Introduction

Avnet, Inc. (NASDAQ:AVT) is a renowned global technology solutions company, offering a diverse range of services and products to customers across various industries. As a prominent distributor of electronic components, Avnet plays a vital role in the supply chain by connecting manufacturers and suppliers with customers worldwide. Its extensive portfolio includes semiconductors, connectors, passive and electromechanical components, embedded systems, and integrated solutions.

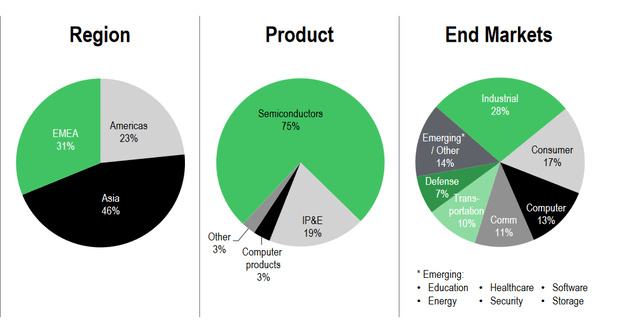

Company Markets (Investor Presentation)

The wide exposure for the company has helped them immensely in keeping strong revenues coming in. The last quarter showed the resilience of the business as sales reached $6.5 billion, a 0.4% YoY increase. The company has been adamant about returning value to shareholders over the years, and the last quarter was no different. $25 million was returned to shareholders through dividends in the quarter. The company has a diversified set of end markets, which seems to have helped them with stable revenue growth. The industry might be facing challenges, but I think the long-term outlook for investment in AVT remains quite appealing and with the low valuation, I will be rating it a Buy right now.

Growth Opportunity

Avnet has exposure to the semiconductor industry and I think it is likely they see similar patterns in terms of revenue as that industry. As the semiconductor market seems to be rather cyclical, with downturns in the market when companies have managed to fill up inventories. The overall long-term outlook seems to be certain, there is a strong demand for the industry and the products are more and more widely adopted. Some estimates suggest the semiconductor industry as a whole growing 12.2% yearly between 2022 and 2029.

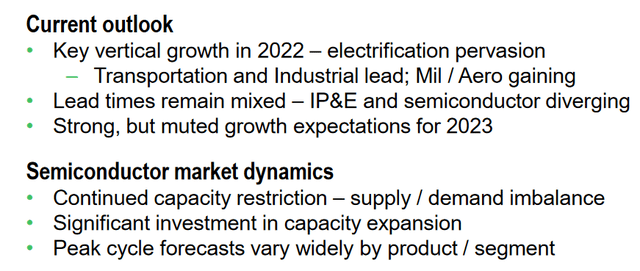

Company Outlook (Earnings Report)

Looking at what AVT is expecting, they see the industry having still strong demand, which will help fuel growth for the company. The semiconductor industry is vast and has many different segments and smaller markets within, which makes it hard to place a number on what a company like AVT might see in terms of growth. They serve one part of the market which they see remaining in demand still, even though 2023 might not reach the same levels as in the year before.

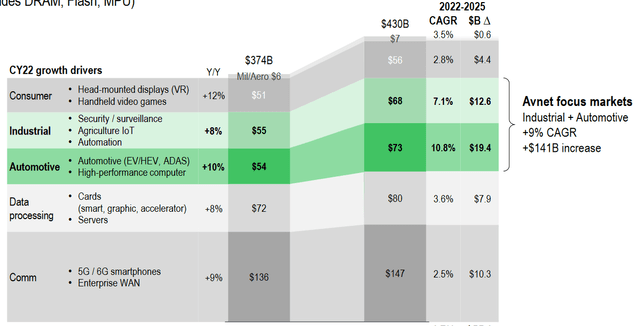

Company Tailwinds (Investor Presentation)

The markets that AVT serves are the industrial and automotive ones where there is an average 9% CAGR between 2022 – 2025, something that should be reflected in revenues in the coming earnings reports from the company, given that they can stay at or increase their market share. I don’t think it is likely we see a massive increase in company revenues in the semiconductor sector as we saw in 2021 and 2022. A catalyst would be necessary to set it off, and for those years it was supply chain issues. Moving forward I think we will have much more stable growth, and it could be a long time until we have the same “joyride” that was 2021 and 2022 for the industry. Despite that, being invested in a company with solid growth potential and not a high premium price tag attached to it will be a great place to be.

