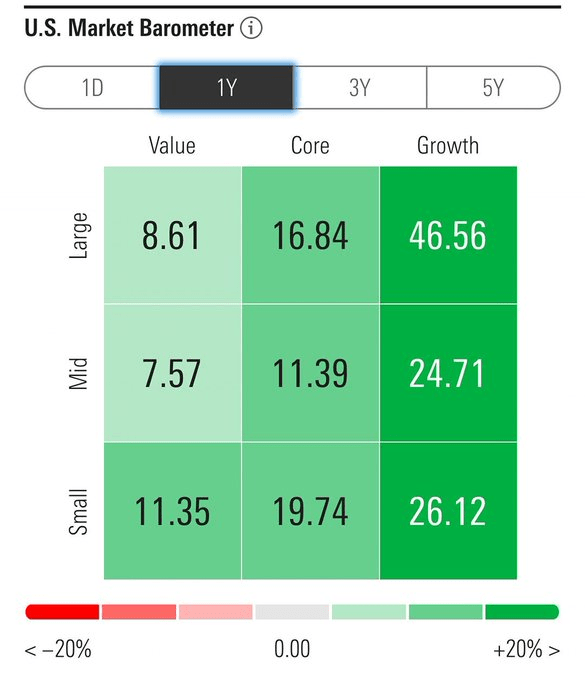

The growth factor sprung back to life in 2023. Morningstar’s Jeff Ptak reports that the right side of the style box easily outpaced the value style last year following 2022’s rout of both large and small growth stocks, particularly those that did not have strong cash flow and robust balance sheets. While many funds holding tech stocks bounced back in a big way over the last 12 months, not all of them have clear skies ahead.

I have a hold rating on the ARK Autonomous Technology & Robotics ETF (BATS:ARKQ). While I have bullish outlooks on some of Cathie Wood’s ARK funds, I spot risks with this portfolio as well as its momentum situation as 2024 gets underway.

US Market Barometer in 2023: Growth Beats Value

Morningstar

For background, ARKQ seeks long-term growth of capital by investing under normal circumstances primarily (at least 80% of its assets) in domestic and foreign equity securities of autonomous technology and robotics companies that are relevant to the Fund’s investment theme of disruptive innovation, according to the issuer. The ETF aims to own companies focused on the development of new products or services, technological improvements, and advancements in scientific research related to, among other things, energy, automation and manufacturing, materials, artificial intelligence, and transportation.

ARKQ is a moderate-sized ETF with $1.05 billion in assets under management and does not pay a dividend as of December 29, 2023. While the near-term momentum with the fund is strong given a more than 20% rally off its October low, I will detail later why I see issues with the bigger-picture chart situation. Expenses are also high with ARKQ as its annual net expense ratio is 0.75% while Seeking Alpha’s ETF Risk Grade is very poor due to a high standard deviation and its concentrated portfolio. Liquidity can be problematic at times, too, since average daily volume is just 76k while its 30-day median bid/ask spread can turn wide at times, averaging seven basis points. Thus, I encourage readers to use limit order when trading ARKQ.

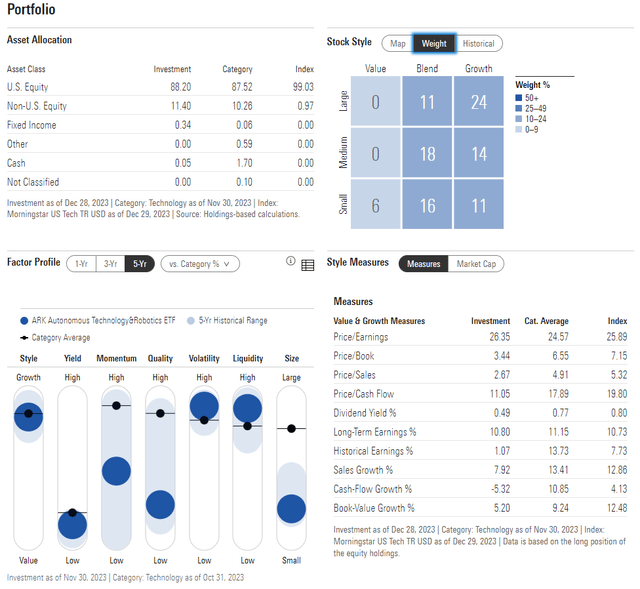

The fund’s portfolio is almost entirely growth, as Cathie Wood is known for. That creates style risk should value come back into relative favor this year. There is a material allocation to the blend portion of the style box on this two-star, Negative-rated ETF by Morningstar.

On valuation, its price-to-earnings ratio is high at more than 26 while its long-term earnings growth rate is just 11% – its historical EPS growth rate is much weaker at 1%, which is concerning. With low-quality earnings, seen in the factor view below, the fund could underperform if the focus shifts back to high-quality companies this year, too.

