By trying to cater to people from both sides of the political spectrum, Anheuser-Busch InBev (BUD) has eliminated a significant portion of its core customers in the U.S. and became another casualty of American culture wars. By getting itself entangled in American trans issues, Anheuser-Busch has started to lose its dominant position in the beer market in North America. There are now questions about whether the damage has been permanent and what would happen to the company’s market share in the region. While we need to wait for the release of Q2 numbers later in August to fully understand the impact of the latest boycotts of Anheuser-Busch’s beers, it makes sense to analyze the potential outcomes for the company’s business right now to figure out whether its stock is an attractive investment at the current levels before the numbers are revealed.

Go Woke, Go Broke?

Trans issues are currently at the center of American culture wars and Anheuser-Busch executives decided to get the company involved in them by collaborating with a known trans activist Dylan Mulvaney and sending her custom cans of Bud Light beer in April. Such a move has backfired greatly as a significant portion of Bud Light’s core customers began to boycott the brand due to their opposite political views that sparked the search for other beer alternatives.

As a result of this, sales of Bud Light in the U.S. have started to decline, while Anheuser-Busch’s shares have been on a losing streak and lost billions of dollars in market capitalization in recent weeks. At the beginning of this month, it was reported that Bud Light sales decreased by 24% Y/Y for the week ending June 3, while data from a few days ago suggests that the sales for the week ending June 10 decelerated by 26.8%.

To fix the situation and mitigate the downside, Anheuser-Busch issued a statement, announced an executive shakeup, offered financial assistance to its distributors, and started working on new advertising campaigns that would align its brands more with its core customer base, all of which angered left-leaning advocacy groups.

Considering that the latest data shows that sales of Bud Light continue to decrease, the only main questions right now are whether the damage has been permanent and if not, how long could the boycott last given that it has real material implications for the whole business.

What’s Next?

Despite the latest significant decline in Bud Light sales, it would be foolish to say that a further decline in sales would be the end of Anheuser-Busch. Let’s not forget that Anheuser-Busch is the single biggest beer company in the world that owns dozens of various brands across the globe in its portfolio and has a reputation for ruthlessly cutting costs, executing M&As, and engaging in financial engineering to meet its financial goals. For years, its model of acquiring popular beers has been its biggest advantage, as it helped the overall business to generate decent returns in recent years.

If we look at the latest earnings report for Q1, which was released shortly after the start of the controversy but includes the numbers only from January to March, we’ll see that the overall company has performed relatively great despite the turbulent macroeconomic environment. Its revenue in Q1 was up 7.4% Y/Y to $14.21 billion, while its non-GAAP EPS was $0.65, above expectations. At the same time, its total volumes increased by 0.9% during the period while from January to April Anheuser-Busch owned 40.4% of the U.S. beer market, up from 38.3% a year ago.

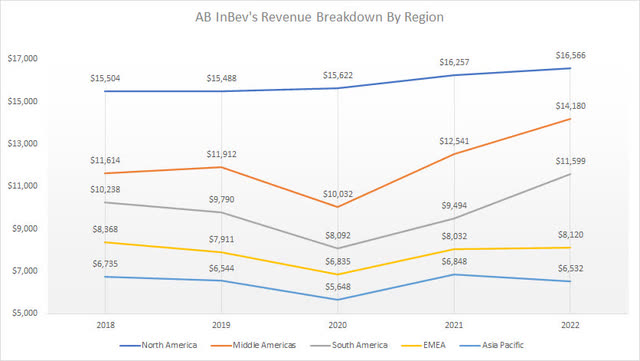

While the market share has likely decreased already due to the boycott, we’ll be able to fully understand how significant it was only after the Q2 numbers come out in August. However, while we await the numbers, we shouldn’t forget that while the U.S. market is the single biggest market for Anheuser-Busch, it accounts for only around 30% of the company’s overall sales while sales of Bud Light account for an even lesser percentage. At the same time, while the sales growth rate in North America has been insignificant in recent years, that wasn’t the case for the Middle Americas and South American markets which were growing at an aggressive rate and are on track to surpass the U.S. sales at the current rate in the following years.

