Introduction

Axsome Therapeutics (NASDAQ:AXSM) is a commercial-stage biopharmaceutical company, committed to creating novel treatments for central nervous system disorders that are currently underserved. Its product range includes two commercial assets: Auvelity, an FDA-approved oral medication for major depressive disorder (MDD), and Sunosi, an innovative drug for excessive daytime sleepiness associated with narcolepsy or sleep apnea. Axsome obtained U.S. and international (excluding specific Asian markets) rights for Sunosi from Jazz Pharmaceuticals (JAZZ), and is in the process of commercialization.

In a previous analysis of Axsome Therapeutics, Auvelity’s potential as an efficacious, unique MDD treatment was highlighted. Despite confronting market challenges, the need for Axsome to maintain clear communication, establish strategic partnerships, pursue continued research, and protect intellectual property was stressed. Given the uncertainty surrounding financials and patent status, it was advised to maintain a “Hold” position on the company until more data could verify its market position.

Recent developments: Axsome Therapeutics expects the combined peak U.S. sales of Auvelity and Sunosi to reach $3.5B. The company recently completed an underwritten public offering, selling 3 million shares at $75 per share, yielding gross proceeds of $225 million.

Financial Performance

In Q1 2023, the company reported a total revenue of $94.6 million, with product sales of Auvelity and Sunosi earning $15.7 million and $12.9 million, respectively. License revenue stood at $65.7 million, primarily resulting from a deal with Pharmanovia for Sunosi. Net loss reduced to $11.2 million from $39.6 million in 2022, driven by the upfront license revenue from Pharmanovia. The company’s cash and equivalents stood at $246.5 million, and an amended loan facility with Hercules Capital increased the size to $350 million.

Stock Performance & Financial Projections

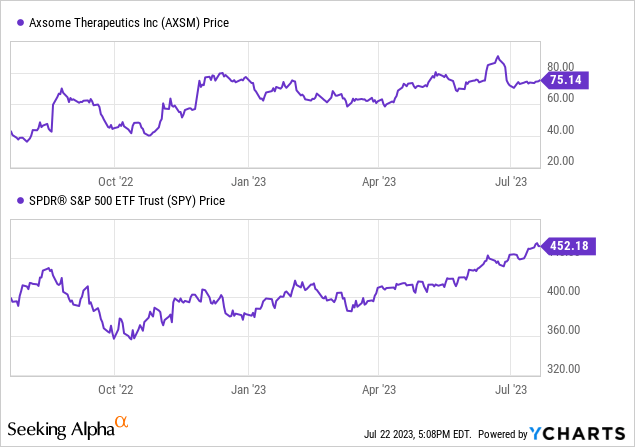

Per Seeking Alpha data, Axsome Therapeutics’ stock has been gaining positive momentum, increasing by 81.15% over the past nine months and 76.30% over the last year, outperforming the S&P 500 in both periods.

However, a high Price/Book ratio of 29.27 and EV/Sales of 21.96 suggest possible overvaluation.

The company’s earnings estimates forecast substantial sales growth, projected to surge by 385.93% in 2023, with additional growth of 60.55% in 2024, and 82.97% in 2025. However, the company is anticipated to remain unprofitable through 2024, with positive EPS only expected in 2025.

Although Axsome boasts a high gross profit margin of 91.94%, it currently exhibits negative net income margins and negative returns on equity and assets, reflective of its current unprofitable state. This is not unusual for biopharmaceutical companies in their early commercialization stages.

Earnings revisions suggest a generally optimistic view, with more upward revisions than downward for FY1, a positive sign for investors. Axsome’s capital structure reveals a moderate level of debt ($147.72M) but a healthy cash position of $246.52M (not including the recent public offering), indicating it is well-positioned to manage liabilities. The company’s market cap stands at $3.27B, with an enterprise value of $3.18B.

Auvelity’s Launch and Future Growth Prospects

The initial adoption of Auvelity by Axsome Therapeutics showcases a promising launch trajectory, with a remarkable increase in prescriber base and the number of prescriptions written in Q1 2023. Notably, within just five months post-launch, Auvelity saw over 31,000 prescriptions, indicating a robust growth of 298% in Q1.

The performance of Auvelity’s launch bears some similarity to that of Viibryd, an MDD treatment introduced by Forest Laboratories in 2011. Like Auvelity, Viibryd entered a competitive market but was able to secure a firm footing. To provide perspective, within a year of its launch, Viibryd reported over $40 million in sales, and within two years, it crossed $200 million in annual revenue. This rapid revenue growth illustrated its acceptance in the MDD market. If Auvelity continues along its current path, it could potentially mirror the revenue growth exhibited by Viibryd.

For investors, it’s vital to monitor several key indicators in the upcoming quarters. The ongoing growth in the number of prescriptions and prescriber base are crucial metrics to track for assessing Auvelity’s acceptance among healthcare providers. Furthermore, monitoring the expansion of payer coverage, especially in the commercial channel, will offer insights into the drug’s accessibility and sales growth potential.

Also, keeping an eye on the competitive landscape is essential, as the MDD market is dense with multiple treatment options. The emergence of a new innovative treatment could pose a challenge to Auvelity’s growth.

Finally, considering the present mental health crisis, compounded by the COVID-19 pandemic, the demand for effective MDD treatments is expected to remain high. This could be a potential tailwind for Auvelity’s future growth.

My Analysis & Recommendation

Reflecting on Axsome’s recent financial and operational performance, there are numerous encouraging signs. The company has shown its capacity to raise funds through public offerings, demonstrated a consistent increase in revenues, and built a healthy cash position to counter future operational uncertainties.

Although the company’s stock appears pricey based on traditional valuation metrics, this must be viewed in light of its significant growth potential. The company’s current lack of profitability is not uncommon for early-stage biopharmaceutical companies, and could change as revenues grow.

Taking all these factors into account, the previous recommendation has been adjusted from “Hold” to “Buy”. The successful launch of Auvelity, combined with the high unmet medical need for MDD treatments, presents an enticing opportunity for long-term investors. Nonetheless, it remains crucial to closely monitor the company’s ongoing performance and market conditions.

Risks to Thesis

When the facts change, I change my mind.

As an analyst, it’s important to note that while I have updated my recommendation to a “Buy” for Axsome Therapeutics, there are several potential risks to consider:

-

Clinical and Regulatory Risks: Axsome operates in the biopharmaceutical industry, where the success of products is contingent upon rigorous clinical trials and regulatory approval. Any setback in these areas, such as an unsuccessful trial or regulatory rejection, could seriously impact the company’s potential for success.

-

Commercialization and Market Acceptance Risks: Although Auvelity has shown promise in early stages post-launch, its long-term success will depend on acceptance by healthcare providers and patients. This includes factors like the drug’s efficacy, side effects, cost, and competition from other treatments. If Auvelity fails to gain sufficient market acceptance, Axsome’s revenues could be impacted negatively.

-

Financial Risk: As of my current analysis, Axsome remains unprofitable and continues to burn through cash. While the company has a strong cash position right now, future funding needs could result in dilution for existing shareholders or increased financial risk.

-

Competitive Risks: The pharmaceutical industry is highly competitive. If a competitor launches a superior or more cost-effective MDD treatment, this could significantly limit Auvelity’s market share and revenue potential.

-

Pricing and Reimbursement Risks: The drug pricing environment is increasingly under scrutiny and could face changes in regulation. Any potential alterations to drug pricing or reimbursement policies could influence Axsome’s profitability.

Read the full article here