Bezos Since Dumping His Stock

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Back To Bookstore Economics

Before Amazon’s (NASDAQ:AMZN) AWS compute services business gained scale and became mission critical, the company’s fundamental appeal was limited. Capital and labor intensive: The stock narrative was based on scale, i.e., that investors would bear low or no profitability in the pursuit of growth now and profitability later. It worked – investors bid the stock up for a very long time on this basis. We can call this from IPO to around 2014/15.

Then came the AWS era – high growth and high cash flows based on extracting additional yield from the compute plant already built for Amazon’s retail business. From 2015 until recently, AWS was a powerhouse of value within Amazon.

And now? Where is the special-ness? We struggle to see it. The retail business is a low/no margin operation which may have a lot of revenue and employees but generates little actual shareholder returns. And with the slowdown in AWS growth and commoditization among these first-generation merchant cloud services players (Amazon AWS, Microsoft Azure (MSFT), Google Cloud (GOOG) (GOOGL)), we don’t see the future as all that exciting there either.

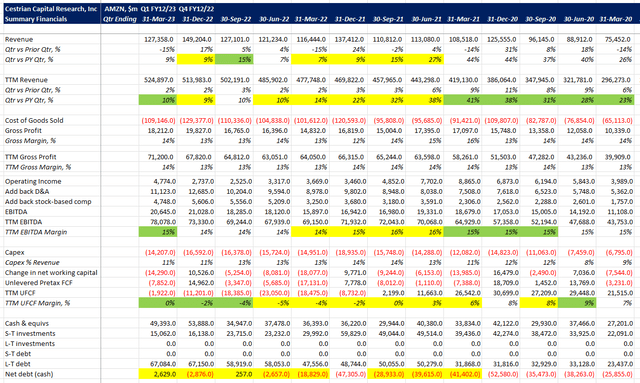

You can see this in the fundamentals. The numbers are “so what.” 10% TTM revenue growth, 15% TTM EBITDA, zero unlevered pretax FCF. Balance sheet neutral, a little net debt this quarter, a little net cash last quarter. Meh. There are thousands of companies that look like that. Sure, this one has a fat market cap but again, so what?

AMZN Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis)

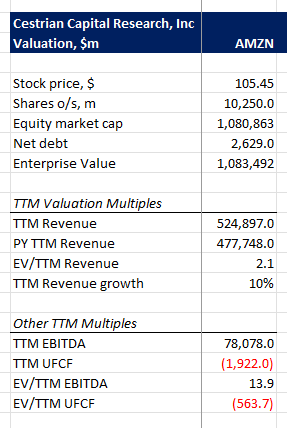

Even the valuation is barely worth mentioning. It’s fine. Can you justify buying the stock, at 14x TTM EBITDA? Sure. Can you justify selling the stock on the basis of no cash flow? Sure.

Yawn.

AMZN Fundamental Valuation (Company SEC Filings, YCharts.com, Cestrian Analysis)

The compelling reason to own AMZN stock – and we do own it in staff personal accounts – is the stock chart. Technically it looks to us that the stock can move up and if it does we believe it will be in sympathy with the market at large, not because of some AMZN-specific reason.

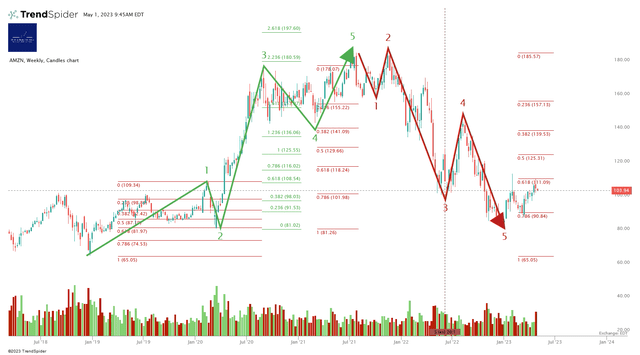

Here’s how the chart looks to us. You can click here to open a full page version of the chart.

AMZN Chart (TrendSpider, Cestrian Analysis)

From the 2018 lows, the stock put in a Wave 1 peaking right before the COVID crisis, then a relatively muted 0.618 Fibonacci retrace into the COVID crisis lows. Then a large Wave 3 up as liquidity flooded the markets, peaking at the 1.236 extension of Wave 1. A modest selloff followed until a new Wave 5 high was struck in 2021.

The stock then puts in a 5-wave impulsive move down, troughing a little below the .786 retrace of that entire move up since the 2018 lows.

And then it bounces, hard – that’s a pattern we’ve seen many times now, with Nvidia (NVDA), Meta (META), and Netflix (NFLX), and others. That .786 retrace of a substantial multi-year stock move has acted as a really powerful support level lately.

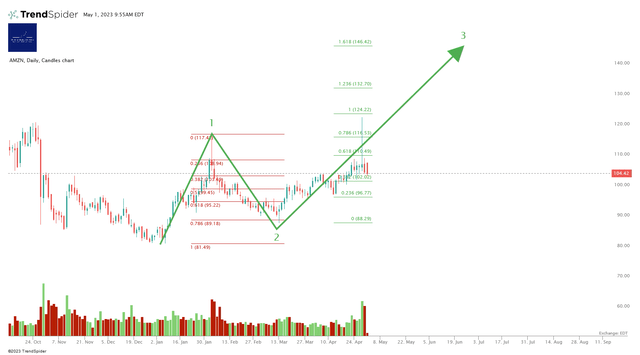

We think that Amazon is now in a new up-cycle – for context we believe the market itself is biased long for the next year or two. If we’re right, the short-term future may look like this (full page version here).

AMZN Short Term Chart (TrendSpider, Cestrian Analysis)

Near-term target, around $140 for the 1.618 extensions of Wave 1, which is a typical Wave 3 high.

Our approach to this stock in staff personal accounts is, do nothing. We think the market will lift many boats including this one, and we’re happy to own it on that basis. Hold rating.

Read the full article here