Altair (NASDAQ:ALTR) provides a range of solutions related to simulation, data analytics and high-performance computing and is heavily promoting the AI aspect of its business. The company has a history of fairly average growth and efficiency though and is unlikely to see a large boost from AI. These factors make Altair’s current valuation look stretched, which coupled with a weakening demand environment presents significant downside risk.

Market

Altair’s business gives it exposure to a number of markets which have quite different sizes, growth drivers and competitive dynamics. Altair’s primary market is simulation software, although the acquisition of RapidMiner will likely increase the importance of the data science tools market.

Simulation is used to analyze and optimize product designs through the use of virtual prototypes. The use of simulation is increasing across industry verticals and throughout the product lifecycle, with CAE software helping companies to improve product quality, lower costs and reduce time to market.

Increased product complexity is also creating a need for software that can model a range of physical phenomena, including structural mechanics, fluid dynamics, heat transfer and electromagnetics, with the focus shifting from component level analysis to the system.

The PLM market opportunity was expected to be 56.3 billion USD in 2021, growing at a mid-single digit rate. The CAE market is a subset of the PLM market and was expected to exceed 7.8 billion USD in 2021, with high single digit growth.

Altair’s addressable market also includes software to facilitate and optimize the use of HPC infrastructure for running simulations. The market for high-end HPC servers was estimated to reach 7 billion USD by 2020, with Altair positioned to capture spending related to workload management systems for these high-end servers. The HPC middleware software market was forecast to exceed 1.6 billion USD by 2019.

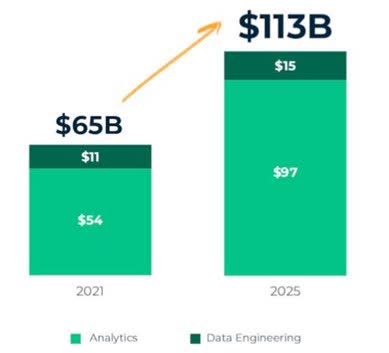

Altair also has exposure to IoT and analytics. The market opportunity for IoT platforms was estimated to be 72 billion USD in 2020. In comparison, Alteryx (AYX) believes its current market opportunity is approximately 65 billion USD across the analytics and data engineering space. These markets are projected to exceed 110 billion USD by 2025.

Similar to RapidMiner, Alteryx wants to democratize access to analytics and believes there are over 78 million advanced spreadsheet users who would benefit from its platform. Alteryx believes its current user base is less than 1% penetrated into this population and that many of its customers are early in their journeys to data-centricity.

Figure 1: Alteryx Total Addressable Market (source: Alteryx)

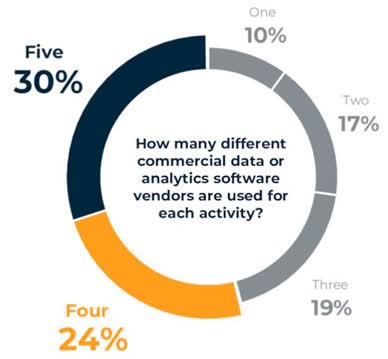

The current analytics landscape is extremely fragmented though, with the majority of spend directed towards disparate siloed legacy data engineering and analytic tools. Customers appear to be transitioning towards unified platforms though and more customers are moving data into environments like cloud data warehouses.

Figure 2: Overlap in Analytics Software Vendors (source: Alteryx)

Altair has stated that demand is currently strong, despite the company’s weak growth. Growth is decelerating for many of Altair’s peers though and a range of indicators point towards softening demand across Altair’s markets.

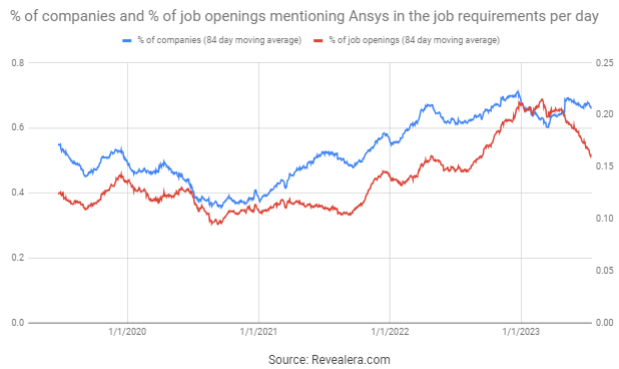

The number of job openings mentioning ANSYS (ANSS) in the job requirements has declined in recent months, suggesting weaker demand for simulation software.

