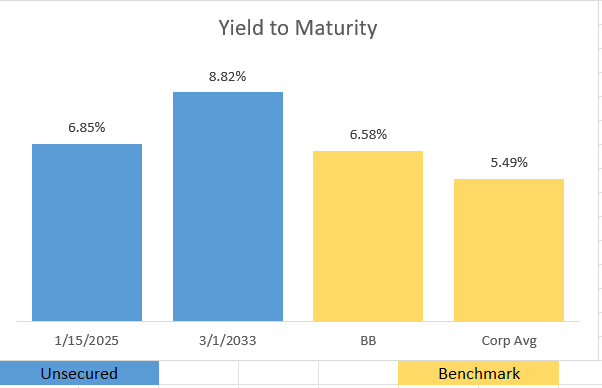

Associated Bank (NYSE:ASB) is a regional bank whose shares have suffered the plight of the regional banking crisis earlier this year. The bank went through with a new debt issuance in the form of a baby bond days before the crisis hit. A baby bond is a debt instrument or bond that trades on an exchange with a ticker symbol. In Associated Bank’s case, the new 6.625% coupon baby bond sold off and is now trading at $21.60 per share. With par being $25 per share, the yield to maturity is now over 8.8%. Based on recent financials, I believe this baby bond is a good pickup for fixed income investors.

FINRA

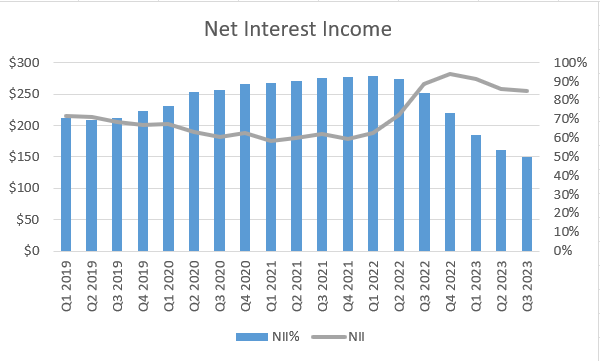

The stimulus and low interest rate environment caused Associated Bank’s net interest income (interest income less interest expense) to decline through the period of monetary easing. Once the Federal Reserve began raising rates, net interest income shot far above pre-pandemic levels. While it has declined sequentially over the past few quarters, net interest income remains 25% higher than it was prior to the pandemic.

Company Financials

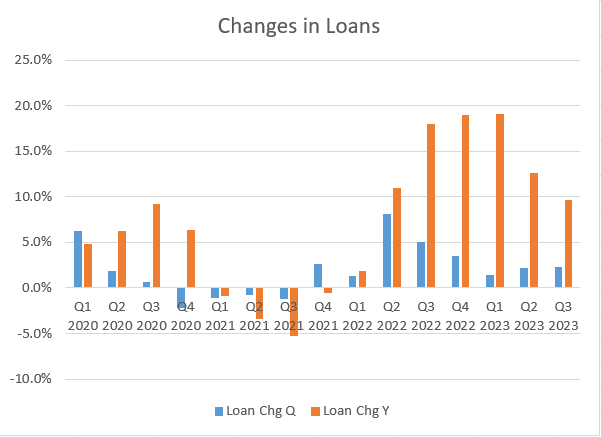

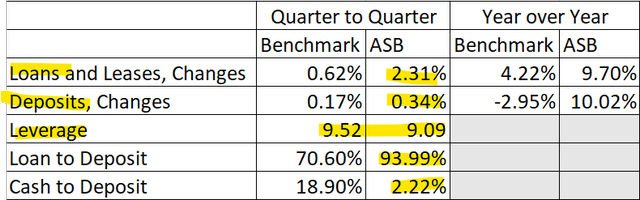

In the face of regional banks losing deposits and having to control lending, Associated Bank has managed to buck the trend. The bank’s year-over-year deposit growth has been at or over 10% for two consecutive quarters. As a result, Associated Bank has been able to grow its lending in the face of higher interest rates, which helps the bank’s profitability.

