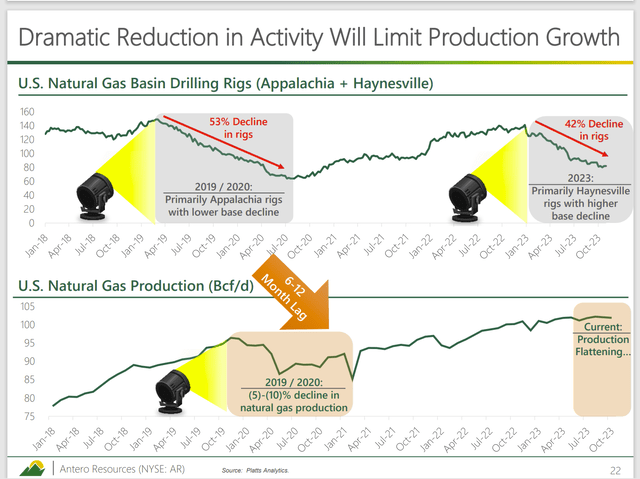

Antero Resources Corporation (NYSE:AR) long ago got rid of the hedges when it became obvious that the rig count was declining. The oil and gas journal today put out another article on the declining rig count which has continued. But the market has focused upon the increasing production because wells drilled will likely be completed because they are protected by hedges or because the breakeven costs are low enough that the wells will pay back even in this environment. However, no matter how mild this winter is, that rig count, especially for the Haynesville Basin (which has long been the swing basin), likely will continue to drop until natural gas prices rise. This is the key concept that the market is missing. All a mild winter means is that more rigs get idled until the natural gas pricing recovery is underway.

Industry Status At November Update

Management reported that the industry continued to decrease production by idling rigs. That has yet to show up as declining production because there are so many ways to make money once capital has been spent. It is in every company’s individual interest to maximize cash flow when prices are low. That is exactly what is happening even if overall natural gas prices decline while the adjustment process is underway.

Antero Resources Report Of Overall Rig Activity and Production Results (Antero Resources Corporate Presentation November 2023)

The market assumes that the oversupply will continue for the foreseeable future. That makes for a contrarian investment opportunity because clearly the industry is doing the reasonable thing to decrease supply. As noted before, the industry simply keeps going until prices recover. The trend above does not stop just because it is a warm winter.

There is the argument that management should have “bet” on a warm winter because of El Nino. However, the weather is not something to be relied upon no matter how it turns out.

The risk factor is that we have a weaker than normal polar vortex. Normally an El Nino keeps the polar vortex “at the top of the world” with no worries. But right now, it looks fairly ragged which is far more typical of a La Nina than an El Nino. It only takes one deep dive as we saw a few years back with Winter Storm Uri to make a huge difference in natural gas prices and company profits. Right now, that is not forecast. However, it is a danger until winter is over.

This industry can be complicated because it tends to make a lot of money at one time. But that only happens if the company is prepared ahead of time for a big event with decent chances to happen without the guarantees of certainty. Antero Resources has generally been that kind of company. Management does not “bet the company” on any one event. But as Uri demonstrated a few years back, it is probably worth keeping the flexibility to participate in that event (when the spot market soared) because the company made several years of profits in a short time.

Right now, Mr. Market is factoring in no chance of that happening.

Why Production Lags The Rig Count

So many wonder why the industry is “so self-destructive.” Yet every company in the industry is doing what is best for that company.

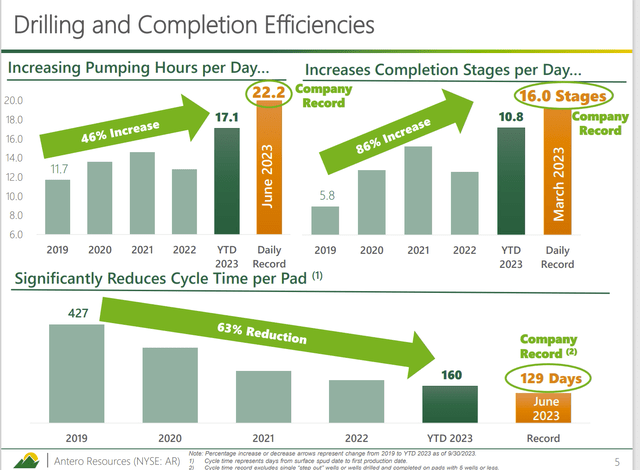

Antero Resources Operating Improvements (Antero Resources Corporate Presentation November 2023)

The answer as to why production keeps climbing after rigs are idled is shown above. Wells do not complete the day after a rig stops drilling the well. Instead, it takes time to complete the wells and have those wells producing long after the rig is gone.

