You Always Make Money If You Only Count Income And Not Your Losses

When we wrote about Annaly Capital Management, Inc. (NYSE:NLY) in February 2023, we aimed our prediction at one of its own metrics, earnings available for distribution or EAD per share.

As we see 3-4 quarters ahead, we think NLY is setup for the most hostile climate for mortgage REITs. We will see very strong compression of the interest spread, which has been held up due to lag and hedges. We think NLY will be lucky if they can manage their own distribution metric to come above 50 cents in 3 quarters. NLY also sees the direction if not the extent and telegraphed the next dividend cut.

Source: Annaly Upcoming Dividend Cut: Not The First, Won’t Be The Last

We got the first full quarter of numbers after that article, and we wanted to see if the thesis was still on the right track. After all, predicting a second distribution so close to the first is likely to be an uphill battle in almost all cases.

The Highlights

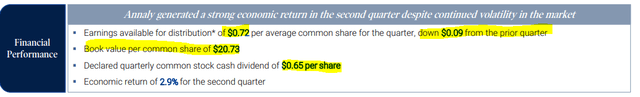

Q2-2023 slideshow immediately greeted you with the EAD metric. In this quarter, it fell 9 cents to 72 cents per share.

NLY Q2-2023 Presentation

Let us remind our readers that we don’t necessarily think this metric is the most accurate metric of NLY’s earnings power. In fact, it overstates the economic return over most timeframes. Nonetheless, it is one which the company prefers and one which we think will work well enough for our prediction.

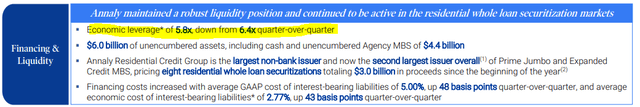

Next up, was the decline in leverage, which fell to 5.8X from 6.4X. NLY actively reduced leverage and once again proved to the bulls that there is no appetite from mortgage REITs to buy more mortgage-backed securities.

NLY Q2-2023 Presentation

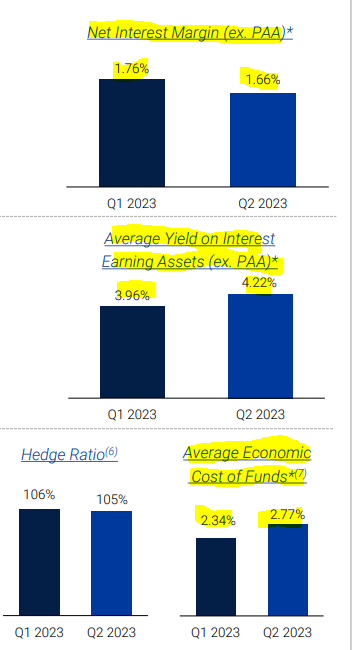

NLY’s net interest margin metrics fell again this quarter and came in 10 basis points lower. Average yield on assets did go up but was mauled by the economic cost of funds. We will add that all of this is happening despite some very high levels of hedging.

NLY Q2-2023 Presentation

Outlook

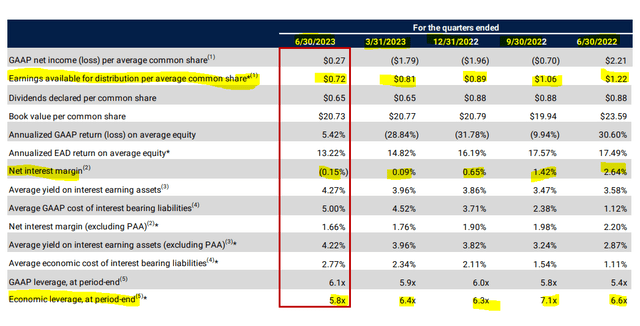

EAD metric has fallen from $1.22 to $0.72 in four quarters. It is dropping at about 12 cents a quarter.

NLY Q2-2023 Presentation

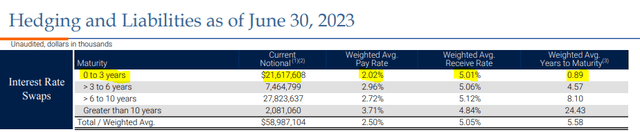

Notice that when we telegraphed the last distribution cut, EAD was still comfortably above the 88 cents run rate. Net interest margin is now negative 15 basis points. Note that this is net interest margin and not net interest margin excluding PAA. Whichever metric you use, you can see the compression. This will get worse as the hedge book drains out. We would note that their front-end loaded hedges are in worse shape than what we saw for AGNC Investment Corp. (AGNC). Currently, that $21.6 billion of hedges are creating an effective cost of funds at 2.02%. That will move to over 5.5% (assuming Fed Funds deliver), over the next year.

NLY Q2-2023 Presentation

Sure, NLY can layer new hedges, but they will incorporate the current interest rate pricing. Over the next two quarters, we expect about 12-15 cents of drop in EAD, taking it below the 65 cents dividend metric. Post that, assuming the Fed stays on hold, we will likely see a further decline in EAD, although the pace is hard to forecast that far out.

Verdict

It won’t be long before bulls are once again talking about how great NLY will do in the next rate cut cycle. They may have to wait a long time on that. Powell just signaled 2% core inflation is a 2025 goal.

Stocks nudged higher during Fed Chair Jerome Powell’s news conference, but then saw those modest gains fade away to trade near levels seen ahead of the central bank’s 2 p.m. announcement of a widely expected quarter-point increase in the Fed funds rate.

Analysts said stocks appeared to lose their grip on gains after Powell said it appeared unlikely inflation would get back to the Fed’s 2% target before 2025. Earlier, investors appeared to be cheered as Powell emphasized future rate decisions would depend on incoming economic data.

Source: MarketWatch

Of course, they can, and likely will, cut before that…if things really break. The bar for rate cuts is extremely high here. Don’t expect it with a 200-point S&P drop. Don’t even expect it with a moderate recession if unemployment only rises modestly. We are talking 1,500 S&P points and possibly a core inflation number well below 3%, alongside a 3-4% points rise in unemployment. Powell will deliver then. It is from here to there that you have to worry about. NLY has to hedge and decide when that point will be. As it stands, in the face of a massively inverted yield curve and hedges slowly eroding, the next distribution cut is quickly approaching. Buyer Beware.

Preferred Shares

NLY has three classes of preference share classes outstanding.

1) Annaly Capital Management, Inc. 6.95% PFD SER F (NYSE:NLY.PF).

2) Annaly Capital Management, Inc. 6.50% PFD SER G (NYSE:NLY.PG)

3) Annaly Capital Management, Inc. 6.75% PFD SER I (NYSE:NLY.PI)

Preferred Stock Trader, who is a contributing author to our Investing Groups service, is currently long NLY.PF from $24.46 in his “Preferreds With Upside” portfolio. This has a high call probability over the next few months, especially, if we see 2-3 more rate hikes. All 3 are likely to become incredibly expensive sources of financing for NLY and add more woes to the EAD metric if rates remain over 5.5% over the next 2 years.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here