Shares of argenx (NASDAQ:ARGX) plunged today after the company reported that Vyvgart (efgartigimod) failed to achieve the primary or secondary endpoints in a phase 3 trial in pemphigus vulgaris (‘PV’) and pemphigus foliaceus (‘PF’) patients. This failure also has negative implications for the bullous pemphigoid trial due to comparable biology and the company has decided not to make a go/no go decision at this time and will instead wait for the learnings from all currently enrolled patients to consider a new trial design.

In my previous update on argenx, I was bullish on the company’s long-term prospects. Still, I believed the risk-reward was more balanced in the near term due to the very high valuation and the risk of the trials in immune thrombocytopenia (‘ITP’) and the above-mentioned PV/PF failing.

Specifically, I was cautious on the ITP trial because of the very modest treatment benefit of the first and successful trial and Vyvgart ended up failing in that trial without showing even a trend in its favor – that was unexpected.

Regarding the pemphigus trial, I said that the issue is that there are no placebo-controlled data from the phase 2 trial and that Vyvgart was only tested in the open-label trial, although I also noted the open-label data were impressive. So, I was not implying I was expecting the trial to fail, but I learned the hard way, from some of my prior failures, not to rely on open-label data in dermatological indications.

Regarding bullous pemphigoid, I believe this will be written off as well due to what the company described as comparable biology to PV/PF, and I would not include this as an upside driver for the stock or reflect the potential success in the valuation on argenx.

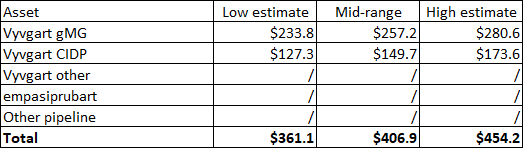

I have seen some analyst models having as much as 30% of argenx’s present value based on the ITP and pemphigus indications, so, that explains the haircut in the share price since my previous article. The two indications accounted for slightly more than 15% of my previous valuation of the four indications, the other two being generalized myasthenia gravis (‘gMG’) and chronic demyelinating polyneuropathy (‘CIDP’), and I gave no credit to the bullous pemphigoid indication which might explain the difference.

Vyvgart’s gMG launch continues to impress

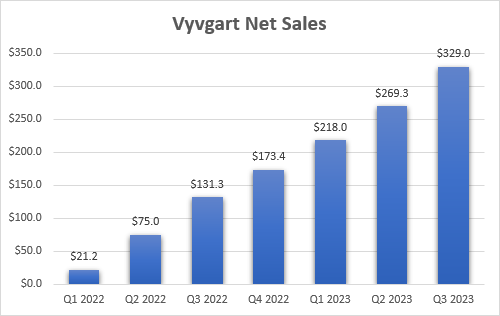

My previous article on argenx was in August and the company has since reported strong third quarter results with Vyvgart’s global net sales increasing 22% sequentially to $329 million. This was certainly good to see and bodes well for my previously increased peak sales estimate from $1.5 billion to $2 billion range to $2 billion+ and with the potential for further increases as it is likely to end 2023 with an annualized net sales run rate of approximately $1.5 billion.

argenx earnings reports

The good news here is that most of the quarterly net sales are still coming from the United States and that Vyvgart is still in the earlier stages of growth in ex-U.S. territories. We are also yet to see the impact of the fairly recent launch of Vyvgart Hytrulo, the subcutaneous version of efgartigimod that should provide a further boost to the growth of the franchise in the following quarters and years.

Both near-term and long-term risk-reward look favorable now

With the stock trading in the $330 range, as I am finishing this article, I believe that even the near-term risk-reward has shifted back to the reward side and that the long-term outlook remains favorable. This is due to the stock trading nearly below the low end of my valuation range of only the gMG and CIDP indications and with more than 30% upside to the high end of the range for these two indications alone without giving credit to the other shots on goal for Vyvgart, or empasiprubart (formerly ARGX-117) in complement-mediated diseases.

Author’s estimates

As such, I would expect the stock to recover in the following months and quarters and believe that the strong sales growth of Vyvgart along with clinical de-risking of Vyvgart in other indications and of empasiprubart in any indication would bring the stock back above $500 and potentially $600-800 per share within the next 2-3 years depending on commercial execution in gMG, and soon CIDP, and the mentioned clinical de-risking events.

Read the full article here