Apple Hospitality (NYSE:APLE) is a publicly traded lodging/hotel REIT that possesses one of the largest portfolios of upscale, rooms-focused hotels in the U.S. APLE’s portfolio consists of 221 hotels – ~ 29,100 guest rooms – spread across 88 markets throughout 37 states.

From the size perspective, APLE is not large as currently it has ~ $3.5 billion in market cap, which is slightly above the average of implied market cap values among the entire publicly traded hotel REIT segment.

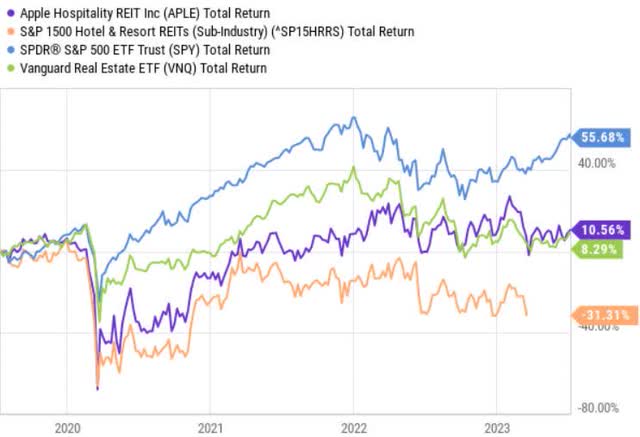

Ycharts

Since the pandemic, APLE has managed to recover at a faster pace than its peers, and in line with the overall REIT market. However, the performance has fallen short of the S&P 500 as the recovery and multiple expansion of APLE have not been that pronounced.

Thesis

Looking at the APLE’s multiple and the prevailing dynamics of the underlying fundamentals, it seems that the odds are becoming increasingly stacked in favour of solid performance.

As of now, APLE stock trades at a FWD P/FFO of 9.3x, which implies a ~30% discount to the sector median. Historically (past 8 years), the multiple for APLE has been in the range from 8.2 to 11.2x.

So, currently, APLE seems to be significantly discounted to the sector median and trading at a midpoint of the historical valuation range.

From the dividend yield perspective, APLE clearly beats its closest peers as the current yield of ~6.3% significantly exceeds the comparable benchmark of 2.7%.

In my opinion, APLE is set to outperform the REIT market including its closest peers in the lodging/hotel sector. Below I will highlight my thinking, which should justify the thesis of strong earnings growth, fully covered dividend and potentially incremental returns via the multiple expansion component.

Fortress balance sheet, which allows to capture distressed assets and fund accretive growth opportunities without introducing too much of financial risk

One of the reasons why APLE has managed to weather the pandemic so well and outperform its peers in the recovery phase is its well-structured balance sheet.

For instance, from the 16 publicly traded hotel/lodging REITs in the U.S., APLE carries the third strongest balance sheet if assessed from the leverage ratio perspective. Namely, the leverage ratio of APLE stands at a very favourable level (30.1%). The debt to EBITDA is also at a rather healthy state (5.3x), which both on an absolute and relative level confirms APLE’s financial resilience.

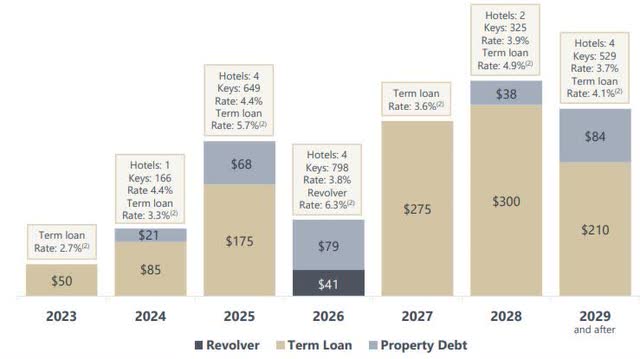

Apple hospitality REIT

The debt maturities are also favourably structured with relatively minor portions of debt falling due in 2023 and 2024. In the context of APLE’s $616 billion in available liquidity, the refinancing risk seems extremely remote.

The notion of having a strong balance sheet in the times when the sector-specific conditions are financially weak allows the Management to act opportunistically.

Opportunistic acquisitions in conjunction with continued recovery from the pandemic should enhance the prospects of solid performance

A solid state of the balance sheet has allowed APLE to devise accretive acquisition and disposition strategy in a considerable fashion.

Since the outbreak of COVID-19, APLE has optimized its portfolio by lowering the average age of hotels (thus reducing near-term CapEx spend) and increasing exposure to markets with more positive growth prospects.

