Introduction

While I’m not a big fan of non-cumulative preferred shares, some issues have features that are sufficiently interesting to consider adding them to my portfolio anyway. In a previous article, I discussed the “busted” preferred shares issued by Wells Fargo (WFC), and in this article, I’d like to have a closer look at the preferred shares Series L issued by Bank of America Corporation (NYSE:BAC). Not only do I like the 6.4% yield, I also think these securities could be a good instrument to take advantage of potential rate cuts in 2024. Although Powell recently stated it is too soon to say when the policy might ease, I think it’s fair to say rates are more likely to move down instead of up.

The preferred dividends are still safe based on recent financials

When I invest in preferred shares, I obviously want to make sur ethe company can afford to make the preferred dividends. And although the Bank of America is a household name, I only makes sense to keep an eye on the bank’s financial performance to make sure I can still sleep well at night.

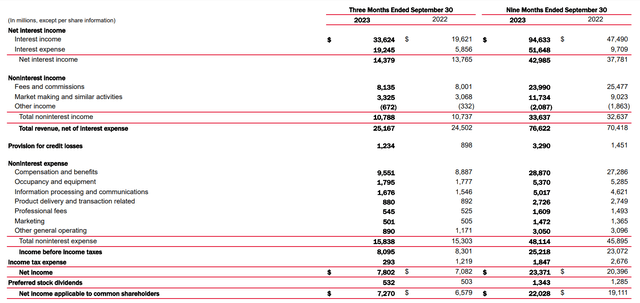

During the third quarter, Bank of America saw its interest income increase once again, but as you can imagine, its interest expenses increased as well. The net interest income did increase compared to the third quarter of last year as the bank reported a net interest income of $14.4B. And that’s an increase of approximately $600M compared to the third quarter of last year.

Bank of America Investor Relations

The bank also reported a total non-interest income of $10.8B and a non-interest expense of $15.8B resulting in a net non-interest expense of approximately $5B. This means the pre-tax and pre loan loss provision income generated during the third quarter was approximately $9.3B. And as you can see in the image above, there was a $1.23B loan loss provision which means the pre-tax income was $8.1B and the net income was $7.8B.

Bank of America needed approximately $532M to cover the preferred dividend payments which means the net income attributable to the common shareholders of Bank of America was approximately $7.27B or $0.91 per share.

The total net profit in the first nine months of the year came in at $23.4B and this includes approximately $3.3B in loan loss provisions. The bank needed $1.34B to cover the preferred dividend payments which means BAC needed approximately 5.7% of its 9M 2023 net income to cover the preferred dividends while that ratio increased to 6.8% in the third quarter. Or in other words, even if the loan loss provisions would quintuple to $6B per quarter, the bank would still make enough money to cover the preferred dividends.

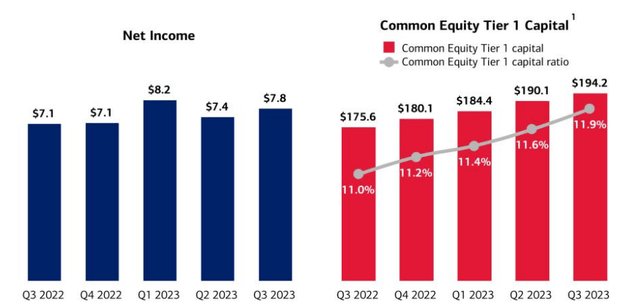

I am also quite satisfied with the evolution of the Common Equity Tier 1 capital position of Bank of America Corporation. As the image below shows, the CET1 capital increased from $176B to $194B in the past four quarters which boosted the CET1 ratio from 11% to 11.9%. And that puts the bank on a much stronger footing and definitely is a more comfortable position to be in. Note, the “net income” shown below is the net income before the preferred dividend payments.

Bank of America Investor Relations

I am leaning towards buying the Series L Preferred shares

The Series L, trading with (NYSE:BAC.PR.L) as ticker symbol, is a so-called “busted” preferred which cannot be called by Bank of America. The owner of the preferred shares has the option to convert the shares into 20 common shares, and if the underlying shares are trading at $65/share, Bank of America may force the conversion.

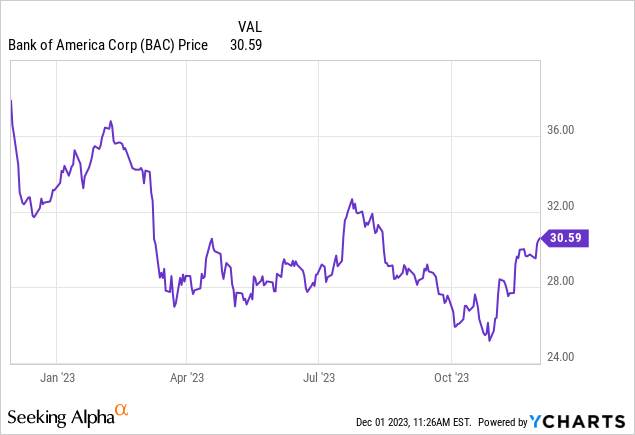

But as the common shares are trading at just over $30, the likelihood of a forced conversion to happen in the next few years is very low. And even if that would happen, the owners of the preferred shares would receive at least $1,300 in common shares (20 times $65) of Bank of America would result in an immediate 15% capital gain based on the current share price of approximately $1125.

Seeking Alpha

Meanwhile, those preferred shares offer a 7.25% preferred dividend based on the $1,000 principal value of the security. Which means that at the current share price of $1,125, this security currently offers a yield of 6.40%. That’s definitely not the highest on the street but I like the fact that this preferred share can’t really be called and the odds to see the forced conversion into common shares is very low.

Investment thesis

When I wrote the previous article on Bank of America’s Series L preferred shares, I ultimately decided to buy the preferred shares issued by Wells Fargo with similar characteristics. As I recently received a decent amount of cash inflow from bond maturities, I am looking to redeploy those proceeds in new income-generating opportunities. And while I am fully aware the preferred shares issued by Bank of America are non-cumulative, I will likely establish an initial long position in the near future. I think the 6.4% yield is acceptable, and if we will indeed see rate cuts in 2024, the price of these preferred shares will likely move up.

I currently have no position but will likely establish a long position in the near future.

Read the full article here