Introduction

As an investor who invests primarily in dividend growth companies, I seek new opportunities to invest in income-producing assets. I usually add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

Consumer staples can be interesting nowadays as investors flock to them for safety. Companies in the sector tend to be less volatile. While some companies in the industry are trading for an extremely high valuation, there may be opportunities in more ignored peers. In this article, I will look at Archer-Daniels-Midland (NYSE:ADM), a company I own. I analyzed ADM stock a year ago and found it to be a Hold.

I will analyze Archer-Daniels-Midland using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Archer-Daniels-Midland Company procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally. The company operates in three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. It originates, merchandises, stores, and transports agricultural raw materials, such as oilseeds and soft seeds. The company also engages in agricultural commodity and feed product import, export, distribution, and structured trade finance activities. In addition, it offers vegetable oils and protein meals, ingredients for food, feed, energy, and industrial customers, crude vegetable oils, salad oils, margarine, shortening, and other food products.

Fundamentals

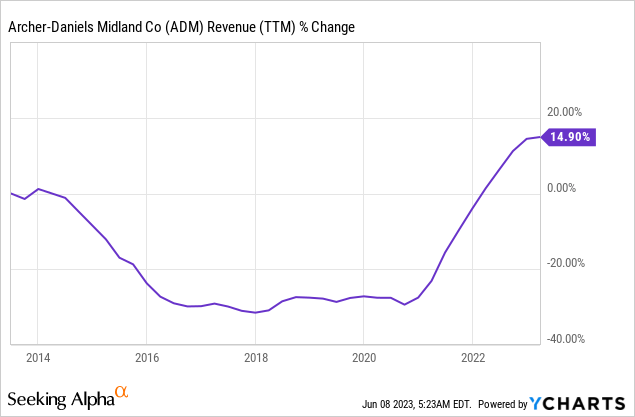

Revenues of Archer-Daniels-Midland have increased by 15% over the last decade. The revenues are cyclical even though the company’s agricultural products are consumer staples. The reason for that is the changing prices of commodities. Low revenues are also the reason for small divestitures as the company focuses on its lucrative businesses. In the future, as seen on Seeking Alpha, the analyst consensus expects Archer-Daniels-Midland to maintain flat revenues as the company is dealing with lower commodity prices.

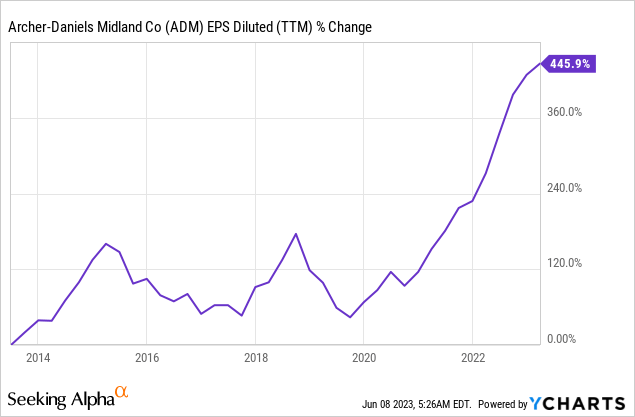

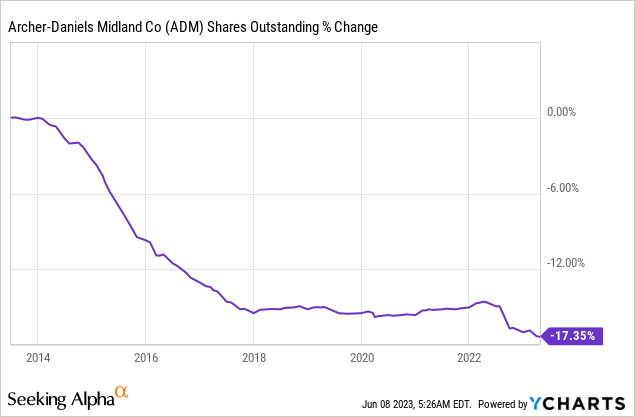

The EPS (earnings per share) has increased faster over the last decade. The 446% increase in the share price results from higher sales, higher prices, and lower expenses. The margins have opened, allowing the company more income from every sale. The company also leveraged its buybacks to support the EPS growth. In the future, as seen on Seeking Alpha, the analyst consensus expects Archer-Daniels-Midland’s EPS to decline by 17% in the coming two years before it stabilizes, again due to the lower commodity prices.