ARKQ: Portfolio & Factor Profiles

Morningstar

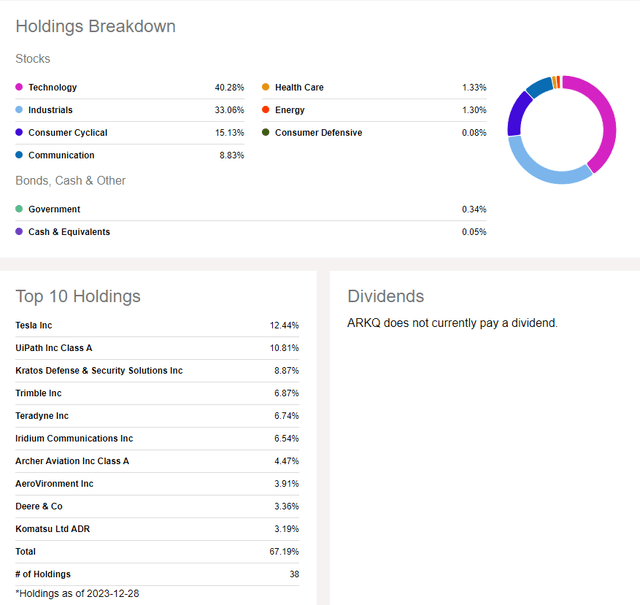

It is not surprising that the Information Technology sector makes up more than 40% of the portfolio, and there’s a significant overweight to the cyclical Industrials sector. Tesla (TSLA) commands 12.4% of ARKQ, and that is the primary Consumer Discretionary position. Thus, there’s scant sector diversification while the top 10 positions comprise about two-thirds of the fund, which is high, and a risk.

ARKQ: Holdings and Dividend Information

Seeking Alpha

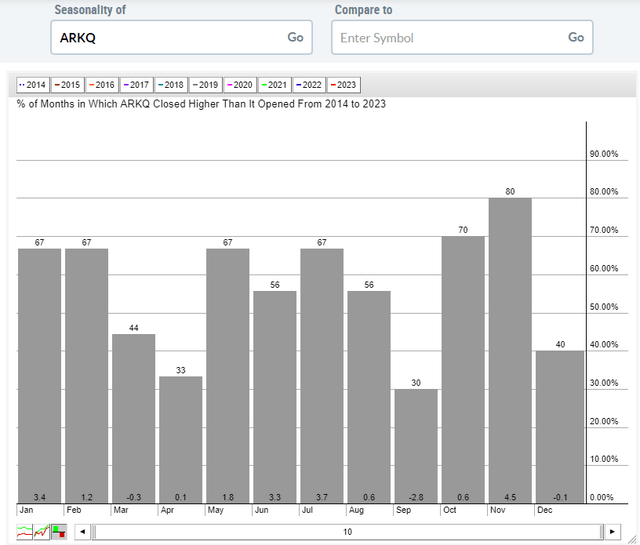

Seasonally, the January to February period is admittedly strong in ARKQ’s 10-year history, though volatility occasionally strikes in March. So, the ETF could see some further momentum to the upside before a late-Q1 correction if history is any guide.

ARKQ: Bullish January-February Seasonal Trends

Stockcharts.com

The Technical Take

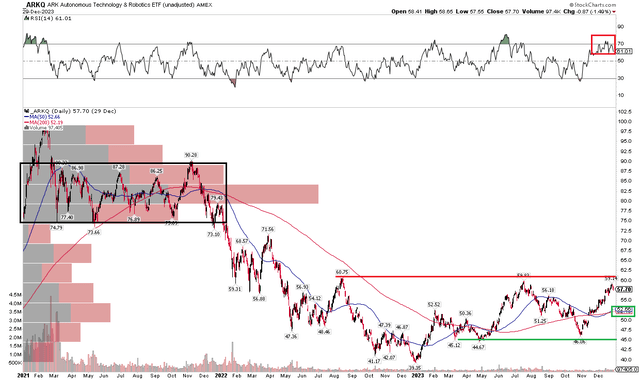

ARKQ, unlike some of the other ARK funds, remains under its August 2022 and July 2023 highs. Notice in the chart below that the fund is currently merely in a trading range between about $45 to $61. This $16 zone is key as a bullish upside breakout above $61 would portend a measured move price objective to $77. There’s clear resistance and congestion starting at about $75 – the range low from 2021 where a high amount of shares previously traded exist. Investors who bought at those levels may look to sell to get back to even, thus creating the resistance.

With a long-term 200-day moving average that is slightly positively sloped, the trend is perhaps modestly with the bulls here, but I would still like to see ARKQ rise above important resistance in the low $60s. Also take a look at the RSI momentum oscillator at the top of the graph – it did not make a new high compared to its mid-2023 peak, making for some negative divergence between momentum and price.

Overall, the chart is neutral despite a sharp rally in the last two-plus months.

ARKQ: A Trading Range with $61 Resistance

Stockcharts.com

The Bottom Line

I have a hold rating on ARKQ. It is a risky ETF with resistance on the chart. A concentrated portfolio with lukewarm long-term earnings growth is a concern as of now.

Read the full article here