I’ve covered the Avantis U.S. Small Cap Value ETF (NYSEARCA:AVUV) a couple of times in the past. I’ve been bullish, due to the fund’s strong performance track-record and cheap valuation. Considering recent market movements, I thought to write a quick article on how AVUV’s performance and fundamentals have evolved these past few months.

AVUV has seen strong capital gains these past few months, slightly outperforming value equity indexes, but slightly underperforming the S&P 500.

AVUV’s valuation has become more attractive, while most U.S. equity valuations have risen. Wider valuation gaps mean strong capital gains are somewhat likelier moving forward, especially if momentum remains adequate.

Earnings have likely grown at a fast pace, although portfolio turnover makes it difficult to know for certain.

AVUV’s dividends have seen very healthy growth but, with a 1.80% yield, the fund remains an ineffective income vehicle.

In my opinion, AVUV’s fundamentals have improved these past few months. As such, and owing to the fund’s strong performance track-record and cheap valuation, the fund is a buy.

AVUV – Quick Overview

A quick look at the fund before looking at some more recent developments.

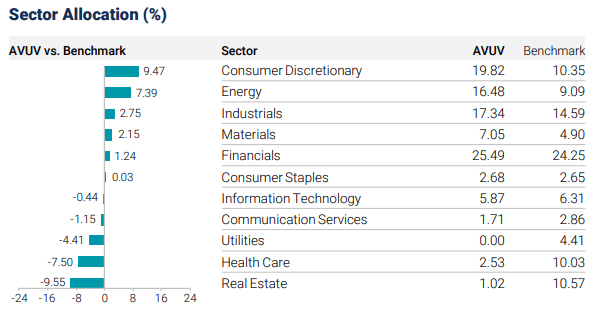

AVUV is an actively-managed U.S. small-cap value ETF. It tried to provide investors with diversified exposure within its niche, with investments in 732 holdings, and with exposure to all relevant industry segments.

AVUV

AVUV

AVUV’s investment strategy has worked quite well in the past, with the fund generally focusing on best-performing industries and stocks, while underweighting the worst performers.

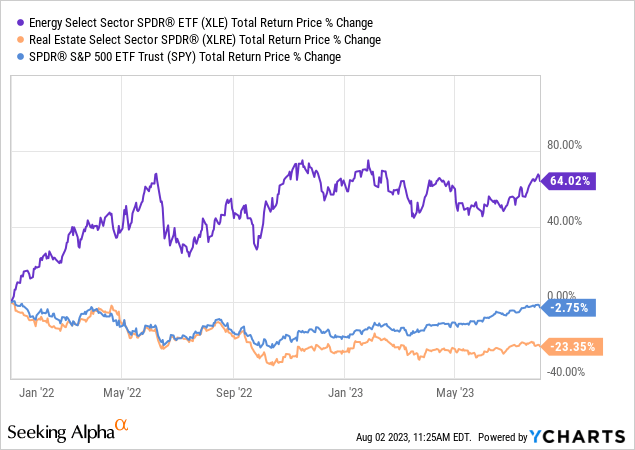

As an example, the fund has been overweight energy for years, during which said industry has outperformed. On the flipside, the fund has been underweight real estate, with said industry underperforming.

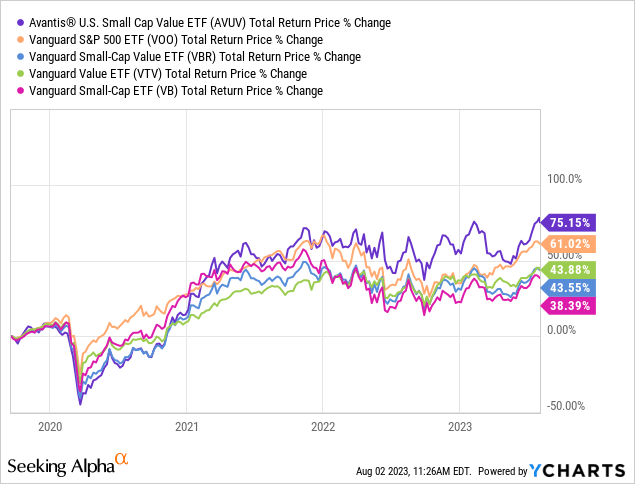

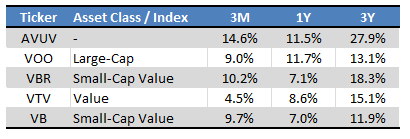

AVUV’s performance track-record is quite strong, with the fund outperforming all relevant / comparable equity indexes since inception:

