Looking to get on the right side of rising rates? Many companies are challenged in this rising rate era, but others benefit from rising rates.

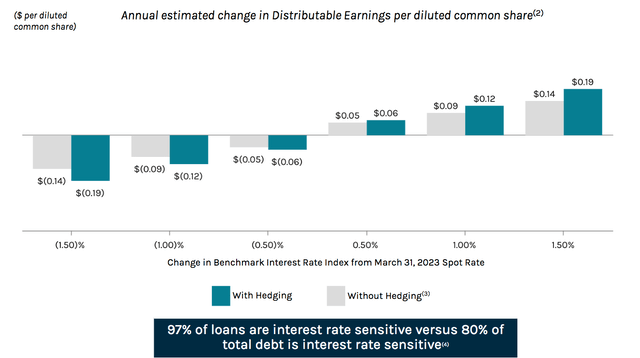

Ares Commercial Real Estate (NYSE:ACRE) is a Mortgage REIT, M-REIT, with 97% of its loans being interest rate sensitive, whereas only 80% of its total debt is interest rate sensitive. ACRE’s management estimates that the company gains $.09 to $.12/share for every 1.00% rise in interest rates:

ACRE site

Company Profile:

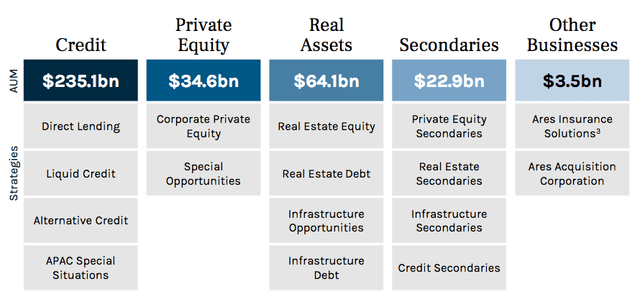

ACRE is part of the Ares Management Corporation (ARES), which has over $360B in assets under management, and more than 2,000 properties globally managed by over 240 investment professionals.

ACRE site

ACRE originates and invests in commercial real estate (CRE) loans and related investments in the US. The company provides a range of financing solutions for the owners, operators, and sponsors of CRE properties.

It originates senior mortgage loans, subordinate debt products, mezzanine loans, real estate preferred equity, and other CRE investments, including commercial mortgage-backed securities. ACRE is required to pay its Manager a base management fee of 1.5% of ACRE’s stockholders’ equity per year.

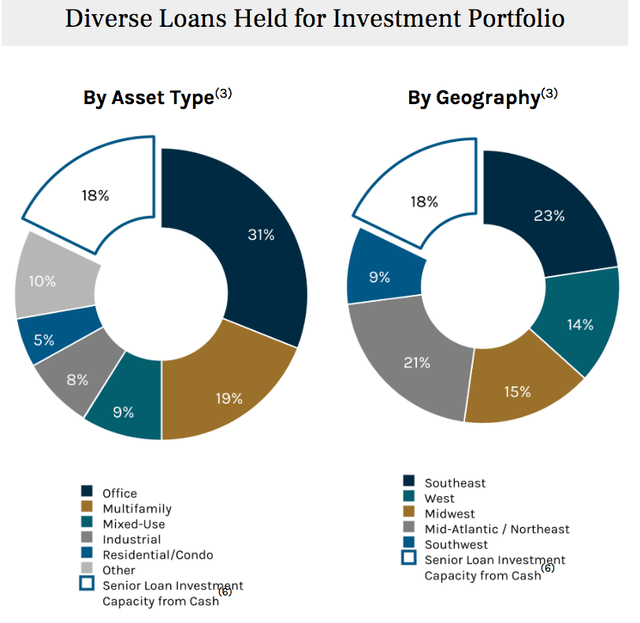

ACRE’s 2 largest exposures are in Office, 31%, (down from 37% in Q4 ’22), and Multi-Family real estate loans, 19%, followed by Mixed Use loans, at 9%, and Industrial, 8%. Its geographic exposure is dominated by the Southeast, at 23%, Northeast, 21%, with the Midwest at 15% and the West both at 14%:

ACRE site

The target investment size is $10 – $250M, Senior loans, usually with a 3-year maturity and extension options. 99% of the loans are floating rate, and 98% are Senior loans.

ACRE’s Loan Portfolio has an outstanding balance of $2.2B, comprised of 53 loans, with a weighted average unleveraged effective yield of 9.2% as of 3/31/23, up from 8.9% at 12/31/22.