Company Financials Company Financials

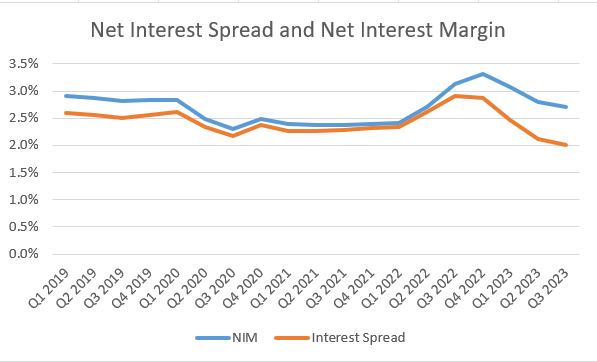

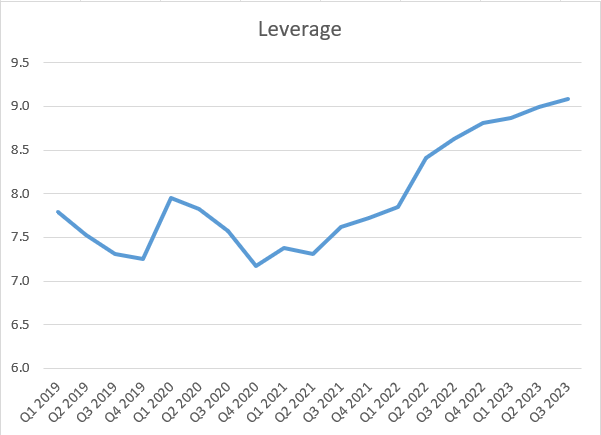

There are headwinds in the bank’s operating metrics. After shooting up during the Federal Reserve’s quick interest rate hikes, net interest margin and net interest spread have fallen to below pre-pandemic levels. The massive increase in interest bearing deposits has put pressure on the net interest spread and the bank’s leverage ratio has risen over the last couple of years.

Company Financials Company Financials

Despite the rise in the leverage ratio, the bank’s leverage remains under the industry average. The rapid growth in lending has brought the loan to deposit ratio to 94%, a bit higher than industry norms. With a low cash balance, it is possible that Associated Bank will need more leverage to maintain liquidity over the next few quarters.

Company Financials & Federal Reserve

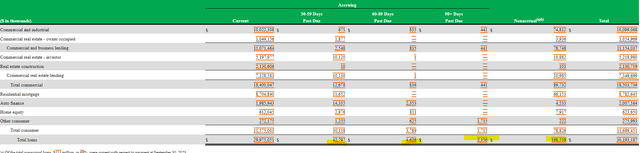

With concerns about commercial real estate loans, it’s important for investors to understand the composition of Associated Bank’s loans. Between owner occupied commercial real estate and investor-owned real estate, approximately 20% of the bank’s loan portfolio is exposed to the CRE space. The largest portion of the bank’s loan portfolio is tied to commercial and industrial loans. These loans are mostly composed of revolving credit facilities that are well collateralized by working capital. I don’t believe Associated Bank’s commercial real estate loans are sizable enough to create a stand-alone risk to the bank.

SEC 10-Q

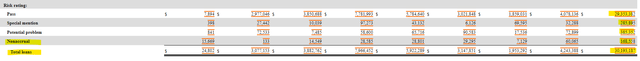

Loan performance is another important factor that investors should monitor when considering an investment in banks. For Associated Bank, past due and non-accrual loans account for approximately $220 million of the bank’s $30 billion loan portfolio. While this number is low, the bank’s risk scoring of its loan portfolio shows that $670 million in loans are not considered passing outside of those that are in nonaccrual status. The increase in nonperforming loans is enough to undermine earnings, which is why I’m not taking a position in common shares, but it should not threaten the life of the bank.

SEC 10-Q SEC 10-Q

A final risk facing the bank is uninsured deposits. Despite being down from the first quarter, uninsured deposits jumped by more than $500 million from the second quarter to $7.2 billion. Fortunately, Associated Bank carries sufficient liquidity to cover uninsured deposits, even if it is needed within one business day through the Federal Reserve or Federal Home Loan Bank.

SEC 10-Q

Overall, there are risks to Associated Bank’s earnings, but I do not see enough to threaten the institution. Cash is tight, but leverage is low, and the bank can raise more capital. Deposit and loan growth is far more robust than the industry average, making it possible for the bank to grow when others are cautious. The bank’s baby bonds are a great investment to take a near 9% return between now and 2033.

Read the full article here