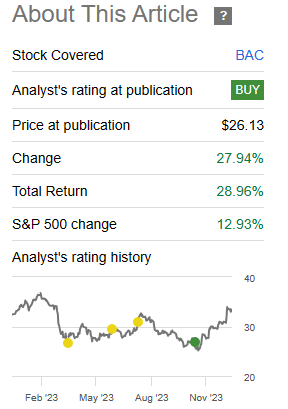

In our last article, we gave (NYSE:BAC) a rare buy rating. We had the coupling of extreme valuations alongside some other factors that setup extraordinary returns.

Our point is that the bond bear story, even if it pans out longer term, will take time to do so. There are no one-way markets and a recession likely gives the bond bear market a breather. BAC will benefit immensely as its poorly purchased held to maturity securities stop taking losses and roll-off over time. Overall, we like the stock here and are upgrading it to Buy with the expectation of 7%-9% annual returns over the long term.

The stock has done well since then and has even outperformed the broader S&P 500 (SPY) and the “magnificent 7”.

Seeking Alpha

We examine potential for more returns.

What Created The Returns?

With a 29% total return over a quarter, one would think that we BAC has perhaps reinvented the wheel or discovered a way to cash in on AI mania. But that has been far from the case. In fact earnings estimates have grudgingly moved slightly lower over the last 1 month.

Seeking Alpha

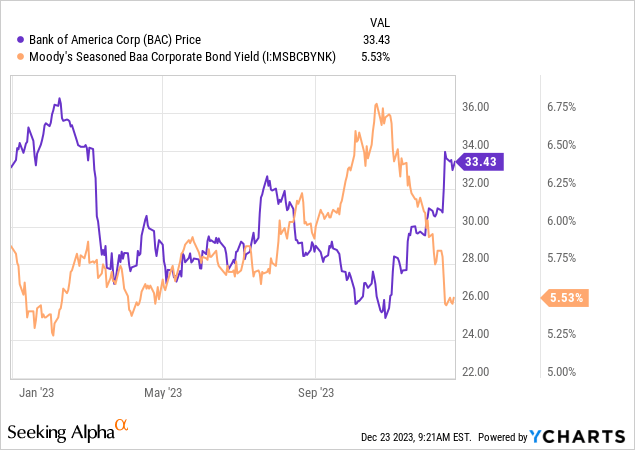

What explains this is simply the market pricing out the risks of a severe recession. While there are many metrics to look at this, Baa corporate bond yields (last rung of investment grade) and their spreads to US Treasuries, have been a great inverse proxy for BAC stock.

So as you see that yield approach its former lows for the last 12 months, you have to ask yourself what is your outlook for this and other risk measures.

