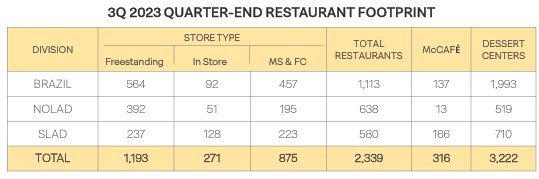

Arcos Dorados Holdings (NYSE:ARCO) operates McDonald’s restaurants as a franchisee mostly in Latin America with exclusive geographical rights. The company divides its operations into three geographical divisions – Brazil, North Latin America, and South Latin America. Almost half of the company’s 2339 current total restaurants and 316 McCafes are located in Brazil, and the majority of dessert centers are in Brazil.

Arcos Dorados Q3 Presentation

Arcos Dorados has paid out a very inconsistent dividend in its past, with the current yield being 1.50%. As the company invests in growth and an improved performance, the company’s capital needs seem to be quite large for the time being. As the company has grown its revenues impressively, the stock price has done the same – Arcos Dorados’ stock price has rallied by 61% in a year at the time of writing:

One Year Stock Chart (Seeking Alpha)

Financials

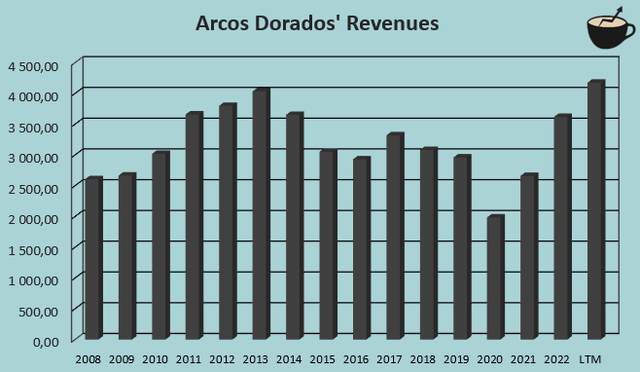

After a turbulent long-term history in revenues, and a further poor performance in 2020 and 2021 due to the Covid pandemic, Arcos Dorados has been able to improve the company’s growth significantly – in 2022, revenues grew by 36.1% well above pre-pandemic figures, and with LTM figures the company has new all-time high revenues. So far in 2023, Arcos Dorados has opened up 45 restaurants according to the company’s Q3 presentation, making the overwhelming majority of sales growth to come from per-store sales growth; I wouldn’t expect the sales growth to continue at the recently achieved level for very long, although the company’s 3D strategy does have promising initiatives for improving store efficiency.

Author’s Calculation Using TIKR Data

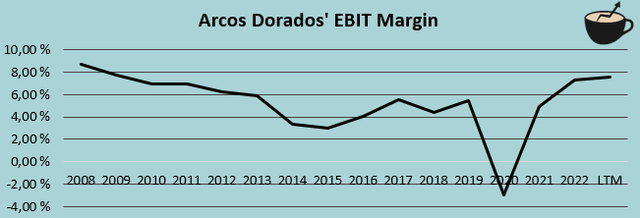

Along with turbulent long-term revenues, Arcos Dorados’ margins haven’t been very great prior to the pandemic. After the pandemic-worsened figures, the company has achieved better results than prior to the pandemic, though – currently, Arcos Dorados’ LTM EBIT margin stands at 7.5% compared to a 2019 figure of 5.5%. The higher margin seems to be a result of great strategic execution of the laid out 3D strategy, which is to be expanded on in a later section.

Author’s Calculation Using TIKR Data

Looking at the company’s EBIT figures can be partly misleading, though – Arcos Dorados has a very high tax rate compared to basically all companies operating in the United States. With LTM figures, Arcos Dorados’ effective tax rate is 37.4%, as many of the countries in Latin America have high tax rates. For example, Aswath Damodaran’s country data includes high corporate tax rates such as 34% in Brazil, and 35% in Argentina and Colombia. Arcos Dorados itself is based in Uruguay with a 25% corporate tax rate, but the company seems to have to pay taxes in doubles in some countries’ operations, making the complete tax rate very high.

The 3D & Growth Strategy

Arcos Dorados has laid out a 3D strategy, including three elements to drive a better operational execution – Digital, Delivery, and Drive-thru. The focus on the sales channels’ growth should be able to improve both Arcos Dorados’ revenue growth and margins, as the company can improve its same-store sales.

The strategy already seems to be a large factor in Arcos Dorados’ recent growth. The company has impressively grown digital sales by 47% in US dollars year-over-year in Q3, improving the digital sales penetration from 42% to 50%. Delivery sales grew by 48% in constant currencies year-over-year, with drive-thru sales growing by 17%. The digital and delivery growth rates seem to provide Arcos Dorados with a significant same-store sales growth channel, providing the company with further room for growth if further growth can be executed on.

