Baidu (NASDAQ:BIDU) published a very bullish set of Q3 results, beating analyst consensus estimates on both revenue and earnings. During the trailing three months ending September the “Google of China” managed to score a 6% and 20% YoY growth in sales and operating earnings, respectively. Complementing strong fundamentals, Baidu management also voiced positive commentary on the company’s road-map for developing and monetizing solutions relating to generative AI. Overall, Baidu looks very well positioned to ride the business tailwind of new tech trends, incl. Cloud computing, AI and autonomous driving/ automation, while Baidu’s legacy advertising business supports organic capital generation for the transition.

For reference, Baidu stock has traded about flat YTD, while the S&P 500 (SP500) appreciated almost 20% in value. Pointing to the chart below, I also highlight Baidu’s elevated relative volatility, suggesting that Baidu is certainly not a suitable stock for inventors with weak nerves.

Seeking Alpha

Baidu Q3 results Beat Analyst Estimates

In the third quarter of 2023, Baidu delivered a strong performance, topping analyst consensus expectations on both top line and earnings. During the period spanning from June to September, the Chinese tech giant accumulated about $4.82 billion in sales, increasing 6% YoY compared to the same period one year prior, and beating consensus expectations by approximately $120 million, according to estimates compiled by Refinitiv.

Profitability-wise, Baidu also managed to exceed expectations: In the September quarter, Baidu managed to increase operating income at 20% YoY, outpacing top line growth on both positive operating jaws, as well as continued cost discipline. After accounting for non-operating expenses of about $45 million, Baidu’s net income available to shareholders (Non GAAP) came in $996 million, or $2.8/ share (compared to $2.34 estimated by analysts).

In the third quarter, Baidu returned a total of US$126 million to shareholders, in context of the ongoing $5 billion share repurchase program.

Baidu Q3 results

Baidu’s strong performance in the September quarter was broadly supported by all operating units, and some AI-specific developments: During the period, Baidu App’s Monthly Active Users (MAUs) hit 663 million; and revenues in the advertising business increased 5% YoY. In the Intelligent Driving segment, Baidu’s autonomous ride-hailing service, Apollo Go, provided 821,000 rides, marking a 73% YoY increase for Q3 2023 vs. 2022. The cloud business was a bit of a headwind, however, with sales down 2% YoY. Relating to AI, Baidu rolled out ERNIE 4.0 (EB4), now accessible through ERNIE Bot and available for enterprise customers via our cloud API.

Bullish Outlook For What’s To Come

I am bullish on Baidu’s outlook, both on the short/ midterm, as well as the long term. For Q4 2023 and early 2024, I see improvements relating to Baidu’s legacy advertising business and cloud growth, with both verticals poised to benefit from a gradual integration of AI technology.

Specifically relating to advertising, I expect a sequential QoQ recovery for Q4 vs. Q3, forecasting a 7-8% YoY increase (compared to a 5% YoY rise in the third quarter). My confidence on strengthening advertising demand is anchored on management commentary that Baidu is seeing continued ad demand recovery in multiple sectors, including education, travel, medical services, and e-commerce. Moreover, the revenue growth boost is also supported by the deployment of AI, which is aimed at strengthening merchant traction on best in class conversion rates.

Baidu’s cloud business was a drag on topline in Q3, with 2% YoY contraction, primarily due to subdued demand in smart transportation. However, the challenging environment for Cloud in China has been well broadcasted by equity research analysts, and thus the poor performance was likely not surprising to most investors. But looking into the fourth quarter, Cloud services are expected to regain momentum. Personally, I now forecast a Q4 and early 2024 growth acceleration of between 7-9% YoY, supported primarily by an easier comp base, but also by a broader economic recovery in China and the country’s tech sector specifically. Moreover, Baidu’s cloud exposure is also supported by an increasingly AI-driven cloud mix, which should materialize to be more value accretive going forward.

Regarding developments in AI technology, Baidu’s launch of Ernie 4.0, a product similar to GPT4.0, stands out. Baidu reported that over 10,000 enterprises are actively utilizing Ernie through API on a monthly basis, while in the consumer space, the scale of users is growing rapidly.

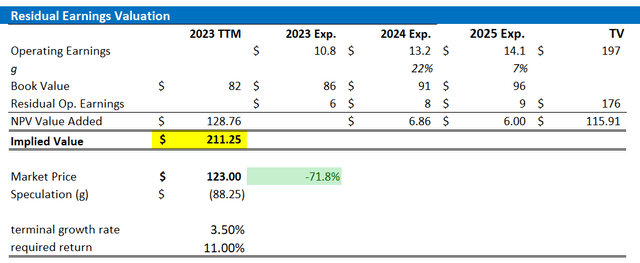

Valuation – $188.94/Share TP

On the backdrop of a supportive earnings report, bolstered by strong advertising revenue and emerging AI monetization, alongside a bullish outlook going into Q4 and early 2024, I am updating my EPS projections for BIDU through 2025. My EPS estimates for FY 2023 now fall between $10.6 and $11 (in line with consensus), with subsequent forecasts for 2024 and 2025 at $13.2 and $14.10, respectively. On rates, I maintain my cost of equity estimate at 11%; but I increase my steady state growth outlook post-2025 by 25 basis points, to 3.5%, reflecting positive momentum in AI development.

Factoring in these EPS adjustments, my fair implied share price for BIDU stands at $211.25 per share, indicating an approximate 70% upside potential.

Company Financials; Author’s EPS Estimates; Author’s Calculation

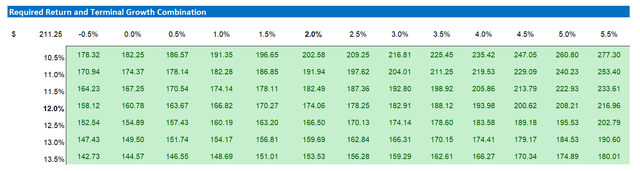

Below also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

Baidu’s delivered strong Q3 results, beating revenue and earnings estimates. Overall, the company’s reporting for the September quarter was supported by a blend of strong fundamentals and encouraging advancements in generative AI. Looking into Q4 and early 2024, the company is poised to see upside on trends like cloud computing, AI, and autonomous driving, leveraging its legacy advertising business for capital generation during this transition.

With a bullish outlook on advertising and cloud recovery, as well as AI developments, I update my valuation model for Baidu; and I now calculate a fair share price of $211.25.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here