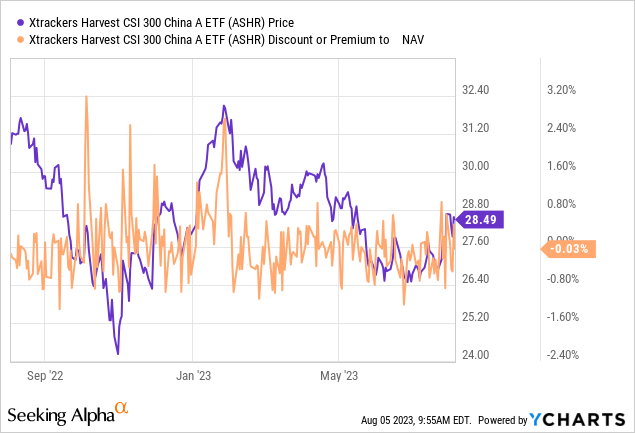

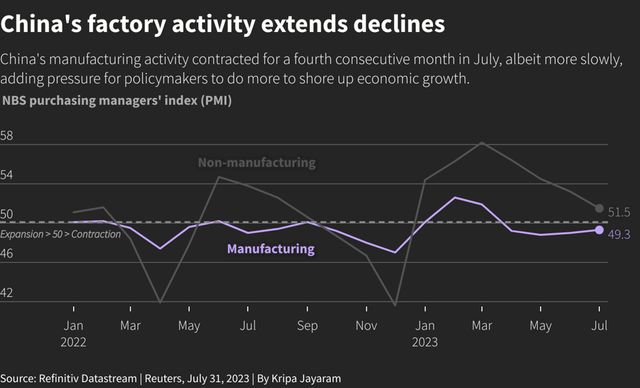

I’ve been bullish on China post-reopening (see prior coverage here), but the slew of underwhelming economic data in recent months indicates it may be time to temper the optimism. The latest manufacturing PMI print, for instance, remained contractionary (i.e., below 50), indicating post-COVID domestic and external demand weakness continuing to bite. With China’s GDP deflator also turning negative, maintaining exposure to a broad-based basket of domestic stocks (i.e., A-shares) via the Xtrackers Harvest CSI 300 China A-Shares ETF (NYSEARCA:ASHR) doesn’t seem all that compelling here.

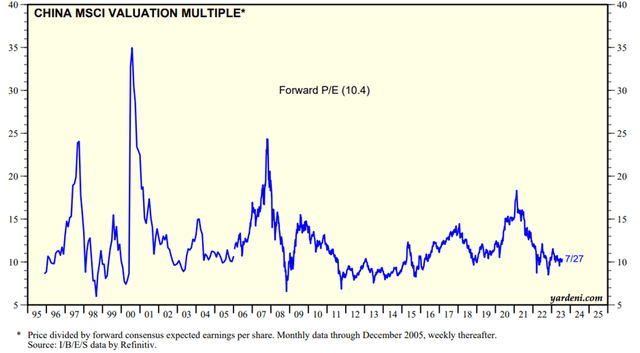

Yes, sentiment has turned slightly following last month’s Politburo meeting, which acknowledged the need for targeted property easing. But the absence of large-scale fiscal stimulus was more important, in my view, confirming that structural concerns about property and local government balance sheets are a key constraint. So even with stimulus hopes driving a modest rally in recent weeks (likely short covering), the lack of a long-term fix to the growth model means this bounce may prove short-lived. Further compounding China’s issues is the prospect of ramped-up restrictions by the West around access to tech and capital flows. Net, I would sell into this tactical rally – even with Chinese equities screening cheaply at ~10x fwd earnings (vs. mid-teens % fwd earnings growth).

Fund Overview – A Reasonably Priced Vehicle to Track Chinese A-Shares

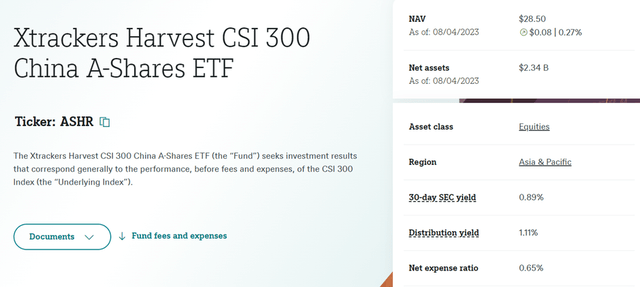

The Xtrackers Harvest CSI 300 China A-Shares ETF tracks (pre-expenses) the performance of the capitalization-weighted CSI 300 Index, a basket of 300 large-caps traded on mainland exchanges (i.e., Shanghai and Shenzhen). The key selling point here is the pure-play exposure to A-shares, removing regulatory risks related to foreign-listed depositary receipts and liquidity issues related to H-shares.

Of note, the ETF has seen its net asset base decline to $2.3bn (down from $2.5bn previously) amid Chinese equity underperformance over the last quarter. However, the fund retains its ~0.7% net expense ratio (mainly from the 0.65% management fee), making it a relatively cost-effective A-share vehicle.

