bluebird bio (NASDAQ:BLUE) is a clinical-stage biotechnology company specializing in developing and commercializing gene therapies for severe genetic and rare diseases. Their business model hinges on establishing and scaling the commercial model for ex-vivo gene therapy. In 2023, they strengthened their commercial presence through multiple product launches. One key pillar of bluebird’s commercial strategy is educating families and healthcare providers about their innovative treatments. Additionally, bluebird has formed strategic alliances to foster product and manufacturing innovation in cell therapy.

bluebird has had a rough run, down nearly 100% from its 2018 high and down 49% across the past year. In addition, short interest is running shy of 24%, and the company only has a cash runway through Q2 to Q4 2024.

BLUE Stock Price Trend (Seeking Alpha)

However, bluebird is also within three weeks (December 20th) of potential FDA approval for a gene therapy to treat Sickle Cell. In addition, they have positioned themselves for growth related to existing treatments and can ramp up quickly for newly approved therapies.

The downside risk for this stock is material, from both FDA approval and cash flow. However, the floor isn’t $0, as competitors would more than likely buy out the company for IP.

With a floor on the downside and the potential for an outsized return on IP, I believe this is an asymmetric buy opportunity that will likely only exist through December 20th. While investors should proceed cautiously with government approval as the primary driver of value, this could be a worthwhile bet.

FDA Approval Likely Based On Signals

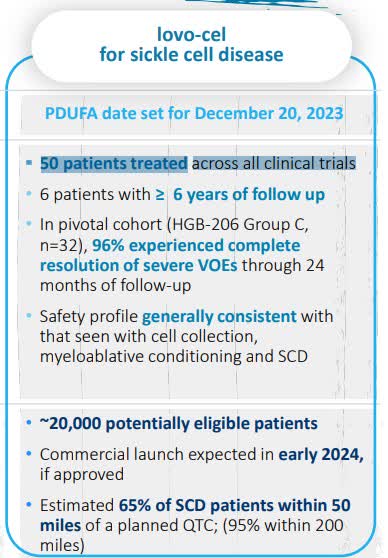

The biggest downside risk and, conversely, upside potential is FDA approval of bluebird’s Lovo-cel treatment for Sickle Cell Disease on December 20th.

Lovo-Cel Overview (BLUE Investor Relations)

While never definite, signals are pointing to approval. First and foremost, the FDA approved Lovo-cel for accelerated approval. Once converted to accelerated approval, nearly every therapy is approved unless the company itself withdraws to the traditional process following an advisory committee recommendation. bluebird did not have to undergo an advisory committee review. In fact, many have criticized the FDA for this pathway to approval being too easy. Also, treatments put through accelerated approval have a strong track record, with only 13% being later withdrawn from the market.

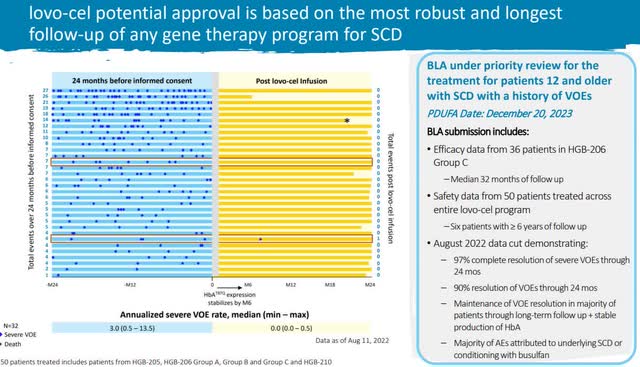

The next signal is the robust follow-up and strong results from the clinical trial. There was a 90% improvement in the target symptom with limited adverse effects. Gene therapies were first approved in 2017, and since then, the clinical trials have become more comprehensive, and the FDA’s approval rate has increased.

Lovo-cel clinical trial (BLUE Investor Relations)

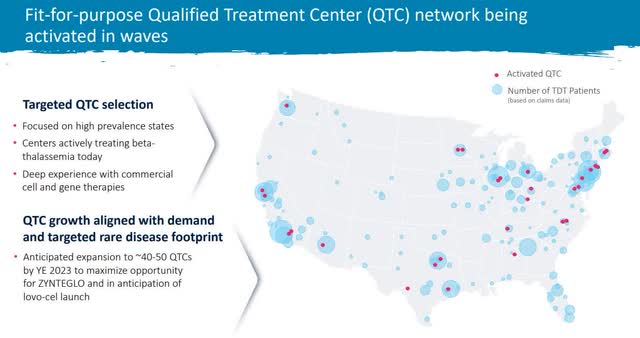

Lastly, management has put significant resources into preparing for a launch. They started 2023 with ten qualified treatment centers or QTC and are growing to 40-50 by the end of the year.

Treatment Center Growth (BLUE Investor Relations)

Given the precarious cash position, investing in growth signals that management is confident in approval.

