to the fact that 95% of leases have build in rent escalation clauses with an average annual increase of 3%. In summary management expect 2023 FFO per share to reach $8.96 at midpoint, representing a 6.4% YoY increase and following 8.5% growth last year.

ARE Presentation

Alexandria’s growth has largely been attributed to their development pipeline and I expect this to continue in the future. In Q1 alone, the company deliver one development and four redevelopment projects, adding 450 thousand sft and $23 Million of incremental NOI. There are two great things worth mentioning, first of these properties were 100% leased from the first day of operation and second they provide a relatively high initial stabilized yield of 7.3% (or 6.6% on a cash basis). Looking ahead, ARE has 6.7 Million sft of space expected to begin operation over the next three years. This space will add an additional $610 Million in NOI. And Importantly 73% of the space has already been leased. This gives the company tremendous growth visibility.

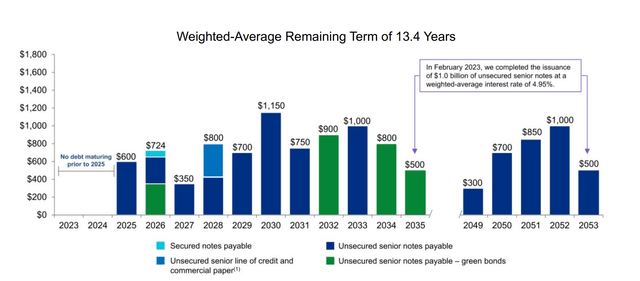

If you’re not convinced that ARE is a high quality company, look no further than their balance sheet. We’re looking at a BBB+ rating, with 96% of the debt fixed and a net debt to EBITDA of 5.3x (target is 5.1x by year-end). A low average interest rate of 3.7% doesn’t hurt either, especially when we consider that ARE has no debt maturities until April 2025. This means no refinancing risk and no interest expense surprises. Finally they have over $5 Billion in liquidity (of which over $1 Billion is cash) which is plenty to take advantage of a market slowdown.

ARE Presentation

Investor takeaway

So there you have it. Those are my reasons for investing heavily into ARE at these low levels. I set a price target at $195 in my original article and I see no reason to move it now. That leaves a 63% upside which I think is very achievable within the next three years and you will get paid to wait with a nice 4% dividend which has grown at a CAGR of 5% and will likely continue to do so. I upgrade ARE to a “STRONG BUY” here at $119 per share.

Read the full article here