ArcBest Corporation (NASDAQ:ARCB) has been in business for 100 years. This is impressive given the highly competitive nature of the trucking and logistics businesses.

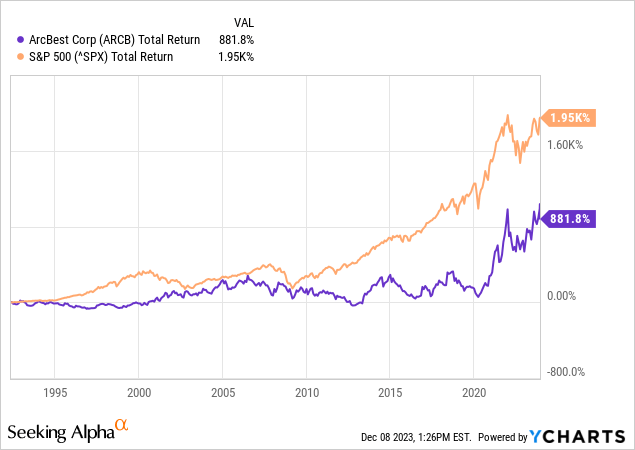

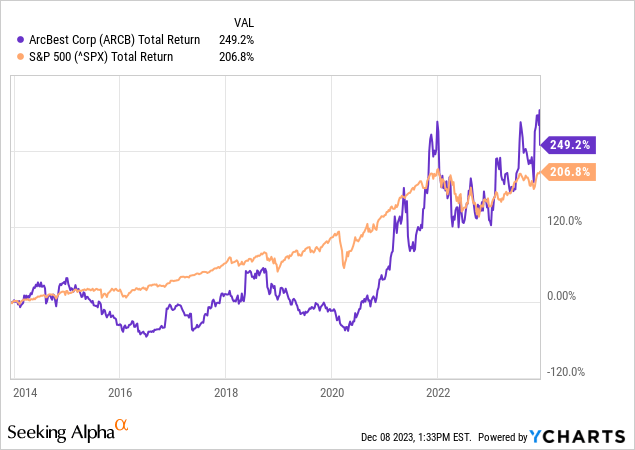

ARCB most recently became a public company in 1992. Since then, ARCB has delivered a total return of 882% compared to a total return of 1,950% delivered by the S&P 500. Recent relative performance has been much better with ARCB delivering a total return of 249% over the past 10 years compared to a total return of 207% by the S&P 500.

The outperformance over the past 10 years has coincided with a major strategy shift by the company to become an integrated logistics company. Previously, the company had been a mostly asset-based player focused on the less-than-truckload segment (“LTL”).

Currently, ARCB trades at just 10.3x consensus FY 2024 earnings. This represents a highly attractive valuation compared to both asset-based and asset-light peers. Additionally, I view ARCB’s valuation as attractive vs the broader market.

Strategy Shift To Become Integrated Logistics Company

In 2009, revenue from ARCB’s asset-light logistics business accounted for ~7% of revenue while the asset-based LTL business accounted for ~93% of revenue.

By 2014, the asset-light logistics business had grown to represent ~27% of the company’s total revenue. For FY 2022, the logistics business accounted for ~45% of the company’s total revenue. ARCB has grown its logistics business organically and through acquisitions.

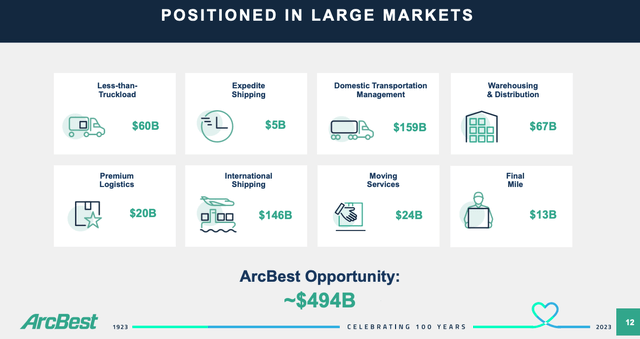

Thus, due to this transformation, ARCB has become an integrated logistics provider with a differentiated business model from most peers and a larger addressable market.

