Aon (NYSE:AON) delivered very solid Q3 FY23 results, and I am continually impressed with their margin expansion and substantial share buybacks. As a long-term shareholder of this stable growth company, I maintain a ‘Strong Buy’ rating with a fair value of $390 per share.

Quarterly Review and Outlook

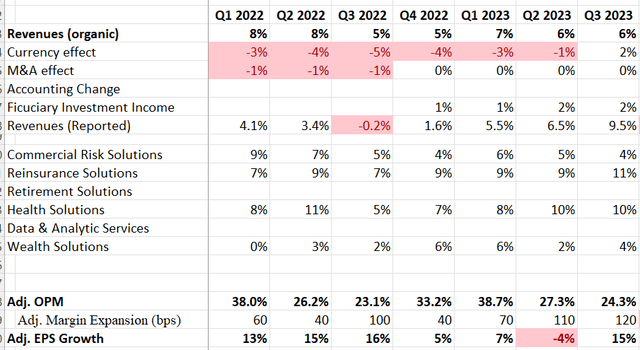

In Q3 FY23, both their top and bottom lines surpassed market consensus. Organic revenue grew by 6%, supported by robust ongoing retention and book renewal. Impressively, the operating margin expanded by 120 basis points year over year, driven by operating leverage and increased fiduciary investment income. Thanks to the strong organic revenue growth and margin expansion, their adjusted EPS grew by 15% year over year.

Aon Quarterly Results

For FY23 guidance, they anticipate mid-single-digit organic revenue growth and high-single-digit free cash flow growth. This guidance aligns with their long-term growth trajectory. YTD for FY23, they have already achieved a 7% organic revenue growth. Therefore, I believe their full-year revenue growth guidance is somewhat conservative.

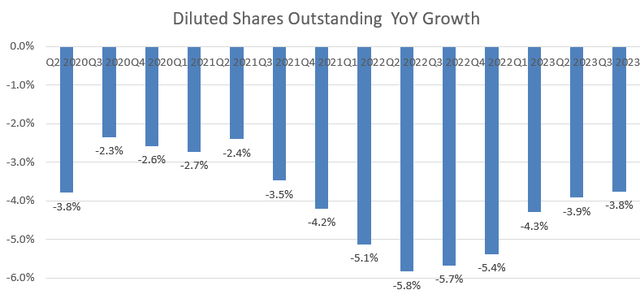

It’s worth noting that Aon continues to repurchase its own shares, with shares outstanding shrinking by 3.8% year over year in the quarter. They consider themselves significantly undervalued in the current market, having completed almost $2 billion in share repurchases YTD.

Aon Quarterly Results

Cost Restructuring Program

Aon is actively engaged in a cost restructuring program with the aim of achieving total annual in-year savings of $350 million by 2026. In the Q3 FY23 earnings call, they revealed the savings ramp-up plan: $100 million in 2024, $250 million in 2025, and the full target of $350 million in 2026. I believe their cost restructuring program is crucial for long-term margin expansion.

Firstly, the cost-cutting efforts are primarily focused on technology costs and workforce optimization. On the technical side, they are integrating AI technology into their entire IT infrastructure, thereby enhancing margins for internal operations. In terms of workforce optimization, they plan to reduce headcounts in legacy areas and allocate more resources to new technologies and growth areas such as cybersecurity, crisis management, and intellectual property.

Secondly, the restructuring aims to simplify their organizational structure, enhancing accountability to their extensive client base. A unified and efficient organizational structure is key to their success and adds value to their customers.

Lastly, as part of the restructuring plan, they are implementing data analytics and connecting various operating platforms. These integrated platforms are expected to improve corporate efficiency for their sales force.

Key Issues

While I don’t believe Aon poses any material or imminent risks for investors, there are some weaknesses in their business.

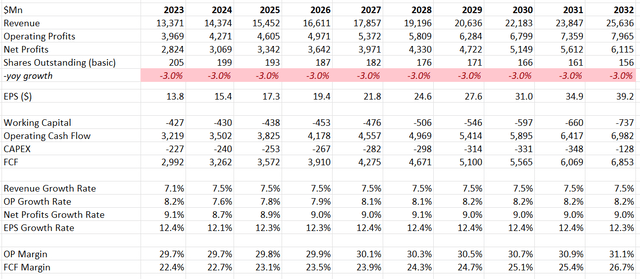

Increased CAPEX: For YTD FY23, their free cash flow decreased by 4% year over year, primarily due to an increase in capital expenditures. They anticipate their CAPEX to be between $220 million and $250 million in FY23, with the midpoint reflecting a 19% year-over-year growth. I believe the increased capital expenditures are linked to several technology projects they are implementing this year, and I expect their capital expenditure to return to historical levels once these projects are completed. Aon is traditionally a capital-light business, with capital expenditure historically representing less than 2% of sales.

Weak external M&A and IPO markets: Aon’s commercial risk business encompasses various end markets, including M&A and IPO markets. The external M&A and IPO markets are currently subdued due to high-interest rates. While their commercial risk business grew by 4% organically year over year, which is a growth rate lower than the group level, I believe these weaknesses are temporary, and the market will likely rebound when interest rates start to decline.

Valuation Update

I have adjusted the capital expenditure to align with their current guidance while keeping all assumptions intact. In essence, I perceive Aon as a company with high-single-digit profit growth and double-digit EPS growth. Their consistent share repurchases are contributing to more than 3% of EPS growth over time.

Aon DCF – Author’s Calculation

Based on the revised assumptions, my calculations indicate a fair value of $390 per share for their stock price. In my assessment, the current stock price is undervalued.

Takeaway

I admire Aon’s robust track record of strong organic growth and margin expansion. Their adaptive business model focuses on streamlining operations and high-growth areas such as cybersecurity, intellectual property, and crisis management. I maintain a ‘Strong Buy’ rating with a fair value of $390 per share.

Read the full article here