Dear readers/followers,

If you recall my articles on Assa Abloy (OTCPK:ASAZF), it’s a company I’ve covered for a number of years at this point. While the relative performance of the company isn’t overall amazing compared to the market at this point, I’m still happy to hold my small position in the company with the assumption of stable growth.

Assa will never make you rich in the short term – but it provides capital safety and growth potential like few others. It can provide stability, a solid dividend, and non-trivial safeties and fundamentals.

In this article, I’ll review 1Q23 and see what we’ve got going for us as we move into June and forward into 2023.

Looking at Assa Abloy and its upside

So, the last set of results we have are the 1Q23, and they more or less confirm my overall positive stance on Assa despite the high valuation we have going for us here.

In its segment, remember, this company is one of the market leaders or at least above average. It’s categorized as “Business Service” by most services and comps, which puts it into a relatively rough set of peers unless you want to stick to the very few companies that do what Assa does on a large scale. The company works at attractive margins, 15% operating, 10% net, and an RoE of almost 16%.

Despite input pressures, inflation, and other factors, Assa Abloy manages very high profitability when looking at returns. ROIC net of WACC has remained above 2-3% for over 10 years, with maybe one exception year, and that’s very good for a company in this industry. What’s more, the company is growing equity and assets like clockwork, a trend that almost perfectly mirrors its cash flow trends.

Remember, cash is king.

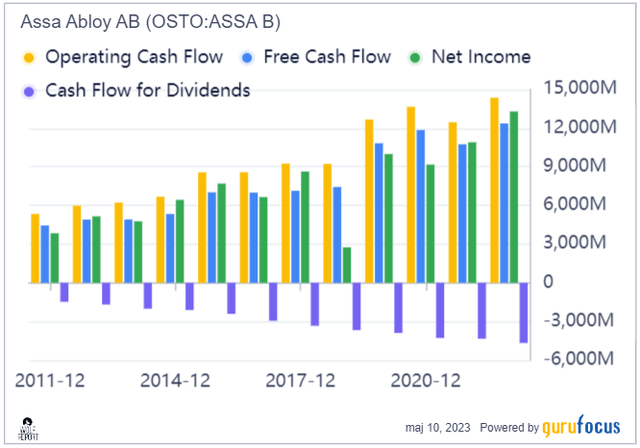

Assa Abloy Cash Flows (GuruFocus)

And this company is certainly proving to us that it is no stranger to generating vast amounts of OCF, FCF, net, and dividend cash flows. Take notes – because with the exception of that one year, this is what a healthy company looks like. You want GAAP profit, you want good cash flows, and healthy trends overall. That’s why the company scores an A rating in credit. The yield really isn’t the greatest. You barely get 1.85% – but very, very few companies offer the sort of safety that Assa Abloy does.

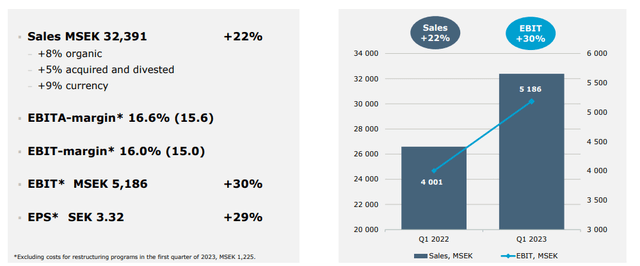

1Q23 results are looking very good. Organic top-line growth is certainly there, with good sales growth in APAC, EMEIA and in the various entrance systems and other products the company sells. The company is not only seeing top line, but margin improvements – with four more M&A’s signed this quarter, and significantly improved OCF.

The company’s quarterly trends seem to speak for themselves.

Assa Abloy IR (Assa Abloy IR)

This isn’t one of those trends or cases where it’s just top-line growth, but profits are looking poor when you start digging deeper. This is sustained growth across the board, backed by organic changes on the positive side in all geographies except South America, which saw only a 0% flat development.

Some highlights include the HID win, which is delivering thousands of mobile access credentials to offices in London, Business In Switzerland ordering 10,000 cylinders, and strong residential and commercial projects in Korea where the company is delivering smart door locks, closers, locker doors, and other high-tech mechanical hardware.

The company keeps winning awards – a new closer for a product of the year award in Germany, the launch of the Yale smart cabinet lock, and new access systems such as the ABLOY BEAT, mission-critical keyless protection.

