Shares of Allstate (NYSE:ALL) have been on a meaningful run over the past two months, rising from $110 toward $140, which has brought shares back into positive territory over the past year. This has come amidst hope that pricing increases will finally stabilize results. Management is also considering a divestiture, and Nelson Peltz’s Trian Fund has taken an over 1% stake in the company. This has added to optimism that management can be forced into shareholder friendly activity. In this case though, I think the market has gotten ahead of itself, and I would use the rally to sell shares.

Seeking Alpha

In the company’s third quarter, it earned $0.81 in adjusted earnings, blowing past consensus by $0.32. This is an improvement from its $1.53 in losses a year ago. So far this year, it has lost $4.91 on an adjusted basis due to underwriting losses, though this has improved sequentially. I want to be clear that Allstate’s operating performance is improving, and I expect that to continue. This improvement is coming off of a very low baseline though, and it appears to be fully reflected in the stock’s multiple.

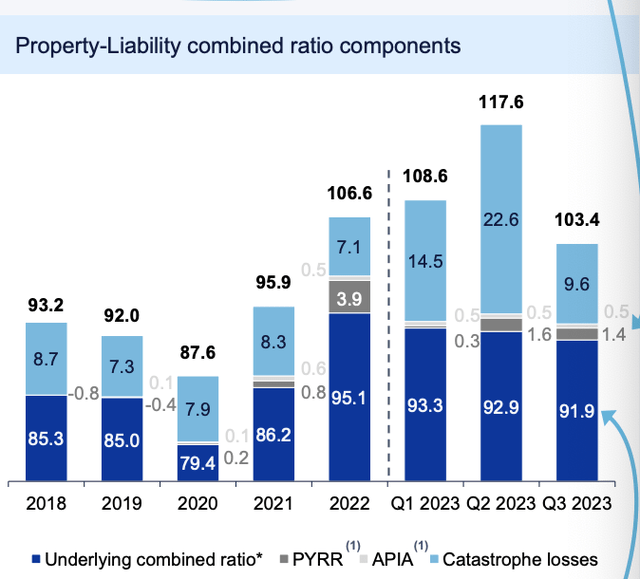

As you can see below, Allstate has been struggling with underwriting losses since the aftermath of COVID. A combined ratio of 100% means that an insurance company is breaking even on underwritings. In other words, its premiums match its claims and expenses. Last year, ALL had a combined ratio of 106.6, meaning it lost over 6% on its insurance premiums. These losses have continued in 2023, though they did improve sequentially in the third quarter with a ratio of 103.4. That still represent a loss on its underlying insurance operations, which is not a strong result.

Allstate

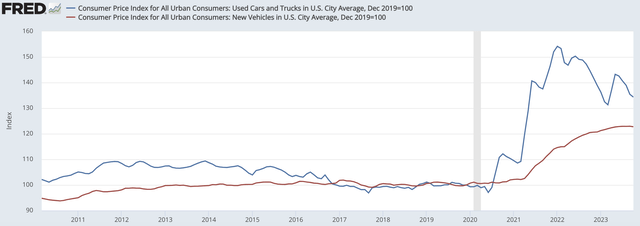

A problem facing insurers like Allstate has been inflation. It prices policies with an assumption of how costly it will be to replace or repair cars damaged in an accident. This is the “severity” rather than the “frequency” of a claim. However due to supply chain issues, the auto market became severely undersupplied, which pushed up new and used car prices meaningfully. This increased the severity of insurers’ claims, worsening their profitability.

