Introduction

Antero Midstream Corporation (NYSE:AM) is a subsidiary of Antero Resources Corporation (AR), an independent natural gas and liquids company. AM’s primary focus is on operating and developing midstream energy assets in collaboration with Antero’s production activities. The company boasts a diverse portfolio of assets, including gathering pipelines, compressor stations, and water handling and treatment facilities. Their business model is to establish long-term and fixed-fee contracts to provide midstream services exclusively to Antero.

AM’s gathering and compression assets consist of high and low pressure gathering pipelines as well as compressor stations strategically positioned to collect natural gas, NGLs, and oil from Antero’s wells located in Virginia and Ohio, USA. Additionally, AM owns fresh water distribution systems that facilitate the delivery of water for hydraulic fracturing operations in Antero’s operating areas.

AM’s financial outlook

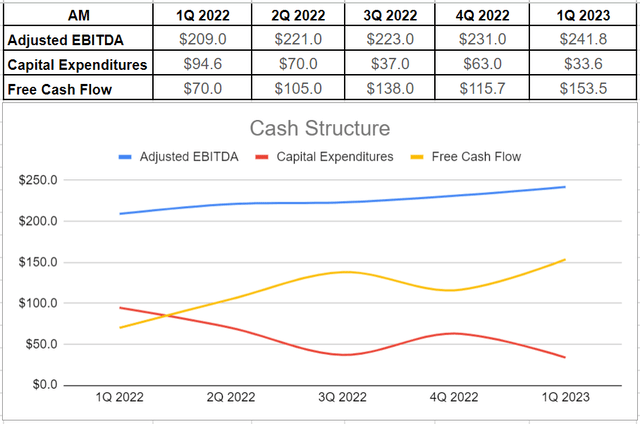

In the first quarter of 2023, the management updated their financial expectations based on the strong performance of the company. The CEO highlighted that this was the third consecutive quarter in which the company generated free cash flow after paying dividends. The management’s strategy to reduce capital expenditures and focus on deleveraging is proving to be effective.

During the first quarter, AM recorded its lowest capital expenditure of $33.6 million compared to $63 million at the end of 2022 and $94.6 million in the same period last year. This reduction in capital spending, combined with approximately $183 million in operating cash flow, resulted in a significant increase in free cash flow, reaching a total of $153.5 million.

Despite paying approximately $108 million in dividends, there was still over $45 million of free cash flow remaining after shareholder payments. Additionally, AM’s adjusted EBITDA showed consistent growth throughout the last fiscal year and reached approximately $242 million in the first quarter of 2023, compared to $209 million during the same period in 2022 (see Figure 1). These records confirm the CEO plan of:

Looking ahead to the remainder of the year, our higher Adjusted EBITDA guidance combined with our lower capital budget guidance is expected to result in a $35 million increase to our Free Cash Flow after dividends. This reflects a 33% increase to the midpoint of the previous guidance range and will allow us to continue reducing absolute debt and leverage, further de-risking the outlook for Antero Midstream.”

Figure 1 – AM’s cash structure (in millions)

Author

Despite the volatility and reliance on commodity prices in the oil and gas industry, Antero Midstream is poised to offer profitable opportunities for investors in 2023. Despite lower oil, gas, and natural gas prices compared to the previous year, Antero Midstream’s strong financials and increased production volumes will contribute to their success. In the first quarter of 2023, they increased their gathering volumes by 8% to an average of 3,171 MMcf/d. Additionally, their compression volume rose by 11% to 3,137 MMcf/d compared to the same period in 2022.

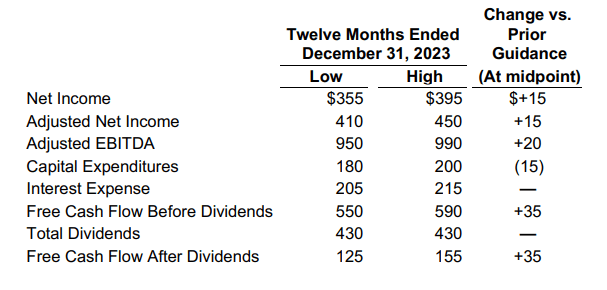

These positive developments have prompted management to update their financial goals for the year. Antero Midstream plans to reduce capital spending to $180-200 million by the end of the year, resulting in $125-155 million of free cash flow after a $430 million dividend payment. Fortunately, their anticipated adjusted EBITDA has been revised upwards by $15 million and is now expected to reach $355-395 million by the year-end (see Figure 2).

