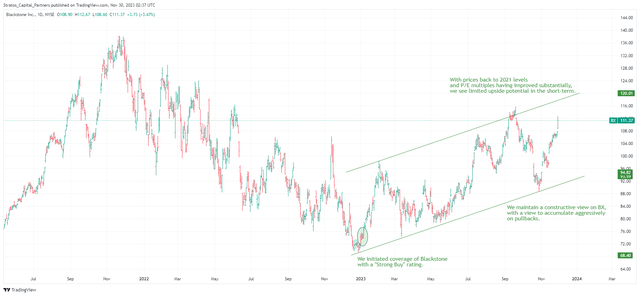

Blackstone Inc. (NYSE:BX) has had an incredible run since we initiated our bullish view back in January when the company was still suffering from a wave of redemptions and multiple rating downgrades by Barclays and Credit Suisse (see “Blackstone Is A Strong Buy For Its High-Performance RE Portfolio And Valuation” – Jan 5, 2023). Since we initiated our “Strong Buy” rating on BX, the stock has gained an impressive 45.4%.

TradingView.com, Stratos Capital Partners

In this article, we share our updated outlook for BX and highlight why we are downgrading our rating on the stock to a “Buy”. We see an opportunity to take some profits on the stock and to tactically rotate into our favourite undervalued themes including residential REITs, healthcare, and biotechnology.

With Great Scale Comes Great Opportunities

Once considered a risky and speculative asset class reserved only for institutional investors and ultra-high-net-worth (UHNW) clients, the private markets industry has witnessed tremendous growth in assets under management (AUM) over the last decade. Partly fuelled by the ultra-low interest rate environment following the 2009 Global Financial Crisis and a wave of high-profile initial public offerings by technology unicorns, private market investments have become a core asset class for sophisticated institutional portfolios.

We expect this secular long-term trend to continue as monetary policy normalizes, with inflows from institutional investors and UNHW clients driving healthy AUM growth for Blackstone in the coming years.

In the high-stakes business of private market investing, fund managers normally employ leverage to enhance returns, which makes the low interest rate environment exceptionally favourable for asset managers. However, it is worth noting that low interest rates only play a limited role in reducing the cost of leverage and financial engineering. The real drivers of returns must come from the skill of the fund managers: either by selecting profitable opportunities and avoiding unprofitable ones, or by enhancing the operational performance of underlying businesses in the case of private equity.

In this respect, scale is a huge competitive advantage in the private markets business. BX’s sheer scale and established reputation not only give the company exclusivity to larger and more profitable deals over smaller managers, but its extensive network of clients and partners also brings desirable synergies to those deals. BX’s demonstrated ability to navigate and weather challenging environments in the private equity space over the years (slow deal flows, redemptions, higher costs) highlights the company’s value in riding through downturns and fully capitalizing on profitable opportunities for shareholders.

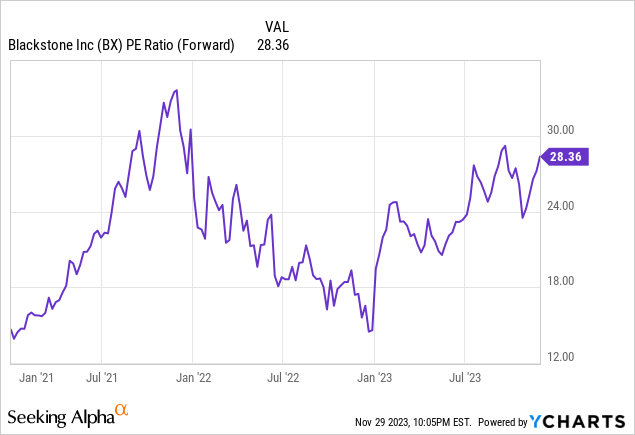

Further Multiple Expansion May Be Capped

Despite our constructive outlook on BX long term, we think it is also crucial to take advantage of short-term tactical opportunities to enhance alpha. Valuation multiples on BX have improved substantially since we initiated our “Strong Buy” rating on the stock. As the accompanying chart shows, forward P/E multiples on BX have almost doubled from 14.8x in January to 28.4x currently.

There are two main reasons why we think the stock could be vulnerable to a pullback in the short term.

Firstly, the outlook for monetary policy remains murky and we expect more clarity to come only in Q2 2024. Consensus expectations are already building up for the Federal Reserve to cut rates in H1 2024, with a small group of analysts calling for rate cuts as early as March. Even Fed Governor Christopher Waller has recently hinted at lower interest rates should inflation continue to ease. This build-up of optimism, however, indicates to us that equity markets may become more vulnerable to any negative surprises ahead. We see increasing risks that the latest U.S. GDP report, which showed that the economy blew past expectations and expanded at an annualised rate of 5.2% in Q3, may encourage the Federal Reserve to further delay rate cuts. Such a scenario would likely see BX’s valuation multiples pull back again, presenting opportunities for investors to accumulate at a discount.

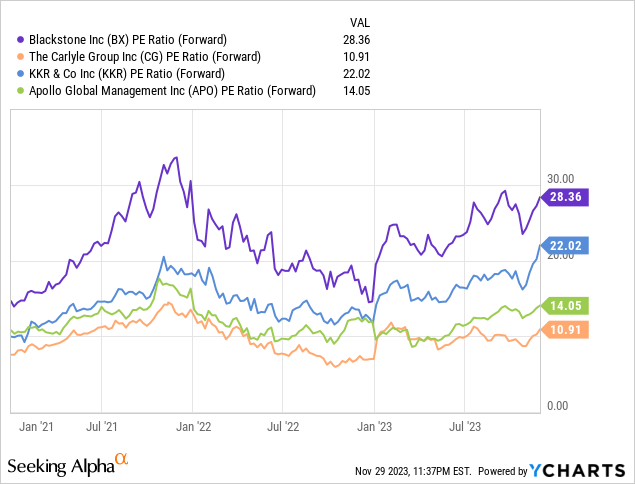

Finally and more importantly, BX’s massive outperformance this year has extended the valuation gap between the stock and its peers including The Carlyle Group Inc. (CG), KKR & Co. Inc. (KKR), and Apollo Global Management, Inc. (APO). Thus, we see BX potentially suffering larger drawdowns in the event of a pullback. We still maintain our “Buy” rating on CG given the attractive valuation on the stock, but we are downgrading our rating on BX from “Strong Buy” to “Buy” to better manage the risk of a pullback short-term.

In Conclusion

We remain constructive on the long-term prospects of Blackstone and we expect sustained inflows from institutional investors and UNHW clients to drive healthy AUM growth for the company in the coming years. However, we see a tactical opportunity for alpha by taking some profits on our position on BX and rotating into our favourite undervalued themes, especially residential REITs.

We downgrade our rating on BX from “Strong Buy” to “Buy” to better manage the risk of a pullback short-term, with the view to accumulate aggressively again in the event of a pullback.

Read the full article here