That is a very simple explanation of a fairly complicated task. Of course, it takes more time for new production to peak so that the “famous” large first year decline becomes noticeable to total United States production.

Most companies will hedge and (therefore) complete wells that show decent cash flow or are sufficiently profitable due to hedging. A lot of these wells are around (producing at decent levels) for decades. Therefore, one year, while that first year has a significant effect on economic returns, may not be the only consideration.

Each management will decide what is best for the company even if that decision is not best for the industry.

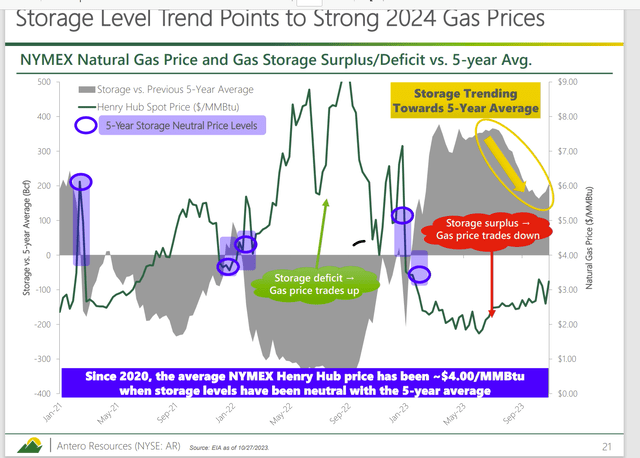

Storage Levels

The market is likewise focused upon storage levels. As EQT Corporation (EQT) management mentioned, the market is focused upon absolute storage levels as shown below:

Antero Resources Graph Of Pricing Relationship Between Natural Gas Storage Levels A (Antero Resources Corporate Presentation November 2023)

The problem with any singular focus is that relationships can be missed. In this case demand has grown over the years. Therefore, the “days use” turns out to be actually quite low because more storage capacity has not been brought online to accommodate the demand growth. Some of that is due to the “just in time” delivery that is popular throughout much of industry because it lowers inventory costs.

However, it is also true that many managements will not invest in more storage until they get “burned” by being short in inventory while having to pay skyrocketing natural gas prices during a crisis. As shown before, that crisis could well be a polar vortex leak that heads South.

Even without the polar vortex as an event, the fact that those high storage levels shown above represent a far more modest amount of daily usage in storage implies that natural gas prices will bounce back rather quickly once a turning point is reached.

Of course, timing is uncertain which is why much of the industry now feels there is not much downside to prices because if a mild winter happens, by the end of the winter, supply and demand could be a much brighter relationship than is the case now.

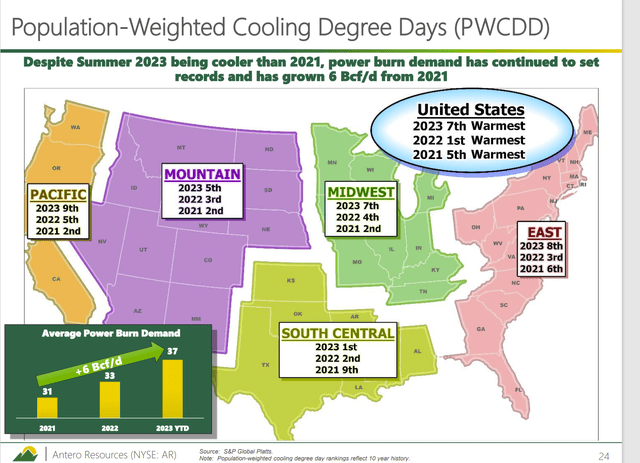

Natural Gas Usage Is Climbing

Management reported on the biggest usage in the United States. That would be the use of natural gas to generate electricity. As coal plants shut down and are replaced by natural gas plants, usage continues to climb despite mild weather seasons.

Antero Resources Natural Gas Usage For Electric Generation (Antero Resources Corporate Presentation November 2023)

Natural gas has the advantage of reducing pollution over other fuels like coal and is therefore the next pollution reduction of step at the current time.