Earnings:

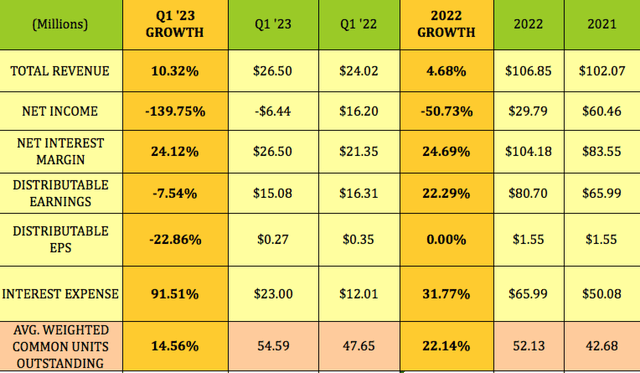

Q1 ’23: While Revenue rose 10.3%, and Net Interest Margin jumped 24%, Net Income was down ~$22M, due to higher interest expenses, which nearly doubled; and a higher provision for current expected credit losses, CECL, of $21M, vs. $(0.6)M in Q1 ’22.

The increase in the CECL provision was due to an increase in loss provisions for “two loans in the portfolio, changes to the loan portfolio, and the impact of the current macroeconomic environment on certain assets.” (Q1 ’23 10Q) ACRE’s total CECL on its balance sheet was -$87.5M as of 3/31/23, vs. -$65.97M as of 3/31/22.

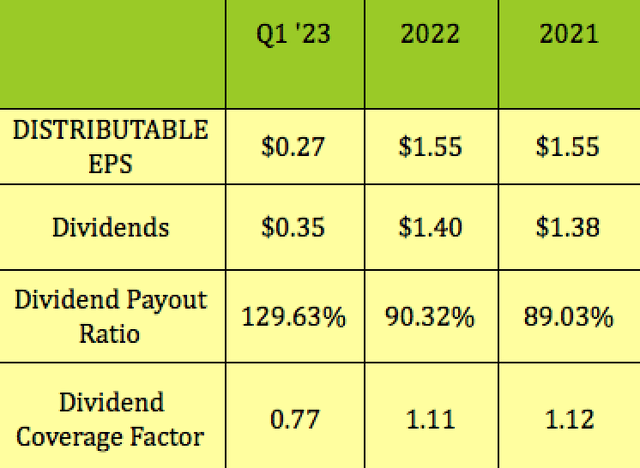

Distributable EPS fell ~23%, to $.27, vs. $.35 in Q1 ’22, as the unit count rose 14.6%.

2022: Revenue rose 4.7%, with a 22.3% rise in Distributable Earnings. However, Distributable EPS was flat, at $1.55, due to a 22% rise in the unit count.

Net Income fell 50.7% in full year 2022 vs. 2021, as a result of CECL provisions rising from $10K to $46M; and Interest Expense rising by $16M. However, Net Interest Margin rose 24.7% in 2022.

Hidden Dividend Stocks Plus

Dividends:

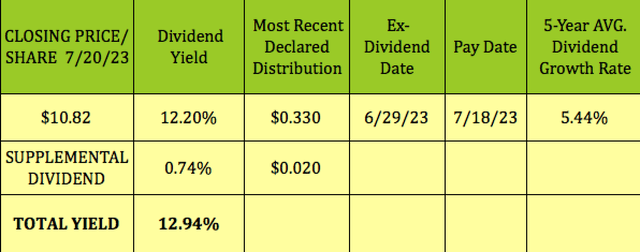

At its 7/20/23 closing price of $10.82, ACRE yields 12.94%, comprised of its regular quarterly distribution of $.33, and its $.02 supplemental payout. ACRE has paid $.33/quarter since Q1 2019, and added the $.02 supplement in Q1 2021. It has a 5.44% 5-year dividend growth rate, and should go ex-dividend next at the end of September.

Hidden Dividend Stocks Plus

The dividend payout ratio was similar in 2022 and 2021, at 90% and 89% respectively, but ballooned to 129.6% in Q1 ’23, due to lower Distributable EPS of $.27, which included a $0.10/common share realized loss on the resolution of a previously defaulted residential loan.

Hidden Dividend Stocks Plus

Taxes:

Most of ACRE’s 2022 distributions were characterized as ordinary dividends, with just $.035 characterized as capital gains. $1.3612 were listed as Section 199A dividends on ACRE’s 1099.

