Timeline: 2 Years

Price Target: $50 / share

Estimated Annual Returns: 15%

Risk Level: Low.

APA Corporation (NASDAQ:APA) (formerly known as Apache) is a large upstream oil and natural gas producer with a market cap of more than $10 billion. In a volatile pricing environment, the company has focused on continued strong production and free cash flow (“FCF”).

As we’ll see throughout this article, APA Corporation’s strong financials, potential catalysts, and commitment to shareholder returns make it a strong investment today.

APA Corporation Financial Performance

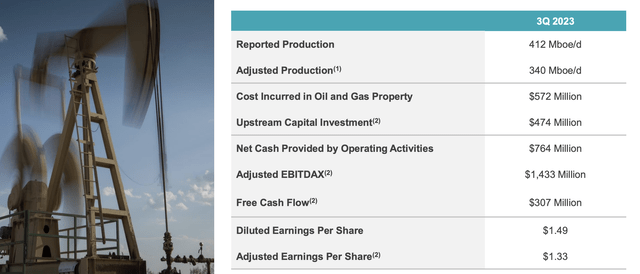

The company has had strong performance in the most recent quarter, with results reported November 2023. Fourth quarter results can be expected to come in roughly 1 month.

APA Corporation Investor Presentation

The company has more than 400 thousand barrels / day in reported production and 340 thousand barrels / day in adjusted production. That put adjusted production at roughly 30 million barrels for the quarter. Incurred costs and upstream capex investments, cost the company just over $1 billion, or ~$34 / share.

At the end of it all, the company had $307 million in FCF and $1.33 in adjusted earnings per share, giving the company an annualized single digit P/E. FCF puts the company at a double-digit FCF yield, showing its continued financial strength.

APA Corporation Strategy

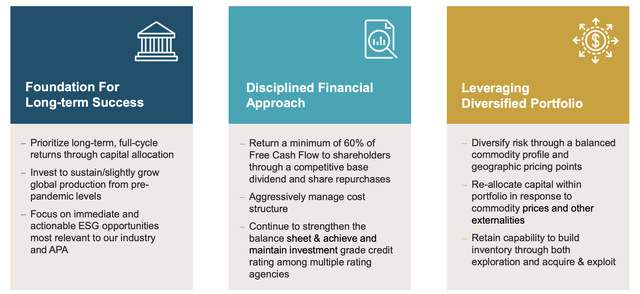

APA Corporation’s strategy has been to focus on continued and reliable shareholder returns.

APA Corporation Investor Presentation

The company is focused on full-cycle returns, backing down from the aggressive up-cycle spending in prior strong markets. At the same time, the company is investing to slightly grow production. The company is committed to strong double-digit FCF generation and returning at least 60% of that to shareholders through dividends and repurchases.

Additionally, that remaining 40% doesn’t disappear, and the company can use that to continue strengthening its balance sheet or a variety of other tasks.

APA Corporation Portfolio

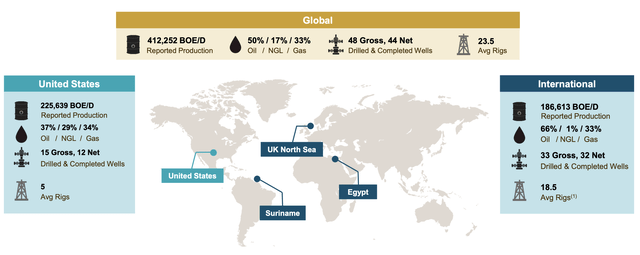

The company operates a diversified global portfolio, primarily focused in the U.S.

APA Corporation Investor Presentation

The company had 5 rigs in the U.S., with 12 net wells and 37% oil. Production for the company made up more than 225 thousand barrels / day reported. Internationally, the company has much more stable long-term businesses, with a much higher oil percentage. That helps provide some respectable stability to the company’s operations.

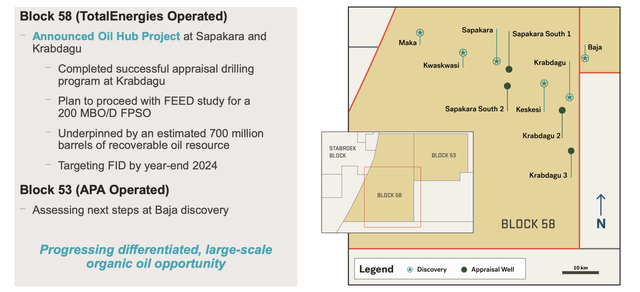

APA Corporation Investor Presentation

Among the company’s most exciting potential assets is Block 58 in Suriname, especially after Exxon Mobil’s (XOM) continued massive success in neighboring Guyana. The company has completed appraisal studying and is targeting FID by end of year for a 200 thousand barrel / day FPSO. The company’s original deal with TotalEnergies (TTE) provided $5 billion in cash carry capital out of the first $7.5 billion.

The company has a 50% stake here, and with the strong margins in Guyana, an FPSO decision here, which could potentially start producing by the latter half of the decade, could provide a strong cash flow boost for those who invest now. It’s also a development that the company can comfortably manage to afford.

APA Corporation Shareholder Returns

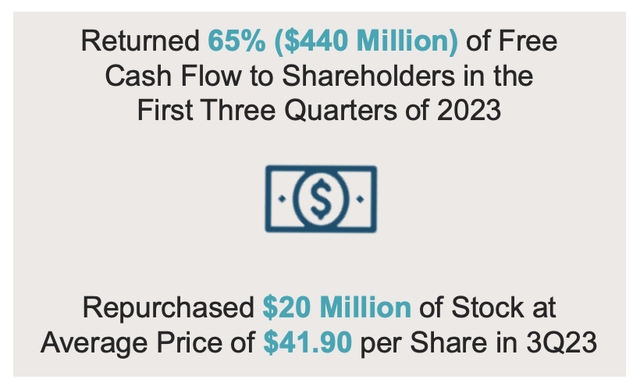

The company has managed to return 65% of its FCF YTD, above its goals. That means $440 million out of $680 million has been returned.

APA Corporation Investor Presentation

The company’s returns have primarily come from its reasonable dividend of almost 3%, but the company also repurchased $20 million of stock and has managed to continued reducing its shares outstanding. With current lower prices in the market, it might be hard for the company to find the cash to repurchase shares, but a lower repurchase prices can help in the long run.

Putting all of this together though, APA Corporation is still an investment today. The company’s FCF remains strong, and a lower share price means the company can more aggressively repurchase shares. Its dividend and capital investment remains strong, and Block 58 remains a hefty catalyst for the company. All of that together makes the company a valuable investment.

Thesis Risk

The largest risk to our thesis is crude oil prices. The company is profitable at current prices and has a good framework for continuing to provide shareholder returns. However, Brent prices (CL1:COM) have been weak recently, and supply remains strong. Demand has not accounted for that and is trickling down. Weakness in prices could quickly hurt margins and future returns.

Conclusion

APA Corporation is a strong oil company with reliable operations around the world. The company has managed to diversify, while continuing to maintain strong production from its legacy assets. Additionally, the company potentially has a major catalyst in the upcoming years, with the development of Block 58 in Suriname, which will see an FID this year.

However, despite all of that, the company is still susceptible to the distributed nature of commodity prices. Brent prices are below $80 / barrel, and they remain weak. Demand isn’t strong, and there remains bountiful low-cost supply on the market. Continued weakness here could continue to hurt its share price and returns, but we expect the company to prevail over the long run.

Read the full article here