Introduction

Headquartered in England, Argo Blockchain plc (NASDAQ:ARBK) (“Argo“) is a middling player in the global cryptocurrency mining industry. With the recent rise in Bitcoin (BTC-USD) (“Bitcoin“), however, the stock price is up roughly 200% year to date.

While I have little interest in the stock, I find Argo’s 8.75% Senior Notes due 2026 (NASDAQ:ARBKL) (the “Bonds“), which are up more than 250% year to date, interesting and have owned them for more than a year now, adding to my position in the Bonds most recently on November 9, 2023 (at $6.53). Since then, the Bonds have skyrocketed to nearly $12 ($11.84 at the time of writing).

In this article, I discuss the investment case for the Bonds. At the very end, I also provide an update on my overall positioning heading into 2024.

Basics Concerning the Bonds

Each of the Bonds is a par $25 bond with an 8.75% coupon maturing on 11/30/2026. The Bonds are unsecured.

Interest payments of .5468 cents are paid on a quarterly basis. Trading at less than 50 cents on the dollar, the Bonds now yield more than 18%.

The Bonds will next pay a dividend on January 31, 2024 to holders of record on January 15, 2024.

If the price of Bitcoin remains above $40,000 and history is any guide, I would expect the price of the Bonds to increase by a couple of percentage points as the interest payment record date approaches.

The Bonds mature on November 30, 2026. The Bonds may be called by Argo starting on November 30, 2025.

A Speculative Investment

To be clear, I do not think Argo is a great mining company and the price of the Bonds reflects this.

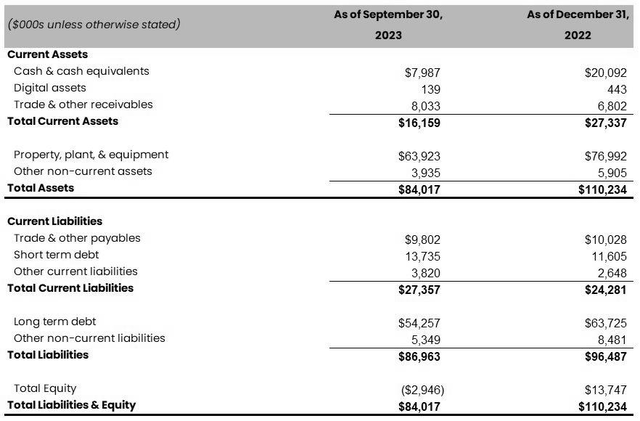

Unaudited Balance Sheet

Q3 Earnings Presentation

As can been seen from the above balance sheet from Argo’s third quarter earnings presentation, (1) total current liabilities of $27.3 million materially exceed current assets of $16.2 million, (2) total liabilities of $86.9 million slightly exceed total assets of $84 million, and (3) as a consequence of the foregoing, shareholder equity is nearly negative $3 million. Indeed, not anything to boast about and, frankly, a lot to be concerned about.

Argo, which trades in London (in addition to trading on the Nasdaq), was able to raise equity earlier in the year at prices much lower than today’s stock price (under $1.75 versus a stock price of above $4 today) On the Q3 Earnings Call, the then Interim CEO, noted:

In July, we strengthened our balance sheet by raising $7.5 million in gross proceeds through an equity raise with primarily institutional investors in the U.K. and also reduced our Galaxy debt by $5 million. And at the end of September, our cash balance was $8 million.”

In addition to that cash, the latest operational update reports that Argo holds 21 Bitcoin (worth approximately $900,000 assuming a price per Bitcoin of $43,000).

The cash position is augmented by power credits (more than $2.5 million worth) that Argo has been generating at its Texas mining facility. The credits do not change the fact that overall liquidity and asset coverage are weak.

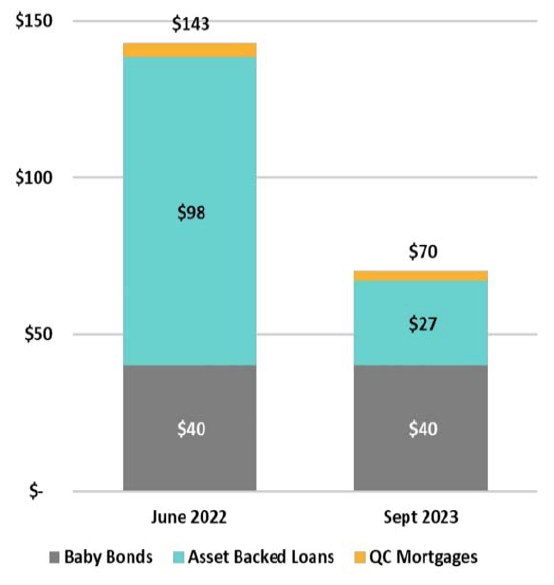

While the Company has reduced its debt considerably over the last 18 months (see debt summary graphic below) a lot more can and should be done. With the Bonds selling below 50 cents on the dollar, Argo should be raising as much equity as it can to pay off the senior secured debt (owed primarily to Galaxy Digital Holdings, a company listed on the Toronto Stock Exchange) (the “Galaxy Secured Debt“).