The Financial State

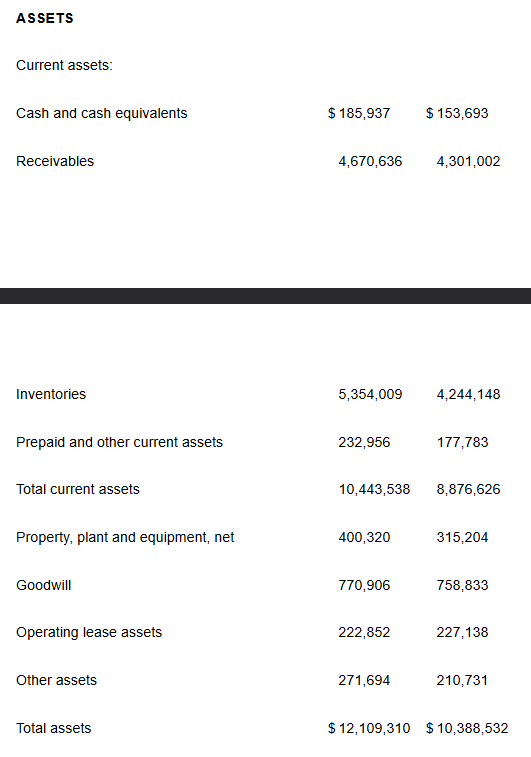

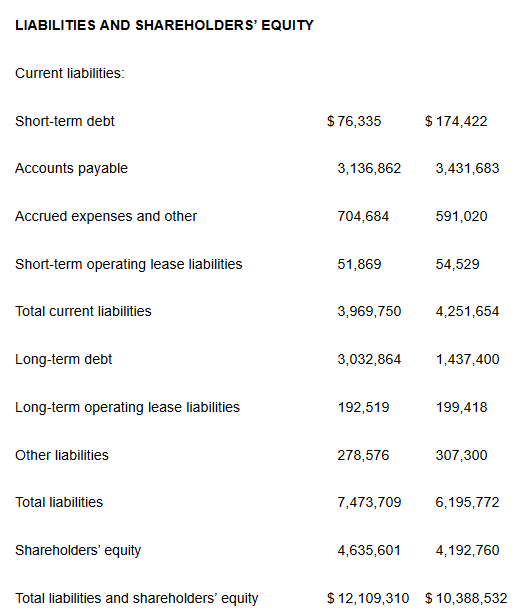

Looking at the financials of the company, they continue to climb upwards and improve their balance sheet. The cash position increased by $30 million, but perhaps the most impressive move is the total assets growing nearly 20% YoY thanks to inventories increasing over $1 billion. But it will be important so whether or not Avnet can turn this increase in inventories into sales, and drive a higher ROA. What I am slightly concerned about is the inventories turning into more of a liability as Avnet might have to drop prices to get inventory through the door. Which of course would be bad for the earnings.

Balance Sheet (Earnings Report) Balance Sheet (Earnings Report)

Where I do see some worry in the balance sheet is the $3 billion long-term debts the company still has, which more than doubled from a year ago. Even though the cash position might be increasing on a yearly basis, it will do little against the debt, and that puts AVT in a less flexible financial position. The debt will become an issue in the future unless the company is able to increase its cash flows. During the last quarter, the company generated $18.3 million in cash flows, which don’t even cover the short-term operating lease liabilities of $51 million. Better margins should be achievable as the market turns into another bull run, as we saw in 2021 and 2022. Thankfully it seems the margins have managed to bounce up significantly from the lows of 2018 and 2020, and I think the demand the company has will make them able to keep a positive bottom line going forward.

Antitrust Win

Very recently, Avnet was awarded $268 million in damages from a pre-fixing lawsuit regarding Nippon Chemi-Con Corp, the subsidiary they have, United Chemi-Con Inc.

