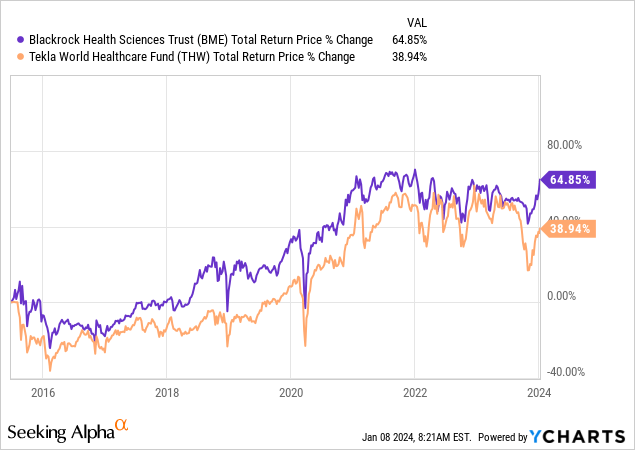

On our last coverage of the healthcare sector, we weighed abrdn World Healthcare Fund (NYSE:THW) (formerly Tekla World Healthcare Fund) and BlackRock Health Sciences Trust (NYSE:BME) against each other and found that there were some glaring issues with chasing the higher-yielding closed-end fund, or CEF. We rated BME a BUY, based on its long term performance among other factors. THW got a SELL, thanks to multiple red flags. We examine the performance of these two and tell how we see 2024 shaping up.

Performance Since Then

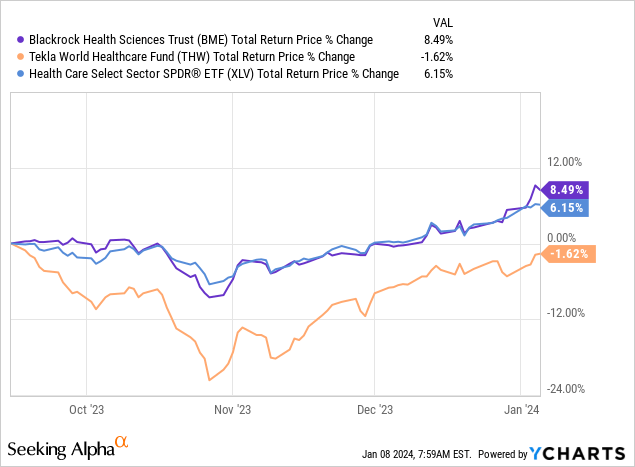

Our last article was released about 4 months back, and through the intervening volatility, BME has triumphed over THW, returning 8.49% including distributions. THW managed a negative total return and lagged both BME and Health Care Select Sector SPDR (XLV). BME won out by more than 10%, or more than 30% annualized.

For those that care, THW also exhibited a wider level of volatility and made this negative return experience even more nauseating.

Components Of The Return Profile

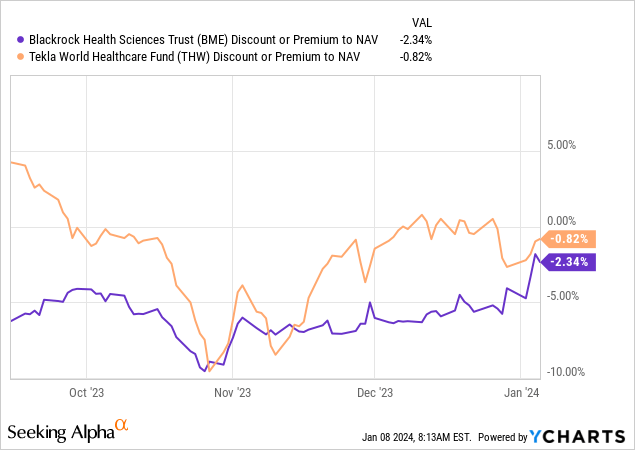

To understand our outlook today, you need to see the “why” behind the underperformance. Above, we showed you the total returns on “price.” This is what you experience as the investor. But now look at how the total returns did on NAV or net asset value. Not such a difference now is there?

BME and THW did very similarly in this timeframe, but the changes in the “total return price,” was impacted by changes in their premiums and discounts. BME which traded at a wide discount, saw some narrowing of said discount. This added to price performance. THW, which traded at a large premium, went to a slight discount.

If you look back at our earlier thesis, this was the key component as to why we expected BME to kick THW to the curb.

Outlook

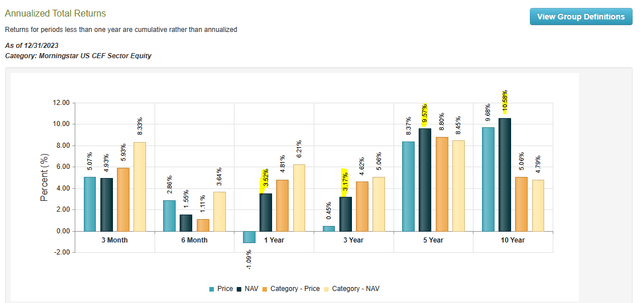

What does the future hold for these two? With THW”s premium having disappeared it is unlikely BME can continue outperforming just on the back of this. But BME can continue outperforming simply because it does so. BME generated 10.58%, 9.57%, 3.17% and 3.52% over 10, 5, 3, and 1 year periods. Note that the data runs till December 31, 2023.