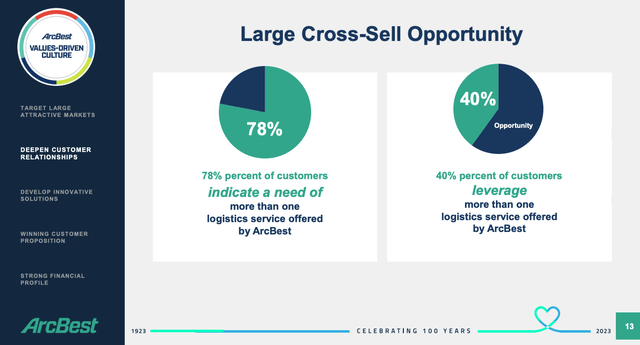

ARCB’s integrated model has created a massive cross-selling opportunity with 40% of the company’s customers now leveraging more than one service offering. This compares with 78% of the company’s customers who say they need more than one of the logistics services offered by ARCB. Thus, the company believes there is significant growth potential related to cross-selling going forward.

I agree with this view and believe an increase in cross-selling represents a key growth driver for ARCB going forward.

ARCB Investor Presentation ARCB Investor Presentation ARCB Investor Presentation

Efficiency & Margin Improvement Story

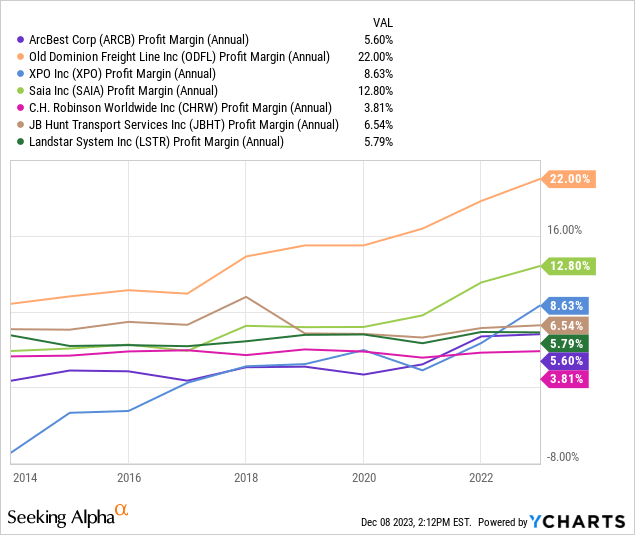

ARCB had long been considered one of the less efficient players in the logistics business but recent operational improvements and cost-cutting initiatives have brought margins more in line with asset-light peers.

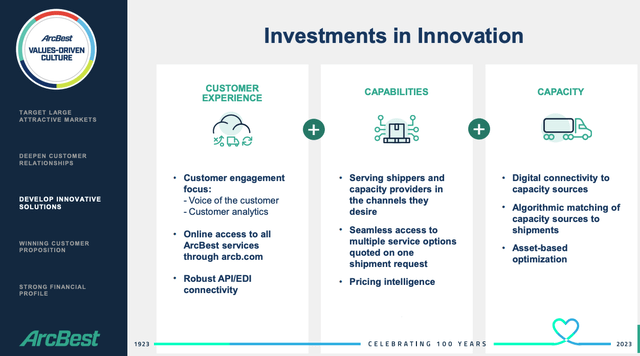

Despite these recent improvements, ARCB still has profit margins that are much lower than LTL peers Old Dominion Freight (ODFL), Saia (SAIA), and XPO, Inc. (XPO). Thus, I believe ARCB still has the potential to benefit from increased profitability going forward if the company is able to execute efficiency initiatives focused on leveraging innovative technology solutions.

One example of potential increased efficiency related to technological innovation is due to the use of AI. The company noted AI benefits on its Q3 earnings call:

For example, earlier this year, we deployed a generative AI tool to support an internal team that performs quality audits of our customer service interactions. This team removes friction points and improves hundreds of processes every year and this new tool quickly provides key insights to further advance these efforts.

In addition, our ABS city route optimization project has leveraged AI to reduce mileage and decrease fuel consumption, which supports a more sustainable future. Looking ahead, we will continue developing and investing in solutions to support best-in-class service to our customers and drive business efficiencies.

ARCB Investor Presentation

Q3 Results Beat Expectations

On October 27, 2023, the company reported Q3 2023 results. Non-GAAP EPS came in at $2.31 which beat consensus estimates by $0.81 per share but was still down sharply from the $3.79 per share reported during the same period a year ago. Revenue came in at $1.13 billion which was in line with consensus estimates and down 16% compared to the same period a year ago. ARCB surged by ~16% following the release.

