Introduction

Alibaba Group Holding Ltd. (NYSE:BABA) is a Chinese multinational company that specializes in retail and e-commerce. It also has branches in the internet technology, mobile media, film, and entertainment industries. The stock has performed quite well in recent months, experiencing a 5.67% increase since December of 2022, with a high of 120.57 USD in January of 2023. Alibaba is rated as a buy with a forecasted twelve-month high of 181.00 USD and a low of 115.00 USD from its current 92.10 USD. With a number of strategic maneuvers, acquisitions, and internal changes on the horizon, Alibaba is a strong buy.

Company Overview

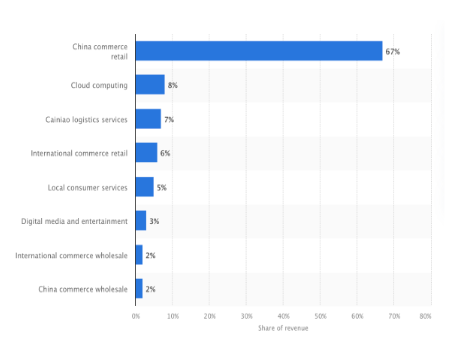

Statista

The Alibaba Group mainly operates in the Chinese retail and e-commerce sectors with their online shopping platforms Tmall and Taobao, which make up for 67% of the company’s revenue. It also has a significant presence in cloud computing, logistics, and the international e-commerce and retail sectors, making up a combined 21% of its revenue. The company also has a small but growing presence in the digital media and entertainment industry, sponsoring the Chinese video streaming service Youkou Toudou and Alibaba Music. Many analysts still see this segment as a money pit, as they pale in comparison to Chinese giants Baidu (BIDU) and Tencent (OTCPK:TCEHY), which sponsor far more popular video streaming platforms.

Industry Overview

The Global retail e-commerce industry is expected to grow at a CAGR of 11.3% in the period from 2023 to 2027. The Chinese retail e-commerce industry is expected to grow at a CAGR of 12.36% in the same period. The Chinese e-commerce market generates 50% of the world’s e-commerce transactions by volume, and further is expected to grow to 3.56 trillion USD by next year.

Competitive Analysis

Alibaba continues to dominate the Chinese retail e-commerce market, having a 50.8% market share. Alibaba’s e-commerce subsidiaries, Tmall and Taobao, account for nearly 50% of all parcel deliveries in China. Through Tmall and Taobao, the company is able to control the sales of both name brand and non-name brand, merchant-sold products respectively. Their combined transactions generated over 163 billion USD last year alone. Alibaba’s closest competitors are JD.com and Pinduoduo, which control 15.9% and 13.2% of the Chinese market respectively. These companies, although quite substantial in growth and market share, simply lack the near monopoly Alibaba holds over the Chinese retail e-commerce market. With growth outpacing analyst predictions, Alibaba is expected to hold this competitive command over the Chinese market for a long time.

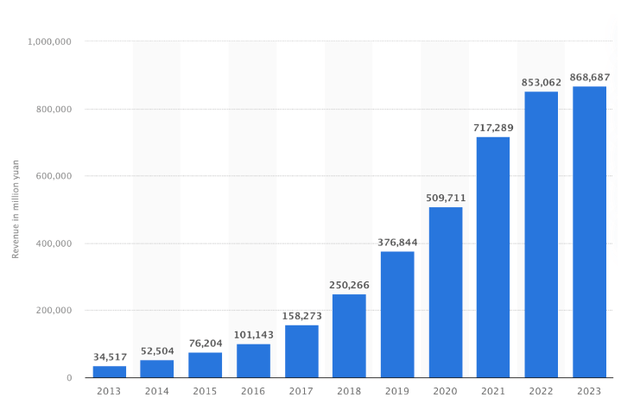

Statista

Financials

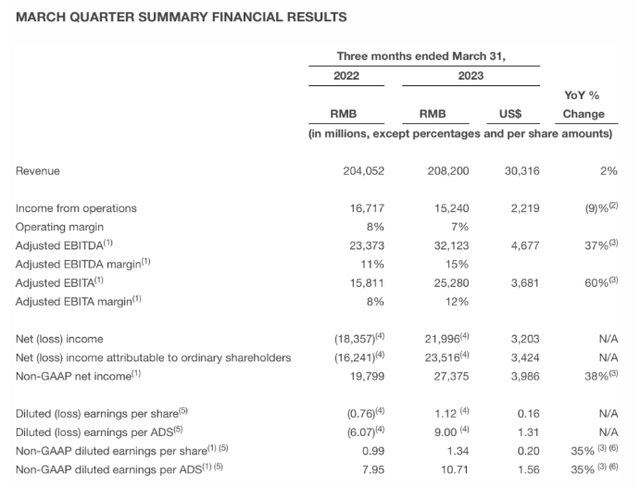

Alibaba reported a revenue of 868.69 million Yuan in the last fiscal year (as of March 31st 2023) or approximately 126.49 billion USD. Their e-commerce subsidiaries generated the bulk of the income, around 582.73 billion yuan, or approximately 81.77 billion USD. Alibaba also reported a Q1 2023 revenue of approximately 29.62 billion USD, a 2% YoY increase, and an increase of 38% in net profits from Q1 2022. In addition to these metrics, Alibaba’s international retail sector grew 15% in orders and 41% in revenue, which is expected to increase further with the launch of Choice, a service providing cost-effective solutions and products for customers. The company also reported Q1 operating expenses of approximately 28.1 billion USD, a 1% of revenue YoY increase. This number is expected to increase as Alibaba spends more into AI research and development following its main competitor in this sector, Baidu.