While sales growth isn’t as high as it was in 2021, it’s still relatively solid and coming in at good numbers. Assa Abloy has not had sales declines in several years now, and the last time it happened, it was during COVID-19.

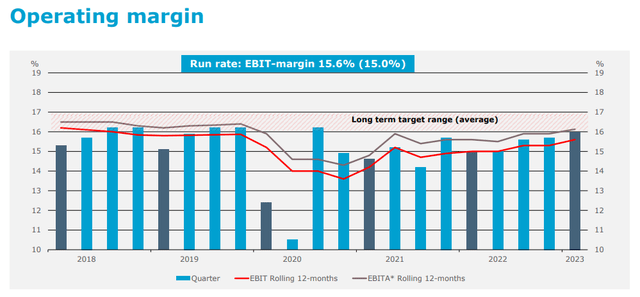

Assa Abloy IR (Assa Abloy IR)

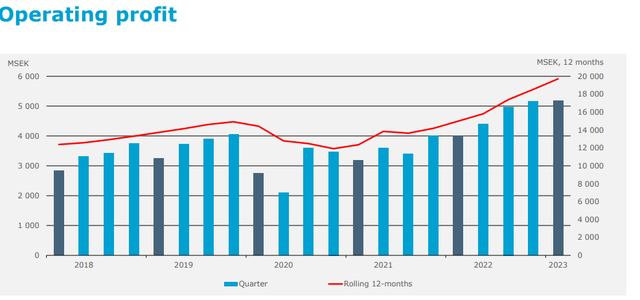

Operating profit is almost more interesting. There is some volatility in there, but really very little, and from a RTM perspective, it’s very stable over time.

Assa Abloy IR (Assa Abloy IR)

The company’s various geographical markets did very well. EU saw decent growth, but America was even better, with operating margins at over 20% in the NA region, the best of all of the company’s operating geographies.

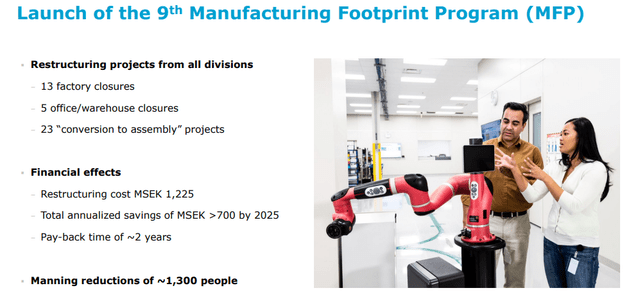

The company recently launched its 9th manufacturing footprint program, or MFP, which includes factory closures, office closures, and conversions, resulting in a headcount reduction of around 1,300 people, making things more efficient.

Assa Abloy IR (Assa Abloy IR)

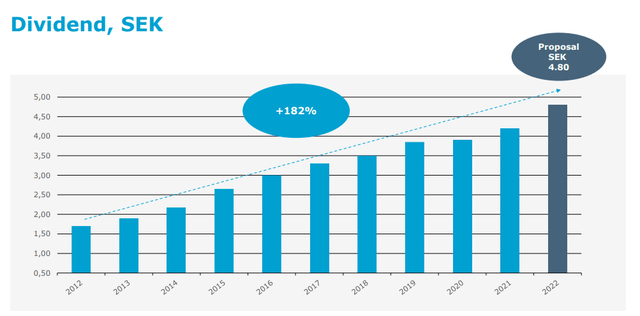

The company is at a gearing level of about 60%, or a net debt/equity of around 33%, which comes to a reduction from a 38% level YoY. EPS keeps climbing on an RTM level, and the company keeps “scoring” here, which also influences the company’s dividend, which keeps climbing and has gone up 182% in 10 years. Assa Abloy is truly the epitome of a long-term growth investment.

Assa Abloy IR (Assa Abloy IR)

On the risk side, we do have an uncertain economic climate which should keep investors, including Assa Abloy investors, on their toes. However, the company’s results speak for themselves. Organic improvements are not only on the top line but the bottom line. Operating profit is up 30%, with very strong overall cash flows, and 700 MSEK in savings is to be realized by the MFP, though this is an estimated level and may be subject to change going forward.

I said in my previous article on the company that in order to invest in Assa Abloy, you must accept a steep premium. This is one of the more qualitative and safe companies in the entire market here. The one thing we have going for us when investing is that the company’s recent trends have not kept up with the overall historical premium.