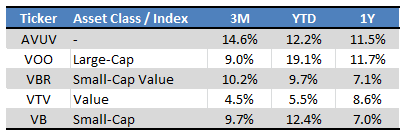

And for most relevant time periods:

Seeking Alpha – Chart by Author

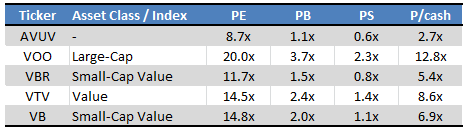

AVUV’s valuation is quite cheap too, and cheaper than that of most equity indexes. Of particular importance is the fact that the fund is cheaper than small-cap value equity indexes, as the fund is actively-managed and tends to focus on particularly cheap stocks within its niche.

Seeking Alpha – Chart by Author

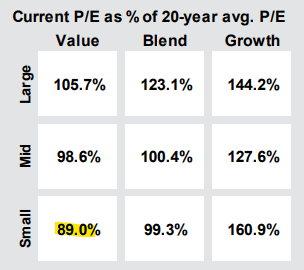

Small-cap value equities are cheaper than their peers and their historical average as well:

JPMorgan Guide to the Markets

AVUV’s investment thesis is remarkably simple: it’s cheap valuation could lead to strong capital gains in the future, as has been the case in the past.

With this in mind, let’s have a look at some recent developments for the fund.

AVUV – Recent Developments

Worsening Performance

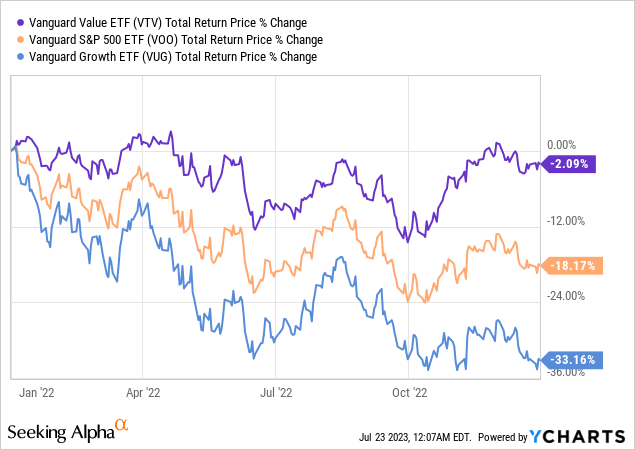

2022 was one of the best years for value stocks in recent memory, with most value equities and equity indexes outperforming the market by wide double-digit margins. Outperformance was particularly large compared to growth equity indexes, which saw outsized losses.

Data by YCharts

Results were driven by sentiment, as skyrocketing inflation, interest rates, and growth valuations made investors reassess the relative merits of growth and value stocks. Less demand for speculative growth investments like Tesla (TSLA) and the ARK Innovation ETF (ARKK) when t-bills and CDs start to yield, well, something instead of zero.

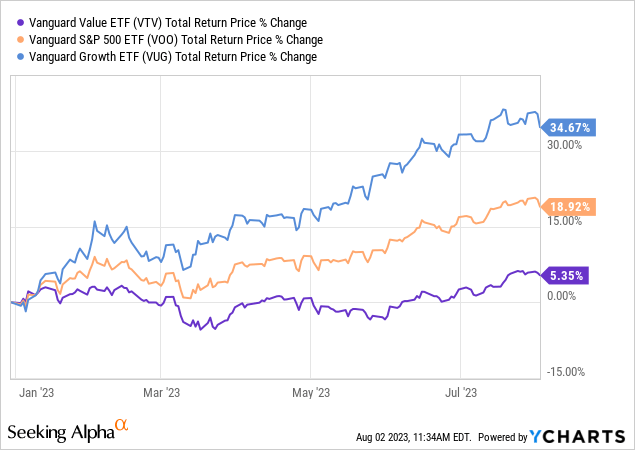

2023, on the other hand, has been a terrible year for value stocks, with most underperforming by double-digits. Underperformance was particularly large compared to growth stocks, which have seen outsized +30.0% gains.

