Introduction

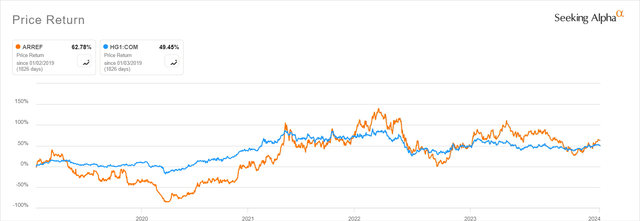

French cabling specialist Nexans (OTCPK:NXPRF) (OTCPK:NEXNY) is currently the largest position in my stock portfolio and I’ve been looking at copper producers to hedge some of the risk there as this is the main raw material used by the company. So far, the top name on my watch list is a company that I covered here in SA in 2021 – Amerigo Resources (OTCQX:ARREF) (TSX:ARG:CA). The company had a difficult autumn in 2023 due to heavy rains in Chile and it doesn’t look particularly cheap based on the historical correlation of its share price with copper prices. That being said, I think Amerigo has a decent dividend yield and 2024 should be a good year for the company as concerns about a global copper surplus are diminishing. In view of this, I’m considering opening a position in Amerigo in the coming weeks. Let’s review.

Overview of the business and financials

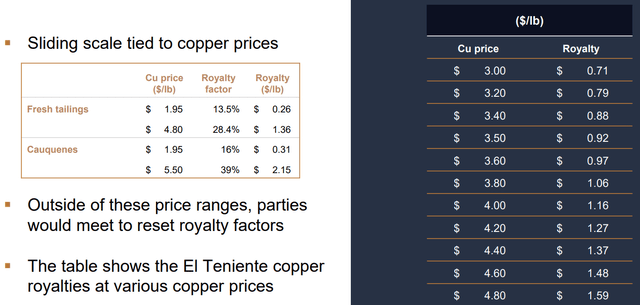

If you’re not familiar with Amerigo or my earlier coverage, here’s a short description of the business. The company is involved in the production of copper by processing the daily waste material (or tailings) at the El Teniente mine of Chilean state-owned copper giant Codeldo. It also produces about a million pounds of molybdenum per year as a by-product which is applied to reduce the unit cash cost. The latter usually stands around $2.00 per pound of copper. This level is somewhat high and the reason behind this is that the grades of the tailings are low considering most of the copper has already been processed by Codelco. In addition, Amerigo has to pay royalties that are calculated based on a sliding scale tied to copper prices.

Amerigo Resources

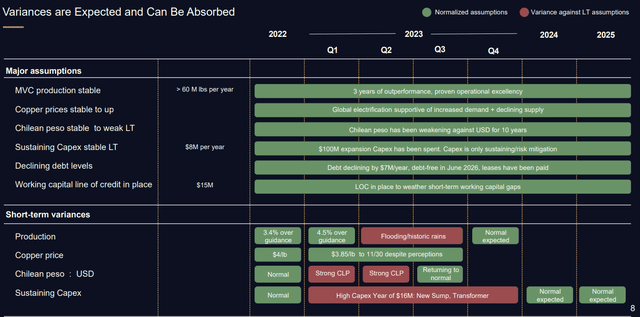

What I like about tailing retreatment businesses is that many of the risks associated with mining are out of the way. CAPEX needs are low and there is no need to invest in exploration activities to find more reserves. Amerigo usually produces about 60 million pounds of copper per year and the sustaining CAPEX for the operation is just $8 million annually. And considering El Teniente’s life of mine (LOM) runs out in 2082, there will be material available for processing for decades.

Amerigo Resources

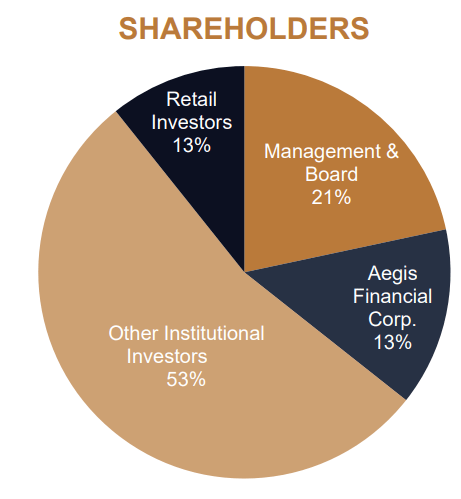

Institutional investors and the management of Amerigo own about 87% of the company and the capital allocation strategy is to return cash to shareholders through dividends and share buybacks during periods with high copper prices. In 2023, Amerigo returned some $17.2 million to investors which translates into a shareholder yield of 10.1%. The TTM dividend yield alone is 8.6% as of the time of writing and the balance sheet looks solid as net debt stood at just $1.6 million at the end of September 2023.

