Summary

The original thesis holds in that businesses that want to thrive in the future will need to digitize their operations. Amplitude (NASDAQ:AMPL) Digital Optimization System streamlines operations and allows for the direct correlation of digital outputs with tangible business results. AMPL’s platform facilitates collaborative business analysis and quick decision-making by bringing together dispersed teams. But the demand environment remains painful for AMPL, and management has emphasized how the demand environment has become much harder as cautious purchasing habits have become the norm. I believe the effect was felt most keenly by AMPL’s SMB and technology customers, who significantly reduced their spending with AMPL. As a result, management has reduced FY23 revenue growth guidance significantly, from 20% down to 12% at the midpoint, reflecting its expectation that the forward environment will remain challenging. Despite the fact that top-line numbers are feeling the effects of the weaker environment, I continue to be optimistic about the long-term opportunity thanks to the fact that product analytics are still in their infancy. Longer term, I believe AMPL will have a strong market position against newer players (that only started competing once the industry became more mainstream), and the current short-term pain for leading out into a new market will be worth it. Investors will need to be more patient now because growth prospects in the near future are dim, and the market clearly does not favor risky bets at this time.

Restructuring updates

AMPL continues to make the necessary adjustments to weather the uncertain demand environment, in particular the iron will to exercise greater cost discipline, and that the April restructuring exercise is now completed. I believe this sets AMPL up for a clearer path to profitability, with higher structural margins given the lower cost base today. Note that the full impact of this restructuring will only appear in 3Q23, as such I expect to see strong sequential improvements in margins in the coming quarters. I also think it’s great that this process has allowed management to restructure the sales department in order to better target both ends of the market. Management instituted a clearer strategy for account ownership and customer success to foster more uniformity in accountability and performance across all accounts. While it is too early to tell whether or not the new GTM strategy is successful, I anticipate increases in sales per employee and more positive feedback on the new logos in the upcoming quarters.

Metrics to monitor

NRR

NRR is definitely a metric to monitor as it relates directly to top line performance and the underlying health of AMPL’s customer base. AMPL reported NRR of 106%, which is a big stepdown from the 113% and 130% in 3Q22/1Q22 respectively. At face value, the 106% seems weak and disappointing, but I believe there is a need to adjust this for temporary churns, which represented about half of the churn at the low-end of the customer base. This is particularly for SMBs that are sizing down their budget with AMPL so that they can better manage cash expenses. While some would argue that AMPL volume-based pricing model has resulted in this negative result, I would think otherwise. I believe this pricing model has helped AMPL to remain relevant in the SMBs space. The sizing down on budget today would mean that these SMBs remain as AMPL customers, and should gear up their spendings when the economy recovers. However, I would also note that the timing of the recovery is uncertain, and there is a good chance that NRR might dip even lower as management continues to see a tougher demand environment throughout FY23.

New logos

AMPL added 181 net new customers in Q1, the most additions ever in a quarter, which I believe is clear evidence that AMPL is able to remain relevant at the SMB space, as I mentioned earlier. AMPL’s recent MTU-based pricing change helped by making it easier for low-end customers to try out the service. Despite the fact that these new customers are not making a sizable financial impact due to their low volume, they do represent a promising pool of prospects who have the potential to develop and broaden their use of Amplitude in the future, particularly if the macroeconomic environment improves. Another perspective is to think of this pricing model as a cheap way of acquiring SMBs in this downcycle.

Valuation

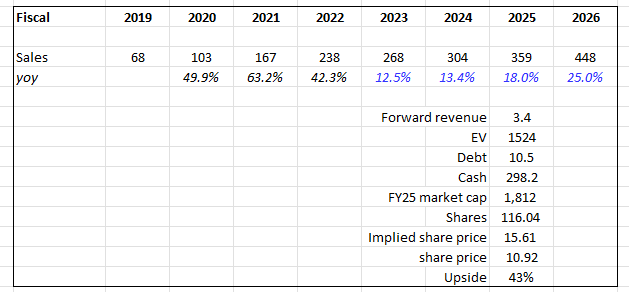

I’ve updated my model to reflect management’s latest guidance that revenue growth in FY23 will be in the low teens, rather than the 20%+ expected. I believe the path to realizing value has now been delayed as a result of this, and I believe investors should brace themselves for the stock to begin acting positively sometime in FY25, when I (and the consensus) expect growth to re-inflect. The S&P North American Tech Software Index (SPGSTISO on Bloomberg) trades at approximately 9x LTM revenue and is expected to grow by 10% (FY23 vs FY22). Given that AMPL is expected to grow in the low teens in the near term with no profits, I believe the current 3.9x and 3.4x forward revenue multiples are justifiable, but that multiples could inflect higher in the future as higher revenue growth occurs.

Author’s work

Risks

Adoption may be slower than expected

AMPL is at the forefront of a brand-new market. AMPL may have been able to acquire the low-hanging fruits, which may explain why growth has been so robust so far. If industry adoption is slower than expected, AMPL could be hurt by the story that the TAM is saturated, and the stock would be revalued as if AMPL were a mature software company rather than a high-growth software stock.

Expect more competition in the future

As long as AMPL maintains that this industry is viable with profitable unit economics, more competitors will most likely enter to capture a portion of the profit pool. If AMPL is still on a small scale by then, it may not be able to grow as quickly or as profitably as it would like.

Conclusion

AMPL faces short-term challenges due to a difficult demand environment and reduced revenue growth guidance. However, AMPL’s restructuring efforts and cost discipline position it for improved profitability and margin expansion. While the near-term growth prospects may be dim, the potential for market leadership in a nascent industry and the ability to target both ends of the market through a revised go-to-market strategy are promising.

Read the full article here