(Note: all ‘$’ figures are CAD, not USD, unless stated otherwise.)

Investment Thesis

Aritzia Inc (TSX:ATZ:CA) has an emerging e-commerce business that has shown signs of sustaining high levels of sales and this looks like it can continue given the success of the company’s omni-channel integration. Aritzia has also displayed impressive growth in the U.S. with 8 boutique expansions planned for this year. The number of U.S. boutiques are on course to surpass Canadian boutiques due to the large amount of untapped market expansion opportunities. This should also be supported by increasing their current distribution infrastructure. I believe Aritzia can take advantage of these growth opportunities by utilizing their strong balance sheet of a large net cash position, low levels of debt, and potentially begin paying dividends to shareholders. After a 20% drop in the share price following its quarterly results and the company citing margin pressures ahead, I believe that the market is overreacting to the news and that the company’s shares are undervalued.

Company Overview

Aritzia is a vertically integrated design house with an innovative global platform in the Everyday Luxury space. It prides itself on good design, quality materials and timeless style. With immersive and highly personal shopping experiences, it owns brands such as Aritzia, Wilfred, Babaton, and TNA which sell a variety of clothing and accessories. The company operates over 100 boutiques throughout North America and also sells online on aritzia.com. The company was founded in 1984 in Vancouver, Canada.

Investor Presentation

Aritzia has several exclusive brands under its name. Each brand allows the company to focus on a specific age demographics and lifestyles. These brands have their own boutiques which are located in Canada. These brands, including the Artizia brand itself, contribute to 95% of the company’s net revenue. Through the acquisition of Reigning Champ, the company has expanded into menswear and athletic wear. I view this acquisition as significant as it allows Aritzia to broaden its market size and capture a new segment of the market.

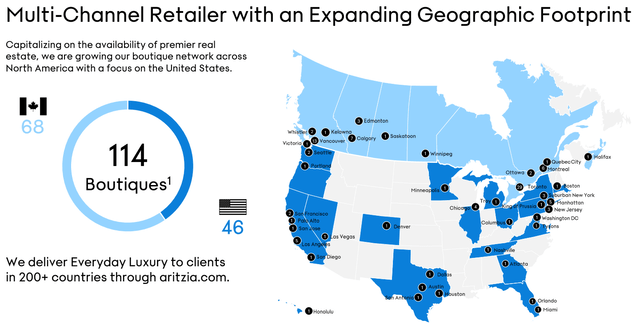

Aritzia has two main operating segments, retail boutiques and e-commerce. The company currently has 114 boutique locations in both Canada and the United States, with two thirds of revenue coming from Canada and one third coming from the United States. The company has three distribution centers to fulfill supply of these locations. About 63% of revenue can be attributed to the retail boutiques while 37% can be attributed to e-commerce.

Investor Presentation

Investment Attributes

One of the ways Aritzia differentiates itself from the competition is by controlling the designing, sourcing, and retail function of their operations. The company recently integrated a Product Lifecycle Management system which is used to analyze product development data that is used to make improvements in production, quality control, and reduce manufacturing costs. Aritzia’s in-house design team helps the company manage its product in raw material and finished product quality, fit, and create new designs. In my view, I view this as integral as it helps the company capitalize quickly on new fashion trends.

Another key attribute is Aritzia’s geographically diversified supply chains in facilities across many countries, which are operating between 80% to 100% capacity. The company uses various inventory management measures to closely monitor the inventory requirements. These measures helped Aritzia begin maintaining high levels of inventory throughout the pandemic during 2020, and in turn, satisfy current demand. The company also uses expedited freight measures to ship their products. They have tripled their expedited freight operations in response to ocean shipping timelines to supplement their product demand. Aritzia also has three distribution centers, one in the U.S. and two in Canada to meet the domestic and international demand.

Finally, Aritzia’s e-commerce business is arguably the firm’s strongest competitive advantage. For its most recent quarter, e-commerce revenue grew by 51% in Q4, driven by traffic growth in both Canada and the U.S. as well as improvement in conversion due to search and browse site enhancements. The company has also rolled out what it calls e-commerce 2.0, where it now offers personalized product recommendation which I believe should lead to increased conversion rates and higher revenue per session. Through its existing omni-channel integration, customers can view the product, purchase it, and get it shipped to the store for pick-up. Or they can ship a product to the store to try on and eventually buy. I view this as a major asset for the company as it enables Aritzia to provide an easy shopping experience for its customers, whether they choose to shop online or in-store. This is especially important in today’s retail landscape, where customers expect convenience and flexibility in their shopping options.

Financials and Recent Quarter

Aritzia has put up decent growth over the years with revenues growing at a 26% CAGR and adjusted EBITDA growing at a 22% CAGR. The company has taken advantage of their good performance over the last few years to make some positive changes to their balance sheet. The company currently has $175 million available on its revolving credit facility and has a cash position of $86.5 million. Debt to Equity currently sits at 0.94 and Net Debt/EBITDA and 1.2x, which is an improvement from a debt to equity ratio of 1.58 and a Net Debt/EBITDA ratio of 1.9x two years ago. Given these numbers, I’d say the company’s liquidity and solvency ratios look okay for a retailer.

