Introduction

Founded in 2008, BioNTech (NASDAQ:BNTX) is an international leader in immunotherapy, aimed at innovating treatments for cancer, infectious diseases, and other severe illnesses. By using their comprehensive model and a varied technological suite, they have made significant strides in areas such as mRNA vaccines, gene therapies, and targeted antibodies. BioNTech’s portfolio includes Comirnaty, a COVID-19 vaccine, 25+ products in clinical trials, and 30+ research initiatives. Following a successful growth strategy in 2022, the company progressed in vaccine development, research, acquisitions, and partnerships, as well as organization-wide expansion. BioNTech’s patient-centered approach leverages the immune system’s potential to address significant health issues, positioning the company as a front-runner in modern therapeutic solutions.

The following article provides a brief overview of BioNTech’s financials, stock, pipeline, and future prospects.

Q1 2023 Financials

Let’s start with financials. In Q1 2023, BioNTech posted revenues of $1,404.7 million, a substantial decrease from the $7,012.06 million registered in the corresponding period the previous year, primarily due to a drop in global COVID-19 vaccine sales. Costs of sales also saw a reduction to $105.6 million from $1,423.51 million due to the same reason. On the other hand, research and development expenses increased to $367.4 million from $314.38 million, propelled by the costs associated with advancing clinical studies and a growing workforce. Likewise, general and administrative expenses escalated to $131.34 million from $99.88 million, driven by heightened costs in IT and external services, along with a larger team. The company set aside $226.05 million in income taxes, corresponding to an effective tax rate of 29.0%, expected to decrease throughout the fiscal year. The net profit stood at $552.42 million, which was considerably less than the $4,068.68 million reported in the same period last year. As of March 31, 2023, cash and cash equivalents amounted to $13,358.29 million, and security investments to $739.09 million. A payment of $4,357.43 million was received from Pfizer (PFE) in April 2023, reflecting the temporal offset between the recognition of revenues and the receipt of payment due to varying financial reporting cycles.

2023 Guidance

BioNTech anticipates COVID-19 vaccine revenues of about $5.5 billion in 2023, considering factors like market shifts, new virus variants, and supply contract renegotiations. Revenues are projected to be higher in the second half of 2023. Planned expenses include $2.64-$2.86 billion on R&D, $715-$825 million on SG&A, and $550-$660 million on capital expenditures. (Values have been converted from Euro to USD)

BNTX Stock Assessment

Per Seeking Alpha, BioNTech’s stock assessment reveals a mixed bag of results. In terms of valuation, the company is rated “A+” with forward-looking non-GAAP P/E at 20.76, trailing twelve months [TTM] GAAP P/E at 4.09, price/book ratio at 1.23, enterprise value (EV) to sales at 1.04, and EV to EBITDA at 1.56. However, its growth is rated “F” due to a YoY revenue decline of 47.59%, a YoY decrease in diluted EPS of 48.68%, and a significant levered free cash flow growth of 184%.

Profitability is another strong point for BioNTech, scoring an “A+” rating. Key metrics include a gross profit margin of 85.29%, an EBIT margin of 65.97%, a net income margin of 51.08%, return on equity of 34.49%, and return on assets of 23.77%.

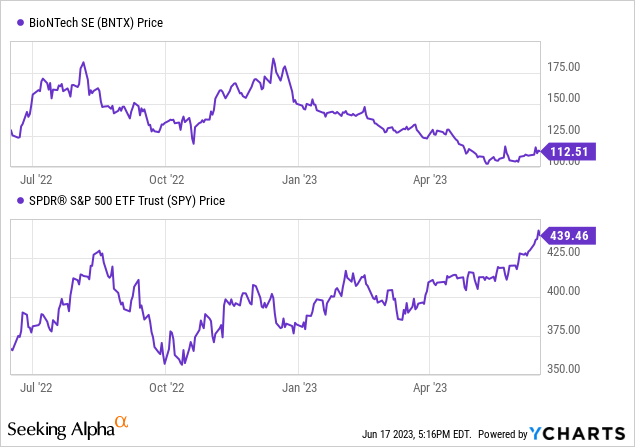

Momentum, however, is rated “D+” with BioNTech’s stock showing a decline over the past year, down by 12.85%, significantly underperforming the S&P 500 which has grown by 20.26%.

In terms of capital structure, BioNTech has a market cap of $27.12 billion, total debt of $227.57 million, and a cash position of $13.56 billion, resulting in an enterprise value of $13.77 billion. The stock’s last price was $112.55, with a 52-week range from $100.08 to $188.99.

