Altria (NYSE:MO) is grappling with a significant downturn in its smokable products segment as the industry inevitably shifts toward smoke-free alternatives. This segment reduced by 10% last quarter. Analysts are divided on how rapidly sales volumes will decrease and whether Altria can consistently hike prices to offset this decline.

For Altria to preserve its revenue streams, it needs to raise prices to keep pace with, if not outpace, falling sales volumes.

I believe Altria will struggle to increase prices quickly enough to compensate for the rapid drop in sales volumes. This challenge is compounded by competition from its vaping products eating into cigarette sales, increased elasticity of demand for cigarettes, and a broader consumer trend with less expensive cigarette brands gaining ground over premium ones.

These challenges are pervasive across the tobacco sector; however, Altria’s reliance on the U.S. market and its premium-priced Marlboro cigarettes may make it more vulnerable to these industry pressures than other tobacco firms with a more diverse market positioning.

Historically, Altria enjoyed the advantages of an oligopolistic market for much of the 20th century and into the 21st. This helped keep its margins extremely robust and gave it powerful control over pricing. However, the vaping and smoke-free sector has a different competitive structure, with numerous small and medium-sized enterprises capable of eroding Altria’s market share.

Given the notably lower production costs of cigarettes relative to those of vaping pods and devices, it seems improbable that Altria will maintain or enhance its margins if it fully substitutes its cigarette revenues with income from vaping products. However, the explosive revenue growth expected in the vaping sector may offset this potential reduction in profitability through higher sales volumes, but investors presently have low visibility into how likely this growth will be.

I believe that the uncertainties surrounding Altria’s transition to a smoke-free business model, including its future profitability and market share, present too many risks for investors to comfortably hold the company’s stock. The substantial challenges in successfully shifting its business operations, after decades in a mature market, are heightened by the changing preferences of younger consumers.

These substantial concerns are enough, in my view, to question Altria’s status as a reliable blue-chip investment.

Accelerated revenue cannibalization

The shift towards vaping products is expected to eat into the sales of all tobacco companies. However, I predict that Altria will face an accelerated downturn because of this transition.

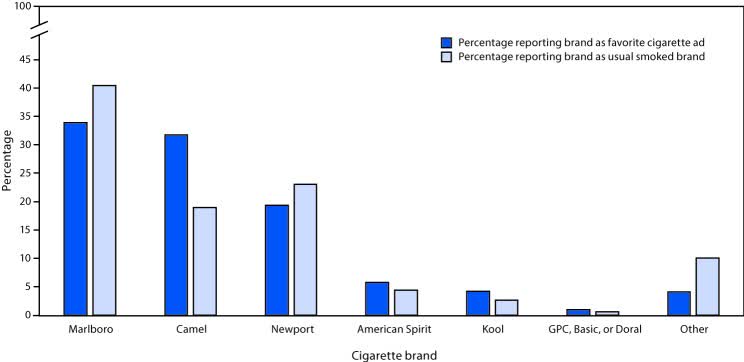

The 2018 study on cigarette brand preferences in the United States found that adult smokers reported a much larger variety of brands and sub-brands than adolescent smokers, with adults reporting 64 brands and 330 sub-brands, while youth reported 14 brands and 50 sub-brands.

For adolescents, the top three brands—Marlboro, Newport, and Camel—dominated the market, with 48.5%, 14.5%, and 12.6% of the market share, respectively, totaling over 75% of the adolescent market. Adults also favored these top three brands, with Marlboro at 40%, Newport at 15%, and Camel at 11%, cumulatively holding 66% of the adult market share.

The study also noted that as age increased, smokers tended to choose from a wider variety of cigarette brands and styles. Value-priced brands were commonly purchased across all age groups, with the highest popularity among those over 55.

Another study analyzed data from the National Youth Tobacco Survey from 2012 to 2016, focusing on middle and high school students who were current cigarette smokers. It found that these students smoked Marlboro, Newport, and Camel, the most common brands. In 2016, these three brands were the usual choice for 73.1% of middle school and 78.7% of high school current smokers. These brands comprised 62% of the U.S. market in 2016, with Marlboro leading at 40.2%.