Outlook

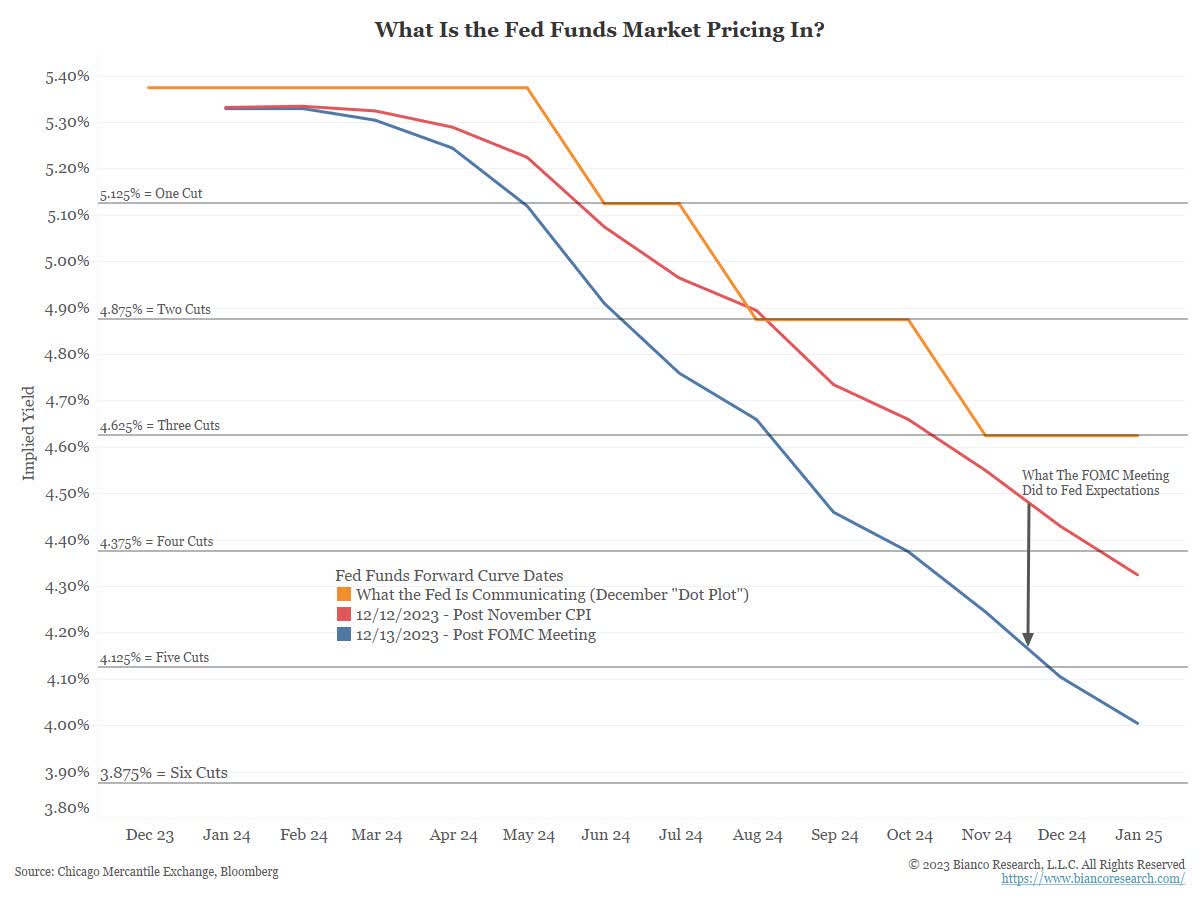

Fundamentally, everyone is celebrating the Fed’s potential rate cuts. Not only did Powell not push back on expectations in his press conference, he hinted that he was all too happy to accommodate the market. The euphoria that followed, blew up rate cut expectations to new highs. We are now pricing in, we kid you not, 6 rate cuts for 2024.

Jim Bianco

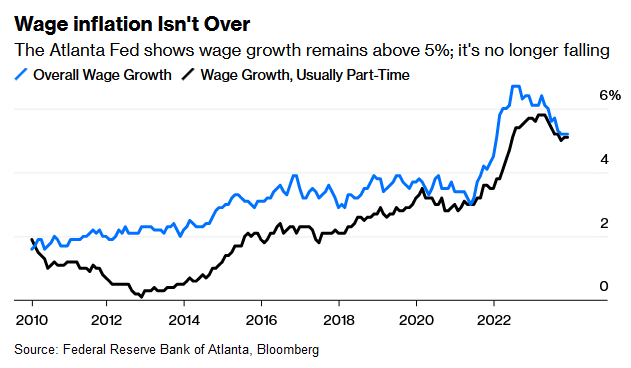

We are doing so with wage inflation still at levels far above what would be consistent with 2% inflation.