Anheuser-Busch’s Revenue Breakdown By Region (Anheuser-Busch)

On top of all of this, the street continues to remain bullish on Anheuser-Busch and expects the business to keep performing relatively well in the following quarters, as RBC and Deutsche Bank state that the company’s stock is undervalued at the current levels. What’s also important to note is that even Anheuser-Busch’s management during the latest conference call when the backlash was already in full force said that they expect the company’s EBITDA to grow in-line of their medium-term outlook of between 4% to 8%.

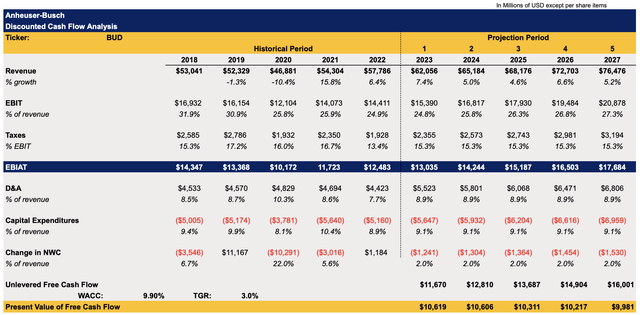

Considering this, I decided to make a DCF model to try and figure out whether there’s a significant upside in Anheuser-Busch’s shares to justify a long position in it. Most of the assumptions in the model below are mostly in-line with the street estimates or are averages of previous historical periods. The terminal growth rate is 3% while the WACC stands at 9.90% and is in-line with the average for the alcoholic beverage industry.

Anheuser-Busch’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

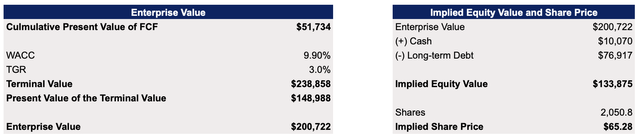

The model shows that Anheuser-Busch’s enterprise value is $200 billion while its fair value is $65.28 per share, which represents an upside of ~14% from the current market price.

Anheuser-Busch’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

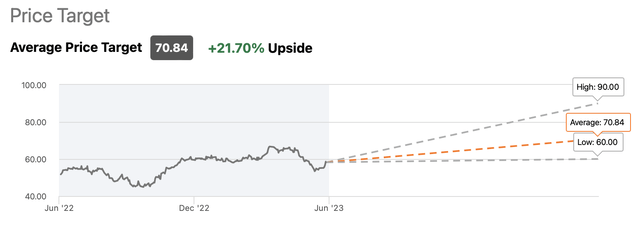

At the same time, the street is even more optimistic as the current price target consensus for Anheuser-Busch is $70.84 per share, which represents an upside of over 20%.

Anheuser-Busch’s Consensus Price Target (Seeking Alpha)

The Bottom Line

It seems that the street is not convinced that Anheuser-Busch is going to significantly suffer as a result of an ongoing boycott. While it becomes obvious that it was a mistake for the management to make a move that would alienate its core customer base, it also makes sense to think that the expected continuous growth of the company’s business in other markets could mitigate a significant portion of the downside caused by the boycott.

However, despite this, the latest release of new data that points to the fact that Bud Light sales continue to decrease at a double-digit rate indicates that it’s too soon to talk about the end of the ongoing crisis. An extended decline in sales of one of the company’s major brands could have a much greater impact on the overall performance of the business than the street might expect. It could lead to a downward revision of various assumptions in my model and would result in a lower valuation for Anheuser-Busch’s shares. Considering this, I decided to wait for the Q2 numbers to come out to get more clarity and conclude whether it makes sense to invest in Anheuser-Busch in the first place, since it seems that the boycott is still far from over.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here