Naturally, advertising exposure significantly influences youth’s cigarette brand preferences. Individuals who favorably viewed a brand’s advertisement were more likely to report regularly smoking that brand.

Cigarette Brand Preference and Pro-Tobacco Advertising Among Middle and High School Students — United States, 2012–2016

E-cigarette use is highest among young adults, with 8.3% of young adults reporting using e-cigarettes every day, someday, or rarely. E-cigarette use is also relatively common among adults aged 25-44, with 5.0% of adults in this age group reporting e-cigarette use. However, e-cigarette use is less common among older adults, with only 3.4% of adults aged 45-64 and 1.1% of adults aged 65 and older reporting e-cigarette use.

| Age group | Prevalence of e-cigarette use |

|---|---|

| 18-24 | 8.3% |

| 25-44 | 5.0% |

| 45-64 | 3.4% |

| 65 and older | 1.1% |

Given their limited disposable income, young individuals are often faced with choosing between smoking and vaping, with vaping usually becoming the winning alternative, notably due to the variety of flavors on offer, especially mint and menthol flavors.

But what could be a silver lining (depending on how you look at it) is that youth who start vaping are also significantly more likely to smoke cigarettes later in life. However, most youth who do go on to smoke do so casually instead of habitually.

One study indicated that concurrently using both traditional cigarettes and e-cigarettes (known as “dual use”) is much more widespread among older adults. Specifically, adults aged 45 and over are twice as likely to engage in dual use than younger age groups.

So, the issue is that the makers of premium cigarettes and vaping pods and devices compete for the same primary demographic of young people. Altria must diversify into the vaping market, but doing so risks undercutting its primary source of income from premium cigarettes.

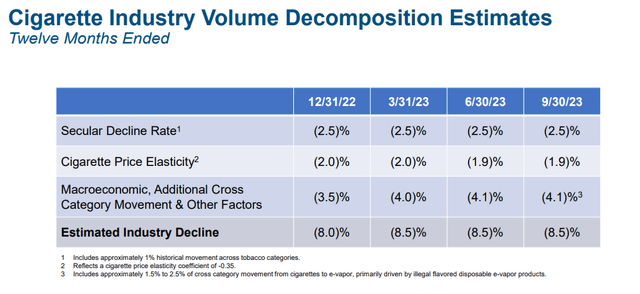

Hence, Altria might face a tighter timeline to shift towards a smoke-free business model than broader industry forecasts imply, not to mention a more difficult execution. For instance, the data from ACLS advanced analytics span the entire range of tobacco products, not just Altria’s high-end cigarette segment. Relying on these industry-wide predictions for Altria specifically could result in miscalculated expectations.

Altria investor presentation

This then creates a complex and unprecedented challenge for Altria, placing the company in a double bind with no straightforward solution. It’s a strategic dilemma of a magnitude and unique nature that Altria’s management team (and possibly any management team) has not previously encountered or resolved.

Value brand structural transition and counter arguments

There seems to be a somewhat unfounded expectation that consumers will spend more on premium cigarette brands such as Marlboro when inflation decreases and the economy improves. Inflation and the cost-of-living crisis certainly contribute to Altria’s declining volumes, but this is relatively insignificant in proportion to the structural decline of the premium cigarette segment before the pandemic started.

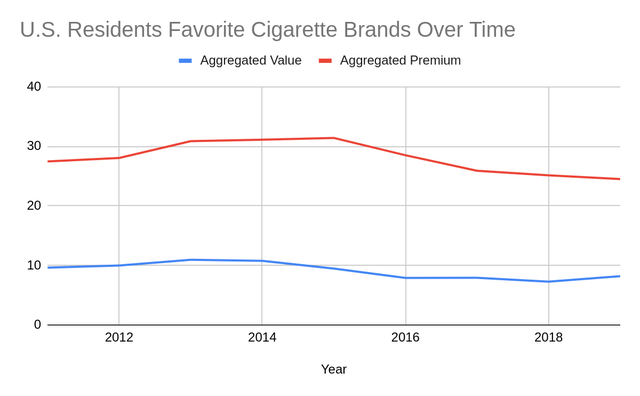

Specifically, data suggests that the premium segment is declining much faster than the value segment.