Pipeline Development

BioNTech’s pipeline indicates a strong pivot towards oncology, with promising developments in targeted therapies and mRNA cancer vaccines. Their collaborations with OncoC4 and DualityBio are notable; the former yielding BNT316 (ONC-392), an anti-CTLA-4 monoclonal antibody that could enhance safety profiles and patient outcomes in NSCLC treatments. The HER2-targeted ADC, BNT323 (DB-1303), is progressing well, earning FDA’s Fast Track designation for advanced endometrial carcinoma.

Notably, BioNTech is leveraging its mRNA technology in cancer immunotherapy. BNT122, an mRNA cancer vaccine based on the iNeST approach, is set to enter a Phase 2 clinical trial for pancreatic ductal adenocarcinoma, signaling progress in personalized medicine. BNT211, a CLDN6-targeting CAR-T cell therapy, showcases BioNTech’s exploration into cutting-edge treatments.

Regarding infectious diseases, BioNTech continues its success with mRNA vaccines, not only with BNT162b4—a next-gen COVID-19 vaccine showing preclinical efficacy—but also with TB and shingles vaccines, marking BioNTech’s expansion into other infectious diseases.

BioNTech’s pipeline presents an ambitious balance between addressing immediate needs (COVID-19) and long-term challenges (oncology and other infectious diseases). Their multi-pronged, strategic collaborations, utilization of mRNA technology, and explorations in personalized medicine position them to make substantial impacts in healthcare.

My Analysis & Recommendation

Wrapping up my analysis, it’s evident that BioNTech is operating in an incredibly dynamic space that presents both immense opportunities and significant risks. Even though revenues from their COVID-19 vaccine have decreased, reflecting the global downward trend, I see great potential in BioNTech’s strong immunotherapy pipeline for future growth. BioNTech’s ability to rapidly develop a COVID vaccine, with assistance from Pfizer (PFE), in my view, is a solid proof-of-concept for its technology. Nonetheless, investors should closely monitor the progression of these pipeline products, especially their oncology-focused initiatives, which I believe will be pivotal to BioNTech’s strategy for revenue diversification.

Another aspect that has caught my attention is the rise in BioNTech’s research and development expenses, indicating the company’s commitment to innovation. This kind of investment could be a key driver for future growth and profitability. Of course, this also introduces a risk of decreased margins if these investments don’t result in marketable products.

Assessing BioNTech’s financial metrics, I see a company that is currently profitable but may be facing some headwinds. The valuation metrics tell me that the company is fairly priced, but the negative momentum signals that the wider investment community might be getting cold feet. However, I am heartened by BioNTech’s strong profitability and low debt levels, which provide a solid financial foundation that could help the company weather any future storms. BioNTech’s robust cash position of $13.56 billion, which is nearly half of its market capitalization, provides optionality (e.g. potential for M&A activity), time (e.g. for pipeline candidates to mature into revenue-producing drugs), and security (e.g. somewhat mitigating any downside for investors).

The expected decline in BioNTech’s COVID-19 vaccine sales is notable, but I view it as a validation of the importance of the company’s ongoing efforts to diversify. The promising developments in oncology, strategic collaborations, and the continuous exploration of mRNA technology for treatments beyond COVID-19, underscore the company’s adaptability and growth potential. Additionally, the poor market sentiment surrounding decreasing revenues provides investors with an opportunity to invest at reasonable prices.

So, given BioNTech’s robust fundamentals, promising pipeline, and commitment to innovation, and in consideration of the current challenging operating environment and stock performance, my recommendation is a “Buy”. I am convinced that BioNTech is not just well-positioned for future success, but also represents a compelling investment opportunity now.

Risks to Thesis

When the facts change, I change my mind.

While BioNTech has demonstrated resilience and innovative prowess in the face of global health challenges, a few primary risks could impact the future performance of the company and hence my “Buy” recommendation. These include:

-

Pipeline Uncertainty: Despite the robustness of BioNTech’s pipeline, the outcomes of clinical trials are inherently uncertain. Even promising products can face delays, regulatory setbacks, or failure in clinical trials, which could result in substantial financial losses. Failure to advance its pipeline and bring successful products to the market may negatively impact the company’s growth prospects and market valuation.

-

Dependence on COVID-19 Vaccines: BioNTech’s revenues currently heavily depend on their COVID-19 vaccine, Comirnaty. With the global rollout of vaccines and subsequent decrease in demand, the future of these revenues is uncertain. Additionally, the emergence of new COVID-19 variants, which may require vaccine modifications or the development of new vaccines, could impact the company’s revenues and profit margins.

-

Market Competition: The pharmaceutical and biotech industry is fiercely competitive. Other companies may develop more effective, safer, or cheaper drugs and therapies, thereby reducing the demand for BioNTech’s products.

- Legal Challenges: Particularly with the development of its COVID vaccine, BioNTech is engaged in lawsuits where other companies alleged their patents were infringed upon. Any negative legal outcomes could significantly impact BioNTech’s revenue outlook and stock value.

Read the full article here