A big part of the upside Q3 earnings surprise was related to improved efficiency in the asset-based business. On the call, the company noted:

The third quarter non-GAAP asset-based operating ratio of 88.8% reflects a sequential improvement of 400 basis points compared to second quarter, which is particularly noteworthy because our new labor agreement added approximately 350 basis points of costs relative to second quarter.

Excluding that increase, our sequential operating ratio improvement was approximately 750 basis points. That impressive result did not happened by accident, and I am proud of the way our team came together over the last few months to serve our customers during the time of market disruption, while remaining focused on cost and efficiency.

I am also pleased to report that, we have carried this momentum into the fourth quarter. Excluding periods impacted by the pandemic, the average sequential change in ArcBest asset-based operating ratio from the third quarter to fourth quarter during the prior 10 years has been an increase of 100 to 300 basis points.

Despite this historical trend, after considering the impacts of the market disruption, recent commercial successes, a general rate increase and cost reduction efforts, the asset-based operating ratio is expected to modestly decrease from third quarter 2023 to fourth quarter 2023.

I view the improvement in efficiency as a major positive for the company as it suggests ARCB is making progress towards improving margins to be more in line with peers.

Historical Financial Performance vs. Peers

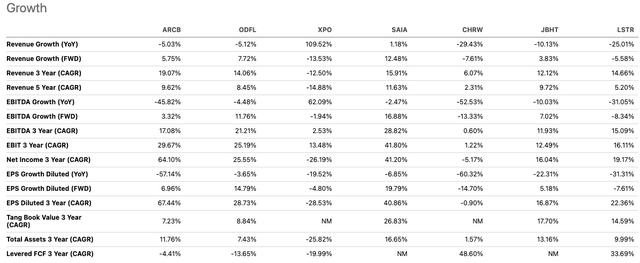

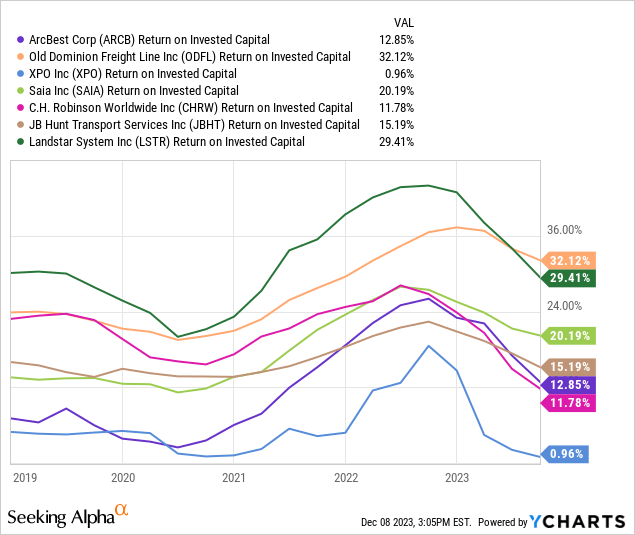

As shown by the chart below, ARCB has experienced recent historical growth which has been towards the upper end of its peer group. Given ARCB’s business mix, it makes sense to consider both LTL players such as ODFL, SAIA, and XPO as well as asset-light players such as CHRW, JBHT, and LSTR.

ARCB has grown its 3yr revenue at a best-in-class 19% CAGR and 5yr revenue at a 9.6% CAGR which is near the upper end of both asset-based and asset-light peers.

ARCB also has experienced best-in-class EBIT and diluted EPS growth over the past 3 years.

In terms of ROIC, ARCB has most recently delivered results that are near the middle of the pack of its peer group up from a position closer to the bottom of its peer group previously.

Seeking Alpha

Highly Attractive Relative Valuation

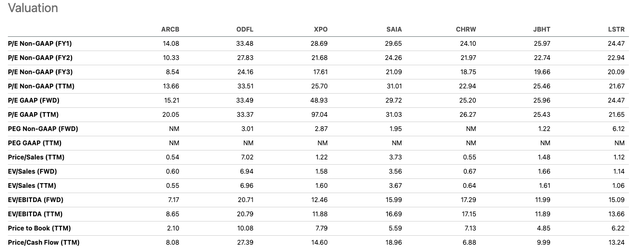

ARCB is trading at a substantial discount to both LTL peers and asset-light peers based on nearly all key metrics such as trailing P/E, 1 yr forward P/E, 2yr forward P/E, EV/Sales, and EV/EBITDA.