CEF Connect- BME

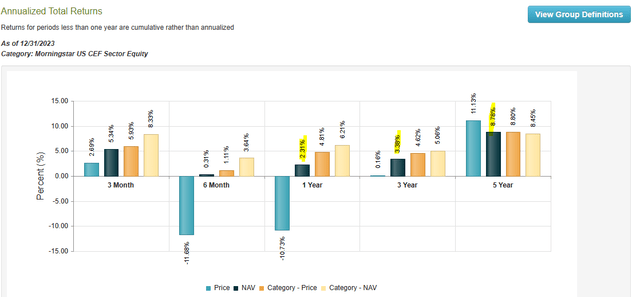

THW’s performance is not bad, but lags BME over 5 years. We can consider the 1 and 3 year time frames a draw over here.

CEF Connect- THW

Since inception (THW was not around 10 years back), though, BME has handily won.

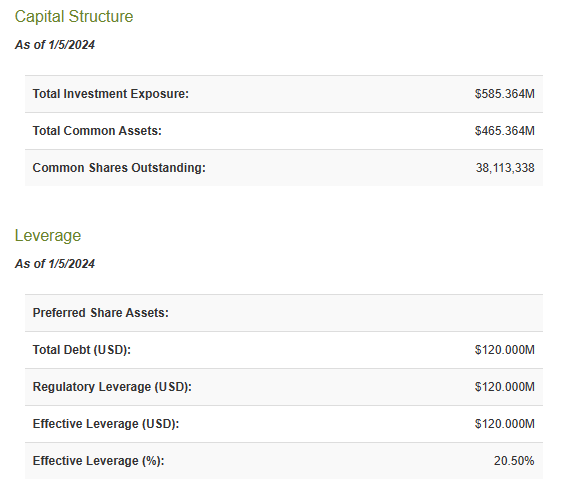

It has also done so using no leverage. THW uses a modest amount.

CEF Connect- THW

So BME has given you true alpha, which is quality performance without using the largesse of ZIRP policy between 2015 and 2021. We think healthcare sector is likely one of the outperformers of 2024, but even there, you would want to bet on the better fund to get you those returns and BME comes out on top.

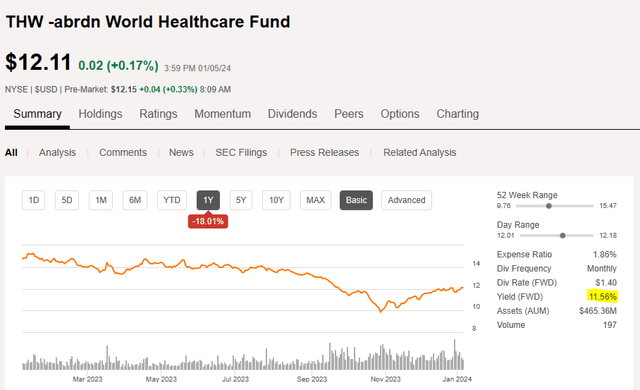

One other large risk for THW investors is the problem with the distribution. THW draws in all the moths to the 11.56% yield flame.

Seeking Alpha

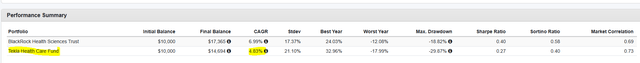

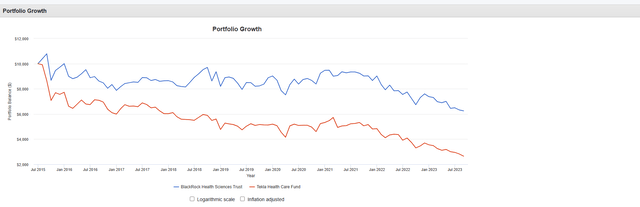

Lost in all of this is the fact that THW’s total return, including distributions since inception, has been 4.83%.

Portfolio Visualizer

Healthcare sector is slightly cheaper than average but it would be tough to expect more than 7%-8% total returns from here. So, obviously we believe that there is likely a close to a zero chance that THW can earn these distributions over the medium term. The key risk here is that THW slashes the distribution to align with its expected returns. A 50% distribution cut would be fairly normal for a fund like this. It is delivering sub 5% total returns. So paying 5.7% yield on NAV would be absolutely logical and that would require halving the distribution. Cuts of that magnitude usually will blow up the discount to at least 15%-20% as income investors finally exit. That is one big risk here. Remember that THW started out with a $20.00 NAV and the aim was to distribute 7% a year on that, matching expected returns. The high yield is a sign of really poor performance, not management benevolence.

But what if THW management comes out and swears they will maintain it for the next 5 years? One would think this is a moot point as total return is all that should matter. You can always fund a higher withdrawal from BME and come out ahead. Below we show how reinvesting distributions back and then withdrawing $80 a month from BME and THW would have done. This method creates an identical yield on original cost of 9.6%. The original $10,000 investment holds up a lot better with BME. You can play with this link and try different scenarios.

Portfolio Visualizer

But let us still address what would happen if THW did maintain the distribution. We think it actually makes matter worse on a NAV level. A fund that is making 4%-6% a year and distributing 11.4%, has to constantly decide which investments to liquidate. This is additional performance pressure on an already bad situation. THW is also leveraged, so to maintain same levels of leverage, liquidation has to be even more. Investments like these tend to be extremely poor performers over the long run. The posterchild for this is abrdn Global Premier Properties Fund (AWP), and you can see how it has fared versus Vanguard Real Estate ETF (VNQ).

Verdict

The long-awaited recession is likely to arrive in 2024, and with it, we should see some valuation compression across the board. Overall valuations are awful for stocks, and S&P 500 returns are likely to be mediocre at best. Healthcare likely does better than the major averages, but we would not expect large total returns. The skew remains to the downside and defense should be the name of the game. We are downgrading BME to a “hold” from a Buy and think the fund is due for a breather. We are maintaining THW at a “Sell” and think the distribution cut likely materializes at some point in the next 12 -24 months. There are just too many better choices here to even consider a “hold” rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here