AST SpaceMobile (NASDAQ:ASTS) has been volatile lately, first surging 130% from October lows on interest rate cuts bets then dipping 20% intraday in response to news that SpaceX launched six Starlink satellites for a direct to cell mobile phone service test with T-Mobile (TMUS). The satellites will mimic a mobile phone mast to allow cellular coverage in remote mobile ‘notspots’, which are areas that T-Mobile’s current cell tower footprint does not adequately cover. The test will initially just be limited to text messaging, but could at some point in the future support voice calls and possibly a low bandwidth internet connection.

X (@SpaceX)

This is somewhat encroaching on ASTS’s turf, and the initial stock reaction reflects fears that the company won’t be the only significant player chasing the $1.1 trillion global wireless services market. There’s also soon to go public via SPAC Lynk Global which claims to have the world’s only proven and commercially licensed satellite-direct-to-standard-phone system. Small satellite operator Lynk is set to go public at an $800 million market cap and is targeting eventually launching up to 5,000 small satellites for mobile broadband.

Liquidity Against The Rising Specter Of Competition

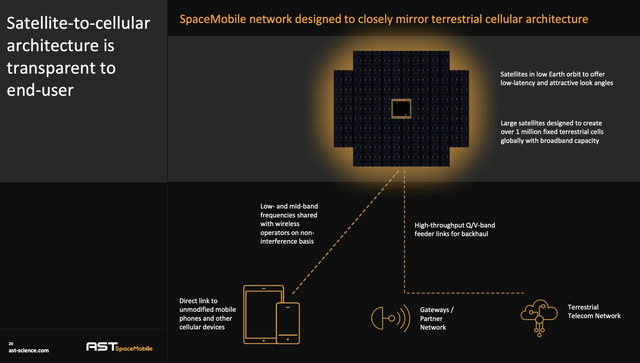

AST SpaceMobile November 2023 Investor Presentation

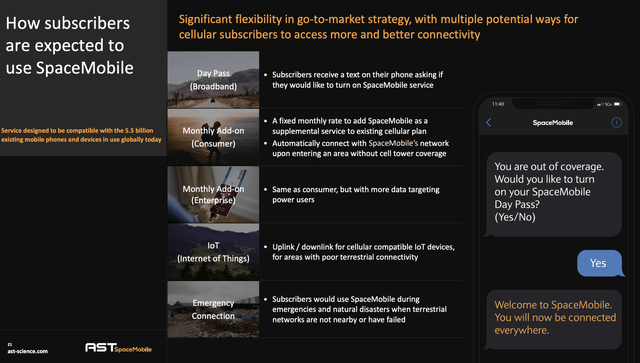

ASTS describes itself as building the first and only space-based cellular broadband network. The company’s approach also differs from its competitors in that it focuses on using larger satellites with a wide surface area of phased-array antennas. These will operate in low earth orbit and are designed to create over 1 million fixed terrestrial cells globally. Any mobile phone registered on mobile network operators “MNOs” partnered with ASTS will be able to have cellular coverage via ASTS without needing to conduct any modification.

