The AMD Investment Thesis

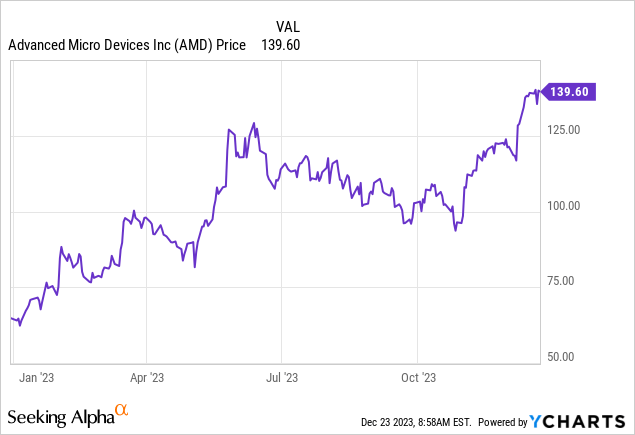

Fueled by the AI hype, Advanced Micro Devices, Inc. (NASDAQ:AMD) has had a fantastic year in terms of its stock price. By selling CPUs, GPUs, and licensing technology to other companies, AMD captures the spirit of the times. Its high-performance, value-priced products appeal to customers ranging from data centers and large enterprises to individuals and gamers.

Combined with energy efficiency and high reliability, this helps AMD maintain a loyal customer base and compete for market share. Despite this, AMD is still underestimated, even though they have an exceptional R&D track record and have taken on Goliath before in the form of Intel (INTC). And this time, the Goliath is NVIDIA (NVDA).

AMD Vs. Intel In The CPU Market

What many never thought possible was that AMD would be able to break Intel’s stranglehold on the CPU market, but AMD has done it. There was a time when Intel dominated all the benchmarks and had superior technology. But as of today, AMD’s Ryzen 9 7950X3D is probably the best gaming processor, and the AMD Ryzen 9 7950x is the best when it comes to multi-core utilization. However, Intel’s Core i9 14900k with 24 cores is the fastest single core. The 8 performance cores and 16 efficient cores work efficiently to help Intel win the neck-and-neck race in this segment.

However, AMD has a new HEDT with the Ryzen Threadripper 7000 that is currently virtually unrivaled in the workstation market, but HEDTs are not a mass product as they are very expensive. The 7980X, for example, costs $4999. But overall, AMD processors are definitely better at multitasking because they tend to have more cores, threads, and memory, and they are more energy efficient. But Intel has its strengths too, as its single-core processors are still the best, but AMD could claim that title in the future. A big win for AMD, for example, was their Ryzen 7 5700k, which beat the Core i5 and thus secured AMD the win in the lower price segment.

In general, however, I believe that both companies will continue to dominate the CPU market because they are far ahead of the competition in this segment and the demand for CPUs is high and will remain so. However, the market for CPUs for mobile phones will probably become more important as well, where there are other strong players.

AMD’s focus on Chiplet has clearly helped them in the past, as the waste rate is much lower compared to Intel’s monolithic approach. Intel has noticed this as well and introduced the first Chiplet lineup with Meteor Lake. But AMD obviously has an advantage because they have been working with this technology longer and more deeply.

AMD Vs. NVIDIA In The GPU Market

One of the most closely watched battles right now is NVIDIA vs. AMD in the GPU market, especially in terms of AI applications. After acquiring ATI in 2006, AMD began to compete in the graphics card market where NVIDIA has clearly set the trends and standards for years. Raytracing, Upscaling DLSS, and G-Sync are just a few of the innovations in recent years that have helped NVIDIA stay on top and dominate the benchmarks with its flagship models. This allows NVIDIA to justify the premium price of its GPUs, although there are some who say that AMD sometimes offers better value.

AMD is committed to making its technologies available to as many users as possible, and FSR is even compatible with graphics cards from the competition. Their approach is to be open source and to use industry standards. NVIDIA takes a different approach. Innovations are often not backward compatible, e.g. DLSS V3 is only compatible with RTX 40 series cards, and NVIDIA definitely does not have an open source approach. In addition, NVIDIA has an ecosystem that is clearly designed to lock customers into the NVIDIA ecosystem and create high barriers and costs to switching.

Both approaches have their advantages and disadvantages, but I would say that NVIDIA’s CUDA currently has a competitive advantage because it is easier to implement and the performance is slightly better than AMD’s open source ROCm. So on the software side, NVIDIA is still ahead at the moment. But a couple of years ago, everybody thought Intel was several years ahead of AMD and AMD was underestimated, and that could be the case in this scenario as well. Although NVIDIA is probably stronger than Intel was then. But AMD is already trying to push Ethernet as the standard for AI networks and to displace NVIDIA’s InfiniBand in order to weaken NVIDIA’s competitive advantage.

In the mid-range of graphics cards, the RX 7800 XT might be even better than the 4070 series, and the RX 7800 generally has a fantastic price/performance ratio. But when it comes to maximum performance, the NVIDIA GeForce 4090 is probably the best card out there right now. But AMD has its strengths in energy efficiency and cost efficiency. In general, I think the focus should not be on who is stronger, but that the situation is similar to Visa (V) and Mastercard (MA). That is, both exist side by side and both benefit from the increasing demand. The market is big enough for both to generate incredible shareholder returns over the next 10 years.

