Thesis

I believe Beam Global (NASDAQ:BEEM) has a unique value proposition for government services organizations and municipalities that prioritize flexibility, energy security, and clean energy. BEEM operates in a specialized market and can be seen as an indirect method to capitalize on the growing demand for electric vehicles ((EVs)). The company is well-positioned to leverage the ongoing expansion of EV infrastructure throughout the United States, which creates opportunities for their business. However, the current cash balance presents difficulties for investors, raising questions about the company’s liquidity position. Moreover, the company’s ongoing expansion efforts could potentially postpone the achievement of profitability, which would continue to weigh on the stock price in my view. Therefore, I currently assign a hold rating to the stock without a price target.

Company Description

BEEM is a San Diego-based company that provides solar-powered charging solutions for electric vehicles. The company’s patented and proprietary solar charging infrastructure can be rapidly deployed without the need of construction, electrical work, regulatory approvals and grid connections. The company does not compete with EV-charging companies; instead, it enhances its offerings by providing off-grid infrastructure solutions. BEEM is agnostic to EV-charging service equipment, meaning it has no preferred EVSE provider and can thus market to the broader industry.

Q1 Review & Outlook

BEEM posted impressive 1Q23 results that exceeded expectations. BEEM surpassed consensus revenue estimates by more than 50% and achieved positive gross margins for the first time in its history. The company also outlined a path to achieving adjusted EBITDA profitability, which only requires minimal growth in EV ARC deliveries from current levels.

Following a 66% sequential improvement in EV ARC deliveries in 4Q22, BEEM continued its growth momentum with a 46% increase in 1Q23, driven by aggressive factory production to clear the backlog. The company achieved marginally positive GAAP gross profits in 1Q, thanks to higher fixed cost absorption and a price increase for future orders. BEEM also outlined process improvements to further enhance gross margins and indicated the potential for positive adjusted EBITDA margins with moderate double-digit growth in EV ARC deliveries, despite being well below the factory’s output capacity. Overall, BEEM is demonstrating its growth potential as a public company. The conference call provided more focused and meaningful information, with the company’s results speaking for themselves rather than relying heavily on future expectations.

Liquidity Remains an Issue

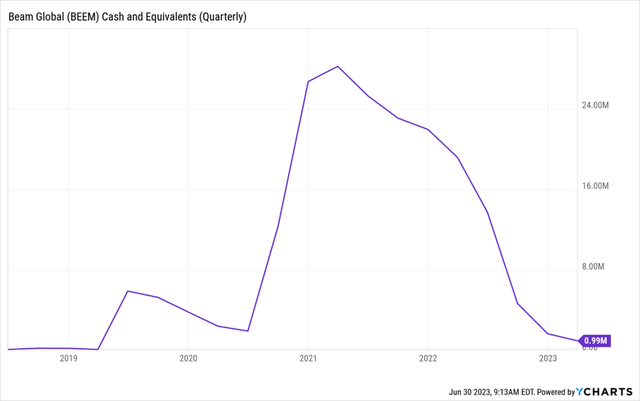

BEEM reported $1 million in cash on their balance sheet for the second consecutive quarter. However, the management mentioned having $5 million in cash as of mid-May, indicating an improvement. This amount of cash is only enough to support operations for approximately two quarters, based on the company’s historical cash burn pattern.

However, the company recently announced the details of a public offering of 2,500,000 shares of its common stock at a price of $9.00 per share. This will result in approximately $22.5 million in gross proceeds, excluding underwriting discounts, commissions, and estimated offering expenses, which will help alleviate liquidity concerns in the short term and for the potential acquisition of Amiga.

Ycharts

BEEM Differentiated from Competition

I believe that BEEM stands out in the competitive landscape of renewable energy and EV charging solutions because it offers a unique and versatile product. Unlike other companies, BEEM provides a deployable, transportable, and off-grid renewable solution. In comparison, traditional grid-tied solar systems often have long lead times of 18-24 months for ordering and installation. Moreover, these systems are not designed to be easily transported to different locations once installed. This flexibility is crucial for several reasons. Firstly, it allows BEEM’s solutions to be repurposed for various needs. For instance, they were successfully deployed at COVID-19 emergency pop-up centers to provide emergency power and EV charging. Secondly, this feature benefits commercial customers who lease office spaces, as it enables them to procure EV charging services for their employees.

Another significant advantage of BEEM is its commitment to innovation, as demonstrated by its numerous patents and ongoing patent acquisitions. An example of BEEM’s innovative approach is the SolarTree, one of their earlier products, which incorporates a tracking system that maximizes solar output by following the sun’s trajectory throughout the day. While this tracking technology is common for ground-mounted solar projects, it is not typically found in individual charging stations.

Company Presentation

Expansions can delay Profitability

In February ’22, BEEM completed the acquisition of AllCell Technologies, primarily for its battery production capabilities. The company considers this acquisition to have yielded significant positive results thus far. Furthermore, BEEM has expressed its active pursuit of additional opportunities for vertical integration. Expansion into new geographic markets is also on the horizon for BEEM, as the management has discussed plans to increase production both domestically in the US and internationally in Europe and the Middle East. Recently, BEEM secured a $100 million credit facility, which serves to enhance their working capital safety and likely supports their growth strategy.

Moreover, the company announced its intention to expand into the European market with the acquisition of Amiga. Although the management believes that the European market provides ideal growth opportunities with a large automotive market, the continued pursuit of this growth strategy may potentially delay the achievement of profitability, which will remain a concern for investors and likely to weigh on the stock price.

Company Presentation

Conclusion

BEEM presents an attractive and unique approach to capitalize on the EV charging market by combining solar power with its EV Arc product. EV Arc offers benefits in terms of cost and installation time, as it eliminates the need for grid connectivity. However, I believe that the cash balance pose challenges for institutional investors at present. Moreover, the continued expansions can delay profitability, which would continue to weigh on the stock price. I currently view the stock as a hold.

Read the full article here