Profitability and Leverage:

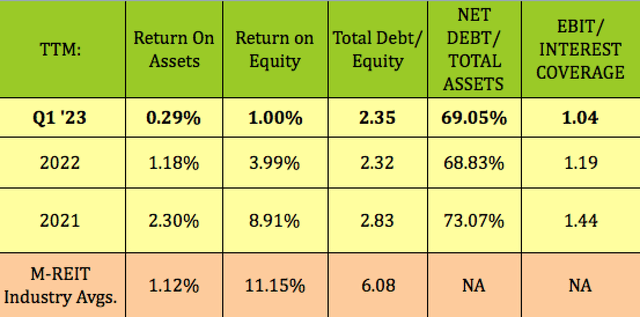

The Net Loss dragged down ROA and ROE in Q1 ’23, with both remaining lower than industry averages. Debt/Equity was ~stable, at 2.35X, as was Net Debt/Assets, at 69%, whereas EBIT/Interest coverage dropped to 1.04X, vs. 1.19X in Q4 ’22. ACRE’s Debt/Equity leverage is much lower than the M-REIT industry average of ~6X.

Hidden Dividend Stocks Plus

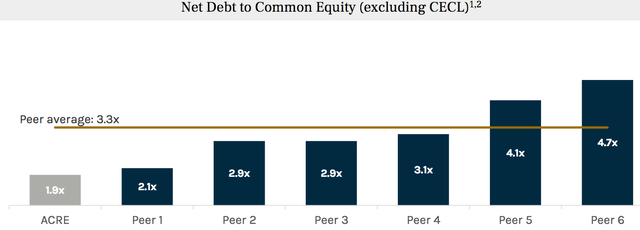

Management estimates Net Debt/Equity at a lower level of 1.9X, excluding CECL, vs. a peer range of 2.1X to 4.7X:

ACRE site

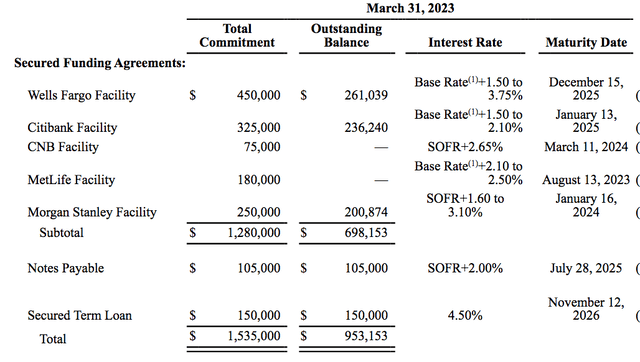

Debt and Liquidity:

ACRES had over $225M of available liquidity and cash, as of 3/31/23.

ACRE had 7 debt sources as of 3/31/23, with 5 being credit facilities from major banks. $1.02B, ~80%, of this debt matures in 2024 – 2025.

The MetLife facility comes due in August 2023, and had $0.00 outstanding as of 3/31/23. It also had a $105M note payable coming due in 2025, and a $150M Senior Loan maturing in 2026.

ACRE site

Analysts’ Targets:

Analysts’ price targets have declined considerably since March 2023, when they ranged from $11.00 to $13.50. At its 7/20/23 closing price of $10.82, ACRE was 6.4% above street analysts’ average price target of $10.17, and 1.6% below their $11.00 highest target.

Hidden Dividend Stocks Plus

Performance:

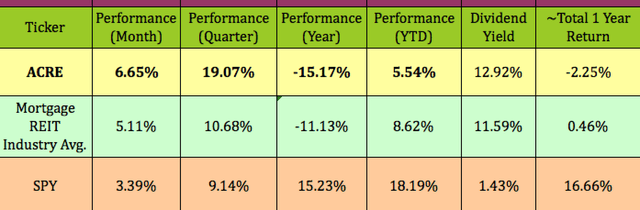

ACRE has caught a bid recently, outperforming the M-REIT industry and the S&P 500 over the past month and quarter. It has lagged over the past year and so far in 2023.

Hidden Dividend Stocks Plus

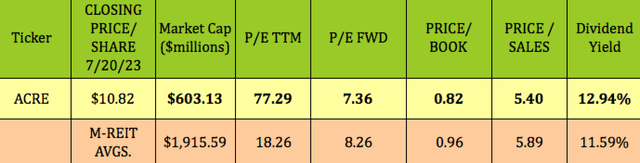

Valuations:

The outlandish trailing P/E is due to the aforementioned non-cash CECL provision hit to EPS. Looking forward, ACRE’s 2023 P/E is 7.36X, a bit lower than the M-REIT industry average of 8.26X. ACRE’s P/Book and P/Sales compare favorably to overall M-REIT averages, and its 12.94% dividend yield is also higher than average.

Hidden Dividend Stocks Plus

Parting Thoughts:

With the FOMC meeting this week, July 25-26, to decide on rates, it’s probably prudent to take a wait and see posture on ACRE. We rate it a HOLD at this point.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here