November was a remarkable month for stocks, though equities have stalled out just below prior lows. That has not thwarted investor sentiment though.

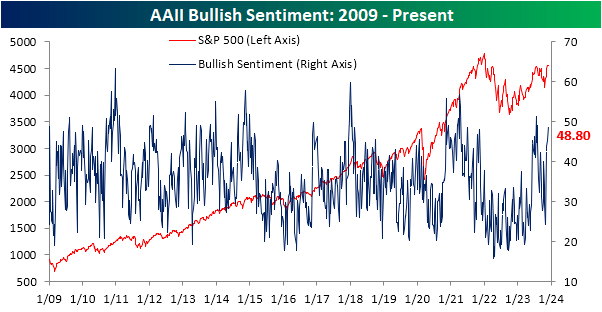

The latest sentiment survey from the AAII showed 48.8% of investors reported as bullish, up from 45.3% last week.

That is now the highest reading on bullish sentiment since the first days of August, and is more than 10 percentage points above the historical average of 37.5%.

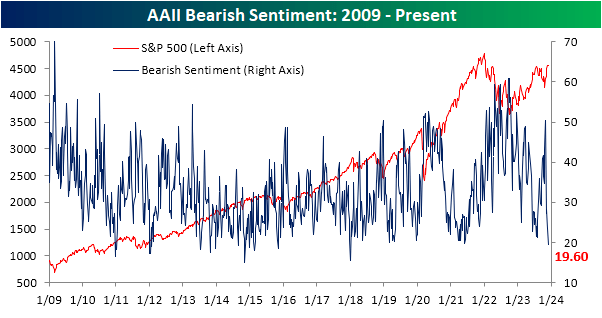

While bullish sentiment has not yet moved above its prior highs, the share of respondents reporting as bearish has set a new low.

The reading has experienced a dramatic shift having started November above 50%, and fallen all the way down to 19.6% this week. That is the lowest level of bearish sentiment since the first week of 2018!

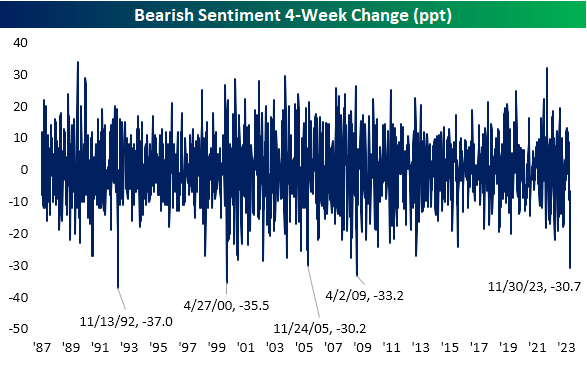

Perhaps even more impressive is that over 30 percentage point drop in the past four weeks ranks as one of the largest declines on record.

Since the start of the survey in 1987, the current four week decline ranks as the fourth largest on record. The last occurrence was all the way back in April 2009.

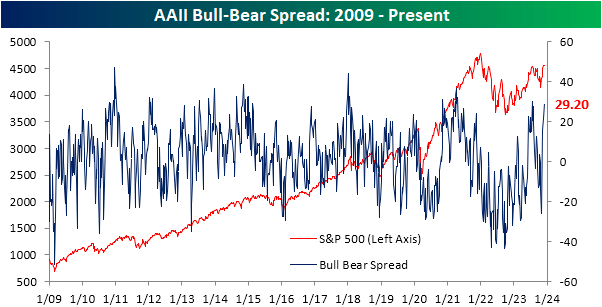

As a result of the massive drop in bears, the bull-bear spread has risen to 29.2, just shy of the July high of 29.9.

The AAII survey was not alone in having seen a surge in optimism. For example, the Investors Intelligence survey likewise is seeing the strongest bullish sentiment since early August and the NAAIM Exposure Index is at the highest level since late July.

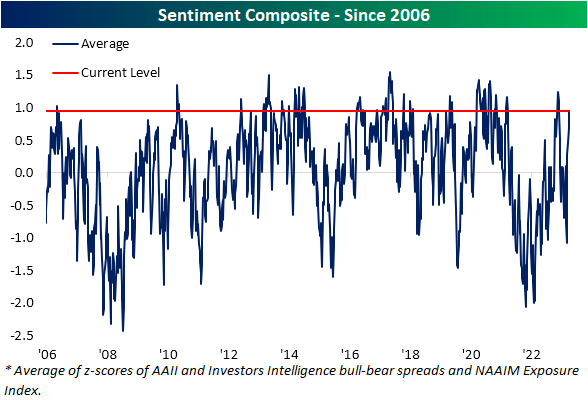

Combining these readings into our sentiment composite shows the index is now at 0.95 indicating the average sentiment survey is now almost a full standard deviation above (meaning more bullish than) its historical average.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here