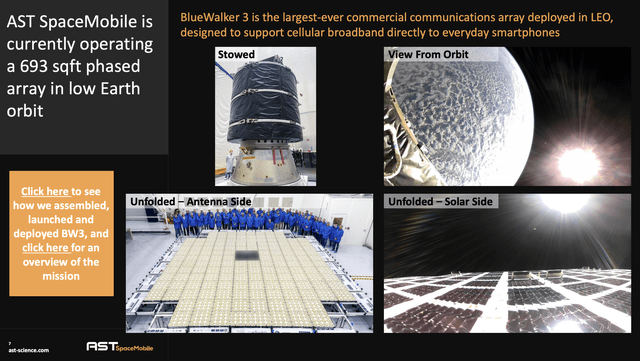

AST SpaceMobile November 2023 Investor Presentation

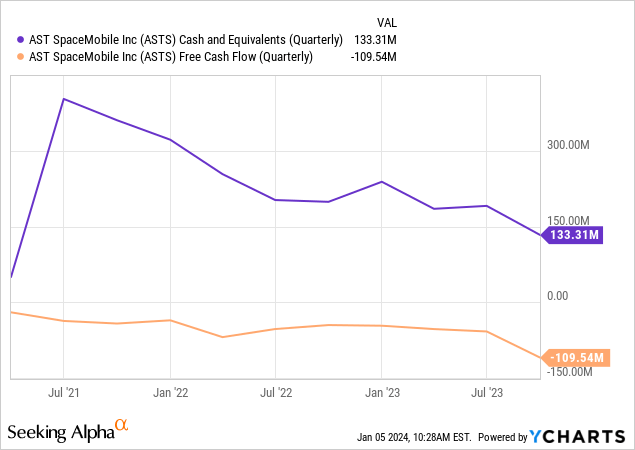

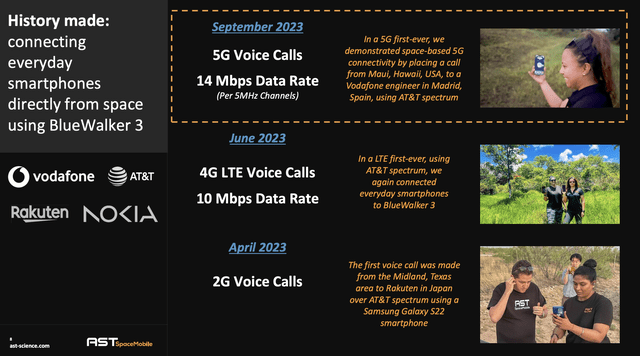

The company has not started commercial operations, but is currently underway with the testing of its BlueWalker 3 satellite and is trying to raise funds to expand its cash runway. Liquidity and cash runway are core financial metrics for pre-revenue tickers that err on the side of speculation, and ASTS held cash and equivalents, including restricted cash, of $135.7 million at the end of its last reported fiscal 2023 third quarter. This was against free cash burn of $109.54 million. Free cash burn sped up sequentially by a huge $51.7 million and was also up from cash burn of $45.2 million in the year-ago comp.

Operating expenses are elevated with ASTS underway with the manufacturing of their first five commercial satellites in Texas with a first quarter 2024 target launch. A successful launch should serve as an upward catalyst for the company’s common shares and is set against a large 20% short interest, around 1 in 5 shares. There is operational momentum with ASTS achieving a 5G voice call from a mobile notspot in Hawaii to Madrid using AT&T spectrum and a simple unmodified Samsung Galaxy S22 smartphone.

AST SpaceMobile November 2023 Investor Presentation

Critically, roughly 85% of planned capital expenditures have already been expensed at the end of the third quarter. ASTS anticipates total operating expenses decreasing by $10 million to $15 million per quarter from the start of 2024, but the company needs to raise more funds to extend a cash runway that is set to terminate this year. Further, the current market cap at just over a billion does offer a decent risk-return ratio, with ASTS chasing a material TAM and making significant progress with commercial operations. The stock is up from when I last covered it.

Raising Funds, Risks, And Fed Rate Cuts

Bulls would likely describe the SpaceX and Starlink threat as contained, with Starlink’s focus remaining on its broadband via terminal service. The direct to cell mobile capability for its small satellite will likely remain a secondary objective for years. This comes as ASTS has signed agreements with 40 MNOs and is fully funded for the operations of its first five commercial satellites.

AST SpaceMobile November 2023 Investor Presentation

However, key risks around funding still exist. ASTS likely cannot take on a material amount of debt against what’s currently a trailing 12-month cash runway that at $267 million amounts to roughly 25% of its current market cap. ASTS has flagged that it’s making progress with a strategic investment with several unnamed parties, with a deal that is set to close by the end of January. The deal will likely be heavy on dilution, but ASTS will need to build more satellites after its first five start commercial operations. The deal would also come against a stock price that is trading at less than half of its previous high. The outlook for 2024 does lend more credence to the bulls, with potential Fed rate cuts, a possible successful launch of its first five commercial satellites, and a fundraiser at decent terms all set to form catalysts. I don’t have a position here, though.

Read the full article here