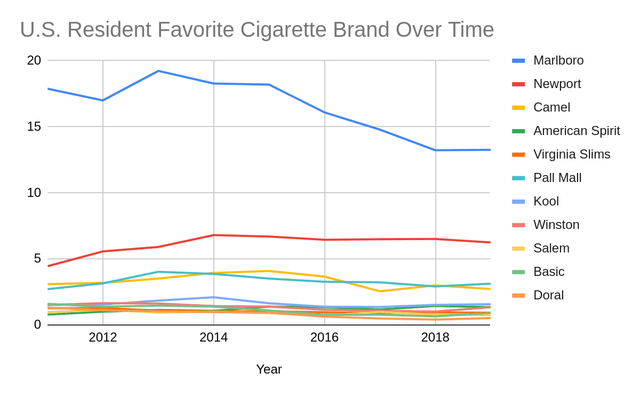

U.S. census data indicates that from 2011 to 2020, premium cigarette brands such as Marlboro consistently saw a significant decline in market share.

The following cigarette brands below are defined as being in the value and premium categories. Note that this categorization was made using my own judgment.

| Premium | Value |

| Marlboro | Pall Mall |

| Newport | Kool |

| Camel | Winston |

| Virginia Slims | Salem |

| American Spirit | Basic |

| Doral |

The graph and table below contain data from the census. A value of one in the table indicates that one million respondents have identified that particular cigarette brand as their most smoked brand of cigarette.

The decline in Marlboro’s share is obvious according to the census data. In this dataset, it peaked in 2013 and decline rapidly from 2015 onwards.

Author supplied

| Year | Marlboro | Newport | Camel | American Spirit | Virginia Slims | Total Premium | Pall Mall | Kool | Winston | Salem | Basic | Doral | Total Value |

| 2019 | 13.26 | 6.25 | 2.72 | 1.35 | 0.93 | 24.51 | 3.13 | 1.57 | 1.34 | 0.74 | 0.9 | 0.52 | 8.2 |

| 2018 | 13.23 | 6.51 | 3 | 1.44 | 0.96 | 25.14 | 2.91 | 1.52 | 1.02 | 0.77 | 0.65 | 0.41 | 7.28 |

| 2017 | 14.79 | 6.49 | 2.55 | 1.17 | 0.89 | 25.89 | 3.23 | 1.36 | 1.07 | 1 | 0.77 | 0.49 | 7.92 |

| 2016 | 16.09 | 6.45 | 3.66 | 1.34 | 0.96 | 28.5 | 3.27 | 1.38 | 1.15 | 0.69 | 0.77 | 0.63 | 7.89 |

| 2015 | 18.2 | 6.69 | 4.09 | 1.39 | 1.04 | 31.41 | 3.51 | 1.64 | 1.39 | 0.88 | 1.1 | 0.94 | 9.46 |

| 2014 | 18.28 | 6.8 | 3.94 | 1.07 | 1.02 | 31.11 | 3.86 | 2.1 | 1.43 | 1.01 | 1.39 | 0.98 | 10.77 |

| 2013 | 19.23 | 5.9 | 3.51 | 1.14 | 1.09 | 30.87 | 4.03 | 1.84 | 1.62 | 0.95 | 1.46 | 1.04 | 10.94 |

| 2012 | 17 | 5.57 | 3.19 | 1.01 | 1.28 | 28.05 | 3.15 | 1.55 | 1.65 | 1.14 | 1.38 | 1.12 | 9.99 |

| 2011 | 17.88 | 4.45 | 3.09 | 0.78 | 1.27 | 27.47 | 2.71 | 1.51 | 1.51 | 0.98 | 1.6 | 1.31 | 9.62 |

When this data is aggregated for both value and premium brands, it shows that the premium segment still has a much larger market share, but it’s losing ground to the value segment due to decreasing at a faster rate, with Marlboro being the loss leader.