As an aside, it is somewhat uncanny the extent to which 2023 has been the exact opposite of 2022 so far. Even the returns are similar, with the signs flipped.

Results were also driven by sentiment, as plummeting inflation and better-than-expected economic conditions led to renewed interest in growth, tech, and other assorted investments.

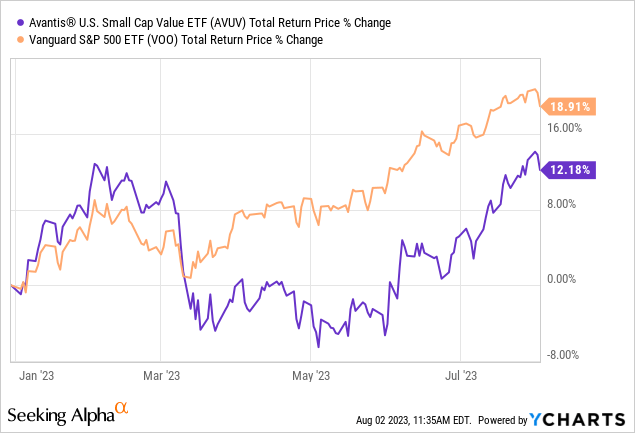

AVUV was impacted by these trends as well, with performance worsening these past few months. AVUV has underperformed the S&P 500 YTD, for instance:

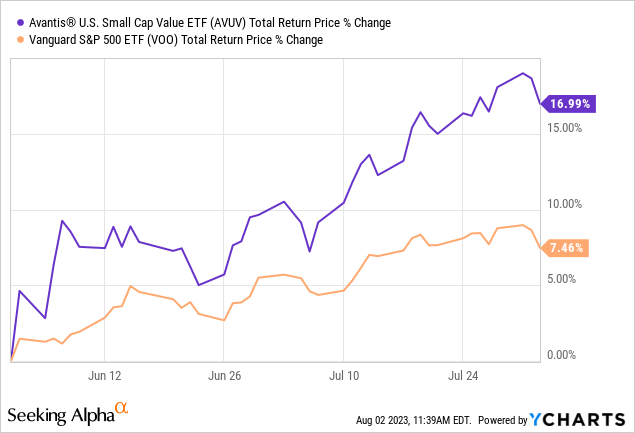

Importantly, AVUV’s performance has held up much better than that of most value equity indexes. Returns have been higher and more consistent, and very strong since June. The result has been outperformance relative to value peers, and somewhat slight, inconsistent underperformance relative to the S&P 500 for the past year:

Seeking Alpha – Chart by Author

In my opinion, although AVUV’s performance has declined these past few months, the fund’s overall performance track-record remains strong. Gains have been quite good YTD, have accelerated these past few months, and remain very strong long-term. Some periods of underperformance are to be expected for even the best factor funds as well.

Cheaper Valuation

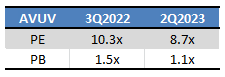

AVUV’s valuation has become quite a bit cheaper these past few months:

AVUV – Chart by Author

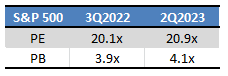

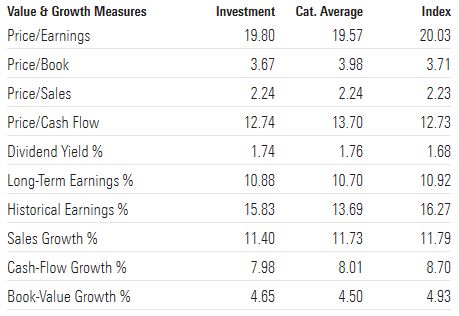

Even as most U.S. equities have become a tad pricier:

SPY – Chart by Author

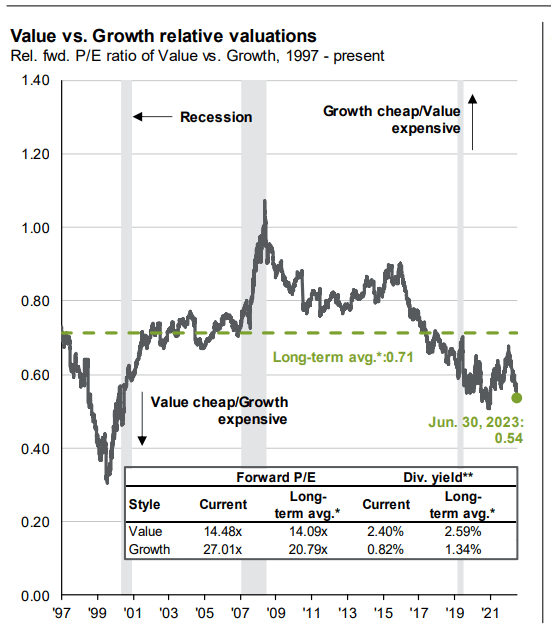

In other words, valuation gaps between cheap value stocks and expensive growth stocks have widened. As per JPMorgan (JPM), these are currently about 20% wider than their long-term historical average. Gaps were wider during the dot-com bubble, and during some months of the pandemic.

JPMorgan Guide to the Markets

Cheaper valuations mean greater potential capital gains and returns, making AVUV an overall stronger investment opportunity right now than before. Gains are dependent on valuations normalizing, which could happen due to changes in investor sentiment, economic fundamentals, investor inflows, and a myriad of other factors. Right now, momentum favors AVUV, with the fund significantly outperforming since June:

In my opinion, conditions point towards further gains for AVUV and its investors. Valuations support further gains, and momentum is clearly on the fund’s side.

On a more negative note, the fund does lack any clear, significant catalyst for further gains. These are very dependent on investor sentiment too, as the fund only yields 1.80%, and does not focus on companies with significant buyback programs or similar. Gains could take years to materialize, although this has rarely been the case in the past.

Strong Earnings Growth

AVUV’s share price has increased even as the fund’s valuation decreased, which implies very strong earnings growth in the past. At least assuming no significant portfolio changes, which I have not noticed or am aware of.

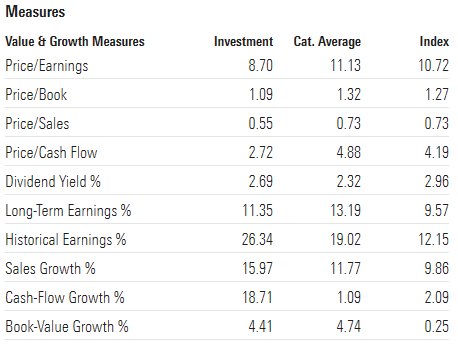

Morningstar says earnings have grown at a 26.3% annual rate long-term, an incredibly strong figure, and more than 10.0% higher than that of the S&P 500. Data for AVUV:

Morningstar

Data for the S&P 500:

Morningstar

Do bear in mind that the figures above are long-term figures, and do not necessarily imply strong recent growth. Valuation and share price data does imply that, however.

Strong earnings growth is a significant benefit for AVUV and its shareholders, especially considering the fund’s extremely cheap valuation. A single-digit PE ratio might be a fair price to pay for a slow growing investment, but with earnings growing at a double-digit pace, that does not seem to be the case for AVUV.

Conclusion

AVUV’s investment thesis rests on the fund’s strong performance track-record and cheap valuation. AVUV’s performance has slightly worsened these past few months, but remains strong, while it’s valuation has become more attractive. In my opinion, on net, AVUV’s fundamentals have improved these past few months, and so the fund remains a buy.

Read the full article here