Figure 3: Job Openings Mentioning Ansys in the Job Requirements (source: Revealera.com)

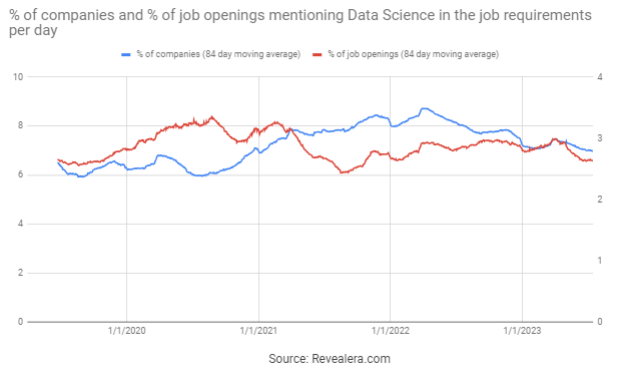

Despite the current hype around AI, the number of job openings mentioning data science in the job requirements continues to decline. The immediate impact of LLMs is likely to be far more concentrated than many expect, and Altair’s RapidMiner business probably won’t see a meaningful near-term boost.

Figure 4: Job Openings Mentioning Data Science in the Job Requirements (source: Revealera.com)

Altair

Altair is a leading provider of engineering simulation software and services. Its portfolio includes tools for simulation, high-performance computing and data analytics. Altair began as a software consulting company working primarily for auto companies, but over time developed its own simulation software. The company expanded into high performance computing in the early 2000s and has been investing in data analytics over the past 15 years. While its main business is simulation, Altair views itself as a computational science and AI company.

Altair offers solutions in five categories related to CAE and high-performance computing:

- Solvers & Optimization – solvers are software that use computational algorithms to predict physical performance. Optimization leverages solvers to determine the most efficient solution to a problem.

- Modeling & Visualization – Design-centric tools that allow physics attributes to be modeled and visualized.

- Industrial & Concept Design – Simulation driven design tools that encompass CAD.

- IoT – Tools for IoT enabled products, including device and data management, and digital twin simulation.

- HPC – Software applications that streamline the workflow management of compute-intensive tasks.

Altair’s software optimizes design performance across a range of disciplines (structures, motion, fluids, thermal, electromagnetics, systems). Altair also supports multi-physics simulation, and Altair offers AI, visualization and rendering solutions. The company is not just focused on enabling more sophisticated analyses though. Altair is also trying to lower the barriers to perform simulation.

Altair acquired SimSolid in 2018 to try and reduce some of the complexity involved in performing simulations. SimSolid is a next-generation simulation technology that allows structural simulation using CAD models without requiring geometry simplification, cleanup, or meshing. This is important as geometry simplification and meshing are two of the most time consuming and expertise intensive tasks in finite element analysis. SimSolid delivers fast and accurate simulations and is particularly suited to simulation-driven design.

Altair is investing aggressively in SimSolid and is reportedly seeing rapid adoption. The company still appears to be adding basic functionality though, like non-linear modelling and thermal modelling. A cloud version was also recently released, giving users web browser access from anywhere.

Altair is banking on SimSolid democratizing the use of simulation software and dramatically improving the productivity of users. This could help Altair to penetrate the mid-market and lower end of the market, where it has historically not had much of a presence. In support of this, Altair is also trying to provide simpler user interfaces and easy access to a broad range of applications.

Altair’s HPC solutions ensure the efficient utilization of compute resources and streamline the management of compute-intensive tasks. HPC tools manage and optimize where and when jobs are running and how storage is accessed and managed. In support of this, Altair’s HPC solutions also enable workloads to be easily moved from on-prem data centers to the cloud and between different cloud providers. This enables customers to perform computation in the lowest cost location. Applications which utilize HPC include AI, modeling and simulation, and visualization. For example, HPC may be used for weather modeling, bioinformatics and electronic design analysis.

Altair offers a broad range of data analytics solutions, covering areas like data preparation, modeling, MLOps, orchestration, and visualization. Altair makes heavy reference to AI when discussing its data analytics business, but most of its tools are what is more commonly thought of as data science.

Altair has low-code tools for data science which help to bring advanced analytic capabilities to line-of-business employees. Adoption of its products should also be aided by its ability to support legacy code created over the last forty years using the SAS language. Altair SLC runs programs written in SAS language syntax without translation and without needing to license third-party products.

This part of the business should be aided by Altair’s acquisition of RapidMiner for 100 million USD in 2022. RapidMiner is a widely used and open end-to-end data science platform. It provides a balance between ease of use and data science sophistication. It’s ease of use is praised by citizen data scientists while its data science functionality, including its openness to open-source code and functionality, make it appealing to experienced data scientists. The platform emphasizes core data science functionality and speed of model development and execution.

RapidMiner Studio is the primary model development tool and is available in a free and a commercial edition. RapidMiner Server is an enterprise extension designed for deploying and maintaining models and facilitating collaboration. The platform supports a variety of languages and deployment environments.