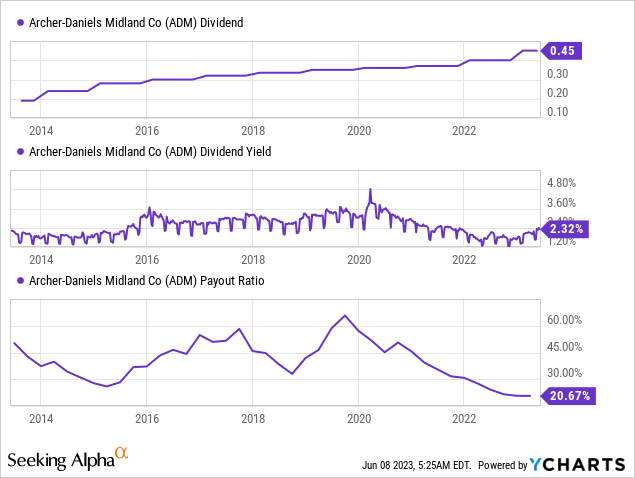

Archer-Daniels-Midland is on its way to becoming a dividend king, which means 50 years in a row of dividend increases. The company has increased the dividend for 47 years, including a 13% increase in January. The company offers a relatively safe dividend with a payout ratio of 21%. It means that even with the decline in the EPS, there is little risk for the dividend. The current entry yield is decent at 2.3% and offers plenty of room to grow.

In addition to dividends, the company also returns capital to shareholders via share repurchase plans. These buybacks support EPS growth by lowering the number of shares outstanding. The EPS will grow with fewer shares even if the net income won’t. Buybacks are highly effective when the share price is attractive, and the current valuation may offer a decent opportunity for the company to buy more shares. Therefore, it allocated $1B for buybacks in 2023.

Valuation

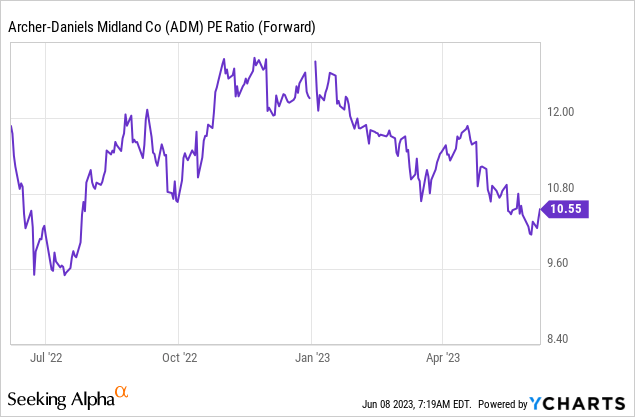

The company’s P/E (price to earnings) ratio is 10.5 when using the 2023 EPS forecast. This forecast considers a significant 11.5$ drop in the company’s EPS. Ten times earnings seem attractive for a company with such a long track record of growth. Moreover, over the last twelve months, the company was trading for a higher valuation most of the time.

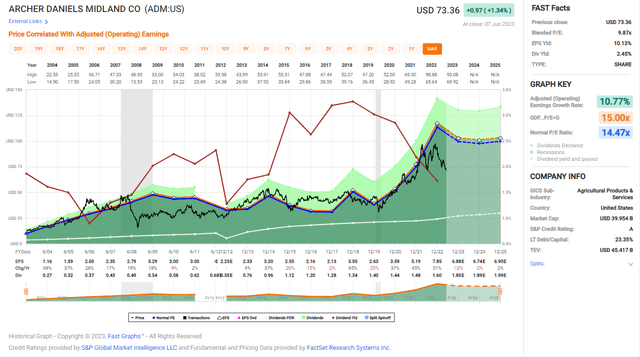

The graph from FAST Graphs shows an ambivalent picture. Archer-Daniels-Midland is trading for an attractive valuation. The company’s average P/E ratio over the last two decades was 15. Right now, the P/E ratio is much lower at 10.5. While attractive, the average annual growth rate in the previous twenty years was almost 11%. The current forecast shows that the company will likely suffer from lower EPS before stabilizing. Therefore, investors prefer more margin of safety.