Bloomberg

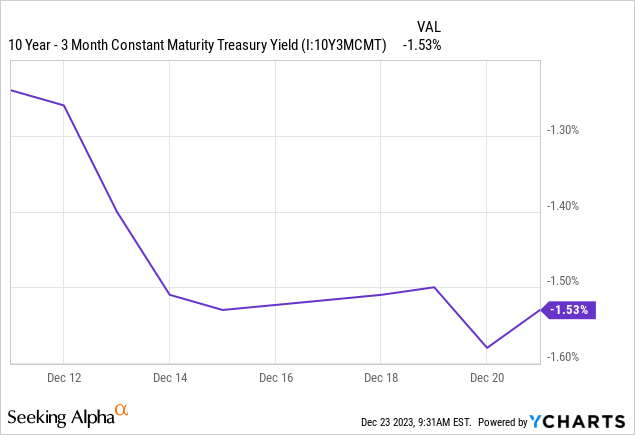

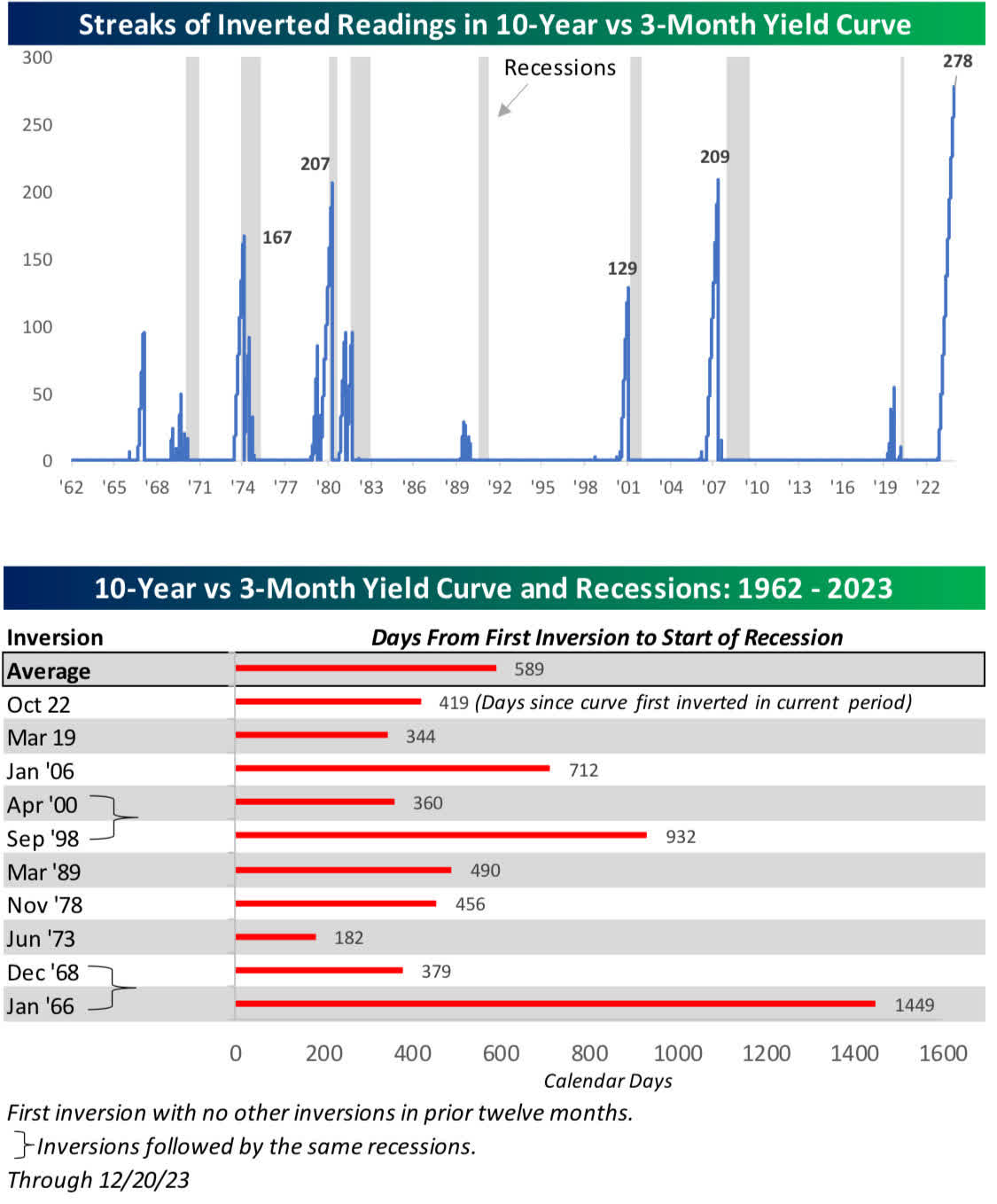

The most perplexing aspect in all of this is that the yield curve remains deeply inverted. In fact, the inversion has worsened remarkably since the last Fed meeting.