RapidMiner has over 380,000 users but few of those users are paying customers. Prior to the acquisition by Altair, RapidMiner’s revenue was fairly low and the business was growing slowly relative to competitors.

Part of the reason for Altair’s acquisition may have been the company’s belief that AI will become an integral part of design and engineering workflows. For example, AI can be used to generate a large number of design options and rapidly evaluate which options are best. AI can also be used in simulation to make running models faster and easier and simulation can be used to create synthetic data to train AI models.

Altair’s design tools leverage simulation and machine learning and the company believes that this approach may eventually subsume traditional CAD in both mechanical and electronic applications. More employees work in design that simulation, so this may help to expand Altair’s business significantly. Altair has stated that more manufacturing customers are already looking to leverage data analytics to accelerate simulation.

Altair is a serial acquirer, having acquired 48 companies or strategic technologies since 1996, with 23 of those occurring in the past 5 years. Recent acquisitions include:

- RapidMiner – acquired in September 2022

- Concept Engineering – acquired in June 2022 for its electronic system visualization software

- Gen3D – acquired in June 2022. Gen3D provides design software that uses an implicit geometry method for describing highly complex geometries

- Powersim – acquired in March 2022 for its power electronics simulation and design tools

- Cassini – acquired in February 2022 for its cloud native technology

Competition

The markets for simulation, HPC, data analytics, and AI software are generally fragmented. As a result, Altair faces a range of competitors with different capabilities and focus areas. These competitors include:

- Dassault Systèmes (OTCPK:DASTY)

- Siemens (OTCPK:SIEGY)

- Ansys

- MSC Software (a Hexagon (OTCPK:HXGBF) company)

- Autodesk (ADSK)

- PTC (PTC)

- SAS Institute

- Alteryx

Ansys is the leader within Altair’s core market, although Altair appears to be differentiated by a greater focus on data science and high-performance computing. Altair also appears to be trying to bring simulation and optimization earlier into the design process, which could increase competition with Autodesk and Dassault.

There appears to be some hype at the moment around Altair’s exposure to AI. Optimism should probably be tempered though, as most signs point towards AI tools remaining a fairly fragmented and low value market. Value is more likely to accrue to companies that have access to proprietary data or are able to leverage AI in their business in unique ways. The combination of AI with CAD and CAE could create value in this manner, but there is no real reason to think that this shift would favor Altair over a company like Ansys.

Financial Analysis

Total revenue only increased by 3.9% YoY in the first quarter of 2023. Altair’s business continues to move away from services, with software product revenue contributing approximately 90% of total revenue. Software revenue is also now predominantly recurring, with 95% of Altair’s software product billings recurring in nature in the first quarter. Given the fact that most revenue is recurring and that approximately 60% of new software revenue comes from expansion within existing customers, Altair’s current growth looks anemic.

Automotive and aerospace accounted for roughly 39% of Altair’s 2022 billings. Other important industries include heavy machinery, rail and ship design, energy, government, life and earth sciences, BFSI, and consumer electronics. Given this industry exposure, it is somewhat surprising that Altair’s growth has been weak over the past 18 months.

Total revenue is expected to increase by 4-5.5% YoY in the second quarter. For the full year, Altair is guiding for 7.3-9% YoY revenue growth.

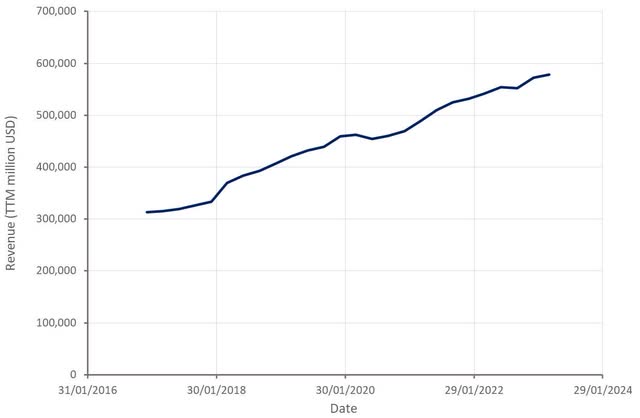

Figure 5: Altair Revenue (source: Created by author using data from Altair)

Altair’s gross profit margins have trended up in recent years, as the software business has grown in importance. With software now responsible for around 90% of revenue, there may be limited further upside though.