Amerigo Resources

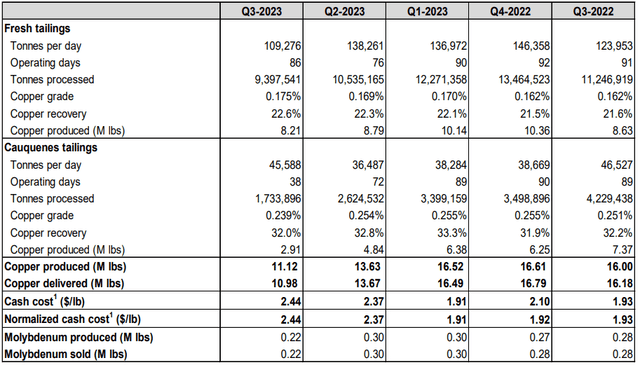

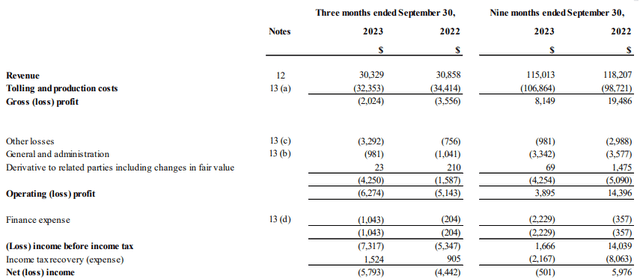

Turning our attention to the latest production and financial results of Amerigo, we can see that Q3 2023 was a challenging period for the company as severe rains in central Chile disrupted operations on two separate occasions which led to a 31.5% decrease in output to 11.12 million pounds. This pushed up cash costs per pound to $2.44 and led to a net loss of $5.8 million for the quarter despite copper prices being higher than a year earlier. Results in Q2 2023 were also underwhelming as the company’s production facility was shut down for several days due to a flooding event that that severed its connection to the central power grid.

Amerigo Resources Amerigo Resources

These heavy rains were highly unusual considering Amerigo had been complaining about droughts for about a decade before 2023 came along. I’m optimistic that production for Q4 2023 was around 16 million pounds of copper as Amerigo resumed full production on September 21. In my view, the annual production guidance of 57.8 million pounds seemed achievable and I think unit costs could be down below $2.00 per pound in Q4 2023.

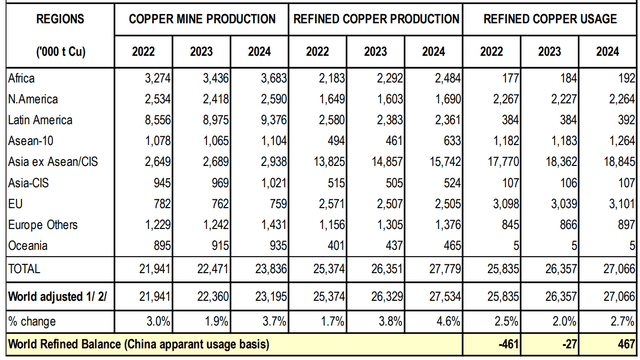

Turning our attention to the global copper market, data from the International Copper Study Group (ICSG) showed that the world refined copper market balance was expected to end 2024 with a 467,000 t surplus due to rising supply.

International Copper Study Group

However, the announcement of the closure of the Cobre Panama mine in late November 2023 looks set to diminish the surplus significantly as the Q3 2023 output of this project alone was 112,734 t. In view of this, I expect copper prices to remain around $4.00 over the majority of 2024.

Looking at the historical correlation between copper prices and the share price of Amerigo, the company looks a bit expensive today. Yet, Amerigo should have a good 2024 as heavy rains are unlikely to come two years in a row and high copper prices should provide a boost for financial results. My rating on the stock is a speculative buy and I think the shareholder yield could remain above 10% in 2024.

Seeking Alpha

Turning our attention to the downside risks, I think there are two major ones. First, copper demand in 2024 could be negatively affected by a slow economic recovery in China, particularly in the country’s construction sector. If the global copper market remains in an oversupply, the price of this commodity could be under pressure over the coming months which would negatively affect Amerigo’s financial results. Second, weather events are usually unpredictable, and I could be underestimating the likelihood of two consecutive years of heavy rainfall in Chile. If Amerigo’s production gets disrupted again in the fall of 2024, the company could be once again in the red even if copper prices remain high.

Investor takeaway

Amerigo had a tough time in Q2 and Q3, but I expect the company to book decent results for Q4 2023. The financial results should be released in late February. In addition, the forecast oversupply in the global copper market could disappear due to the closure of Cobre Panama which should keep copper prices high over the coming months. In my view, 2024 is likely to be a strong year for Amerigo and the shareholder yield could remain in double-digit percentage territory.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here