BusinessWire

Catalysts for Growth

Alibaba has a solid foundation within the Chinese retail e-commerce market; as such, apart from the projected growth of the aforementioned, additional catalysts for Alibaba’s stock growth come primarily from investments into other subsidiaries through internal changes to the company’s holdings. Alibaba’s grocery-shopping arm, Freshippo, for example, seeks to complete its IPO within a year, part of the company’s larger reform initiative. Alibaba’s logistics arm, Cainiao Smart Logistics has also been given the green light to seek an IPO. Alibaba’s stock price increased by 14% when the company announced its intention to split its key holdings into larger, more organized subsidiaries, namely into e-commerce, local services, smart logistics, global e-commerce, and entertainment and digital media sectors. With a prospective future IPO for subsidiaries, and lesser expenses into what many investors have described as a money pit, Alibaba has massive potential for growth in this regard.

Valuation

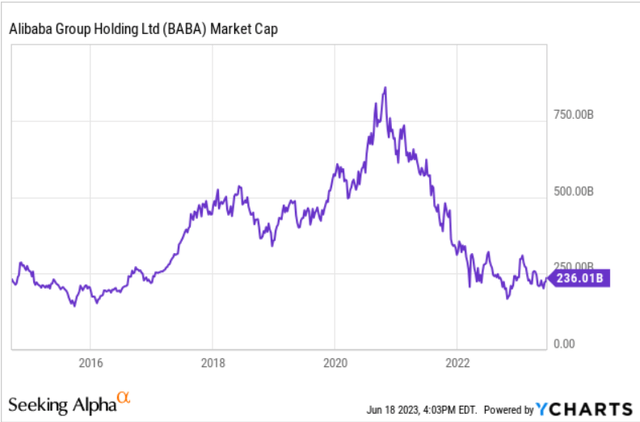

Alibaba currently has a forward P/E ratio of 10.08, indicating a pretty good expectation for growth. The company also has a trailing P/E ratio of 24.09, indicating outstanding growth in the past year. Alibaba also has a five-year annualized earnings growth rate of 11%, an impressive rate compared to other companies. Although metrics have indicated a decrease in growth Alibaba in recent quarters, this is bound to increase as the company splits its subsidiaries and takes and increases market share in key sectors, particularly logistics. In addition, the combination of the projected growth of the Chinese consumer market and Alibaba’s dominating size over the retail e-commerce sector will lead to sizable growth in the future. Alibaba’s market capitalization currently stands at approximately 236 billion USD. The company’s capitalization has been as high as 648.31 billion USD, and has frequently been higher than its current value. The combination of factors stated indicates a low current valuation, and that the company’s true value may be higher than it is.

Y Charts

ESG metrics

Alibaba has made significant strides in recent years to reach benchmark ESG goals. The company aligns itself to the UN’s 2030 Sustainable Development Goals (SDGs). They have also aligned themselves toward restoring the climate, enabling a sustainable digital economy and social sphere, and fueling small businesses, among other goals. Alibaba’s primary method to reach their ESG targets is via communication with stakeholders and through charitable donations the company makes in this regard. Overall, the company is rated as a BBB, or average, MSCI in terms of ESG, particularly in the fields of labor management and carbon emission control.

Risks and Concerns

Being a multinational Chinese company, Alibaba has to maintain close relationships with both foreign regulators and the Chinese government. The latter relationship can prove volatile at best and can cause a company to fold entirely at worst. The Chinese government seeks to hold active regulatory roles even in private companies, which can prove concerning for a company like Alibaba. Furthermore, economic conditions and volatility, especially with regard to China’s relationships on the world stage can directly affect the company’s cross border e-commerce initiatives, which account for a significant amount of projected future growth. In addition to this, political changes, such as sanctions and tensions can affect Alibaba’s stock price.

These concerns, however, pale in comparison to a much bigger risk: data theft. China’s National Intelligence and Data Security laws have made it necessary for Chinese companies to comply with Chinese data collection policies. This has already proved a problem for nations like Australia, which have barred Huawei, among other companies, from installing technology within their nation. As a Chinese company, Alibaba is also forced to comply with these legal bindings, and thus secure data collection for foreign customers continues to be an issue which may significantly hurt Alibaba’s international expansion projects in the future.

Conclusion

Alibaba controls a significant share of the Chinese retail e-commerce market, with many of its competitors trailing behind. Alibaba’s future growth is a function of its non-ecommerce subsidiaries and how they can adapt and evolve to the evolving Chinese consumer market, as well as the growing market itself. With significant investments into each of these ventures, particularly with regards to its excellent logistics arm, however, Alibaba is expected to even outpace investor expectations as its internal unitary reforms continue.

Analyst Recommendation By: Ratul Chakraborty

Read the full article here