St. Louis Federal Reserve

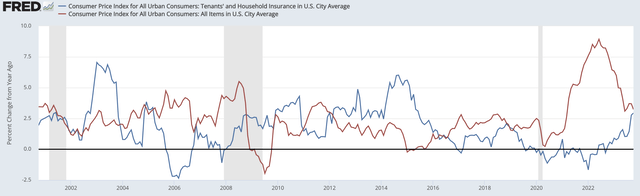

Fortunately, with supply chains recovering and the Federal Reserve acting aggressively to reduce inflation via higher rates, we have seen prices moderate. At the same time, insurers have been responding to higher historic losses by increasing premiums. Because most auto contracts are 6-12 months, it takes time to raise prices across the entire portfolio, meaning that insurance prices can lag overall prices. That is exactly what has happened this cycle. As measured by CPI, insurance premiums barely budged in 2021-2022 as inflation soared. They are now rising even as overall inflation slows, and based on the current trajectory, insurance premiums may eclipse overall inflation in coming months. This relative re-pricing should provide industrywide support to underwriting margins.

St. Louis Federal Reserve

This macroeconomic data is evident in Allstate’s results. Allstate auto insurance raised prices by 17% last year and by 9.5% so far this year. These price increases are a major reason why company insurance premiums rose by 10% to $12.3 billion. Given the magnitude of the price hikes, it is disappointing the underlying combined ratio in auto was 100.5 from 103.2 last year, meaning it is still losing money. Moreover of that 2.7% increase, about half, or 14% came from reduced operating expenses, in part due to lower marketing spend. Claims’ growth continues to offset nearly all of the price hikes, which points to structural underwriting issues, given slowing inflation.

Auto losses are focused in New York, New Jersey, and California with the rest of the country profitable. Of course, these are three of the biggest auto markets, making the poor performance there particularly costly to the bottom line. Allstate also had a 6% decline in policies in force, due to less advertising and higher premiums. In Texas for instance, rates are up over 50%. With such dramatic price increases, there is risk that its highest-quality drivers (those least likely to have a claim) can find better quotes elsewhere, leaving Allstate with a worse pool of drivers. Given the slow improvement in its combined ratio, this may be happening already.

It is a similar story in its homeowners unit where insurance premiums rose by 12.1% due to a 13.2% increase in the average premium. The combined ratio rose from 90% to 104.4%. This was because catastrophe losses added 29.6% to the combined ratio from 16.2% last year. There were $878 million of cat losses in this unit. Given the fact the hurricane season was quiet, insured losses industrywide were meaningfully lower in 2023 than 2022, making Allstate’s worse performance more disappointing. This was because ALL had over $320 million in Maui-related losses from the wildfires there. Cat losses can be quite volatile, and hopefully, this proves to be an anomaly.

In October, cat losses were back below $150 million, which is an encouraging sign. Still, Allstate is on pace for the worst catastrophe losses in 25 years. In addition to higher cat losses, Allstate took $166 million of unfavorable reserve estimates. Insurance companies are periodically re-evaluating the performance of policies relative to past modelling and adjusting reserves. This essentially means that Allstate’s legacy policies were less profitable than originally expected, which is consistent with the poor underwriting results we are seeing on a current-year basis.

Ultimately, Allstate is still losing money on underwriting. It is raising prices aggressively, which when combined with slower inflation should improve its underwriting margins. However, progress is quite slow. I do expect to see improvement, but I fear it may take longer than investors are now hoping.

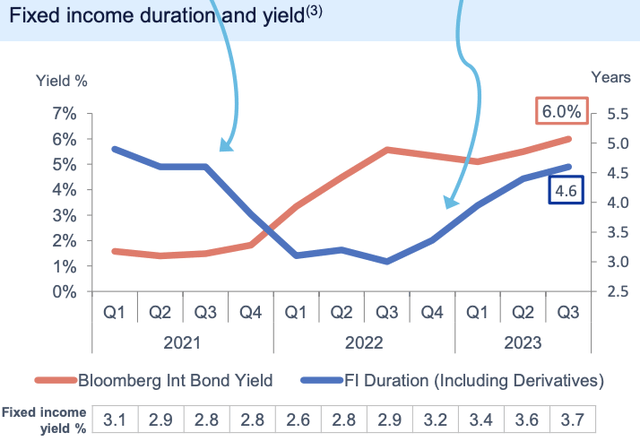

In the last quarter, net investment income was flat at $689 million. However, there was significant movement within this line-item. Its fixed income portfolio generated $567 million in income from $402 million last year while its “performance” portfolio of alternatives earned $186 million from $335 million. Its performance portfolio has more volatile performance as private assets’ valuation can move with equities. Conversely, fixed income results are tied to interest rates.