Simply put, I do not believe this valuation discount is warranted. ARCB has made substantial progress in terms of efficiency improvement over the past few years and has shown the power of its integrated logistics business model.

ARCB has reported best-in-class revenue and EPS growth over the past 3 years. Despite margin improvements related to cost-cutting and better operating efficiency, the company still has margin improvement potential as margins remain below most peers. Further margin improvement has the potential to drive additional EPS growth going forward.

Currently, consensus estimates for FY 2023 and FY 2024 EPS growth for ARCB are near the top end of its extended peer group. Thus, I believe ARCB has better near-term growth prospects relative to peers in addition to trading at a much lower valuation.

I believe ARCB should reasonably trade at a fair valuation of ~23.6x forward earnings. This represents 55% of the average forward P/E of ODFL, XPO, and SAIA plus 45% of the average forward P/E of CHRW, JBHT, and LSTR. Based on 23.6x forward earnings ARCB could reasonably trade at $246 per share, more than double its current trading level.

In addition to trading at an attractive valuation vs peers, I also view ARCB’s valuation as attractive vs the broader market. ARCB trades at 10.3x FY 2024 earnings compared to ~18.9x for the S&P 500. While ARCB is cyclical and thus has higher earnings volatility, the near-term growth prospects for ARCB are much higher than the S&P 500.

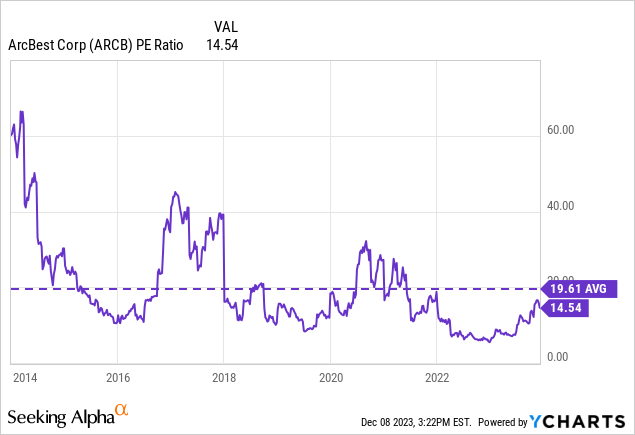

Finally, I also view ARCB as attractively valued relative to its own historical norm. Currently, ARCB trades at 10.3x consensus FY 2024 earnings and 8.5x consensus FY 2025. These metrics compare to an average P/E ratio of 19.6x over the past 10 years.

Seeking Alpha Author (Seeking Alpha Data)

Risks To Consider

One key risk that investors considering a long position in ARCB must be aware of is the potential for an economic slowdown. ARCB is a highly cyclical company and will experience a significant drop in earnings should the economy experience a downturn. I do not think this is a likely outcome in the near term. Additionally, ARCB has a fairly strong balance sheet and enjoys an investment-grade credit rating. Thus, I believe the company has the ability to ride out challenging economic conditions if necessary.

Additionally, I believe the highly attractive valuation could provide downside protection in the event that earnings come in below expectations as I believe the ARCB story is more about multiple expansion than it is about earnings beating expectations.

Conclusion

ARCB has undergone a major strategy shift over the past decade to become an integrated logistics player as opposed to an LTL-focused player. The company’s shift in strategy has recently started to pay off with the company reporting industry-best growth over the past few years.

Despite these improvements, ARCB still has room for further improvements as margins remain towards the lower end of its peer group. Additionally, ARCB has additional growth potential related to increasing cross-selling opportunities.

The most compelling part of the ARCB investment story is valuation. The stock currently trades at a substantial discount to its peer group and at a discount to its own historical average. Thus, I am initiating ARCB with a strong buy as I view the stock as a highly attractive investment opportunity at current levels.

I would consider downgrading the company if the valuation were to become less attractive or the company was to fail to deliver financial performance that is in line with peers moving forward.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here