The company has a high historical premium in P/E of over 23x – and we’re not below 20x. This might be an opportunity, or it might not, depending on how you view the company.

Let’s look at what we have in terms of valuation.

Assa Abloy – Valuation is stretched but below the historical highs

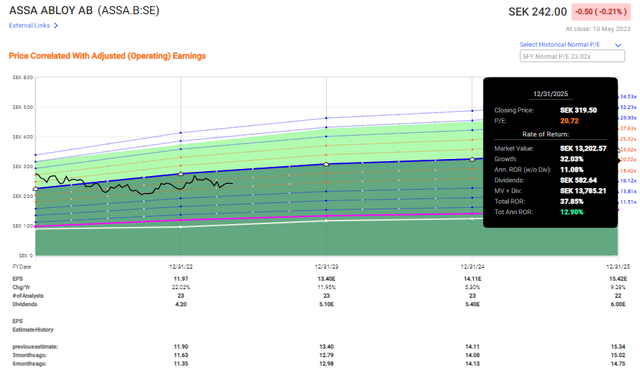

There’s no doubt that Assa Abloy will remain a highly valued, premium stock even going forward. With the exception of certain dips, this company is an expensive story to look at and invest in. Double digits on the low end are the highest you can really expect from an annualized perspective – and if you get double digits from Assa, you know it’s a relatively decent prospect.

Typical valuation ranges for this company include expectations of 250-350 SEK. On a DCF basis, this company does not appear to be undervalued given certain specifics in its EPS forecasts. On a DCF based on FCF, we do see an upside for the company, around 3-4% to a DCF of 251 SEK based on a terminal growth rate assumption of around 4% – which I consider to be conservative relative to where the company’s prospects typically have been.

Based on an analyst average, we have a range starting at 220 SEK and going to 325 SEK, with an average of 271 SEK, which implies an upside in those double digits at 12.1% at the current share price.

The upside for the company does exist. If you forecast on a 15x P/E, you may see negative or bad RoR, Assa Abloy does not typically come in at these multiples. The 5-year average is around 23x, and upside annually here is 17.3%. That’s high, but that’s also a full premium consideration. Between 19-21x is more conservative and more realistic, and that’s where we get between 9-12.5% per annum, with the yield being a very modest part of this scenario.

Assa Abloy Upside (F.A.S.T graphs)

My argument for why Assa Abloy is likely to continue to command such premiums is simple. Fundamentals. The company is a very strong business that operates the infrastructure in terms of protection of some of the most significant buildings on earth, including parliaments, airports, aerospace companies, museums, military installations, and the like. For those reasons, I’m actually willing to accept a double-digit high 19-20x P/E level for this company, and that’s why I remain positive about Assa Abloy even at this valuation.

The company remains a good example of paying for quality, and how you could construct a portfolio with a very low yield, but aimed strictly at quality. Assa Abloy would be on your list in this case. In my last piece, I gave the company a guidance bump to 255 SEK per share, but as I said before, this assumes that you’re “okay” with paying for that quality.

If you’re not, then you should look elsewhere. While the risks for the sector aren’t gone and inflation and other input increases will continue to deliver challenges for Assa Abloy, the company has met these admirably and even outperformed.

The only reason to invest in a company that pays this sort of yield is if the company is above average in profitability, fundamentals, and growth prospects. Assa Abloy scores good marks in all of these KPIs, with above-average margins, return metrics, and fundamentals, such as F and Z-scores, and has a superb ROIC net of WACC. It shows all the signs I look for in identifying a good company. Based on this, it’s not only good, it’s excellent.

For that reason, I’m sticking to my Assa Abloy PT, and I’m still considering the company to be an attractive “BUY” here.

Thesis

- Assa Abloy is a global, market-leading provider of solutions in access, ID, locks, and passage systems. The company is an M&A-heavy, proven capital allocator with excellent fundamental safeties and a potential upside at a good valuation. At a cheap price, it’s possible to deliver significant market outperformance by investing in the company.

- However, at 255 SEK/share, valuations are still stretched and my position seems to have reached most of its potential. There is a 5-7% growth potential from here, which with efficiencies translates into an 8-12.5% annualized upside from a premium as of May of 2023.

- This is a “BUY”, but a quite weak one, all things considered.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Assa Abloy is not “cheap” here, but it still does have an upside – so I’ll say “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here