In its recent Q4 2023 results, Artizia reported EPS of $0.40 which was a beat by $0.14. Revenue also beat by $203.5 million at $637.6 million however gross margins declined materially by 240 bps to 38.0% from 40.4% in Q4 2022. With the market punishing the stock down 20%+ following the earnings release, the market focused negatively on margin pressures and guidance. While the revenue guidance looks strong at $450-$460 million, an implied increase of about 10-13% from the previous year, the company expects a decrease of 200 bps to gross margins and an increase in SG&A by 150 bps.

In my view, I see the strong revenue outlook as encouraging given that we are facing a challenging environment. It seems to me that the everyday luxury product strategy is resonating and should support its top-line growth outlook. This is key, as the margin profile on COGS and SG&A and be addressed in the near term, but a decline in brand affinity would be something to worry about. While the margin issues appear to be short-term, management also reiterated its 2027 target growth metrics, so the longer term thesis still remains intact. With strong revenue growth over the next few years, I believe that longer term, this should drive operating leverage and long-term profitability.

Valuation

Based on 6 analysts with one year target prices for Aritzia, the average price target is $53.19, with a high estimate of $68.11 and a low estimate of $44.00. From the average price, this implies an upside of about 23.4%, even after several downgrades and revisions to target prices this week.

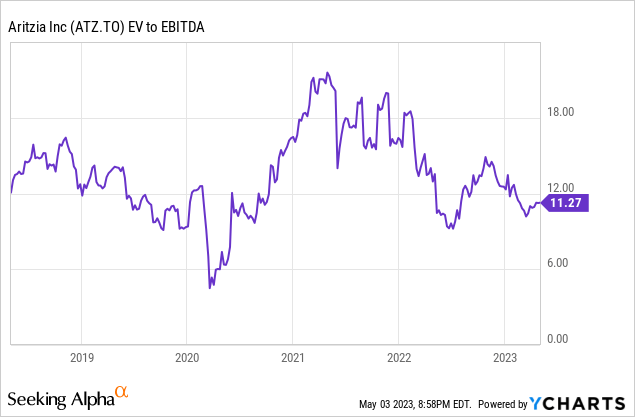

At present, the company currently trades at 11.3x EV/EBITDA and 26.4x P/E. Compared to peers like Canada Goose (GOOS:CA) and Lululemon Athletica (LULU) at 13.3x and 20.2x EV/EBITDA, respectively, Aritzia’s valuation seems reasonable for a company that is likely to grow faster than its peers over the next 5 years.

Risks and Catalysts

As prices of raw materials rise under the backdrop of increasing inflation, particularly in cotton prices, Artizia’s margins are likely to decrease in the near term. Sustained inflation rates might mean that it would cost more money to build new stores, create new products, and ship products. While Aritzia is still highly profitable and is quickly expanding in the U.S., the company does not expect to have to pass on price increases to customers in the near term, as near term price increases have been offset by leverage and U.S growth. Management expects that the first half of the year will see a gross margin decline of 600 bps and SG&A decline of 400 bps, but this should moderate in the back half of the year as warehousing costs subside and the company benefits from IMU improvements, automation, and optimizing processes for cost efficiencies.

A key catalyst I view as important for the company is the investments the company has been making in ecommerce and omnichannel innovation. The company has been betting on enhanced digital experiences and omni-capabilities to seamlessly integrate boutiques online and make their sales channels more robust. With large infrastructure builds planned for the year through distribution centers and boutique expansions, I believe Aritzia is in a “year of investment” that should support their rapid growth long-term.

Finally, a key growth driver is expansion into the U.S. which currently contributes to a third of total revenue. The company expects that U.S. revenues will outpace Canadian revenues as a result of boutique expansions in the U.S. With a great opportunity to continue expansion, there are 8 new boutiques already in the pipeline and the company has identified 100 potential locations within many untapped markets. With a quoted payback period of a boutique between 12 to 24 months, I believe further expansion is also complemented by the profitability of the boutiques. These boutique expansions should also support building brand awareness by propelling client acquisition and fueling the ecommerce channel. In my view, the company’s early success in the U.S. suggests that its suite of products of everyday luxury through classic designs have international appeal beyond Canada.

Conclusion

In summary, after a 20% drop in the share price on issues related to margin pressures, I believe the long-term thesis for the company still remains largely unchanged. Aritzia is still poised to grow in the double digits and has been making investments that should sustain its growth over the long-term. With a strong balance sheet and disciplined capital allocation, the company should continue to grow in the U.S. market and further grow its ecommerce and omnichannel presence. At 11.3x EV/EBITDA, trading at a discount to its peers, Aritzia’s shares look attractive today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here