Author supplied

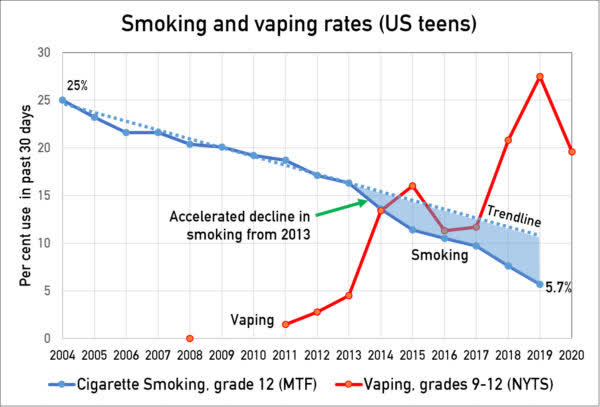

The sharp decrease in the popularity of premium brands happened during the same time that vaping became more popular among teenagers. However, this shift did not significantly impact the lower-priced value brands.

The structural decline of the premium segment I think can be attributed partially to younger people taking up vaping as an alternative. Supporting evidence points to this as being a causative factor than mere coincidence.

Dr Colin Mendelsohn

The correlation suggests that Altria’s attempts to enter the vaping market could further erode its already waning premium cigarette business. The quicker Altria pivots to vaping, the more it risks cannibalizing its traditional cigarette sales, intensifying the challenge of balancing new market opportunities with the management of its existing product lines.

Something else we can infer from the above data is that consumers gradually became more price-sensitive over time. This increased elasticity also means it may be relatively more difficult for Altria to continue to increase the prices of its cigarettes in the future. Since consumers are demonstrating that they are less willing to pay higher prices for cigarettes, especially premium brands like Marlboro, continuing to raise prices could lead to a loss of revenue.

On a different matter and to quickly address the common counter-argument here to Altria’s decline, many proponents of the stock on Seeking Alpha cite analyst consensus as one of the primary reasons for investing. Analyst opinions are undoubtedly valuable and should be heavily considered.

However, using “expert consensus” as the primary reason to invest in Altria’s shares is not a robust argument. Arguments should be grounded in direct evidence and rational analysis rather than the perceived credibility of experts. In a formal debate, claiming that someone is wrong solely because experts have a different opinion would not constitute a logical or persuasive argument, so the same conclusion should be applied consistently on this platform.

Ideally, the consensus should be used as a deciding factor only when two differing opinions are closely matched in evidence and reasoning. This means that the collective judgment of experts is used as an additional factor, rather than the defining one. In such cases, consensus could be a helpful tiebreaker to suggest the more plausible thesis. However, how consensus is used in discussions about Altria doesn’t reflect this. It seems to be employed more as a means to handwave the critical viewpoints of skeptics without properly engaging with their arguments, amounting to an appeal to authority (and, to a lesser extent, the bandwagon) rather than a constructive counterargument.

Menthol cigarette ban and declining economies of scale

The Food and Drug Administration (FDA) sent the final rules last month for banning menthol cigarettes and flavored cigars to the White House for review. The FDA’s proposal, initially disclosed in June 2022, is expected to face legal challenges, potentially delaying implementation until at least 2026. Additionally, Republican-sponsored legislation seeks to block these regulatory efforts.

This ban is expected to severely harm the tobacco industry, as menthol cigarettes make up around 37% of all cigarette sales in the U.S.

I’m not going to speculate on whether this ban will be approved or not. But I believe that if a ban were to be approved, it would be a highly significant threat to the company, perhaps even enough for management to reconsider its dividend policy.

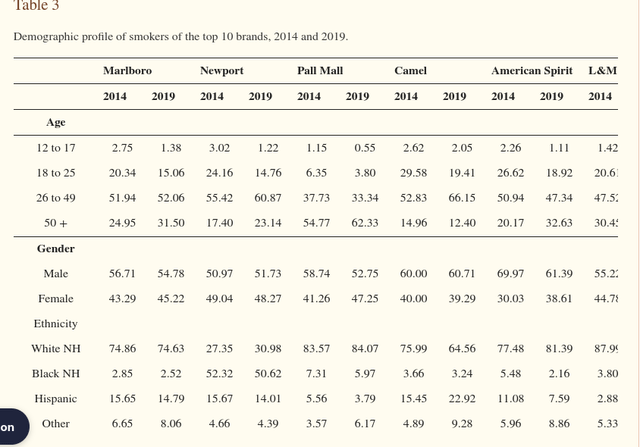

Marlboro held the second-highest market share in the menthol category in recent years, experiencing an 18.1% growth from 2014 to 2019. It held approximately 25.75% of the market in 2019.