There were also some out-of-court settlements, and it is not impossible that Avnet gained close to $350 million from all of this. I think that this win will be a tailwind for the company and the added capital they are getting from it does put them in a better financial position. Hopefully, we get some more clarification on this in the next report by the company, or perhaps a dedicated news release by the company. Nonetheless, I think the win makes the future for Avnet bode well, and I look forward to seeing the impact this will have on the balance sheet and whether or not it can result in a reduction of the debts. To be fair, the estimated $350 million would be almost 3x the current cash position for the company.

Risks

Where I see some risk with the company however is that it remains within this multiple range and doesn’t get an upgrade to a similar level to the sector 18 – 20x forward earnings.

Apart from that, I think the large portion of the debt, above $3 billion, is a cause for concern. The company holding this much with only barely under $200 million in cash doesn’t leave them a lot of wiggle room, unfortunately. With the margins also not being the greatest, it could cause some shaky quarters in my opinion. This concern is also perhaps one of the reasons the company is trading within the valuation range it does. With a healthier balance sheet and steady climb in margins should also come a climb in the p/e multiple the company receives. But until then, I see the concerns investors have with the company right now.

Valuation

I have mentioned here before that the valuation of the company remains very intriguing right now, with the forward p/e at just 5.5. The upside potential seems strong if the company can raise margins and make debt less of an issue. The growth might not be explosive, which could be a cause for the lower multiple the company is getting from the market. I think the not-so-high margins for the company as well as a reason for the lower multiple. The lack of strong cash flows is also likely a reason for the pessimism the market has placed on the multiple. But as the company develops and grows, I think these issues will be addressed and AVT will manage to grow its margins efficiently thanks to strong demand and the competence of the management team.

Despite that, I don’t think you are necessarily overpaying for AVT right now, p/s at under 0.2 and p/b under 1 doesn’t scream overvalued, quite the opposite in fact.

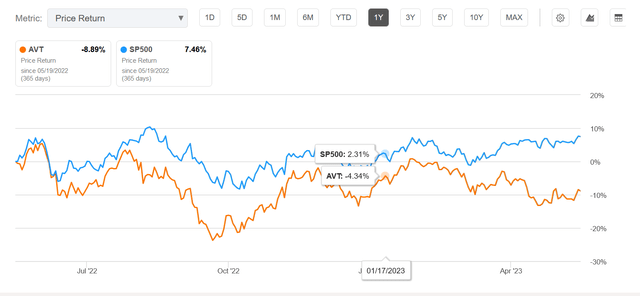

AVT vs S&P 500 (Seeking Alpha)

If you are looking for a company that will be trading more in line with the sector and still provide exposure to the broad semiconductor industry, then Microchip Technology Incorporated (MCHP) might be an option. The company has a phenomenal balance sheet and shareholder-friendly management. While MCHP might be trading at a higher FWD P/E than AVT right now, almost 2x as much, the market position of MCHP and the established position they have is what justifies that. What AVT offers however is the growth potential, with a lower FWD p/e also comes the added benefit of a major jump up in valuation if the company proves it can continue to grow at the rate they have been. With that said, AVT even has a higher dividend yield right now at 2.65% compared to MCHP just above 2%. AVT does lack similar margins to MCHP, but I think this leaves more room for them to grow, with TTM net margins just above 3% I think they have the potential of getting at least half of what MCHP has, which currently is 26%. Over the long term, I see more growth potential with AVT than I do with MCHP.

Company Takeaway

Avnet Inc is generating incredible sales, much higher than its current market cap. The valuation seems to offer much less risk than reward right now, and I think it is a buy. AVT has exposure to two industries within the semiconductor sector and is expected to generate around 9.9% CAGR between 2022 – 2025. With a strong market presence, I would expect to see similar revenue growth for AVT. In the meantime though, investors will be able to enjoy owning part of a company actively buying back shares.

The concerns I have regarding the balance sheet, or more specifically the debt, will be a key issue to watch going into the next few quarters. But right now it’s not enough to justify a hold or sell rating for AVT.

Read the full article here