DWS

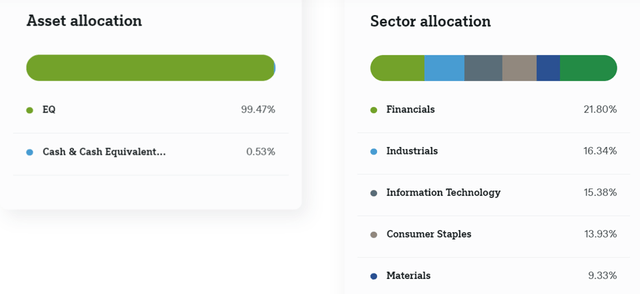

The fund’s sector composition is largely unchanged, with financials still the largest allocation at 21.8%, followed by industrials at 16.3% and information technology at 15.4%. Including consumer staples (13.9%) and materials (9.3%), the top-five sectors account for a hefty 76.8% of the overall portfolio. The fund’s single-stock allocation is also essentially unchanged. Spirits leader Kweichow Moutai remains the largest holding at 6.0%, followed by battery manufacturer CATL at 3.3% and insurer Ping An (OTCPK:PNGAY) at 2.9%.

DWS

Fund Performance – Track Record Still Positive Despite the Near-Term Weakness

Following a disappointing Q2, the ETF has now returned +0.7% YTD and has appreciated in value by +4.9% per annum in NAV and market price terms since its inception in 2013. Helped by its broader China exposure, ASHR has outperformed ADR-focused China funds like the Invesco Golden Dragon China ETF (PGJ), which tend to skew heavily toward consumer and tech. As for comparable A-share ETFs like the iShares MSCI China A ETF (CNYA), the fund closely tracks these over shorter time frames, though its expense differential has led to a relative performance lag over the longer three and five-year periods.

DWS

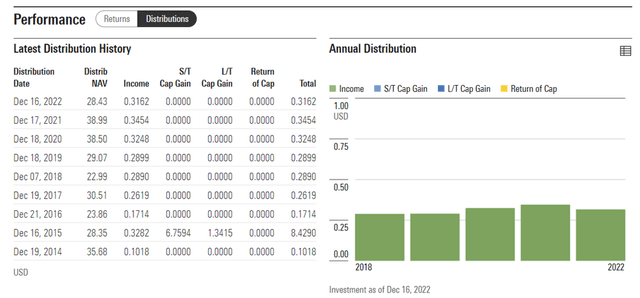

ASHR’s trailing distribution yield also remains relatively low at ~1% – slightly below the closest ETF comparable CNYA but above ADR-focused funds. With China’s post-reopening bounce faltering, however, I suspect this year’s distribution (annual payout due in December) may be skewed to the downside.

Morningstar

Politburo Positives Not Enough to Offset Structural Challenges

The news flow out of China over the last week has focused on the prospect of a ‘soft landing’ post-Politburo meeting. In sum, stimulus now looks to be on the cards, given the Politburo’s explicit acknowledgment of economic growth challenges (a first for Chinese policymakers this year) and pledge to implement countercyclical measures. Also boosting investor sentiment was that policymakers omitted any mention of the ‘housing is for living, not for speculation’ refrain (a key staple of prior meetings), signaling targeted policy support ahead for the troubled property sector. Alongside the toning down of regulatory crackdowns on the private sector (specifically tech) this year, stocks seem to have taken the news positively.

Yet, there isn’t a quick fix to many of China’s structural issues. Any stimulus will undoubtedly help near-term, but with many of the proposed measures leaning toward administrative relaxation measures (e.g., expanding first-time buyer incentives) rather than large-scale easing, I wouldn’t be so quick to underwrite a turnaround. After all, the constraint here is a weak demand curve (compounded by an unfavorable external backdrop), with the latest contractionary manufacturing PMI print being a case in point. Even if Beijing did attempt to roll out the kind of large-scale fiscal stimulus necessary to shift the demand curve, China would likely pay for it via a prolonged deleveraging process (i.e., balance sheet recession), weighing on future growth.

Bloomberg

Tempering the China Optimism

The stream of negative data points out of China continued this month, with manufacturing PMI numbers yet again in contractionary territory. While the market has now shifted its attention to stimulus hopes post-Politburo meeting, any boost will likely be short-lived given the structural problems (overleveraged balance sheets, demographic headwinds, etc.) underlying the Chinese growth story. With the external backdrop also faltering amid the monetary tightening cycle globally, it’s hard to see much upside to the earnings outlook for ASHR. Pending improved economic data, I suspect this month’s stimulus-driven rally, driven by record low positioning rather than a fundamental shift, will falter in the coming months.

With an executive order related to curbing Chinese investment flows also set to kick in this month, the prospect of extended restrictions from tech transfers to capital access could further clamp down on equity upside. China is optically cheap at ~10x fwd earnings, but given the magnitude of the challenges ahead, I would take some chips off the table here.

Yardeni

Read the full article here