Trends in Overall and Menthol Market Shares of Leading Cigarette Brands in the USA: 2014–2019

Altria’s present financials, including net income, dividend payments, and revenues, indicate a solid buffer to maintain its dividend payouts without any imminent risk. The dividend is also very well-covered by its free cash flow.

The company’s payout ratio would only reach an unsustainable level if there was a substantial decrease, exceeding 10% for its net income, and assuming that its cost structure remains intact.

In reality, I feel it’s unlikely that Altria’s cost structure would remain the same as the top-line declines. This is due to declining economies of scale as its production falls. When volumes decrease, the cost per unit can increase because those fixed costs are now spread over fewer units. Fixed costs, such as factory leases, machinery, and salaried labor, do not change in the short term with the volume of production.

It’s therefore unclear how robust its net income buffer is. If revenues decline and costs rise simultaneously, the margin could be smaller than expected due to net income being pressured from reduced revenues as well as increased costs.

There’s a small amount of evidence to suggest that Altria’s cost structure could change from its most recent earnings call.

In response to a question asked on controllable costs, management replied:

As you have fluctuations again in a quarter as you have fluctuations in volume, that’s going to gyrate that controllable cost per pack.

Earlier in the call, management opened with the following summary for the quarter:

Reported OCI decreased $20 million (0.2%), due primarily to lower shipment volume ($1,186 million), higher per unit settlement charges, higher costs ($62 million) and lower NPM Adjustment Items ($45 million), partially offset by higher pricing, which includes higher promotional investments.

If this volatility in volume was not fully accounted for then it makes sense that its costs for that quarter would be higher than expected. What’s not clear though is that if volumes continue to decline, is this going to permanently damage its cost structure moving forward?

In any case, given that menthol cigarettes account for a significant amount of Altria’s sales, a ban for this category could substantially strain the company’s ability to maintain its dividend payments, assuming all other financial factors remain constant.

This scenario presumes that there won’t be sufficient revenue from the smokeless products segment to offset the loss from menthol cigarettes. It also presumes that a decline in variable costs (costs that vary with production volume, like raw materials and hourly labor) would also not offset the rise in fixed costs due to lower production volumes. It’s therefore important to clarify that this is an assessment of potential risks for Altria, rather than a definitive forecast of the consequences of a menthol ban. Nonetheless, it is widely acknowledged that such a ban could be extremely harmful to the company’s financial health, and part of the tobacco industry’s success has been linked to leveraging low fixed costs over massive volumes.

One more minor point: Altria believes that a likely consequence of a ban on menthol is that the black market will absorb the excess demand through contraband cigarette smuggling. I agree that this makes sense.

If a menthol cigarette ban is implemented, it is plausible to expect not only a rise in the smuggling of menthol cigarettes but also an uptick in the illegal importation of all cigarette varieties. The increased demand for menthol cigarettes could broaden the existing smuggling networks and facilitate the illegal entry and distribution of various types of cigarettes into the U.S. market, similar to how existing counterfeit and illicit drug networks have grown in the past in response to regulatory catalysts.

Takeaway

Altria faces a pivotal moment as the Smokable Products segment contracts and the industry leans into smoke-free alternatives. The company’s heavy reliance on U.S. markets and premium brands like Marlboro might amplify its vulnerability to industry shifts more than its peers.

I feel that the cannibalization of its own vaping products eating into its premium cigarette sales is an unacknowledged risk, as well as its ability to successfully navigate its transition away from cigarettes.

There’s a lack of evidence to suggest Altria is capable of making a smooth transition, and I also expect that premium cigarette sales will continue to accelerate. For these reasons I don’t recommend that investors hold on to Altria’s stock.

Read the full article here