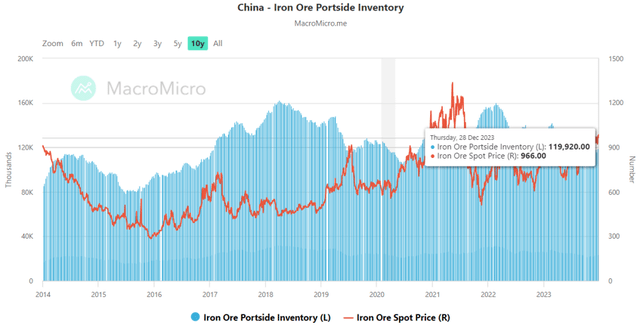

We previously covered BHP Group Limited (NYSE:NYSE:BHP) in September 2023, discussing the uncertain recovery in the iron spot prices as China’s portside inventory declined and imports accelerated over the past few months.

However, with the demand for iron ore expected to moderate over the next few decades, it was unsurprising that the producer had pledged intensified capex towards electrification metals, naturally impacting its variable dividend payouts.

As a result of the uncertainty, we had preferred to rate the stock as a Hold then, since it remained to be seen when the macroeconomic outlook might improve.

In this article, we shall discuss why we are rerating the BHP stock as a Buy despite the immense rally after the Q2/Q3’23 sideways movement, thanks to the surge observed in the commodities’ spot prices.

With the inflation already cooling and the Fed open to a pivot by Q1’24, we may see this optimism persist for a little longer, with the property and EV demand likely to return sooner than expected, boosting the demand/ spot prices for iron ore and copper.

The Dynamic Commodity Investment Thesis Remains Robust

Iron Ore/ Copper Spot Prices

Market Insider

The iron ore spot price has continued to climb since the previous bottom to record a new 2023 height of $136.07/wmt at the time of writing.

Readers may want to note that this is well above the 2019 averages of $90/wmt, BHP’s FQ1’24 average realized prices of $98.04/wmt (-1.8% YoY), and FY2023 average realized prices of $92.54/wmt (-18.1% YoY).

Iron ore is also the producer’s bottom line driver with $16.7B of adj EBITDA generated in FY2023 (-23% YoY), or the equivalent 59.8% (+6.4 points YoY) of the overall profitability.

As a result, it is unsurprising that Mr. Market has cheered at the recent recovery in spot prices, due to the accretive impact on BHP’s near-term top/ bottom lines.

The same recovery has also been observed in the copper spot prices, with the commodity trading at $3.91/lb at the time of writing compared to $2.70/lb in 2019, BHP’s FQ1’24 average realized prices of $3.63/lb (-4.4% YoY) and FY2023 average realized prices of $3.65/lb (-12.2% YoY).

With it commanding $6.7B of the company’s overall adj EBITDA (-21.7% YoY), or the equivalent 23.7% (+2.7 points YoY), we may expect H1’24 to bring forth excellent top/ bottom line numbers indeed.

China’s Iron Ore Portside Inventory Level

MacroMicro

China’s lower portside inventory of 119.92K (-9% YoY) as of December 28, 2023 compared to the pre-pandemic averages of 131K also implies that iron ore spot prices may remain elevated for a little longer, providing further tailwinds to BHP.

The same may occur for copper, attributed to the closure of First Quantum Minerals Ltd.’s (FM:CA) Cobre Panama mine, with the mine’s FY2022 production capacity of 350.4K mt temporarily negating the supposed supply surplus of 467K mt in 2024

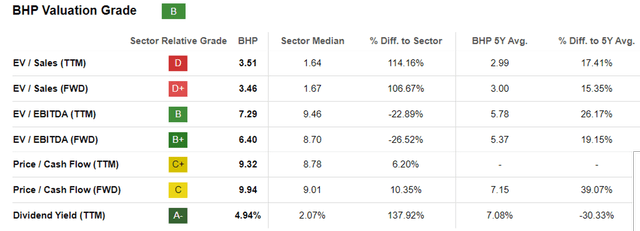

BHP Valuations

Seeking Alpha

As a result of these developments, we can understand why BHP’s FWD EV/ EBITDA valuation of 6.40x and FWD Price/ Cash Flow valuation of 9.94x have recovered tremendously.

This is compared to its 1Y mean of 5.68x/ 6.80x, while finally nearing its 3Y pre-pandemic mean of 6.12x/ 7.20x and the sector median of 8.70x/ 9.01x, respectively.

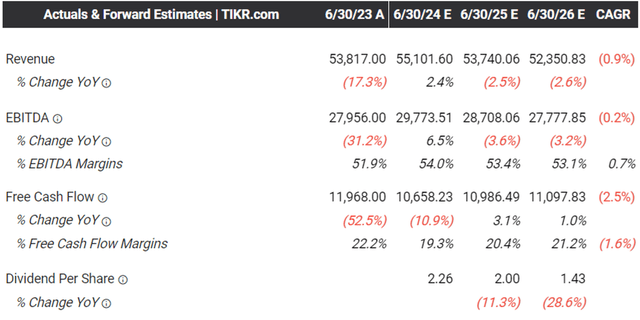

The Consensus Forward Estimates

Tikr Terminal

These valuations do not appear inflated either, with the consensus still expecting BHP to sustain its highly profitable adj EBITDA margins of over 53% and FCF margins of over 19% through FY2026.

