Investment Thesis

Despite the stagnant smoking tobacco market, Altria Group (NYSE:MO) remains a stable company. Altria shifts inflation to consumers, which partially compensates for the market’s drop in volume. This allows the company to earn stable free cash flow to pay a high dividend of 8%. Approval of the deal with NJOY will allow Altria to enter a new growth market and diversify revenues.

However, with a current upside of +10% and a dividend yield of 8%, we do not think it is worth rushing to buy. It is better to gain a position in installments on the correction in the company’s share price.

Situation around JUUL

We excluded JUUL Labs from the estimation of the company’s fair value, given the litigation and the carrying value of Altria’s stake in JUUL. As a reminder, JUUL didn’t prove to be a profitable investment for Altria. Altria paid $12.8 bln for the stake in 2018. Over time, the carrying value of that stake has been reduced to $250 mln.

At this moment, Altria has exchanged the entire JUUL stake for a non-exclusive, irrevocable global license to certain of JUUL’s heated tobacco intellectual property. As a result of that deal, Altria recorded a non-cash loss of $250 mln on the disposition of the JUUL stake in 1Q 2023.

The company didn’t record an asset associated with this intellectual property on its balance sheet as it determined that the fair value of the intellectual property was not material to the company’s financial statements. The primary drivers of this conclusion were that Altria’s rights to the intellectual property were non-exclusive and there wasn’t any transfer of a product or technology associated with the intellectual property.

Smoking tobacco market

The trend for smoking less tobacco continues in the US. In 1Q 2023 the total volume of the cigarette market fell to 39.8 bln units (-9% y/y). Altria’s share also dropped, reaching 47% (-1.1 pp y/y).

Over 2022, the US tobacco market decreased to 180.36 billion cigarettes, according to our estimates, or by 8% y/y. Altria attributed that decline to high gas prices and inflation in a wide range of other goods. However, the smaller volume was offset by a 9.4% increase in the average price of a cigarette pack in 2022.

The trend of a shrinking smoking tobacco market continues in 2023. The smoking tobacco market fell by 9% y/y in 1Q 2023, according to our estimates, while Altria’s average price for a pack of cigarettes climbed by 8.8% y/y, which is less than the average increase in 2022 as the broader US inflation is also slowing. Currently, Altria attributes the decline of the smoking tobacco market to persistently high inflation and falling personal real incomes, making no mention of US gas prices, which are now significantly lower compared to last year.

In reality, tobacco is a staple good, and whenever real incomes fell, people typically did reduce their tobacco consumption in terms of quantity, but rather switched from more expensive brands to cheaper ones. The real reason why volumes are falling is the trend for tobacco consumption to shift toward less harmful alternatives such as chewing tobacco and e-cigarettes. According to Statista, the smoking tobacco market will still expand in 2023 in terms of its money value, but half of that growth will be driven by the growing consumption of e-cigarettes (of the additional $1.1 billion in sales of smoking tobacco, $0.64 billion are expected to come from e-cigarettes sales, even as e-cigarettes make up just 8% of the total market).

We are lowering our forecast for the volume of the smoking tobacco market from 174.6 bln cigarettes (-3.2% y/y) to 164.1 bln cigarettes (-9% y/y) for 2023 and from 169 bln cigarettes (-3.2% y/y) to 155.9 bln cigarettes (-5% y/y) for 2024.

Financial results outlook

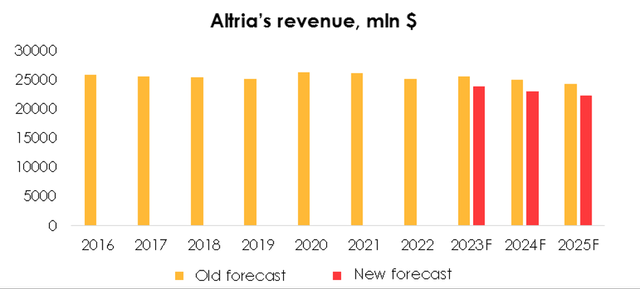

Due to the lower forecast for the volume of the US tobacco market, we are cutting the forecast for Altria’s revenue from 25.5 bln(+1.6% y/y) to 23.9 bln (-4.8% y/y) for 2023, and from 25 bln (-2% y/y) to 22.9 bln (-4.2% y/y) for 2024.

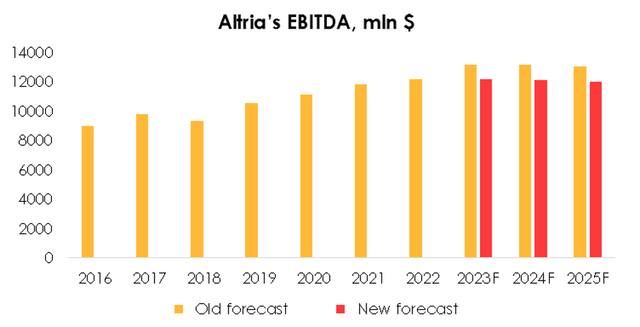

Invest Heroes

Given the reduced revenue forecast, we are lowering the EBITDA forecast from $13 147 mln (+8.2% y/y) to $12 192 mln (+0.4% y/y) for 2023 and from $13 153 mln (+0% y/y) to $12 094 mln (-0.8% y/y) for 2024.

Invest Heroes

Valuation

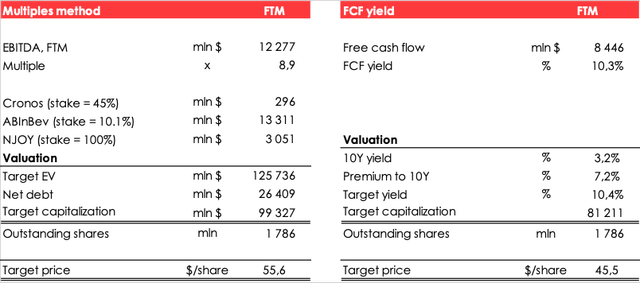

We value the company by averaging the results of two methods: EV/EBITDA and FCF Yield. The EV/EBITDA method helps us to better value a company as a business that has a stake in other businesses. The FCF Yield method helps us to value a company both from a business perspective and from a quasi-bond perspective. Altria pays a high dividend yield with stagnant financial results. As a result, many investors likely view the company as a quasi-bond.

Based on the new assumptions, we are maintaining the rating for the shares at HOLD. The fair value price for the stock is $50.6.

Invest Heroes

Conclusion

Despite the stagnation of the tobacco industry, Altria remains a stable investment in a turbulent period in the markets and in anticipation of a future U.S. recession. A high dividend yield of 8% protects the stock from high drawdowns. However, the current upside on the stock is too low to gain on the company long term.

As the tobacco industry is often subject to new regulation amidst the increasing role of green initiatives, the investment carries attendant risks. For example, one of the main risks is the banning of menthol cigarettes by the authorities, which act as the most frequent flavor in the U.S. An additional risk is the potential disapproval of the purchase of NJOY or disapproval of their new products from the FDA, which would make the purchase of the company unreasonably expensive.

However, if the deal is successful, it would open up a new consumer market for Altria.

We recommend not to rush to buy at current prices and to wait for correction in securities to gain position by portions

Read the full article here