Company Overview

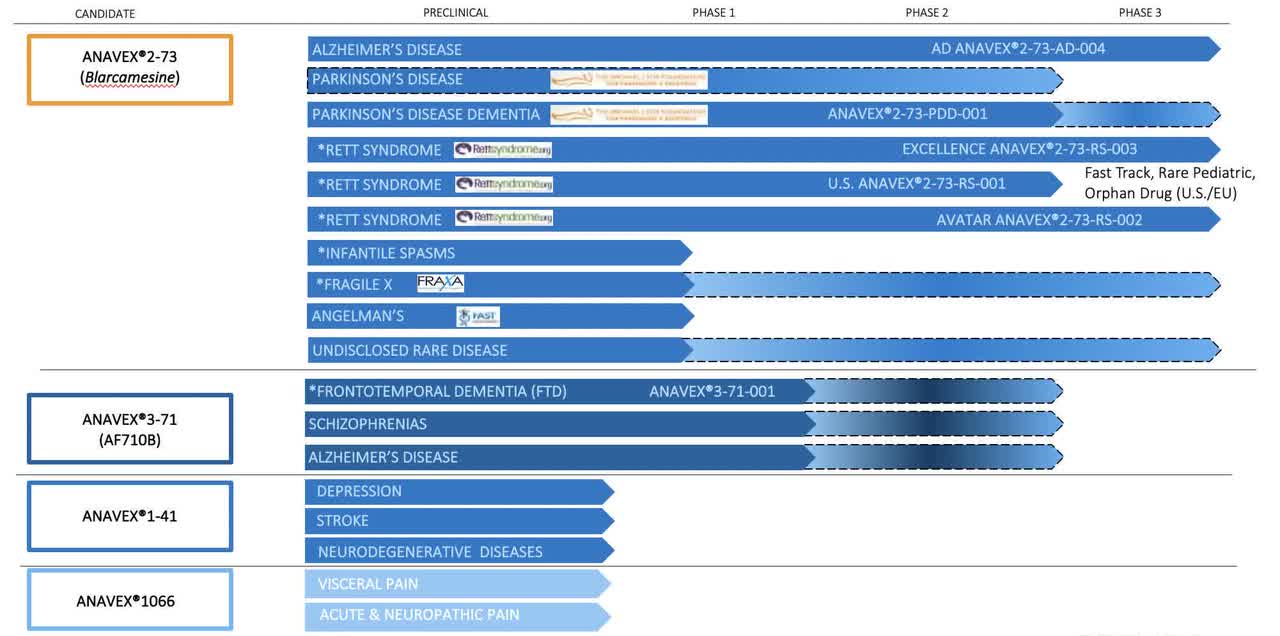

Anavex Life Sciences (NASDAQ:AVXL) is a clinical-stage biopharmaceutical firm that stands out for its dedication to developing novel therapeutics through precision medicine to address unmet needs in central nervous system [CNS] diseases. Its lead candidate, ANAVEX2-73, has been developed to tackle diseases like Alzheimer’s, Parkinson’s, and potentially other CNS disorders, including the rare Rett syndrome.

Anavex pipeline (Anavex 10-K)

Recent developments: Anavex Life Sciences announced its partnership with Partex Group. This collaboration will harness Partex’s AI technology to bolster Anavex’s drug pipeline, patient applications, and AI-centric marketing strategies.

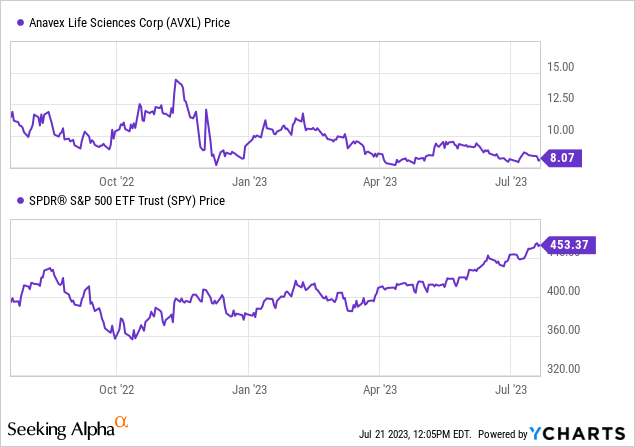

Financial & Stock Performance

As for its financial standing, Anavex reported a cash reserve of $153.5 million as of March 31, 2023, a slight increase from $149.2 million in September 2022. Despite stable quarterly expenses of $2.9 million, R&D expenses saw an uptick to $11.3 million. Consequently, the quarterly net loss swelled to $13.1 million, an increase from the previous year’s same-quarter loss of $10.4 million.