This is compared to its pre-pandemic averages of 49% and 23%, respectively, with the moderate decline in the FCF margins only attributed to its intensified exploration capex for electrification metals such as copper and nickel.

With BHP already guiding an excellent growth in the FY2024 copper production to 1,815 kt (+5.7% YoY) and nickel production to 82 kt (+2.5% YoY) at the midpoint, we believe that these expenditures will eventually be accretive to its top/ bottom lines in the long-term.

The management has also guided a moderate expansion in its annual copper production to 1,935 kt and a reduction in its midpoint unit costs to $1.45 by FY2025/ FY2026, down from the current midpoint of $1.55.

This suggests that BHP may eventually generate improved adj EBITDA copper margins ahead, up from the 47% reported in FY2023 (-4.1 points YoY), further boosted by the market analysts’ projection of the commodity’s higher spot prices of $4.985/lb by 2025.

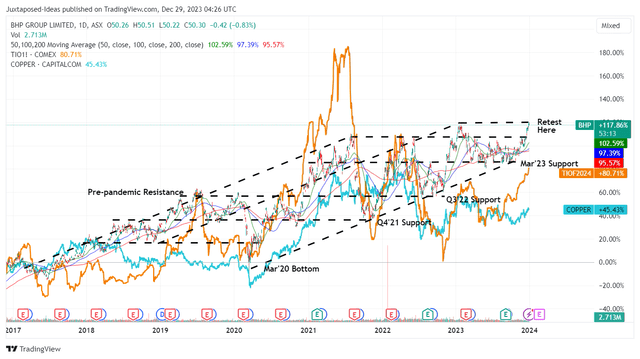

BHP 7Y Stock Price

Trading View

With BHP’s financial performance inherently tied to the commodities’ dynamic spot prices, we can understand why the stock has also rallied as it has thus far, with it being well supported by the notable premium over pre-pandemic spot prices.

So, Is BHP Stock A Buy, Sell, or Hold?

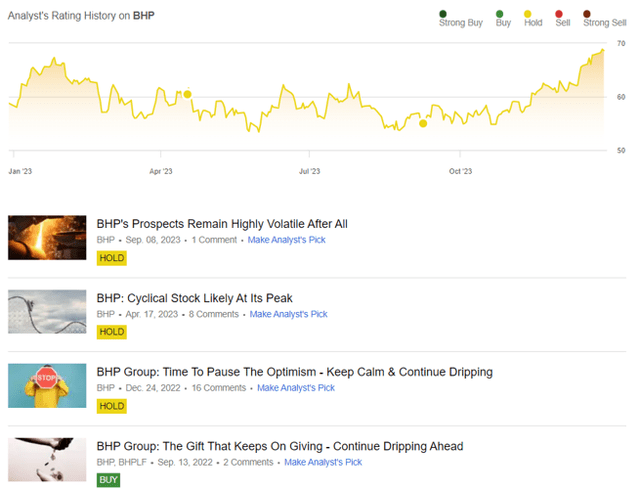

Author’s Historical Rating For The BHP Stock

Seeking Alpha

Well, this is the most important question indeed. Our previous Hold rating in September 2023 has proven to be wrong, with the BHP stock already rallying by over +20% since then.

Most importantly, we admit that we had been greedy then, in the hopes of a lower entry point of $52 for an expanded forward dividend yield, with us already missing the train.

Does this mean that we should jump in here? Not quite.

The BHP stock has rapidly broke out of its 50/ 100/ 200 day moving averages, with it currently retesting its January 2023 resistance level of $70.

Assuming that the spot prices sustain its premium over the pre-pandemic averages, we may see the stock well supported between $62 and $70s, offering interested investors with a clear trading range.

The BHP stock’s recent rally also results in its lower FWD dividend yields of 4.65% compared to its 4Y average of 7.62%, though still decent compared to the US Treasury Yields of between 3.82% and 5.33%.

Its dynamic dividend investment thesis remains safe as well, with an excellent TTM Interest Coverage Ratio of 25.21x and the management committed to a 50% dividend payout policy, despite the intensified capex over the next few years.

As a result, we are cautiously upgrading the BHP stock as a Buy, though with a caveat. Existing shareholder may continue dripping ahead, allowing them to regularly accumulate additional shares on a quarterly basis.

At the same time, they may also moderate at any dips for an improved margin of safety, depending on their dollar cost averages, portfolio allocation, and risk appetite.

With the inflation already cooling and the Fed open to a pivot by Q1’24, we may see this optimism persist for a little longer.

It goes without saying that investors who add BHP must do so as part of a well-diversified portfolio, since its variable dividend payouts may not be suitable for those who rely on regular incomes.

Read the full article here