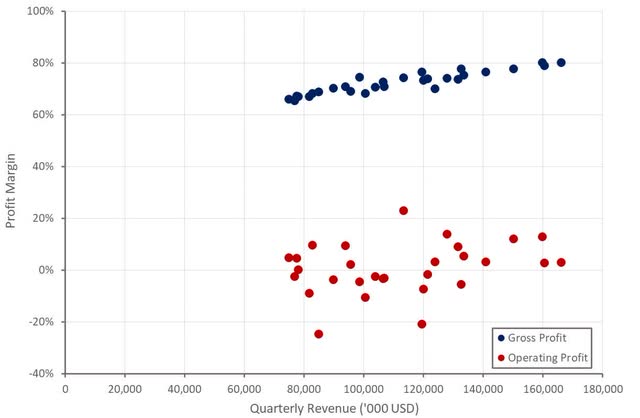

Altair hasn’t been able to drive operating leverage in recent years as investments in sales and marketing and R&D have more than offset revenue growth. While this isn’t necessarily a bad thing, coupled with Altair’s modest growth this does raise questions about efficiency.

Figure 6: Altair Profit Margins (source: Created by author using data from Altair)

Approximately 86% of Altair’s 2022 software revenue was generated through its direct sales force, which may help to explain some of the high burden of sales and marketing expenses.

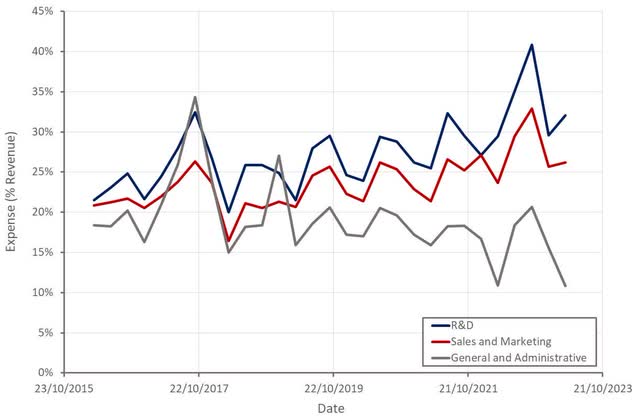

Altair is currently in the process of moving some indirect expenses from the general and administrative line item to R&D and sales and marketing, making its presentation more comparable to peers. While this is just moving expenses between buckets, it again raises questions about the efficacy of R&D and sales and marketing spend.

Figure 7: Altair Operating Expenses (source: Created by author using data from Altair)

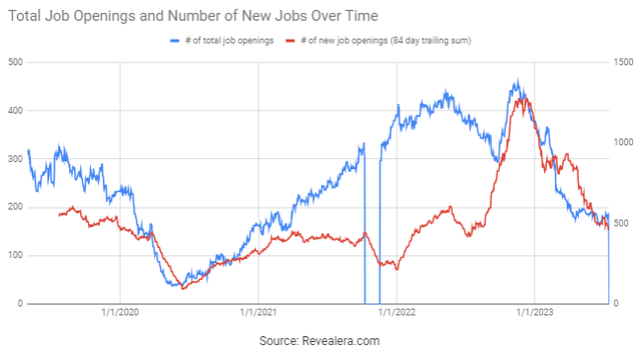

At the end of 2022, Altair had over 3,000 in-house employees and more than 200 on-site Client Engineering Services employees. Altair’s pace of hiring continues to moderate, which is probably indicative of a soft demand environment and a greater focus on costs. Management has also stated that employee turnover rates have now returned to pre-pandemic levels, reducing hiring needs.

Figure 8: Altair Job Openings (source: Revealera.com)

Conclusion

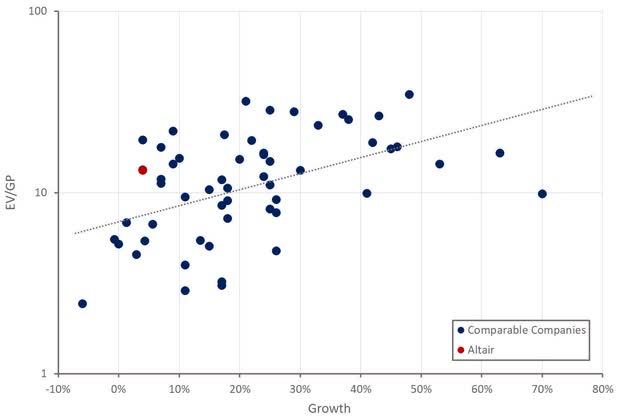

Altair’s valuation currently looks stretched given the company’s recent history of modest growth and the average efficiency of investments in R&D and sales and marketing.

Investors appear to be willing to pay a premium for Altair based on its exposure to AI and the potential synergies between AI, CAD, CAE and HPC. The near-term impact of this is likely to be muted though, and AI will probably benefit customers and the simulation market as a whole, rather than Altair specifically.

Weakening end market demand also presents a downside risk, particularly if economic conditions deteriorate further later in the year. In particular, strength in automotive and aerospace is probably supporting Altair’s business at the moment. If these end markets soften, Altair’s growth could miss expectations later in the year.

Figure 9: Altair Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here