Per Seeking Alpha data, The recent performance of Anavex Life Sciences stock hasn’t been favorable, with a slump of 30.25% over the past year, trailing behind the S&P 500’s growth of 14.52%.

However, its three-month growth shows a marginal increase of 0.38%. The company’s market capitalization stands at $646.7 million with no reported debt and cash reserves amounting to $153.47 million, culminating in an enterprise value of $493.23 million. This downward trend in stock performance necessitates a cautious approach towards investment decisions.

Clinical Trials and Potential of ANAVEX2-73

ANAVEX2-73 (blarcamesine), an oral, small-molecule SIGMAR1 activator, underwent clinical trials in the U.S. for treating Rett syndrome. Out of 25 patients involved in the initial double-blind study, 24 proceeded to a 12-week extension study, extended further to 36 weeks.

This extended study witnessed the sustained effects of ANAVEX2-73, highlighting its dual impact as a symptomatic and disease-modifying agent. Patients who were consistently given ANAVEX2-73 showcased a significant decrease in disease severity and progression compared to those initially administered a placebo, thus satisfying the criteria for a disease-modifying agent. The data merits context, as the extended study was open-label and the p-values were slightly over 0.01, which, in my view, threatens the integrity of the drug’s efficacy.

Nonetheless, the potential of ANAVEX2-73 in treating Rett syndrome, which currently has limited treatment options due to its severity and rarity, provides a significant market opportunity.

Trials for Alzheimer’s, Parkinson’s, and Frontotemporal Dementia

Anavex is currently conducting thorough clinical trials for ANAVEX2-73 and ANAVEX3-71, targeting Alzheimer’s disease, Parkinson’s disease, and Frontotemporal Dementia (FTD).

The Alzheimer’s disease trial of ANAVEX2-73 demonstrated encouraging results in both primary and secondary endpoints in the completed Phase 2a trial. An ongoing larger Phase 2b/3 trial, which started in 2018, is evaluating the drug’s safety and both cognitive and functional efficacy.

For Parkinson’s disease, the Phase 2 trial of ANAVEX2-73 showed safety and significant improvements in various standard parameters after 14 weeks of treatment.

In the case of FTD, Anavex completed a Phase 1 trial with ANAVEX3-71 that met its primary and secondary endpoints, demonstrating safety and favorable pharmacokinetics.

Market Competition & Opportunities

The Alzheimer’s disease treatment market is fiercely competitive and rapidly changing, with numerous companies, including Anavex Life Sciences, pushing the envelope in drug development. The market’s focus is now on high-cost therapies like Biogen (BIIB) and Eisai’s (OTCPK:ESALF) Leqembi, which could potentially spike Medicare’s annual costs by $2B to $5B.

In this competitive and cost-conscious landscape, Anavex sees both challenges and opportunities. The competition is intense, with Biogen, Eisai, Eli Lilly, and others propelling their drug candidates. However, there is also a clear chance to develop cost-effective and, therefore, more accessible treatments.

Investors, however, must be cognitive of the clinical risks associated with developing these drugs for Alzheimer’s, as nearly all fail. However, given Alzheimer’s high prevalence, costs, and health consequences, throwing drugs “at a wall to see if anything sticks” is a worthwhile pursuit.

My Analysis & Recommendation

In conclusion, while Anavex’s stock performance has been less than ideal in the past year, there are key indicators pointing towards potential future growth. Their lead compound, ANAVEX2-73, is showing promising results in the treatment of Rett syndrome, and ongoing trials for Alzheimer’s disease offer a glimpse of hope.

Anavex’s strategic partnership with Partex Group to leverage AI technology might provide an edge in drug development and marketing. Additionally, with a robust cash position and zero debt, the company is financially prepared to continue its R&D efforts. It’s worthwhile to note that many of these indications are historically difficult to achieve success in. This may account for Anavex’s conservative valuation in light of its market opportunities. In my view, the stock is appropriately priced considering the risk/benefit profile.

Therefore, investors are advised to “Hold” onto their shares and closely monitor the upcoming data from Anavex’s various trials and the integration of AI into their drug pipeline. Despite some concerns raised by past performance, Anavex’s dedication to tackling unmet medical needs and the potential of their lead compound in Rett syndrome should keep this stock on the radar of investors. As for a future upgrade, I’d like to first see more convincing data for a key indication.

Read the full article here