Chart Industries (GTLS), which has a sizable presence in the oil and gas industry, is “only” predicting an earnings increase in the 40% to 50% range for the coming fiscal year. This will likely get updated in February. But with the long lead times for the equipment, it is not likely to change much.

From an equipment supplier’s standpoint, Chart Industries is confirming the story of Antero Resources that the outlook for natural gas is increasing demand for natural gas.

Liquids Have A Similar Story

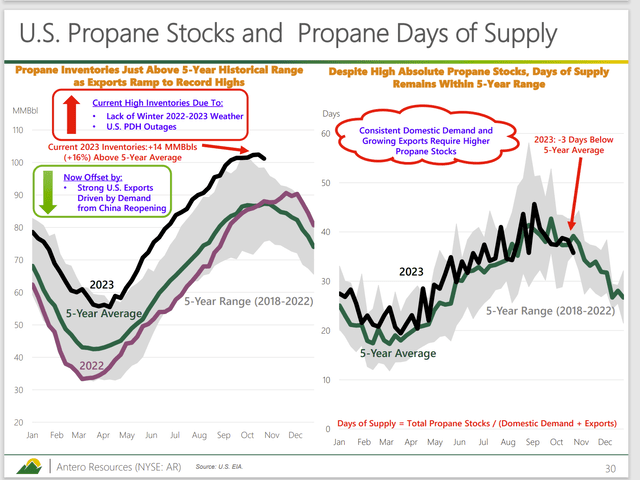

Shown below is the summary of conditions for propane. Ethane is in a similar situation. Both are raw materials for the rapidly growing plastics market.

Antero Resources Summary Of Propane Market Storage Conditions (Antero Resources Corporate Presentation November 2023)

Here again, the market is focused upon absolute natural gas storage levels while not considering the daily usage of propane as shown on the right. That graph on the right clearly shows that storage is really not out-of-line as some would have investors believe simply by looking at the absolute storage levels.

It, therefore, will not take a whole lot of change for these prices to return to better levels relative to oil.

Conclusion

The time to purchase natural gas stocks is usually when they are “left for dead” because “nothing can possibly happen” for an adequate return. However, this industry is notoriously low visibility. Therefore, a beginning investment or opening position as part of a basket of stocks, may work out much better than expected.

Antero Resources is in very good financial shape compared to many in the industry. Right now, the weather has led to some generous supplies and weak commodity prices. But that can change very fast. Clearly the market rarely if ever has that “very fast” priced into the stock.

Instead, Mr. Market, as usual extends the current conditions out into the long-term as if things never change. What really never changes is Mr. Market’s reaction to current conditions. But that provides an investment opportunity for investors.

The stock remains a strong buy as a solid competitor with a decent cost structure in the natural gas industry. The company depends upon the prices of a matrix of products rather than the price of one product. It likewise usually receives a premium price for its products compared to competitors in the Marcellus Basin.

Long term, Antero Resources Corporation should do well from the current price. But if an investor is worried about the stock price going lower still, then a consideration would be to open a small starting position with the idea of averaging down. Most good managements will pass the last stock price peak (in this case around $40) and grow or improve operating conditions enough to climb past an inflation adjusted price in the next cycle.

For long-term holders, Antero Resources Corporation is a volatile stock that has been on a cyclical growth path. Now the company is much more mature. But the long-term pricing for natural gas and related products is very bright thanks to the green revolution. That could change in the future as technology continues to advance.

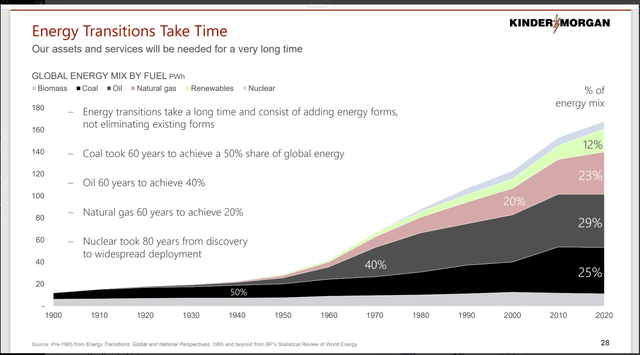

Kinder Morgan Presentation On The History of Energy Use (Kinder Morgan Corporate Presentation November 2023)

Then again, any energy source ((use)), as shown above, has never stopped growing in the long term. History could change in the future. But right now, it would appear to be a strong “bet” that natural gas use will continue to grow in our lifetime and probably after we are gone.

Read the full article here