Asseco Poland (OTCPK:ASOZF)(OTCPK:ASOZY) is one of our favourite major Polish stocks. They continue to generate strong organic growth, and they continue to be undervalued, but have responded with a buyback programme. With the fact that certainty might have returned to the tech buyers’ market, we think that they will go from strength to strength, and have put them back on our radar.

Key Earnings Comments

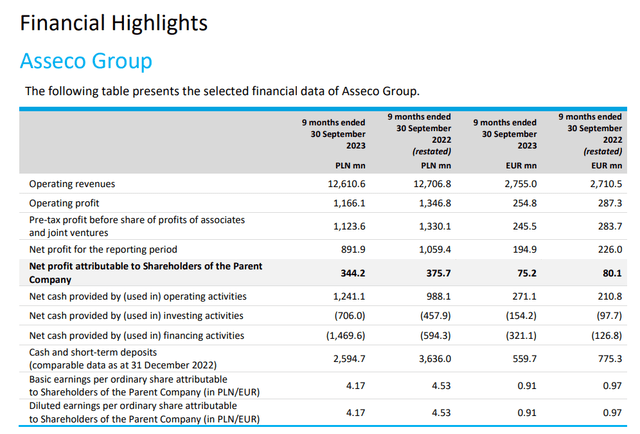

The September ended quarter looked decent. In PLN terms things were a bit rough, but on a constant currency basis, there was growth of 6% which continues their longstanding growth results.

IS (Asseco Poland Financials)

The EUR situation better represents their YoY situation, where immense strength YoY with the PLN affects results a lot. At any rate, the PLN isn’t a currency many readers will have as their base.

Formula Systems (FORTY), which has a 25% controlling interest in the company and is a holding company in turn, performed reasonably well in the 3-month period and the 9-month period on a constant currency basis, reflecting strong demand for insurtech at Sapiens (SPNS) and cloud services at Magic (MGIC), and general IT demand at Matrix IT – all the holdings saw growth.

The Asseco Group overall continues to be cash generative with around a 24% increase in operating cash flows, and FCF conversion is around 56%, which is rather solid for a service company.

Bottom Line

Their revenue is substantially in the Visegrad countries and the Balkans, so finding a geographically similar comp is difficult, especially at Asseco’s scale which is one of the largest companies on the Polish stock market, second only to CD Projekt Red (OTCPK:OTGLF).

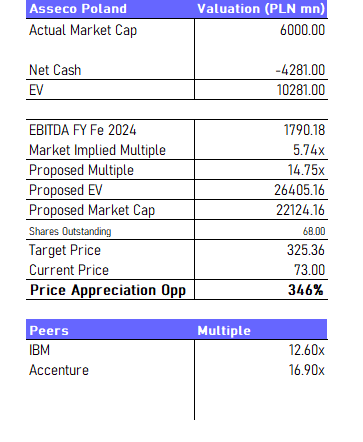

Nonetheless, we compared them to IBM, because they have a similar composition of technology consulting and software in their revenue mix. We have always used them as a comp, and they are closer to IBM since they shed Kyndryl (KD). Against IBM their consulting businesses have historically performed with higher and more consistent growth, balancing out the fact that Red Hat is a leading property for IBM on the software side.

Using IBM, and possibly Accenture (ACN) as a comp as well, we get a very favourable valuation situation even when accounting for the market value of minority interests.

Valuation (VTS)

The fair bit of leverage means the multiple revisions could drive substantial upside for the company.

Asseco affirms that its value is perceived as low by the markets, and it has bought back a substantial number of shares, driving down shares outstanding from 83 million to 68 million, or around 18% of shares which is really quite substantial.

They also pay an excellent 4.77% dividend yield and have for many years, and with the substantial share buyback they can afford to pay a higher yield to remaining shareholders.

In all honesty, it will be difficult for the multiple revision story to materialise due to the lack of discovery and the relative isolation of the Polish market, but the company has been driving substantial growth without much issue for years and will continue to pay a strong and growing dividend that can provide a tangible level of return. With the prices also currently retreated to year lows, and with no YTD growth, we are definitely keeping an eye on the stock to consider for the portfolio in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here