Arcos Dorados’ strategy revolving around sales growth can be seen well on the company’s cash flow statement – in 2022 and 2023 combined, Arcos Dorados is expecting to spend $567 million in capital expenditures, including expected store openings of 75 to 80 for 2023 alone – the growth initiatives aren’t completely limited to the 3D strategy, but also to some new store openings.

I still believe that the 3D strategy is Arcos Dorados’ main avenue for value-creating growth. The sales growth from digital growth seems to be the main reason for Arcos Dorados’ recently strong margins in addition to revenue growth – improving same-store sales decreases fixed costs’ percentage of sales, providing valuable operating leverage. If the 3D strategy can be developed on further with good execution, the company’s earnings should see very good growth in the future as well.

Valuation

Arcos Dorados’ stock seems moderately priced at a quick glance, as the stock currently trades with a forward P/E of 15.6 at the time of writing. To estimate a rough fair value for the stock, I constructed a discounted cash flow model.

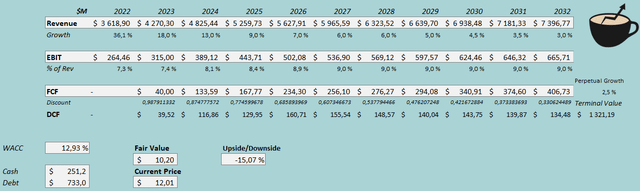

In the DCF model, I estimate the revenue growth to continue through the execution of the 3D strategy, as well as through new store openings. For 2024, I estimate a revenue growth of 13% after a 2023 growth of 18%. After the year, I believe that the company’s room for growth through the strategy should start to slow down, and I estimate the growth to slow down in steps into a perpetual growth rate of 2.5%. The revenue estimates represent a CAGR of 7.4% from 2022 to 2032.

As the 3D strategy should leverage Arcos Dorados’ costs well creating operating leverage, I believe that the company’s margins have some room to grow – from a 2023 EBIT margin estimate of 7.4%, I estimate a margin expansion of 1.6 percentage points into an EBIT margin of 9.0%, achieved in 2027 and forward. Due to the high tax rate and high capital expenditures, Arcos Dorados’ cash flow conversion isn’t very good. With the slowing growth estimates, I estimate the conversion to slightly improve with time.

With the discussed estimates along with a cost of capital of 12.93%, the DCF model estimates Arcos Dorados’ fair stock value at $10.02, around 15% below the current stock price at the time of writing. The stock seems to have some overvaluation, if the company doesn’t prove higher margin expansion or growth than I anticipate.

DCF Model (Author’s Calculation)

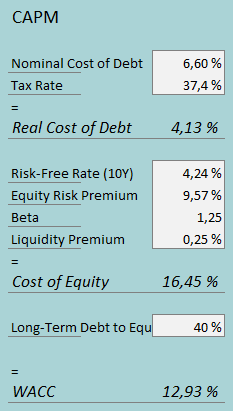

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In the most recent reported quarter, Arcos Dorados had $12.1 million in interest expenses. With the company’s current amount of interest-bearing debt, Arcos Dorados’ annualized interest rate comes up to 6.60%. Arcos Dorados leverages a good amount of long-term debt in its financing – I believe that a long-term debt-to-equity ratio estimate of 40% is reasonable. Arcos Dorados’ taxes seem very inefficient – the company seems to have effective tax rates fluctuating around 40% in most years. In the CAPM, I use the current trailing figure of 37.4% as a long-term estimate.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.24%. The equity risk premium of 9.57% is Professor Aswath Damodaran’s latest estimate for Brazil, made in July – as Brazil represents around half of Arcos Dorados’ operations, I believe that the rate is a good base figure to use in the CAPM. Yahoo Finance estimates Arcos Dorados’s beta at a figure of 1.25. Finally, I add a small liquidity premium of 0.25%, crafting a cost of equity of 16.45% and a WACC of 12.93%.

Currency Risks

Arcos Dorados doesn’t come without risks. The company’s presence in Latin America exposes the company to high inflationary risks and currency risks from certain areas. Most notably in South Latin America, Arcos Dorados’ revenues grew by 90.6% in constant currencies in Q3 year-over-year, but only by 16.1% in US dollars. On the other hand, revenues in Brazil and North Latin America grew more in US dollars than in local currencies due to currency fluctuations. So far, the company seems to have managed to perform well through currency fluctuations and high inflation, though.

Takeaway

As Arcos Dorados operates in areas with high inflation and currency fluctuations compared to the US dollar, I don’t necessarily favor the stock’s risk profile. Arcos Dorados has been able to drive great growth and better-than-average EBIT margins through a focus on digitalization and different sales channels, but the current valuation doesn’t support a theory that the improvements would have upside for the stock. My DCF model estimates Arcos Dorados to be somewhat overvalued, but for the time being, I don’t see the risk-to-reward as poor enough for a sell rating as the company’s financial performance could still surprise to the upside. I believe that currently a hold rating is constituted.

Read the full article here