We can ignore this data point, but history has suggested that this likely comes to bite at some point.

Bespoke

So a couple of things can go wrong here. The first being that inflation rears its ugly head again and the Fed disappoints on rate cuts. The second being that the recession finally strikes as the past rate hikes flow through and deliver the hit.

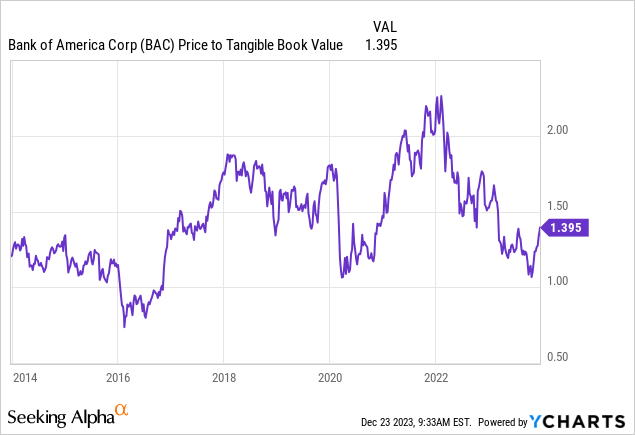

BAC remains slightly expensive, if outcomes other than a perfect “soft landing” are achieved. We would view 1.5X tangible book value as the upper limit of what investors will choose to pay with 150 basis points of inversion in the curve.

When we suggested a long side bias a few months back, the rationale was that at close to 1.1X tangible book value you were not risking life and limb to make money. At 1.4X you have to take a back seat, especially in light of growing risks that don’t seem to worry any one these days. With that in mind, we are now downgrading this back to a Hold.

Preferred Shares

On our previous coverage we had also alerted investors to a great income play, Bank of America Corporation 7.25% CNV PFD L (NYSE:BAC.PR.L). These busted convertibles were setup delightfully well at $1,050 at the time the last article was released.

Seeking Alpha

We had a buy rating on them as the 6.93% stripped yield provided a very high degree of certainty of good returns over the medium term. Unfortunately the rally has destroyed prospects for anyone that gets in today. At a sub 6% yield, these no longer remotely interest us and look dangerous if either of our suggested outcomes come to pass. We downgrade these to a “hold” as well and would move to a straight “Sell” over $1,300.

The other preferred share we would like to discuss is Bank of America Corporation 5.875% NCM PFD HH (NYSE:BAC.PR.K). BAC.PR.K has rallied sharply as well and moved close to par. We did not have this on a Buy, as its characteristics made it inferior to BAC.PR.L. At this point these are more risky than BAC.PR.L. While we still maintain these at a “hold”, we would move to a “Sell” if they went over par.

A new one we would like to highlight today is Bank of America, Floating Rate Dep Shares Non-cumulative Preferred Stock, Series E (BAC.PR.E). Their payout is as follows.

Floating rate non-cumulative distributions are paid quarterly on 2/15, 5/15, 8/15 & 11/15 to holders of record on the date fixed by the board, not more than 30 days prior to the payment date (NOTE: the ex-dividend date is one business day prior to the record date). The floating rate distributions will be paid at a rate per year equal to the greater of the three-month LIBOR plus 0.35% or 4.00% per annum.

Source: Quantum Online

The LIBOR has been adjusted to SOFR and the current yield is quite high, at 6.86%. These might make sense for anyone expecting a radically out-of-consensus outlook for yields. If you expect rate cuts to only marginally materialize in 2024, followed by higher inflation and new rate hikes, these would be the play. They might also make sense if you expect the ZIRP era to return. The 4% floor yield on par (4.5% on current price) makes them one of the better floating rate issues out there.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here