FAST Graphs

Opportunities

Diversification is a key growth opportunity for Archer-Daniels-Midland. It allows the company to find the most suitable and attractive opportunity constantly. The company offers its products globally, allowing it to grow in different markets when a chance arises. It also sells products, from oil seeds and carbohydrate solutions to alternative proteins and animal food.

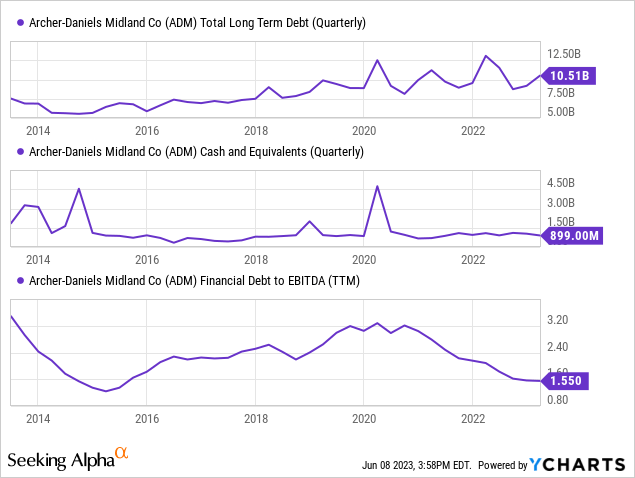

The balance sheet of Archer-Daniels-Midland also serves as a growth prospect for the company. Its debt to EBITDA ratio stands at 1.5, more than 50% lower than a decade ago. Its conservative balance sheet with a low debt burden is beneficial, allowing the company to be active in the M&A field. Archer-Daniels-Midland may acquire smaller competitors that will improve its value proposition. It may be extremely helpful in the alternative proteins business where dozens of startups operate, and with the harsher environment, they may be willing to be sold.

Another growth opportunity is the realm of alternative proteins. Archer-Daniels-Midland has entered that realm, producing plant-based proteins from soy and wheat that the industry can use. As plant-based diets enjoy increased demand, this may be a significant growth opportunity for the company, as the need for primary agricultural products grows slower, in line with population growth.

Risks

Competition in growth drivers is fierce, a risk for the company’s growth. FoodTech and AgTech startups kept raising capital in 2022 and are working on disrupting the sector. Archer-Daniels-Midland will have to compete with them on the production of alternative proteins and on their ability to improve its production process.

Another risk for Archer-Daniels-Midland is the cyclicality of the business. Usually, consumer staples companies do not tend to be cyclical. They set prices and enjoy a steady demand for their everyday product. The demand is steady with this company, but the market decides the prices, as seeds and grains are commodities. For example, wheat, corn, and soy price changes will affect revenues and EPS.

Medium-term stagnation is a significant risk for Archer-Daniels-Midland, as it is happening right now. The company is suffering from declining EPS this year, and analysts expect the EPS to decline again in 2024. Therefore, there is a chance that 2025 will also see lower EPS if the current trends of commodities continue. A more extended stagnation period means that investors may see a stagnant share price.

Conclusions

To conclude, Archer-Daniels-Midland is a great company. You don’t get so close to a dividend king status without a long track record of successful execution. The company has solid fundamentals with top and bottom-line growth leading to that unique dividend and buybacks growth. It has several growth opportunities and is trading for what I believe to be an attractive valuation.

However, there are risks to the investment thesis. In the long run, it will keep dealing with the cyclicality and the competition. I am very concerned about the medium-term stagnation as there is no guarantee that prices of commodities will increase or stabilize in 2025. Therefore, due to the uncertainty, I believe the company is a Hold, and it will be more interesting at a P/E ratio of 8-9, which may be reached during a market pullback.

Read the full article here