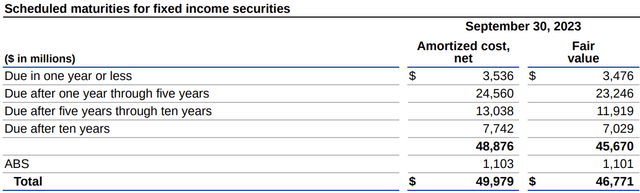

Allstate has extended the duration of its portfolio, doing much of this last year, somewhat early relative to the peak in yields. Still, it has managed this fairly well. As a consequence, its fixed income yield has been steadily rising. However, the pace of improvement has slowed as many of its lowest yielding bonds have matured and already been rolled over.

Allstate

Moreover, because ALL has been extending its portfolio’s duration, there are fewer short-term maturities. Less than 8% of its portfolio matures in the next year. As these mature, we should see some incremental yield gains. But, we are likely to see fixed income investment income rise by less than $60 million over the next year, vs the $165 million of the past year, barring surprise further increases in rates by the Fed, given its maturity profile.

Allstate

The challenge Allstate faces is that its poor underwriting results have reduced its capital. Its statutory surplus has declined by $1.8 billion this year to $10.5 billion at the insurance company. This is a reason that rating agencies have downgraded its debt. Allstate, like all insurers, is owned by a holding company, which is the entity that pays dividends and does buybacks. Insurance operations occur at the operating companies, which pay a dividend to the holdco, which in turn pays shareholders. Because of its poor results, there have been just $40 million in intercompany dividends this year. Last year, dividends totaled $4.2 billion in the first three quarters.

Allstate is preserving capital in its insurance operating company to manage through the current spate of losses. This is why it suspended its share repurchase program in July. It has $2.9 billion in assets at the holding company, providing several years of dividend and interest coverage. Until results improve at the insurance arm, dividends up to the parent will be constrained, which in turn limits shareholder returns.

ALL has been looking at ways to improve its capital position. One possibility has been buying reinsurance to reduce potential losses, but it has not found attractive pricing for this. Instead, it has announced it is pursuing a sale of its National General Health and Benefits Unit. This is a relatively small unit that does not fit with its auto and homeowners’ units, though it provides diversification. However, it is the only part of the business generating an underwriting profit; it has about $240 million in net income and $2.3 billion in revenue. We will see if a sale materializes, but it can use the proceeds to enhance the capital position of the insurance entity, though such a sale may also reduce earnings power.

For the next twelve months, at least, Allstate will be focused on enhancing its own capital position, by retaining earnings, or selling assets, before it can focus on returning additional capital to shareholders. It also needs to show progress on returning to a profitable underwriting position. Given how slowly we are seeing progress, I fear this may be a multiple year endeavor.

ALL will likely loss money this year, given its losses through nine months. Over the longer-term, if it can return to a 95% combined ratio (from 103% currently), assuming $690-720 million in run-rate investment income, ALL has $13-14 of earnings power. That gives shares a 10x multiple on its “potential” earnings, which may take a few years to materialize—if they do. In the meantime, though, earnings will be below this level.

I struggle to see the compelling rationale to buy a struggling insurer at 10x down-the-road earnings, if everything goes right, when I can buy an insurer doing well today, like Chubb (CB) at 11x earnings. Given its struggles, Allstate should trade at a discount to where Chubb trades, so it appears shares are already pricing in this recovery scenario. The risks are now skewed to that recovery not occurring as quickly or as easily as hoped. Having recovered meaningful ground, Allstate has little further upside, and I would be a seller, rotating into other insurers who are performing better today. Considering the execution risks, I would only be a buyer if shares fell below $115, or less than 8x potential earnings to reflect the long-term nature of the turnaround.

Read the full article here