Investment Thesis

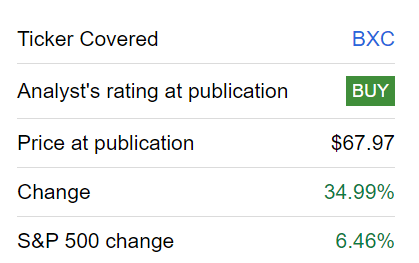

Here’s how I concluded my analysis of BlueLinx Holdings Inc. (NYSE:BXC) last month,

The takeaway here is that investors could be too dismissive towards BlueLinx Holdings Inc. on the fear that single-housing starts have not been strong in Q1 2023.

However, the market is looking further afield and coming to the belief that the real estate market may already be starting to find some support.

In hindsight, I couldn’t have called BXC better if I tried. Perhaps, the only thing that I’ll add here is that I’m even more confident that BXC could make $8 of EPS in 2023 than I was last month.

This puts this stock priced at 12x this year’s EPS. But I believe this multiple could become a lot cheaper next year if BXC continues to deploy excess capital towards share repurchases.

In sum, there’s a lot to be bullish about here.

Everything Is Moving So Fast

It’s just over a month since my last article on BlueLinx and so much has happened!

Author’s work on BXC

It’s not only that the stock has massively trounced the S&P 500 (SP500) over the same time period — although that is the outcome. But there’s a lot more to it than this.

This is my critical argument. The market has been right to re-rate BXC higher. Why?

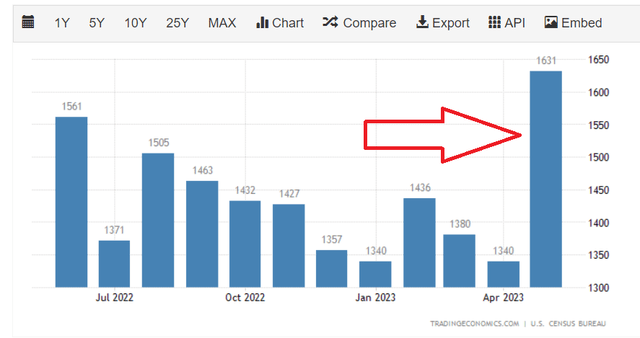

Trading Economics

This data for housing starts come out a few days ago, and what can you see? A significant spike in housing starts. So what does actually mean? It means that despite the Fed’s interest rate policy of sustainably higher for longer, this is categorically not slowing down housing starts.

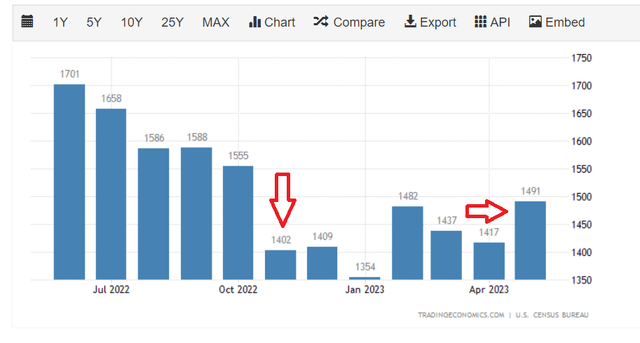

Similarly, consider this chart showing housing permits that came out yesterday (June 20):

Trading Economics

Interestingly, housing permits improved to the highest number since November 2022, six months ago.

And I know the argument well, that interest rate impacts have long and variable lags. But I’m sorry, I’m not buying that argument.

The jump in housing starts for the month of May plus the increase in building permits are not just ”some variability.” It’s a clear break from the previous trend.

I make the case that what’s happening with housing starts in the U.S. is that people have been locked up with a low-interest 30-year mortgage. Therefore, homeowners are not moving unless they are forced to move.

Consequently, this means that the housing supply is drying up. Hence, anyone that wishes to buy a house is being forced to buy up ”new properties”

With this in mind, why consider BXC?

Why BXC? Why Now?

BXC’s business is contingent on lumber sales. If lumber prices go up, BXC makes more revenue. And if lumber prices fall, BXC could make significant losses. This is simple enough, it’s not rocket science. Next, consider this:

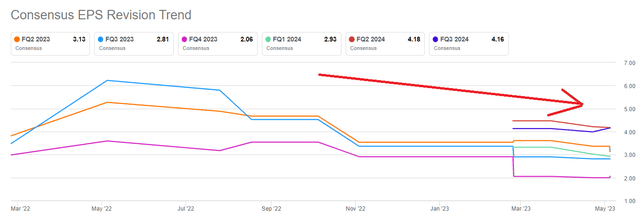

SA Premium

Analysts following BXC are not upward revising their financial models to incorporate this new data.

In fact, it appears to me that even for Q2 2023, analysts have actually further downwards revised BXC’s EPS estimates. I find this astounding.

Moreover, note in the graphic below the overall trajectory for lumber prices.

Trading Economics

I recognize that lumber prices are very volatile. Just because lumber prices are up about 20% in the past month doesn’t mean much in and of itself. It’s very likely that prices could retrace lower as they have countless times throughout 2023.

Nevertheless, the point I’m making here is that lumber prices, at least to me, appear to be off a very strong base. I don’t believe that lumber prices are likely to fall back to around $440 bcf. Accordingly, I argue that analysts are out of touch with the underlying reality of this business’ prospects.

The Bottom Line

Above, I emphasized that investors may have underestimated BlueLinx Holdings Inc. due to weak single-housing starts in Q1 2023.

However, the market is shifting its perspective and recognizing signs of support in the real estate market.

If BXC continues to allocate excess capital to share repurchases, its 12x multiple to EPS could become even more attractive next year.

Furthermore, housing starts and permits indicate a significant increase. This suggests that despite the Federal Reserve’s interest rate policy, housing starts are not slowing down.

Finally, BXC’s business is closely tied to lumber sales. While lumber prices are volatile, they appear to be off of a strong base, making analysts’ downward revisions to BXC’s EPS estimates surprising. Overall, I believe analysts are disconnected from the underlying reality of BlueLinx Holdings Inc.’s prospects.

Read the full article here