With the huge rise in Argo’s stock price, I would like to think the company could raise at least double the $8 million of proceeds it raised earlier in 2023. If it did, I would expect the Bonds to rise to at least $15 dollars.

Given the precarious position of its balance sheet, the Board of Directors of Argo has to be thinking about raising equity at every meeting and even in between meetings (and if the Board is not doing so, it would be grossly negligent). Any such equity raise will be a catalyst for another big increase in the price of the Bonds. Moreover, if the Galaxy Secured Debt can ever be paid off, Argo could then start buying back the Bonds at a discount. Of course, I am getting ahead of myself, but as long as Bitcoin can stay near or above $40,000, Argo should have the time and flexibility to engage in some positive financial engineering via equity raises.

While management might not want to dilute the equity holders, absent Bitcoin doubling from here, I believe it has no choice. Moreover, the dramatic rise in its stock provides the cover to do so, as it can point to the last equity raise being a success (and, indeed it was).

DEBT SUMMARY FROM Q3 2023 PRESENTATION

Q3 Earnings Presentation

Operations Are (Slowly) Improving

Per the November update (linked above):

During the month of November, the Company mined 145 Bitcoin or Bitcoin Equivalents (together, “BTC”), or 4.8 BTC per day. The Company was able to increase its daily BTC production in November by 5% compared to the prior month, despite a 9% increase in the monthly average network difficulty in November compared to October. Mining revenue in November 2023 amounted to $5.30 million, an increase of 25% compared to the prior month (October 2023: $4.26 million). The increase in revenue was driven primarily by the increase in the price of Bitcoin.”

While other operating metrics are also improving, the Company has to show that it can stabilize its liquidity situation and balance sheet. Year-end results will be important in this regard as shareholders and bondholders will get a chance to see the effects of (1) improved operating performance, (2) reduced debt and reduced interest expense, and (3) an increased Bitcoin price. In short, Q4 2023 is a show-me quarter for Argo.

Whether the Company performs well or not, it needs to raise equity. This task will be a lot easier if Argo outperforms in Q4 2023. Given the latest operational update, the probabilities have increased that Argo does just that.

Risks

Some of the risk to Argo’s business include:

1) Liquidity and asset coverage weaknesses, as described above.

2) Argo’s management team is in flux. A new CEO, Thomas Chippas, was just hired. Most recently the CEO of CBOE Digital and a former member of its Board, Mr. Chippas “is a New York-based executive with significant experience in digital assets, technology and financial services. He has previously held the positions of Chief Executive Officer of Citadel Technology LLC, Chief Operating Officer of Axoni and Managing Director of Citigroup, Barclays and Deutsche Bank. He also serves as a director of TS Imagine.” Notwithstanding a good resume, he and the rest of the Argo management team have a lot to prove.

3) Argo’s success is highly dependent on the Bitcoin price and mining fee levels.

4) Argo’s success is also highly dependent on the cost of electricity.

5) With a weak balance sheet, Argo’s future success is dependent on being able to raise capital in the capital markets. There is no guarantee that it will be able to do. That said, the opportunity appears to exist now, and I am hoping management will take advantage, even if it is to the detriment of the equity holders.

Conclusion

In summary, while its financial problems are readily apparent, the Bonds of Argo are worth speculating on, in my view, given the rise of the Bitcoin price, Argo’s improving debt profile and the increased likelihood that another equity raise is likely, if not certain, given the need for capital and the stock price’s recent rise (which provide cover for Argo’s Board to do such an equity raise).

In short, the Bonds are a Speculative Buy, while the equity of Argo is a Hold.

Happy New Year!

P.S. A portfolio update heading into 2024 is below.

Portfolio Allocation Update

As of December 28, 2023, my portfolio holdings were allocated as follows (with representative holdings noted), and the allocations as of March 31, 2023 (the last time I reported my portfolio on Seeking Alpha) are also included for comparison purposes:

Read the full article here