Apple hospitality REIT

On a net basis, APLE has expanded its portfolio without sacrificing the balance sheet. All of the acquisitions made (with an exception of one) so far have already made their impact on the financial performance. This means that at least for Q2, 2023, we should not expect an increase in RevPAR or EBITDA stemming from inorganic growth activities.

However, on July 5, 2023, APLE announced that it had successfully acquired an additional hotel for $31 million. The full effects will likely percolate through the financials in Q3, 2023, and will be relatively minor due to the insignificant size in the context of total portfolio.

The good news was that Nelson Knight, president of APLE, while announcing the $31 million deal also clearly articulated that:

We will continue to actively explore transactions that refine, enhance and grow our existing portfolio while increasing our exposure to markets like Cleveland with strong growth trajectories and attractive cost structures

Considering the financial strength of APLE’s balance sheet and still relatively distressed hotels sector (due to highly indebted operators and developers), we should expect accretive transactions going forward. This should, in turn, enhance portfolio quality, yields and growth prospects.

An additional boost for the future earnings or performance of APLE should stem from the continued recovery.

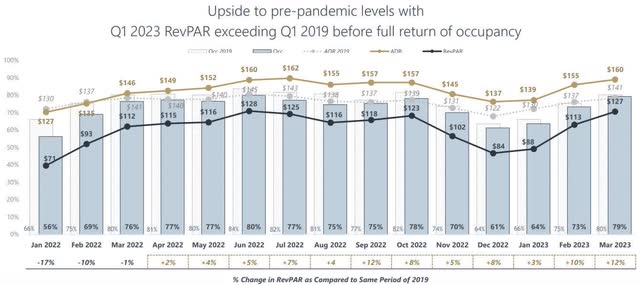

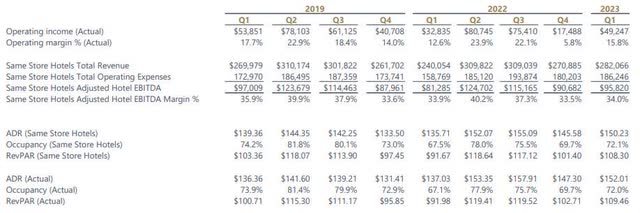

Apple hospitality REIT

Already know, we are seeing how APLE is successfully increasing the RevPAR component, which is a major driver of the underlying profitability and growth. The full effects of the improving RevPAR will materialize once the occupancy rates revert back to the normalcy.

There has already been a notable convergence to the pre-pandemic levels (underpinned by positive quarterly rate of change dynamics), but still insufficient.

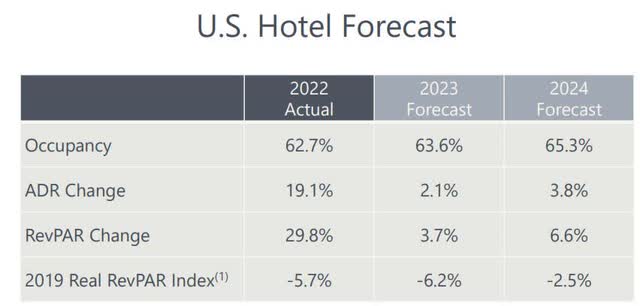

STR 2023 CoStar Group January 2023

Going forward, there will be a structural force supporting APLE’s earnings growth – i.e., the sticky recovery of lodging/hotel sector from the COVID-19 consequences. It is projected that 2023 and 2024 will result in growing RevPAR and occupancy rates across the board in the U.S. hotel sector.

Apple hospitality REIT

Lastly, the aforementioned data about APLE’s financials captures the essence of the thesis:

- The underlying fundamentals of APLE (from both portfolio and balance sheet side) are very resilient, where even in the worst quarters during the pandemic, the Company was able to shield its business by generated solid EBITDA margins. This also provides a significant support for recovery story.

- Having a fortress balance sheet in relatively distressed sector conditions allows APLE to seize high yielding projects to recycle portfolio and secure long-term growth.

Bottom line

Given the multiple at which APLE currently trades and the overall recovery in the sector, the odds are stacked in favour of strong capital appreciation. This is propelled by the APLE’s aggressive M&A strategy, which has been funded by a fortress balance sheet, thus allowing to secure more favourable spread between the WACC and property cap rates. APLE is poised to deliver juicy total return in the short- to medium-term by delivering strong results via sector wide recovery and continued expansion of its portfolio in a profitable and asset-improving manner.

Read the full article here