Company Overview

Alpha Metallurgical Resources (NYSE:AMR) is an American mining company that produces coal in Virginia and West Virginia. Here’s a link to their website where more background information can be found.

Trade Thesis

I’m often looking for stocks that are in industries that the average investor and institutions loathe; this is because I can usually find the best companies going for the cheapest valuations there. One of the reasons that retail investors and institutions dislike many commodity-related companies is ESG. One area that we see this is the coal industry, which is not ESG friendly thus companies in the industry are going for a dirt-cheap valuation. Another reason that coal companies are going for a discount valuation is that prices for coal have gone down due to recession fears, and this is being priced into the stock.

This company is already going at 2-3x earnings and I considered it to be the best in class in this industry. This is because it has extremely wide operating margins, negative net debt, and the management has put an emphasis on returning capital to shareholders.

Breakeven Prices

When looking at commodity-related companies, especially those going at very low multiples, I look at it from a liability-based investing perspective, not an absolute return perspective.

The term liability-based investing originated in the pension fund space where the portfolio manager’s liability would be the payout they would have to make to pensioners over time; they would look to match that liability with an appropriate asset that could produce those returns with minimal risk; essentially in liability-based investing you come up with your liability, which would be your return parameter, for example, I might say that I want a 50% CAGR for the next 5 years with drawdowns of no more than 30%; this becomes the return parameter and hence the liability, then your job as an investor is to find assets that can match this liability. Also, rather than looking for a great investment, you start with an investment and presume that it’s great as it meets basic parameters like a low P/E or high ROE(which this stock does), then ask yourself if there are any red flags as to why this might be a value trap; if there aren’t any red flags then it’s a great investment. Essentially you are reversing the process of stock picking.

In this case, I see the liability as being able to generate enough earnings that the P/E ratio stays reasonable(6-8x) even if coal prices go down. Hence I would look to calculate breakeven prices for coal and see if the company can withstand a recession.

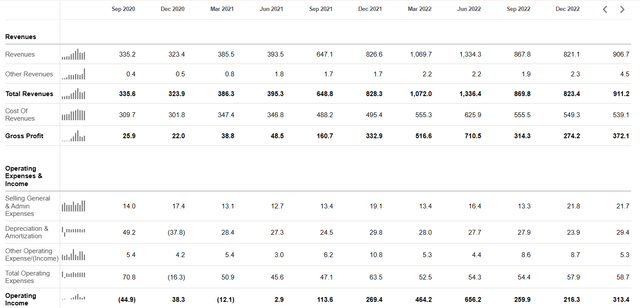

Seeking Alpha

Source

I took a screenshot of the quarterly P&L as shown by Seeking Alpha. The floor or breakeven price can be calculated by how low the gross profit can go till it is under the operating expenses. For example, if the company did $100 million in gross profit and $100 million in operating expenses, which evens out to zero operating income, then it is at its breakeven.

The reason I choose to use operating income or EBIT is that the company has negative net debt and taxes wouldn’t have to be paid if the company was at breakeven.

First off regardless of how much revenue the company does the operating expenses are always stable. This is seen in the P&L where the operating expenses are always around $50-$60 million. This is the floor for the gross profit at breakeven.

Over the last two years, the gross margin has roughly been a third. It was lower 2 years ago and is now closer to 40%. To be on the safe side we can use the lower gross margins which are around 15% when running a breakeven analysis. This means that the company needs to do 350 million in revenue per quarter to be at breakeven. This is about a third of the revenues the company has had for the last year on a quarterly basis. This means that coal prices could fall 60% or so and the company would be profitable.

Below is a chart of coal prices through front-month futures contracts on a rolling basis.

Newcastle Coal Front-Month Futures (Tradingview)

The above chart shows coal prices in USD. The blue line roughly represents where the breakeven is.

Most of the time the price is above the breakeven and it seems that the market has already priced in a recession with the large retracement we’ve seen. Even if we get back to more normalized levels which would be $75-$115, I see continued profitability in the company.

I don’t think the stock is a value trap even if the price of coal goes down. Coal prices would only have to go down 10%-25% to get to a “normalized” pre-covid level. This would still likely leave the P/E multiple of the company below 4x if commodity prices were to return to normal levels.

Return of Capital To Shareholders

One of my frustrations with the management of many companies whose stock looks “cheap” by traditional methods is that they don’t do anything about it. A lot of companies with stocks at low valuations are continuing to reinvest in the company at measly returns or are still using their stock to do dilute activities like M&A when their main focus should be to buy their own stock.

Fortunately, the management realizes that the stock is going for a cheap valuation, so they are using the vast majority of the company’s cash flows to buy back stock.

This in essence does two things. First is that it puts a floor on the stock price which provides investors with more price stability. The second thing it does is to reduce the P/E ratio of the stock, making the low valuation even lower.

Here’s what the company has to say in their last quarterly report:

As previously announced, Alpha’s board of directors authorized a share repurchase program allowing for the expenditure of up to $1.2 billion for the repurchase of the company’s common stock. As of May 4, 2023, the company has acquired approximately 4.8 million shares of common stock at a cost of approximately $715 million. The number of common stock shares outstanding as of May 4, 2023 was 14,452,474, not including the potentially dilutive effect of unexercised warrant shares or unvested equity awards.

At their current rate of stock buybacks, I wouldn’t be surprised if they are able to buy back 50% of outstanding shares over the next year. I think this is more likely than most think as the company is doing roughly $1.3bn net income per year. This is half of their market capitalization. On top of that, the company has virtually no debt and over a billion in current assets. This means that most of the FCF can be invested into stock buybacks. Also, if the price of the stock goes lower due to recession fears this would be a blessing in disguise for the shareholders as it would allow even more stock buybacks.

Capital Efficiency

When working through the numbers for this company I also noticed something else interesting, which is the extremely high ROE. Normally when I see a cigar-butt stock, which is commonly defined by having a low P/E ratio I notice that the P/B is also low since the company has such a low ROE, which is likely why it’s priced cheaply in the first place. In this case, even though the stock is trading for a low earnings multiple the book value of the company is lower than the market capitalization. Sometimes this can be explained away if the company has a lot of debt or little in current assets, but in this situation that isn’t the case. The trailing ROE for this company is 76%. Even if the earnings go down due to lower commodity prices the ROE will still likely be above 50%. This is impressive, especially seeing as though the company has a negative net debt position.

When I see a company with a high ROE it’s a stock that I’ll look to hold on to for a long period of time (instead of a quick cigar-butt trade) as it’s a sign that management has made the business capital efficient and if the company wanted to expand it would require a minuscule capital injection to do so. Also, the ROE of a business can also give us a clue as to what the long-term compounding rate is, as often they are the same or very close.

Risks

The only major risk I see is that the price of coal drops so much that the company’s revenues are too low to sustain profitability. Another potential risk would be environmental regulations that make it harder for companies in the coal vertical to operate, although I don’t currently find this to be a major risk.

The Bottom Line

The bottom line here comes down to a few simple points. The first of which is that the industry is disliked by many due to ESG mandates, so it provides a great opportunity for investors like myself who aren’t concerned with ESG. The second is that the valuation from a traditional perspective is very low and stock buybacks are putting a floor on the stock price. I find the risk to be low as the only major risk to the company I see is the price of coal dropping drastically; I think this is unlikely and the company has a low breakeven price. Overall my opinion is that it’s a great company at a great price.

Read the full article here