Figure 2 – AM’s 2023 guidance (in millions)

Antero Midstream first quarter results

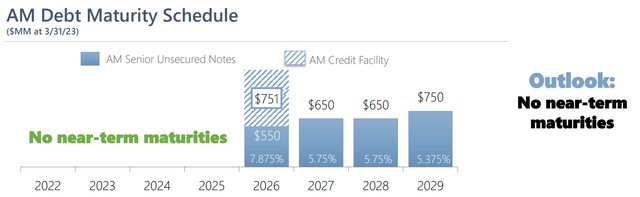

Antero Midstream ended the first quarter of 2023 with a total debt of $3.3 billion, raising concerns about its ability to meet its obligations before achieving anticipated free cash flow and adjusted EBITDA levels. However, it is important to note that the company does not have any immediate debt maturities, which helps it in reaching its targets.

The closest due date is in 2026, with approximately $1.3 billion owed to Credit Facility and Senior Unsecured Notes. The remaining maturities range from $650-750 million between 2027 and 2029. Consequently, the absence of near-term maturities strengthens their balance sheet and creates opportunities for mid-term growth (see Figure 3).

Figure 3

AM’s performance outlook

AM’s performance outlook

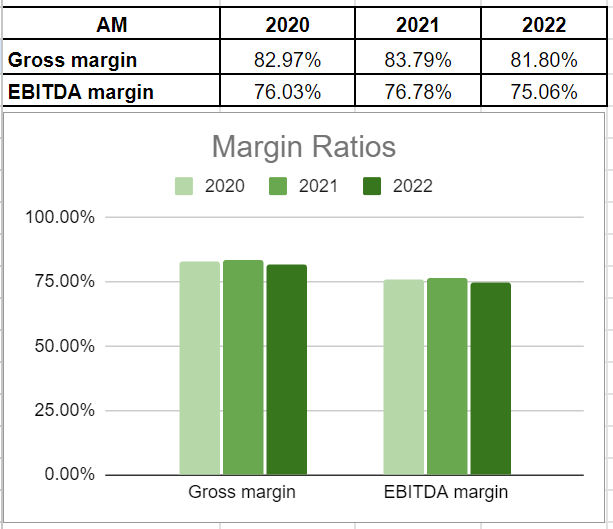

In this section, I have analyzed Antero Midstream’s profitability ratios across return and margin metrics. The company has set a target of achieving a return on invested capital (ROIC) between 17% and 20% by the end of 2027. In 2022 and 2021, their ROIC stood at 17% and 18% respectively. This ratio serves as a reliable indicator of how effectively the company is utilizing the funds provided by investors. Furthermore, Antero Midstream has demonstrated efficient core business operations in recent years.

Specifically, their gross margin of approximately 82% indicates that the company is well-positioned to cover operating expenses, fixed costs, dividends, and generate profits. Although there was a slight decline to 75% in 2022 compared to 76.7% at the end of 2021, AM is expected to increase its EBITDA margin based on the company’s guidance in the upcoming years.

Overall, Antero Midstream’s profitability condition appears healthy and suggests that the company possesses the capability to generate profits in the foreseeable future (see Figure 4).

Figure 4 – AM’s margin ratios

Author

Risks

One of the primary risks associated with Antero Midstream is its dependence on Antero Resources. Any factors that impact Antero’s growth and financial stability could have a negative impact on AM’s cash flow and overall business. To maintain a minimum quarterly distribution of $0.17 per unit, AM needs to maintain a cash balance of at least $30 million each quarter. This requires ensuring an adequate supply of water for well operations and meeting specific gathering and compressing volumes of natural gas to meet dividend obligations. However, if lower commodity prices disrupt Antero’s drilling schedules, it could have an adverse effect on the volumes produced by Antero Midstream.

Conclusion

Antero Midstream’s management has devised a strategy to reduce their capital expenditures, allowing them to generate higher free cash flow and ultimately pay off the company’s debt. The absence of immediate debt maturities and a robust balance sheet are key factors that contribute to the company’s ability to achieve its goals. Additionally, Antero Midstream’s impressive return and margin ratios demonstrate its capacity to deliver favorable outcomes for its unitholders. Consequently, I believe that assigning a buy rating to Antero Midstream units is appropriate.

Read the full article here