Financials Tight, But Manageable

The Q3 earnings call, especially Q&A was heavily focused on revenue and expense expectations following FDA approval in addition to cash flow.

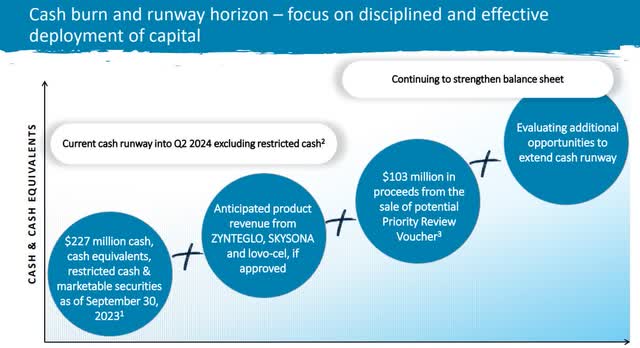

Looking first at cash flow, unrestricted cash gets bluebird to Q2 FY24. Restricted cash of $50 million and an FDA certificate sale of $100 million buy bluebird until mid Q4 FY24, again at current burn rate. With that in mind, bluebird needs to be on a path to profitability by Q3 FY24 at the latest, or at least be on the right path to secure additional financing.

Cash Flow Plan (BLUE Investor Relations)

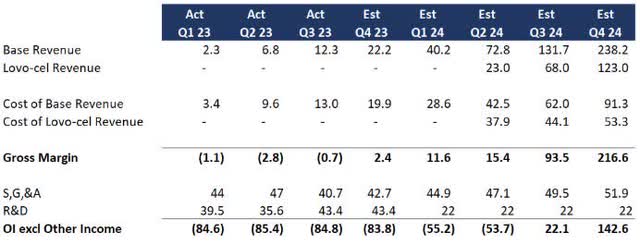

Assuming FDA approval, I wanted to see if this was possible. Here are some key assumptions I lifted from the Q3 earnings discussion:

- Existing therapies will grow linearly, with cost of revenue improving to a 30-40% margin

- Lovo-cel will grow linearly starting from Q2 FY24 except at a 10x size based on eligible patients and expanded treatment centers

- S,G,&A investments are largely in place for the expansion (I added 5% q-o-q growth as a buffer)

- R&D will drop materially following FDA approval (I cut R&D in half for 2024 although management signaled it could be more

Here is a rough forecast based on year-to-date 2023 performance and management’s implied guidance:

1-Year Forecast (Data: SA; Analysis: Mike Dion)

A lot still has to go right, but based on current trends, bluebird could become profitable before running out of cash or at least set up for additional financing as the business grows.

Stock Isn’t Priced For FDA Approval

I do not believe that the current market cap of $419 million assumes near-term profitability. Essentially, the stock is priced for failure.

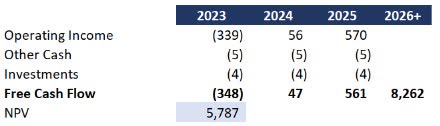

From a valuation standpoint, assigning a direct price target with so much up in the air wouldn’t be fair. However, I wanted to extend my forecast into a simplified DCF to see just how far off the market cap might be. I made the following conservative assumptions:

- Q4 performance in 2024 annualized to 2025

- A long-term growth rate of 3% essentially pacing with inflation

- Cost of capital at 10%

With those assumptions and the forecast above, the value of the company would be $5.8 billion versus $419 million today.

Simplified DCF (Data: SA; Analysis: Mike Dion)

To be clear, I am not suggesting a $5.8 billion valuation because there is a lot of execution timing at play. However, even considering timing and execution risk, I do not feel this is even close to a $400 million company.

In my opinion, the stock is priced for an IP sale. A competitor would likely scoop up existing therapeutics if FDA approval were denied or delayed. The book value of bluebird is closer to $200 million, and therapeutic premiums have been running at 50-60%, giving a floor value of approximately $300 million.

Verdict

Assuming FDA approval, bluebird’s current market cap at $419 million seems undervalued, given the potential growth trajectory. The simplified DCF valuation, albeit with conservative assumptions, suggests a $5.8 billion valuation, starkly contrasting its current standing. Even considering execution timing and potential risks, the company appears significantly undervalued.

Even in the event of an FDA approval delay or denial, the IP sale and therapeutic premiums provide a floor value of around $300 million, implying limited downside risk. Thus, the stock seems priced more for an IP sale rather than profitability through FDA approval.

With asymmetric risk in mind, I cautiously recommend a ‘Buy’ on bluebird. The potential upside appears substantial compared to the current market cap. However, investors should remain cognizant of the inherent risks and uncertainties associated with FDA approval and the execution of business growth plans.

This article represents my personal opinion and does not constitute financial, legal, or tax advice. Please consult a licensed advisor prior to making investment decisions.

Read the full article here