AMD’s partnership with HP and Lenovo in the notebook space should drive sales, and AMD’s CDNA with Infinity Fabric Technology and high-bandwidth memory is delivering significant improvements in AI performance. In particular, CDNA 3 delivers improved performance and efficiency.

AMD had an impressive showing with their MI300x when they introduced it on December 6th and showed that it outperformed NVIDIA’s AH100. NVIDIA responded by releasing their own benchmark that shows the AH100 is still better with the right settings. AMD responded by releasing a new benchmark that once again showed the MI300X outperforming with the right settings. Which settings are correct and whether AH100 or MI300X is stronger is secondary in my opinion. The important fact is that AMD can compete with NVIDIA in this area and that both companies have incredibly powerful solutions for AI. And are therefore perfectly positioned for the future.

AMD’s Metrics and Balance Sheet

With $5,785 million in cash + ST investments versus $1,715 million in LT debt, AMD has a very secure balance sheet. The debt can be easily serviced with cash and therefore the downside risk is protected in terms of balance sheet quality. And if we look at the income statement, we see that interest income is higher than interest expense, another sign of financial stability.

- Interest Income: $179m

- Interest Expense: $98m

What’s not so nice, however, is that shares outstanding are steadily increasing, and SBC had incredibly large increases in 2022 and 2023. SBC increased from $379 million in December 2021 to a TTM value of $1,325 million. This is nearly a fourfold increase in two years.

Adjusted TTM FCF is therefore $2,758 – $1,325 = $1,433 million, which is only half of what it looks like at first glance.

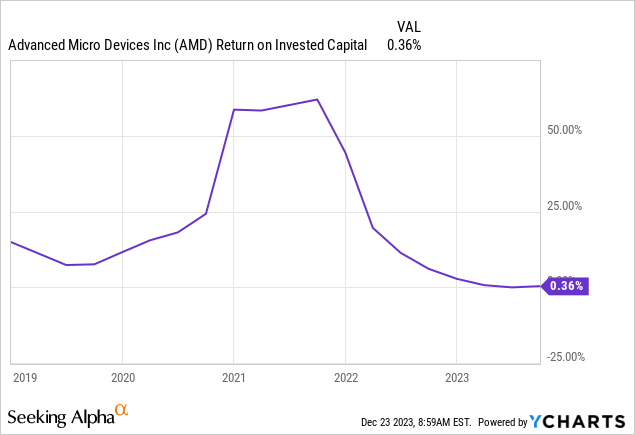

AMD’s Capital Allocation And ROIC

If someone were to use a simple screen for high ROIC companies, AMD would not appear right now. Under normal circumstances, I would look at the ROIC-WACC spread, but in this case, it does not make sense because with an ROIC that is almost zero, the spread is negative. However, given the importance of R&D and intellectual property in the industries in which AMD competes, I expect AMD’s ROIC to increase in the coming years as its investments bear fruit. So I expect them to have a strong spread at some point in the next 3 to 5 years. And let us not forget that companies that increase their ROIC are among the best investments if we can rely on Professor Mauboussin’s research.

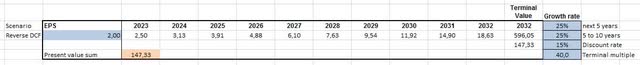

AMD’s Reverse DCF

Author

AMD’s reverse DCF is a tricky one. The TTM diluted EPS is not appropriate and we should use a normalized one due to the rapidly increasing revenues, cost of sales, and operating expenses. So, with normalized EPS of $2 and a hurdle rate of 15%, the stock has priced in an EPS CAGR of 25% over the next 10 years.

The required growth rate is definitely very difficult to achieve, but AMD has the growth opportunity to do it. But it will be a hell of a task even with the TAM they have.

What could EPS look like in 5 years?

I could see $4 to $5 EPS in 5 years. But with a company like AMD in such a fast-growing and changing market, it is like playing the lottery to give an EPS estimate 5 years out. I think it is better to look at their position in the CPU and GPU market and that they are in the top 2 in both and therefore will benefit from all the growth. And even if the EPS is lower in 5 years, they could still make a very attractive return based on growth and the market environment.

Conclusion

AMD is in two very critical industries where they have a strong competitive presence. Very high barriers to entry in the form of know-how and a small pool of people who are truly experts in this area will protect revenues. Even with unlimited resources, it will take years for the competition to reach the level of NVIDIA, AMD, or Intel.

However, dependence on key suppliers such as chip manufacturers gives companies such as TSMC (TSM) some bargaining power. On a positive note, however, the fact that Meta (META) and Microsoft (MSFT) want to buy AMD’s newest AI chip as an alternative to NVIDIA’s definitely speaks in favor of AMD’s chips. Therefore, I think AMD is still underappreciated when we look at their success with the latest AI chips, their market share development over the last few years in the CPU and GPU market, and the potential for market share gains in the future.

And even if AMD remains the perennial number 2 in the GPU market, that should be enough to grow earnings and revenue at an incredible rate. There are countless examples where being the second-best company in a market has also been a great investment. And if they continue to execute with excellence, AMD still has a shot at challenging NVIDIA’s lead.

Read the full article here